- Home

- »

- Advanced Interior Materials

- »

-

Carbon Nanotubes Market Size, Share, Industry Report 2030GVR Report cover

![Carbon Nanotubes Market Size, Share & Trends Report]()

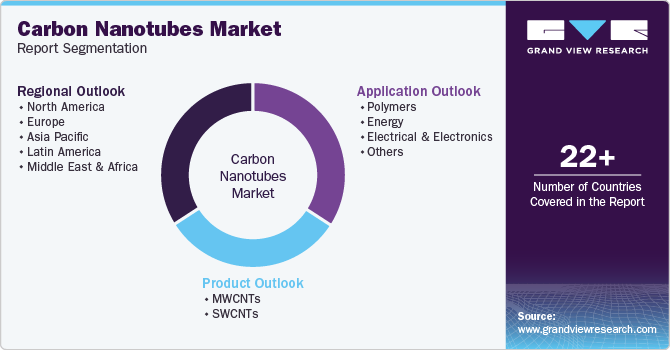

Carbon Nanotubes Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (MWCNTs, SWCNTs), By Application (Polymers, Energy, Electrical & Electronics, Others), By Region, And Segment Forecasts

- Report ID: 978-1-68038-393-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Carbon Nanotubes Market Summary

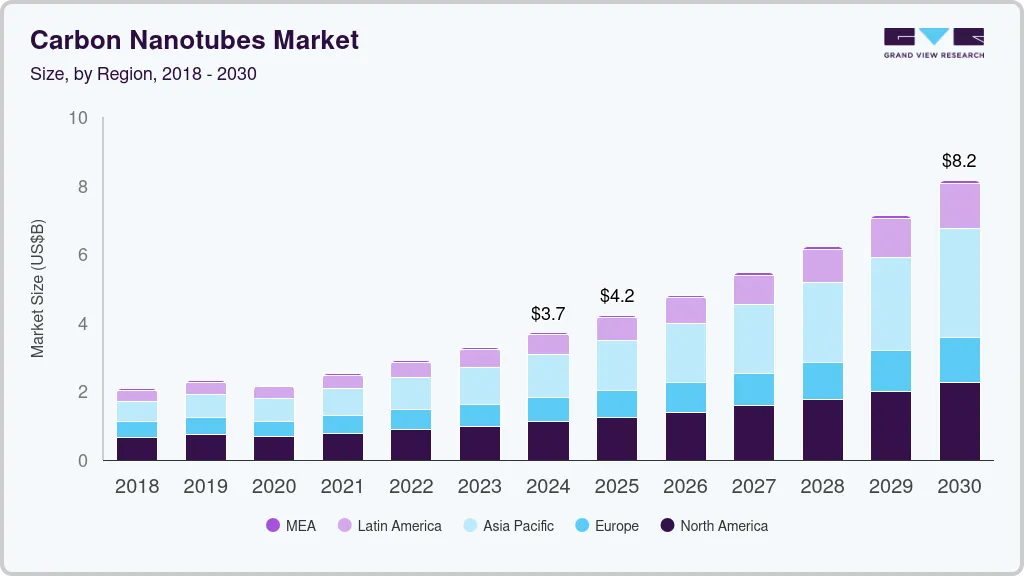

The global carbon nanotubes market size was estimated at USD 3.71 billion in 2024 and is projected to reach USD 8.15 billion by 2030, growing at a CAGR of 14.1% from 2025 to 2030. CNTs offer exceptional electrical conductivity, mechanical strength, and lightweight properties, making them ideal for enhancing electronic devices, batteries, and sensors.

Key Market Trends & Insights

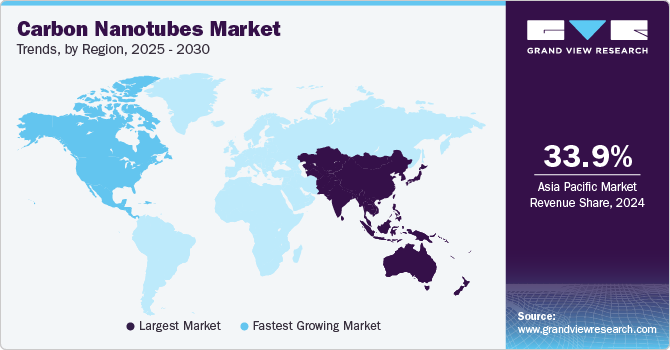

- APAC carbon nanotubes market secured the largest share of 33.9% in 2024.

