- Home

- »

- Advanced Interior Materials

- »

-

Carbon Steel Market Size & Share, Industry Report, 2030GVR Report cover

![Carbon Steel Market Size, Share & Trend Report]()

Carbon Steel Market (2025 - 2030) Size, Share & Trend Analysis Report By Type (Low Carbon Steel, Medium Carbon Steel, High Carbon Steel), By Application (Ship Building, Construction, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-415-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Carbon Steel Market Summary

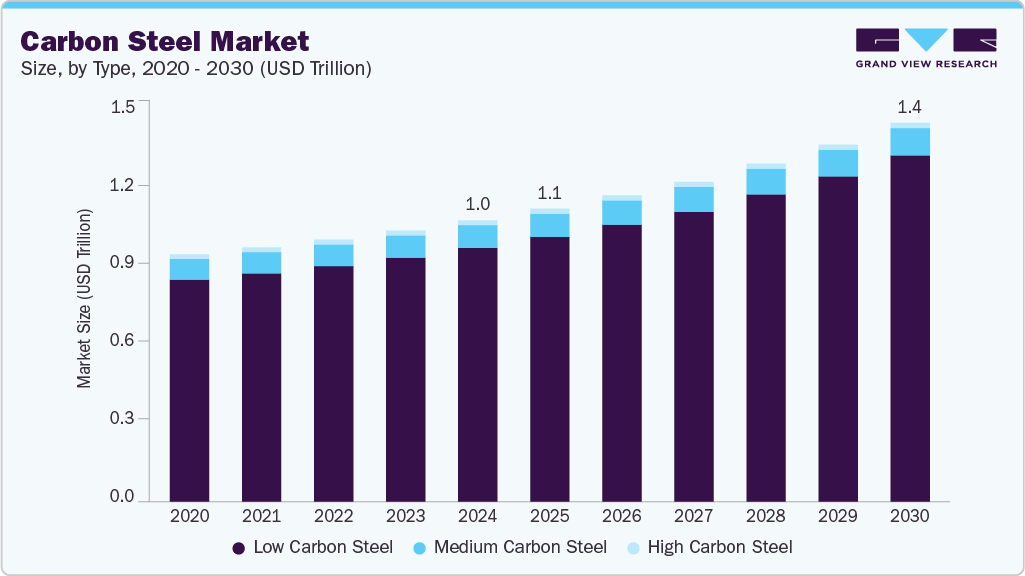

The global carbon steel market size was estimated at USD 1,017.52 billion in 2024, and is projected to reach USD 1,370.43 billion by 2030, growing at a CAGR of 5.3% from 2025 to 2030. Increasing focus on infrastructure development, particularly in Asia Pacific countries, is projected to drive the consumption of carbon steel products over the coming years.

Key Market Trends & Insights

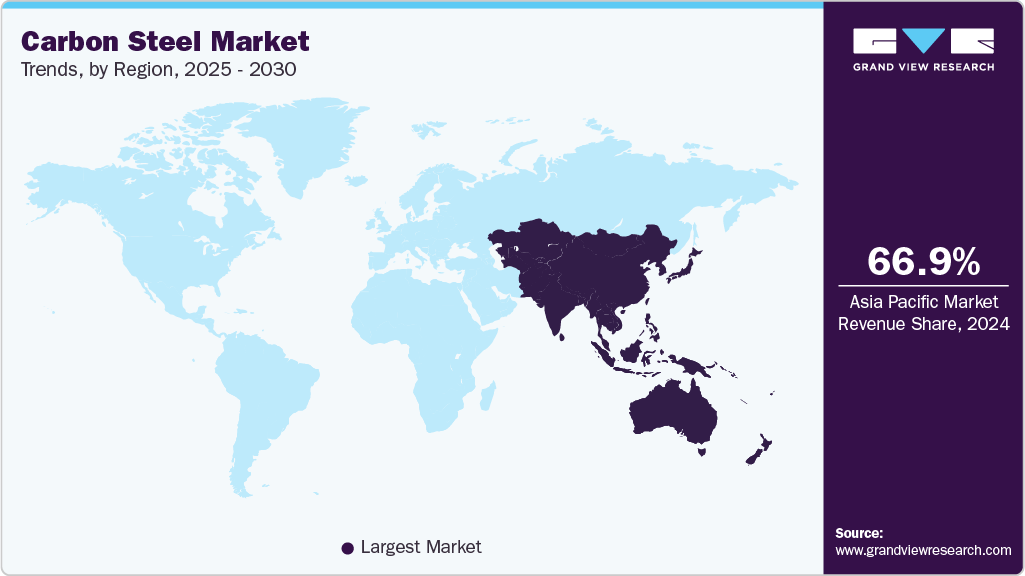

- Asia Pacific held 66.98% revenue share of the global carbon steel market.

