- Home

- »

- Clinical Diagnostics

- »

-

Cardiac Biomarkers Market Size And Share Report, 2030GVR Report cover

![Cardiac Biomarkers Market Size, Share & Trends Report]()

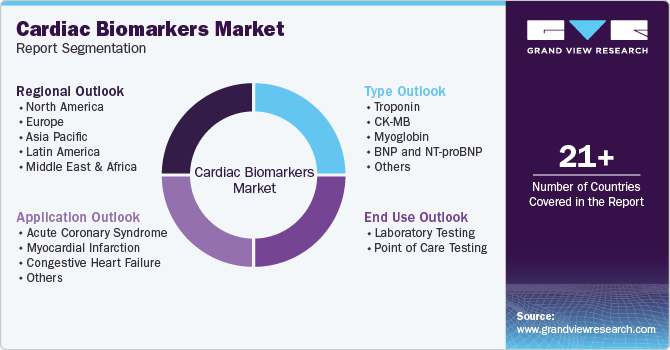

Cardiac Biomarkers Market Size, Share & Trends Analysis Report By Type (Troponin, CK-MB, Myoglobin, BNP And NT-proBNP), By Application (Acute Coronary Syndrome, Myocardial Infarction), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-083-5

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Cardiac Biomarkers Market Size & Trends

The global cardiac biomarkers market size was valued at USD 16.05 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 14.6% from 2023 to 2030. Cardiac biomarkers are witnessing growth owing to factors such as the high prevalence of acute coronary syndrome, technological advancements in cardiac biomarkers, rising demand for point-of-care (POC) cardiac testing kits, and high specificity in detecting cardiac diseases, especially myocardial infarction.

The enhanced usage of cardiac biomarkers in SARS-CoV-2 patients to minimize the risk of cardiac diseases further drives the demand. For instance, according to National Center for Biotechnology Information (NCBI) in 2021, biomarkers for cardiac injuries were elevated in complicated cases of COVID-19 patients and were directly associated with adverse disease outcomes. Thus, cardiac biomarkers enabled the disease management of severely ill patients.

Moreover, cardiac test kits contain an array of combination tests that detect the presence of biomarkers, facilitating the easier diagnosis of cardiac diseases. Increasing demand for these kits is due to quick diagnosis and fast results obtained through them, which reduces the diagnostic time involved, expediting the treatment process. In addition, they diagnose chest pain and help identify risk factors prior to the occurrence of adverse cardiac events.

An increase in the prevalence of cardiovascular diseases is expected to boost segment growth. According to the WHO, 17.9 million people die every year from cardiovascular diseases, which is 32% of all deaths worldwide. The report published by World Heart Federation projects that cardiovascular illnesses continue to impact more than 500 million individuals worldwide, accounting for 20.5 million deaths in 2021. Cardiovascular diseases are the leading cause of mortality and morbidity in the U.S. Companies are currently focusing on identifying cardiac biomarkers as they provide an increased understanding of the pathophysiology of cardiovascular diseases. Elecsys Troponin T-Gen 5 STAT, a cardiac biomarker by Roche Diagnostics, delivers results in 9 minutes and helps in quick decision-making.

The decline in the rate of heart attack mortality is expected to affect the adoption of products adversely. According to a study conducted by the American College of Cardiology, from 2006 to 2016, the death rate from CHD in the U.S. declined by 31.8%, while for cardiovascular diseases, it declined by 18.6%. In addition, a research study conducted in the UK in September 2020 revealed that a decline in recurrent heart attacks was observed, but the risk of heart failure remains high. In addition, the same study mentioned a decline in repeat attacks from 2008 to 2017, and a greater decline was observed in women compared to men.