- The carbon nanotubes market in U.S. held a considerable position in 2024.

- By product, the multi-walled carbon nanotubes segment captured the largest share of 93.6% in 2024.

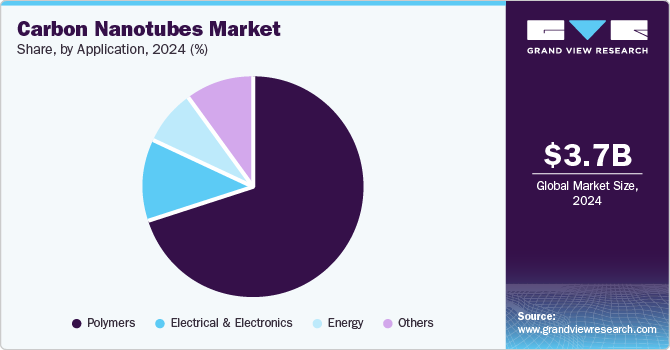

- By application, The polymers segment accumulated the largest share of 69.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.71 Billion

- 2030 Projected Market Size: USD 8.15 Billion

- CAGR (2025-2030): 14.1%

- Asia Pacific: Largest market in 2024

CNTs improve fuel efficiency, structural integrity, and overall performance in the automotive and aerospace sectors. As industries push for more efficient, durable, and lightweight materials, adopting CNTs is anticipated to accelerate, driving market expansion across these high-growth sectors.

Moreover, the surging demand for high-performance materials in construction and the growing interest in smart materials bolstered the market size. CNTs offer exceptional strength, conductivity, and flexibility, making them ideal for advanced construction applications, including durable and energy-efficient buildings. As the construction industry increasingly embraces sustainable, high-performance materials, the demand for CNTs is poised to rise. Additionally, the rising adoption of smart materials capable of responding to environmental stimuli further fuels the market expansion, positioning CNTs as a key component in future innovations.

Product Insights

The Multi-Walled Carbon Nanotubes (MWCNTs) segment captured the largest share of 93.6% in 2024, fueled by their superior mechanical strength, electrical conductivity, and thermal properties. MWCNTs are widely used in various applications, including electronics, energy storage, and composite materials, where their enhanced performance characteristics make them highly desirable. Their versatility in improving the properties of materials such as polymers, metals, and ceramics has contributed to their dominance. Also, the scalability and cost-effectiveness of MWCNT production have further accelerated their adoption across industries, solidifying their market share.

Furthermore, single-walled carbon nanotubes (SWCNTs) are expected to emerge as the fastest growing segment and are projected to grow at a CAGR of 11.7% over the forecast period, attributed to their exceptional electrical, thermal, and mechanical properties. These unique characteristics make SWCNTs highly sought after in applications such as electronics, energy storage, and composites. The escalating demand for advanced materials in electronics, aerospace, and automotive industries is fueling the adoption of SWCNTs. Besides, ongoing advancements in production techniques and cost reduction are anticipated to accelerate commercialization, propelling substantial market growth in the coming years.

Application Insights

The polymers segment accumulated the largest share of 69.7% in 2024, owing to a surge in demand for high-performance materials in industries such as automotive, electronics, and aerospace. Carbon nanotubes enhance the mechanical, thermal, and electrical properties of polymers, making them ideal for advanced applications. Their lightweight yet strong nature improves the durability and efficiency of polymer-based products. The rising trend for energy-efficient and high-strength materials, coupled with the unique properties of CNTs, has significantly boosted their adoption in polymer composites, driving market growth.

