- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Carbon Fiber Tapes Market Size & Share Report, 2020-2027GVR Report cover

![Carbon Fiber Tapes Market Size, Share & Trend Report]()

Carbon Fiber Tapes Market Size, Share & Trend Analysis Report By Form (Dry Tapes, Prepreg Tapes), By End Use (Aerospace & Defense, Automotive), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-780-3

- Number of Report Pages: 143

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

Report Overview

The global carbon fiber tapes market size was estimated at USD 1.8 billion in 2019 and expected to grow at a compound annual growth rate (CAGR) of 13.4 % from 2020 to 2027. The emergence of carbon fiber as one of the critical materials for enabling lightweight construction of automotive and aerospace components expected to drive the market in the future. Carbon Fiber (CF) tape is one of the popular materials used for manufacturing composite parts for automotive and aerospace equipment. Advancements in carbon fiber tapes expected to lead the incorporation of other properties such as de-icing, shielding, self-repair, energy storage, and stealth, thereby enabling the manufacturing of multi-functional carbon fiber tapes.

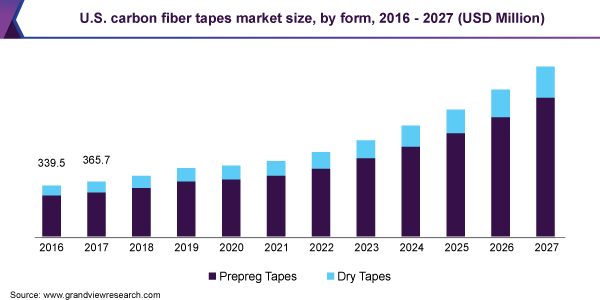

The U.S. exhibits a major demand for carbon fiber tapes backed by the long-term production schedules of the Boeing and Airbus aircraft programs. In addition, undergoing research on improving the production of composite parts in the country further expected to offer growth opportunities for the market in the U.S.

Carbon fiber tapes are recognized as clean energy technologies owing to their position as facilitating materials for several initiatives of the U.S. Department of Energy and Office of Energy and Renewable Energy. In addition, incorporation of this material also enables a weight reduction of vehicles in transportation applications leading to energy reduction through fuel savings.

Researchers are focusing on the advancement of the recycling process for long recycled CF, which expected to preserve the length of the fiber as well as enable the load-related fiber orientation. The aforementioned effort is expected to facilitate the industry players to exploit the full potential of carbon thereby positively influence the demand for carbon fiber tapes in the future.

Presently, limited production capacity along with higher production costs are the major factors restraining the growth of the market for carbon fiber tapes. However, the major players across the globe are employing to strategies expand their production capacities to cater to the rising demand for carbon fiber tapes, which in turn is expected to positively impact the market revenue growth in the future.

Form Insights

The prepreg tapes led the market and accounted for more than 79.0% of the global revenue in 2019. Unidirectional prepreg carbon fiber tapes are ideal for fabricating composite parts that require thick laminate construction and long-layup time. As a result, these tapes are highly suitable for infrastructure, industrial, medical, and sports & leisure applications.

The use of prepreg tapes for manufacturing components offer exceptional strength properties and allows part uniformity and repeatability. In addition, the use of prepreg carbon fiber tapes bleeds lesser resin during the curing process, takes lesser curing time, and offers superior aesthetics thereby positively impacting the overall market growth.

The dry tape segment is also one of the most popular categories in the carbon fiber tapes market that is likely to witness a CAGR of 12.7% from 2020 to 2027. The aforementioned tapes produce lesser mess during production and cater to tight tolerances for width and aerial weight, thus posing high growth opportunities.

Dry carbon fiber tapes offer a cost and production rate optimized taping solutions providing mechanical properties comparable with prepreg tapes without an autoclave. As a result, these tapes are well suited for automated production in a broader range of automotive, winter sports, aerospace & industrial applications.

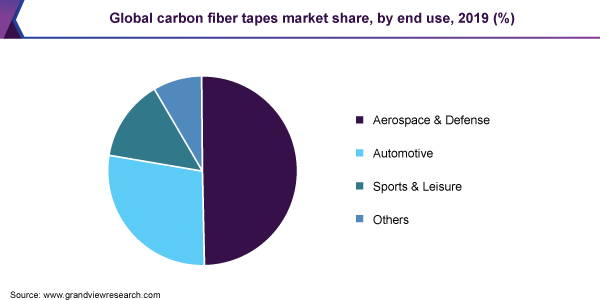

End-use Insights

The aerospace and defense segment led the market and accounted for more than 49.0% of the global revenue in 2019. Rising use of CF materials in Boeing Dreamliner and Airbus 350 expected to offer positively influence the demand for carbon fiber tapes, thereby driving the overall market growth over the forecast period.