- The carbon steel market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By type, low carbon steel segment held the largest market revenue share of 90.2% in 2024.

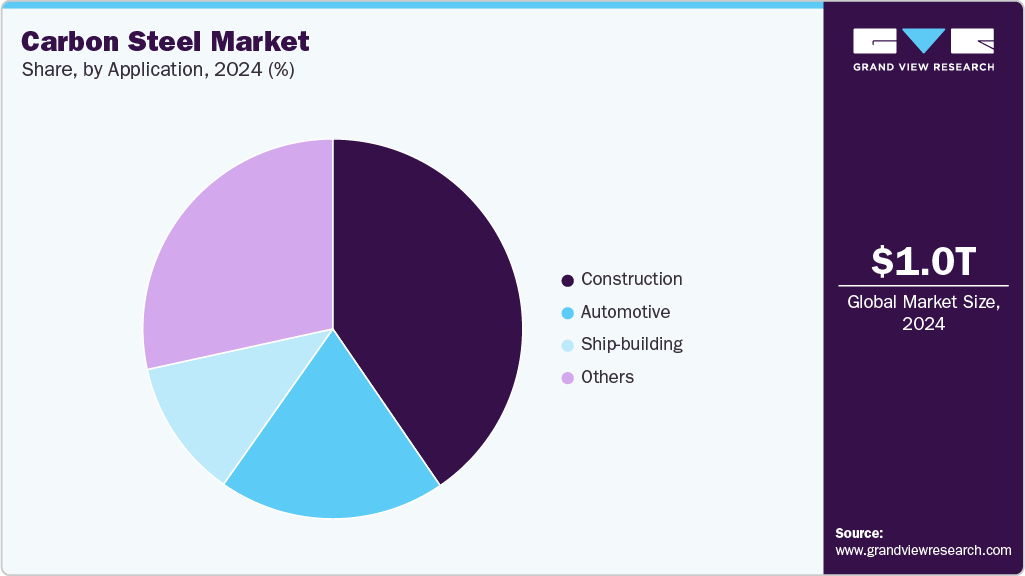

- By application, the construction segment held the revenue share of 40.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,017.52 Billion

- 2030 Projected Market Size: USD 1,370.43 Billion

- CAGR (2025-2030): 5.3%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

The automotive industry plays a big role in boosting the consumption of carbon steel. Automakers use it to manufacture car bodies, exhaust systems, chassis frames, wheels, engine blocks, and many under-the-hood components. Its strength, formability, and cost-effectiveness make it ideal for mass production. As vehicle production rises, more carbon steel is needed, especially electric vehicles (EVs) in markets like China, the U.S., and Europe.For instance, in 2024, the global EV market surpassed 17 million units sold, marking a 17% year-on-year increase. China led this surge with 11 million EV sales, propelled by affordable pricing and robust domestic production. In EVs, carbon steel is also used for battery enclosures, structural frames, and undercarriage protection. Developing countries are witnessing a rising middle class and increasing car ownership, leading to the growth of local vehicle production. Moreover, many automakers are expanding or relocating their manufacturing plants to reduce supply chain risks. New machinery, stamping lines, and robotic arms are installed, mostly made using carbon steel.

Manufacturing industries rely on carbon steel for its durability and ease of machining. The need for strong steel components rises as factories expand production lines and adopt automated systems. Sectors like mining, shipbuilding, chemicals, cement, and food processing use carbon steel in the form of tanks, conveyors, hoppers, gears, and shafts. Even basic industrial shelving, workbenches, and welding tables are made of carbon steel. In many regions, governments promote local manufacturing through incentives and policy reforms, such as “Make in India” and similar initiatives across Southeast Asia and Africa. These efforts are encouraging new investments in factories, which in turn increases the need for steel-based machinery and structures.