The electrical & electronics segment is poised to stand out as the fastest-growing segment and capture a 15.1% CAGR during the forecast period. Due to their exceptional electrical conductivity, high strength, and lightweight properties, CNTs are increasingly being integrated into electronics, semiconductors, and energy storage devices. These properties enhance the performance of batteries, capacitors, and flexible electronics, improving efficiency and miniaturization. As demand for advanced electronic devices, renewable energy solutions, and high-performance batteries rises, CNTs are expected to play a pivotal role in shaping the future of the electronics industry.

Regional Insights

North America carbon nanotubes market is set to emerge as a fastest growing region and expand at a CAGR of 12.8% from 2025 to 2030, driven by technological advancements and sizable investments in research and development. The surging demand for CNTs in electronics, energy, and automotive industries is fueling market expansion. The region's strong manufacturing base and its focus on innovation make it an ideal hub for CNT applications. Additionally, the region’s commitment to sustainable energy solutions and enhanced product performance in electronics further boosts the adoption of CNTs, positioning the region for market growth.

U.S. Carbon Nanotubes Market Trends

The carbon nanotubes market in U.S. held a considerable position in 2024, spurred by a surge in technology and burgeoning demand across electronics, automotive, aerospace, and healthcare industries. The U.S. leads research and development, fostering innovation in CNT applications such as lightweight materials, energy storage, and electronics. Also, the escalating adoption of CNTs in next-generation technologies, including 5G and electric vehicles, is propelling market growth. With expanding manufacturing capabilities and investment in sustainable materials, the U.S. is poised to expand the carbon nanotubes market substantially.

Canada is projected to achieve a remarkable CAGR over the forecast period, owing to its growing focus on advanced manufacturing, clean energy, and technology sectors. The country’s investments in research and development, particularly in nanotechnology, fueling the adoption of CNTs across electronics, automotive, and aerospace industries. Moreover, the region’s emphasis on renewable and green technologies, such as lightweight materials for energy-efficient vehicles, drives the demand for carbon nanotubes. With a supportive innovation ecosystem, Canada is positioned for significant growth in the global market.

Europe Carbon Nanotubes Market Trends

Europe prominence in the carbon nanotubes industry is attributed to the region’s dynamic technological progress and sustainability. The region’s advanced industrial sectors, particularly aerospace, automotive, and electronics, are adopting CNTs for their superior strength, conductivity, and energy efficiency. Furthermore, the region’s commitment to green technologies and carbon reduction strategies positions CNTs as critical in energy storage and sustainable manufacturing. Ample investments in R&D and favorable policies will support the region’s leading role in the thriving CNT market.

Germany is anticipated to accumulate sizable gains by 2030, propelled by its strong focus on innovation, advanced manufacturing, and sustainability. With a leading presence in the automotive, aerospace, and electronics industries, Germany is notably adopting CNTs for lightweight materials, energy storage, and high-performance components. The country’s commitment to technological advancement and robust R&D initiatives support the growth of the CNT market. As demand for high-performance materials rises, the country’s strategic investments in CNT production thereby bolster its position in the global market.

The UK is expected to establish a considerable foothold by 2030, fueled by its emphasis on innovation, research, and sustainability. The country's rising focus on advanced materials for electronics, aerospace, and automotive industries is boosting the demand for CNTs due to their superior properties. In addition, the U.K. government's support for cutting-edge technologies and green initiatives encourages the adoption of CNTs for energy-efficient and eco-friendly solutions. With robust R&D activities and a thriving industrial base, the U.K. is set to see remarkable market growth in the CNT sector.