Type Insights

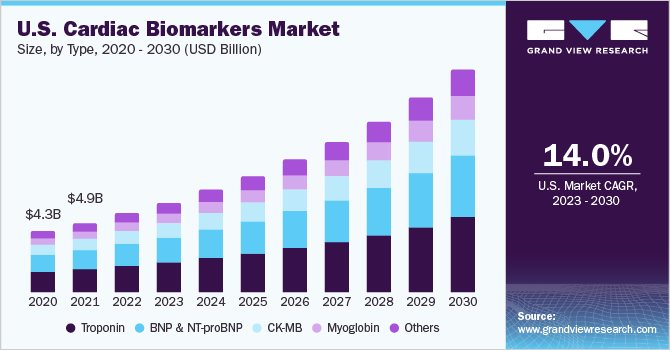

The troponin segment held the largest revenue share of over 32.8% in 2022 and is expected to witness the fastest CAGR of 15.0% during the forecast period. The exponential growth can be attributed to factors such as diagnostic efficiency, specificity, and accurate predictive detection of cardiac events when compared to other tests. The growing prevalence of myocardial infarction and stroke across the globe further boosts market growth. In July 2023, Mylab Discovery Solutions launched the Mybox+ diagnostic device powered by optical AI engines, which offers accurate, rapid results in clinical samples for over 30 diseases. This portable device is ideal for small labs and centers, allowing for the testing of cardiac markers (troponin), thyroid panels (T-3, T-4, TSH), and biomarkers (CRP, D-Dimer).

The BNP and NT-proBNP segment is expected to grow significantly due to its usage in detecting heart damage and stress. New players are entering the market with the test to generate lucrative revenues. For instance, in June 2022, LumiraDx Limited announced the diversification of its portfolio with a CE Mark for its D-Dimer test and NT-proBNP test. The commercialization of the latter is projected by the end of 2022, which is expected to facilitate clinical decision-making.

Application Insights

Acute coronary syndrome held the largest revenue share of over 54.5% in 2022 as the disease burden is rapidly rising in low- and middle-income countries compared to high-income countries. Factors such as rapid urbanization and an increase in jobs that are sedentary are driving the disease incidence. Cardiac troponin T and I biomarkers tests have emerged as the prime diagnostic methods for diagnosing the disease. In February 2023, Cardio Diagnostics launched PrecisionCHD, an integrated epigenetic-genetic blood test for early detection of coronary heart disease. The test uses genetic biomarkers and epigenetics and a machine learning model analyzing genomic and epigenomic data. It maps a patient's biomarker profile to modifiable risk factors such as diabetes, hypertension, hypercholesterolemia, and smoking, which are critical drivers of coronary heart disease.

The other application segment dominated the market with the fastest CAGR of 15.5%. Myocardial infarction is anticipated to witness lucrative growth owing to its rising incidence globally. The enhanced focus of researchers on myocardial infarction is expected to create lucrative opportunities in the segment. For instance, as per the Science Journal, in 2022, researchers identified 27 novel proteins for personalized prediction of myocardial infarction risk.

End-use Insights

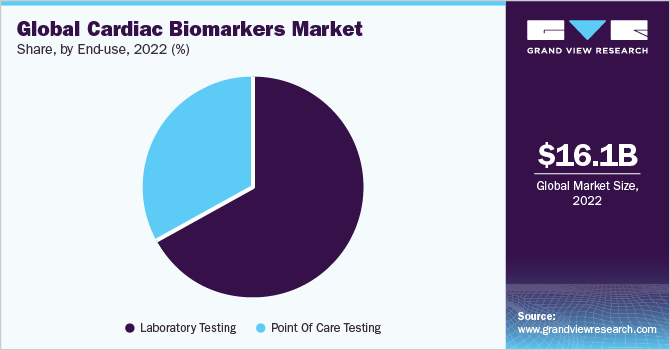

The laboratory testing segment held the largest revenue share of over 66.9% in 2022. This can be attributed to the advantages offered by laboratory testing, such as high sensitivity, specificity, scalability, and cost-efficiency. Furthermore, these laboratories facilitate the testing of all types of samples. Diagnostic laboratory services are crucial in clinical decision-making.

The point of care (POC) testing segment is expected to grow at the fastest CAGR of 14.9% during the forecast period. The segment has grown exponentially due to the increasing use and adoption of highly sensitive and easy-to-use POC Troponin tests. The rising emphasis on providing effective, value-based healthcare services in the face of tight budgets enhances the importance of POC tests. In addition, these tests are the primary choice of medical professionals during emergencies for faster diagnosis of the patients. The demand for POC test kits for use in nursing homes and home healthcare is driven by the global aging population, which is on the rise.