Carbon fiber tapes offer exceptional properties such as superior strength to weight ratio, and high impact resistance thus offers utility in manufacturing composite parts for the primary and secondary structure of the aircraft. In addition, the composite parts manufactured through automated laying up of tapes lead to the economical production of parts with superior aesthetics.

Automotive end-use is also one of the most popular categories in carbon fiber tapes, which is expected to register a CAGR of 13.5 % over the forecast period. The CF materials have found applications in almost every supercar, hypercar, and luxury sports car in production to reduce weight, improve handling performance, and enhance fuel efficiency.

Carbon fiber tapes are used in high-end cars where performance is the critical factor driven by a lower center of gravity, drive experience, and aesthetics. These tapes find applications in components including primary structure, internal and external body, roof structures, and panels. Moreover, these tapes witnessing rising penetration in the production of components for smaller cars.

Regional Insights

North America dominated the market and accounted for over 36.0% share of the global revenue. The U.S. hosts the presence of top aircraft manufacturers complemented with the robust production capacity of carbon fiber tapes. Thus, the growth potential of aerospace sector is expected to positively influence the growth of the market.

Mexico is also witnessing rapid expansion of aerospace manufacturing and maintenance, repair & overall, owing to the entry of global players such as Bombardier in the economy. In addition, the economy is also witnessing rapid growth in automotive production, thereby providing growth opportunities to the market.

In Europe, the market is expected to witness the fastest CAGR of 14.4% from 2020 to 2027. The top automotive OEM brands in the region are employing efforts to replace conventional metal components using advanced materials with lower weight and high strength. Hence, it is expected to curb emission and enhance the fuel efficiency of the vehicles.

Europe is one of the most impacted regions owing to the spread of the corona pandemic, which in turn has led to a significant decline in automotive and aerospace production in the region. Moreover, the uncertainty regarding the post-COVID situation is expected to and the required interval to recover normal production levels in the region is expected to negatively impact the market for carbon fiber tapes.

Key Companies & Market Share Insights

The industry is competitive owing to the presence of several well-established market players with a strong foothold in the industry. The industry characterized by the long-term contract of manufacturers with the application industries. Moreover, the industry is witnessing a trend of forward integration, since the raw material suppliers are entering in to tapes manufacturing.

The CF tapes industry is currently witnessing a limited production capacity. Key industry players are employing efforts to expand their production capacity. The rapidly extending scope for application of carbon fiber tapes in the various end-use industry will complemented by the increased production capacity, thereby heightening the overall sales revenue. Some of the prominent players in the carbon fiber tapes market include:

-

Evonik Industries

-

SABIC

-

Solvay

-

Hexcel Corporation

-

Royal Tencate

-

SGL Group

-

Teijin Limited

-

BASF SE

-

Celanese Corporation

-

Victrex

-

Cristex

-

Eurocarbon

-

PRF Composite Materials

-

TCR Composites

-

Sigmatex

Carbon Fiber Tapes Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 1.9 billion

Revenue forecast in 2027

USD 4.9 billion

Growth Rate

CAGR of 13.4% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in thousand sq.m, revenue in USD million, and CAGR from 2020 to 2027

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

Evonik Industries; SABIC; Solvay; Hexcel Corporation; Royal Tencate; Teijin Limited; BASF SE; Celanese Corporation; SGL Group; Victrex; Cristex; Eurocarbon; PRF Composite Materials; TCR Composites; Sigmatex

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global carbon fiber tapes market on the basis of form, end use, and region:

-

Form Outlook (Volume, Thousand Sq.M; Revenue, USD Million, 2016 - 2027)

-

Dry Tapes

-

Prepreg Tapes

-

-

End-use Outlook (Volume, Thousand Sq.M; Revenue, USD Million; 2016 - 2027)

-

Aerospace & Defense

-

Automotive

-

Sports & Leisure

-

Other Applications

-

-

Regional Outlook (Volume, Thousand Sq.M; Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America (CSA)

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global carbon fiber tapes market size was estimated at USD 1.80 billion in 2019 and is expected to reach USD 1.90 billion in 2020.

b. The global carbon fiber tapes market is expected to grow at a compound annual growth rate of 13.4% from 2020 to 2027 to reach USD 4.93 billion by 2027.

b. North America dominated the carbon fiber tapes market with a share of 36.85% in 2019. This is attributable to the presence of robust manufacturing base for aerospace & defense sector.

b. Key players in the industry include Teijin Limited (Japan), Zoltek Corporation (US), Hexcel Corporation (US), Mitsubishi Rayon Carbon Fibers and Composites (Japan), SGL Group, Royal TenCate (Netherlands), Solvay (Belgium), 3M (U.S.), SABIC, Cristrex, Sigmatex, BASF SE, PRF Composite Materials, Eurocarbon, TCR Composites, and others.

b. Key factors driving the carbon fiber tapes market growth include; replacement of metal components using advanced high strength and lightweight materials; development of automated tape laying parts production process.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."