Asia Pacific Carbon Nanotubes Market Trends

APAC carbon nanotubes market secured the largest share of 33.9% in 2024, fueled by rapid industrialization, technological upgrades, and robust manufacturing capabilities in countries such as China, Japan, and South Korea. The region is a hub for electronics, automotive, and aerospace industries, where carbon nanotubes are in high demand for superior performance in these applications. Besides, ample investments in research and development and government support for nanotechnology have further accelerated market growth. The cost-effective production and availability of raw materials in the region also c

Asia Pacific is projected to grow at a noteworthy CAGR during the forecast period, spurred by fast-paced industrialization, technological breakthroughs, and a high demand for CNTs across key electronics, automotive, and construction sectors. Countries such as China, Japan, and South Korea are major contributors, leveraging CNTs in developing lightweight, high-strength materials and next-generation technologies. Furthermore, sizable investments in R&D and an emphasis on sustainability and innovation have further bolstered the region's dominance. The broadening manufacturing capabilities in Asia Pacific continue to drive the widespread adoption of CNTs.

China is expected to emerge as a booming region in the carbon nanotubes (CNTs) market, propelled by its expanding technological upgrades and large-scale manufacturing capabilities. As a global leader in electronics, automotive, and energy industries, the country’s demand for CNTs is driven by their potential to enhance performance in batteries, conductive materials, and composite manufacturing. The Chinese government’s strategic investments in nanotechnology research and development further support market growth. With an augmenting industrial base and rising innovation, China is set to dominate the global carbon nanotubes market in the years ahead.

India is poised to emerge as the fastest-growing region due to its rapid industrial expansion and demand for advanced materials. With a strong presence in electronics, automotive, and renewable energy sectors, India is increasingly adopting CNTs to enhance product performance and efficiency. The country’s technological enhancement and government initiatives promoting manufacturing and R&D are further accelerating CNT adoption. As industries seek high-performance, sustainable solutions, India is projected to witness substantial growth shortly.

Key Carbon Nanotubes Company Insights

Some of the key companies in the carbon nanotubes market include Resonac Holdings Corporation, Hanwha Solutions Chemical Division Corporation, Arry International Group Limited, Carbon Solutions, Inc., Jiangsu Cnano Technology Co., Ltd, Arkema, CHASM, Cabot Corporation, Nanocyl SA, Continental Carbon Nanotechnologies, Inc., and others.

-

Arkema offers various advanced materials, including high-performance thermoplastics, specialty chemicals, and carbon nanotubes, catering to the aerospace, automotive, and electronics industries.

-

Hanwha Solutions Chemical Division Corporation specializes in producing chemicals, petrochemicals, and advanced materials, focusing on innovative solutions in the energy, construction, and electronics sectors.

Key Carbon Nanotubes Companies:

The following are the leading companies in the carbon nanotubes market. These companies collectively hold the largest market share and dictate industry trends.

- Resonac Holdings Corporation

- Hanwha Solutions Chemical Division Corporation

- Arry International Group Limited

- Carbon Solutions, Inc.

- Jiangsu Cnano Technology Co., Ltd

- Arkema

- CHASM

- Cabot Corporation

- Nanocyl SA

- Continental Carbon Nanotechnologies, Inc.

Recent Developments

-

In March 2024, CHASM Advanced Materials, Inc. partnered with Ingevity to boost carbon nanotube (CNT) supply for North American and European EV battery markets. This collaboration aims to meet growing demand and support the expanding electric vehicle industry in these regions.

-

In September 2023, Huntsman Corporation started building a 30-ton MIRALON® carbon nanotube plant, one of the largest in the Americas. The facility will convert methane gas into carbon nanotubes and clean hydrogen, advancing MIRALON® technology toward industrial-scale production.

Carbon Nanotubes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.21 billion

Revenue forecast in 2030

USD 8.15 billion

Growth rate

CAGR of 14.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in tons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, South Korea, India, Brazil, Argentina, Saudi Arabia

Key companies profiled

Resonac Holdings Corporation, Hanwha Solutions Chemical Division Corporation, Arry International Group Limited, Carbon Solutions, Inc., Jiangsu Cnano Technology Co., Ltd, Arkema, CHASM, Cabot Corporation, Nanocyl SA, Continental Carbon Nanotechnologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carbon Nanotubes Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global carbon nanotubes market report on the basis of product, application, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

MWCNTs

-

SWCNTs

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Polymers

-

Energy

-

Electrical & Electronics

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Latin America

-

Brazil

-

Argentina

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.