Regional Insights

North America dominated the global cardiac biomarkers market with the largest revenue share of over 41.1% in 2022. This can be attributed to the developed healthcare system and the high adoption of cardiac biomarkers as a tool for diagnosis and predictive diagnosis of conditions. The rising geriatric population requires biomarker testing to identify conditions such as acute myocardial infarction, which is driving the demand for testing products. The presence of key players such as Quidel Corporation and Danaher Corporation in the region is another factor adding to the growth of this market. According to the World Health Organization (WHO), 77 million adults above 18 years have type 2 diabetes, with 25 million prediabetics. This increases cardiovascular disease risk and puts additional pressure on the health system.

Asia Pacific is expected to expand at the fastest CAGR of 16.0% during the forecast period owing to the rising affordability of advanced cardiac tests, modernization in the countries, and increasing disposable income. The growing incidence of cardiovascular diseases (CVDs) in this region has increased the demand for improved diagnostics, government funding for target disease and other research, and healthcare expenditure. India has a higher prevalence of CVDs when compared to other developing countries.

This high disease burden in the region is expected to drive the demand for cardiac biomarker diagnostics for facilitating the diagnosis, evaluation, and management of CVD. For instance, in January 2023, Cipla Inc, an Indian multinational pharmaceutical company, launched a diagnostic device called Cippoint, which offers a point-of-care testing solution for various health conditions. The European In-Vitro Diagnostic Device Directive device approved the device and offers a broad range of testing parameters, including diabetes, cardiac markers, fertility, infectious diseases, inflammation, thyroid function, metabolic markers, and coagulation markers.

Key Companies & Market Share Insights

Players are increasingly opting for product launches, geographical expansions, strategic collaborations, partnerships, and mergers and acquisitions in emerging and economically favorable regions. For instance, in November 2022, OMRON Healthcare and CardioSignal partnered to develop early cardiovascular disease detection technologies for cardiac health management. This partnership will offer digital cardiac biomarkers that could potentially save lives.

In April 2021, using the Elecsys technology, which has the NT-proBNP and highly sensitive cardiac troponin T, Roche announced a series of five new intended uses for two key cardiac biomarkers (cTnT-hs). This is expected to improve risk identification and diagnosis and allow the company to generate higher revenue from the existing products. Some prominent players in the global cardiac biomarkers market include:

-

Abbott

-

Quidel Corporation

-

Siemens Healthcare GmbH

-

F. Hoffmann-La Roche Ltd.

-

Danaher

-

BIOMÉRIEUX

-

Bio-Rad Laboratories, Inc.

-

Randox Laboratories Ltd.

-

Creative Diagnostics

-

Life Diagnostics

Cardiac Biomarkers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 18.47 billion

Revenue forecast in 2030

USD 47.88 billion

Growth rate

CAGR of 14.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Quidel Corporation; Siemens Healthcare GmbH; F. Hoffmann-La Roche Ltd.; Danaher; BIOMÉRIEUX; Bio-Rad Laboratories, Inc.; Randox Laboratories Ltd.; Creative Diagnostics; Life Diagnostics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cardiac Biomarkers Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cardiac biomarkers market report on the basis of type, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Troponin

-

CK-MB

-

Myoglobin

-

BNP and NT-proBNP

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute Coronary Syndrome

-

Myocardial Infarction

-

Congestive Heart Failure

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Laboratory Testing

-

Point of Care Testing

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cardiac biomarkers market size was estimated at USD 16.05 billion in 2022 and is expected to reach USD 18.47 billion in 2023.

b. The global cardiac biomarkers market is expected to grow at a compound annual growth rate of 14.6% from 2023 to 2030 to reach USD 47.88 billion by 2030.

b. North America dominated the cardiac biomarkers market with a share of 41.1% in 2022. This is attributable to the significant disease burden stemming from the high incidence of cardiovascular diseases in North America and the increasing popularity of PoC diagnostics. High awareness levels associated with advanced diagnostic & prognostic tools and supportive reimbursement policies facilitate adoption of novel technologies in the region.

b. Some key players operating in the cardiac biomarkers market include Abbott, Siemens Healthineers, Thermo Fisher Scientific, Inc., Becton, Dickinson and Company, bioMérieux SA, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd, and Randox Laboratories Ltd.

b. Key factors that are driving the cardiac biomarkers market growth include the high prevalence of cardiovascular diseases such as Acute Coronary Syndrome (ACS), Acute Myocardial Infarction (AMI), ischemia, and Congestive Heart Failure (CHF) globally and the rising adoption of biomarkers as a prognostic tool.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."