The oil and gas industry uses it for pipelines, drilling rigs, tanks, and refinery equipment due to its strength and resistance to high pressures. Natural gas transmission projects, including cross-border pipelines, are expanding across regions like the Middle East, Africa, and Central Asia. Meanwhile, the renewable energy sector is also using carbon steel extensively. Wind turbine towers, solar mounting structures, and hydroelectric dam components are all steel-intensive. Even in nuclear power plants, carbon steel is used for pressure vessels and structural applications. As countries strive to improve electricity access, reduce emissions, and upgrade energy grids, using carbon steel in conventional and renewable energy projects is gaining strong momentum.

Drivers, Opportunities & Restraints

The demand for carbon steel is largely supported by rapid infrastructure development, industrial expansion, and growth in the automotive and energy sectors. Carbon steel is extensively used in constructing bridges, highways, buildings, pipelines, and industrial machinery due to its strength and affordability. Emerging economies such as India, China, and Vietnam are witnessing a surge in urban development and manufacturing activity, increasing the need for construction-grade steel. The global shift towards electric vehicles and renewable energy systems is also boosting the demand for carbon steel components used in battery structures, wind turbine towers, and energy transmission systems.

There are several promising opportunities in the carbon steel industry, especially driven by green energy projects, infrastructure stimulus plans, and the trend of reshoring industrial production. The expansion of wind and solar energy installations across the U.S., Europe, and the Asia Pacific requires strong support structures, which often rely on carbon steel. Moreover, with many governments implementing infrastructure stimulus programs post-COVID, the demand for structural steel is expected to rise steadily. There is also growing interest in lightweight, high-strength variants of carbon steel for automotive applications, which could open up innovation-driven growth segments shortly.

Despite strong demand, the carbon steel industry faces several challenges. Volatility in raw material prices—particularly iron ore and coking coal, can impact profit margins and pricing stability. Environmental regulations related to carbon emissions from steel manufacturing are becoming stricter in regions like Europe and North America, putting pressure on producers to invest in cleaner technologies. In addition, the growing preference for stainless steel or aluminum in high-end or corrosion-sensitive applications can limit carbon steel’s usage in certain markets.

Type Insights

The low carbon segment led the market with the largest revenue share of 90.2% in 2024. Low-carbon steel, also known as mild steel, is witnessing strong demand due to its widespread use in construction, automotive, and consumer goods industries. Its properties, such as high ductility, ease of welding, and relatively low cost, make it ideal for manufacturing structural components, pipelines, metal sheets, and frames. Low-carbon steel is commonly used for reinforcing bars, light structural sections, and HVAC systems in the construction sector. Its machinability and formability make it a preferred material for parts that require bending, punching, or shaping.

The high carbon segment is anticipated to register at the fastest CAGR over the forecast period. It is gaining attention due to its superior hardness, strength, and wear resistance, making it suitable for specialized industrial applications. It primarily produces cutting tools, blades, springs, high-strength wires, dies, and rail tracks. The manufacturing sector, especially machinery, mining equipment, and automotive components, relies on high-carbon steel for parts that must withstand high stress, impact, and friction. For example, components like crankshafts, gears, and axles in heavy-duty vehicles often require high-carbon steel due to its durability under load. As global manufacturing recovers and industries modernize their equipment, the need for strong and wear-resistant materials is rising, benefiting this steel grade.

Application Insights

The construction segment led the market with the largest revenue share of 40.4% in 2024. This industry is one of the largest consumers of carbon steel, driven by its strength, versatility, and affordability. Carbon steel is extensively used in structural applications such as beams, columns, reinforcement bars (rebars), roofing materials, staircases, and frameworks for buildings, bridges, and tunnels. Its ability to withstand heavy loads and harsh weather conditions makes it ideal for residential and commercial construction.

The automotive segment is anticipated to grow at a significant CAGR over the forecast period. Carbon steel is a key material in the automotive industry due to its excellent strength-to-weight ratio, cost-effectiveness, and suitability for forming and welding. It is widely used in manufacturing critical vehicle components such as chassis frames, body panels, engine parts, drive shafts, suspension systems, and exhaust pipes. As global vehicle production expands, particularly in emerging economies, this segment's demand for carbon steel has consistently grown.

For instance, in 2024, global vehicle production surpassed 93 million units, with China contributing over 30 million units, making it the largest vehicle manufacturing hub. In countries like India, Mexico, and Thailand, rising income levels and urbanization are driving up domestic automobile production, which fuels demand for carbon steel components due to their affordability and structural reliability.

Regional Insights

The carbon steel market in North America is supported by robust demand from the construction, automotive, energy, and manufacturing sectors. The U.S. leads the region in production and consumption, with carbon steel playing a key role in infrastructure development projects such as bridges, highways, pipelines, and public buildings. The passing of the U.S. Infrastructure Investment and Jobs Act, which allocates over USD 1.2 trillion for infrastructure upgrades over the next decade, is expected to boost demand for carbon steel across multiple applications significantly. Growing investments in commercial construction, transport networks, and energy transmission lines in Canada and Mexico further contribute to a steady demand for structural and low-carbon steel products.

U.S. Carbon Steel Market Trends

The carbon steel market in the U.S. accounted for the largest market revenue share in North America in 2024. In the U.S., carbon steel is widely used in construction, automotive, and energy industries. Large infrastructure projects such as roads, bridges, airports, and rail systems continue to support steady demand. The automotive industry is another major user of carbon steel in the U.S., especially for making vehicle frames, engine parts, and exhaust systems. In 2024, over 10 million vehicles were produced in the country, and production is expected to grow in 2025. Electric vehicle manufacturing is also rising, with carbon steel still playing a key role in structural and internal components. At the same time, steelmakers in the U.S. are investing in cleaner technologies like electric arc furnaces to meet environmental goals and reduce emissions, ensuring the long-term sustainability of the domestic carbon steel industry.

Asia Pacific Carbon Steel Market Trends

Asia Pacific dominates the carbon steel market with the largest revenue share of 66.98% in 2024, driven by rapid industrialization, urbanization, and infrastructure development across major economies such as China, India, Japan, and Southeast Asia. China, in particular, is the world’s largest producer and consumer of carbon steel, accounting for over half of global output. The country’s massive investment in infrastructure, including highways, high-speed rail, bridges, and smart cities, has kept demand for carbon steel consistently high. India also has strong momentum due to its National Infrastructure Pipeline (NIP), smart city initiatives, and expanding construction and manufacturing sectors. In addition, Japan and South Korea continue to use carbon steel extensively in automotive production and shipbuilding, supported by their advanced industrial bases.

Europe Carbon Steel Market Trends

The carbon steel market in Europe is anticipated to grow at the fastest CAGR during the forecast period. In the automotive sector, Europe is home to some of the world’s largest car manufacturers, including Volkswagen, BMW, Stellantis, and Renault. These companies continue to use carbon steel for vehicle chassis, structural parts, and engine components. The demand for strong yet affordable materials remains high with the ongoing shift toward electric vehicles. At the same time, European steel producers are under pressure to reduce emissions, leading to increased investment in green steel technologies and low-carbon production methods. These efforts are expected to shape the future of the carbon steel market in Europe while keeping it competitive and environmentally aligned.

Latin America Carbon Steel Market Trends

The carbon steel market in Latin America is seeing steady demand for carbon steel, mainly driven by infrastructure development, construction projects, and industrial expansion. Countries like Brazil, Mexico, Argentina, and Chile are investing in roads, bridges, railways, and public housing, which rely heavily on carbon steel for structural applications. Brazil, in particular, is the region's largest producer and consumer of carbon steel, supported by a strong domestic steel industry and major construction programs. Mexico also shows solid demand, especially with the growth of its automotive manufacturing sector and cross-border industrial exports to the U.S.

Middle East & Africa Carbon Steel Market Trends

The carbon steel market in the Middle East & Africa is witnessing a shift towards sustainable steel production. Countries like the UAE and Saudi Arabia are investing in green steel initiatives to reduce carbon emissions, leveraging their abundant renewable energy resources. For instance, in November 2023, Emirates Steel Arkan has partnered with international firms to develop green steel production facilities in Abu Dhabi. In addition, the automotive sector in Egypt and Morocco is expanding, increasing the demand for carbon steel in vehicle manufacturing. Despite challenges like fluctuating raw material prices and competition from alternative materials, the MEA carbon steel industry is poised for growth, supported by ongoing industrialization and infrastructure development.

Key Carbon Steel Company Insights

Some of the key players operating in the market include ArcelorMittal, AK Steel Corporation, and others.

-

ArcelorMittal, headquartered in Luxembourg City, is one of the world's leading steel and mining companies. With operations in over 60 countries and industrial footprints in 18 countries, the company produced approximately 58 million metric tonnes of crude steel in 2024, making it the second-largest steel producer globally. The company offers a diverse range of products, including flat and long carbon steel products, tailored to meet the needs of different industries. The company has also introduced the XCarb initiative, encompassing ArcelorMittal's reduced, low, and zero-carbon steelmaking activities.

-

AK Steel Corporation, now a subsidiary of Cleveland-Cliffs Inc., is a prominent producer of flat-rolled carbon, stainless, and electrical steel products. The company's operations are primarily in the U.S., with Indiana, Kentucky, Ohio, and Pennsylvania facilities. AK Steel specializes in producing hot and cold-rolled carbon steel products in the carbon steel segment, including coated and enameling steels. These products are essential for automotive manufacturers, especially for body panels and structural parts.

Key Carbon Steel Companies:

The following are the leading companies in the carbon steel market. These companies collectively hold the largest market share and dictate industry trends.

- AK Steel Corporation

- ArcelorMittal

- Baosteel Group

- Evraz plc

- HBIS Group

- JFE Steel Corporation

- Nippon Steel Corporation

- NLMK

- POSCO

- United States Steel

Recent Developments

-

In February 2025, Gunung Raja Paksi Tbk (GRP), signed a multi-million-dollar deal with Primetals Technologies to become Asia's first supplier outside China of zero carbon endless hot rolled coil (HRC) for export to Europe. The new production line is expected to be operational by 2027, coinciding with the European Union's carbon border adjustment mechanism (CBAM) regime, positioning GRP as a leader in low-carbon steel manufacturing in Southeast Asia.

-

In July 2023, Hyundai Steel, a major South Korean steelmaker, launched its low-carbon steel brand, HyzeroSteel, under the new HyECOsteel initiative. This brand represents Hyundai Steel’s commitment to environmentally friendly steel production, aiming to reduce carbon emissions throughout its manufacturing process. As part of this initiative, the company plans to expand electric arc furnace (EAF) usage and adopt hydrogen-based steelmaking technologies. The launch aligns with Hyundai Steel’s broader sustainability strategy and goal of achieving carbon neutrality by 2050, reinforcing its position as a leader in green steel innovation in the Asia Pacific region.

Carbon Steel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,059.64 billion

Revenue forecast in 2030

USD 1,370.43 billion

Growth rate

CAGR of 5.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, Volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Russia; China; India; Japan; Brazil

Key companies profiled

HBIS Group; Baosteel Group; ArcelorMittal; Nippon Steel Corporation; POSCO; AK Steel Corporation; NLMK; Evraz plc; United States Steel; JFE Steel Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carbon Steel Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global carbon steel market report based on type, application, and region.

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Low Carbon Steel

-

Medium Carbon Steel

-

High Carbon Steel

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Ship Building

-

Construction

-

Automotive

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global carbon steel market size was estimated at USD 1,017.52 billion in 2024 and is expected to reach USD 1,059.65 billion in 2025.

b. The global carbon steel market is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2030 to reach USD 1,370.43 billion by 2030.

b. The low carbon steel segment dominated the market with a revenue share of over 90.0% in 2024. The segment is witnessing significant growth owing to easy availability of material and low cost associated with it.

b. Some key players operating in the carbon steel market include HBIS Group, Baosteel Group, ArcelorMittal, Nippon Steel Corporation, POSCO, AK Steel Corporation, NLMK, Evraz plc, United States Steel, and JFE Steel Corporation.

b. The key factor that is driving the growth of the global carbon steel market is the growing demand for infrastructure development and construction activities across emerging economies, coupled with increasing application in automotive, energy, and manufacturing sectors due to its cost-effectiveness, strength, and recyclability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.