- Home

- »

- Medical Devices

- »

-

Cardiac Resynchronization Therapy Market Size Report, 2030GVR Report cover

![Cardiac Resynchronization Therapy Market Size, Share & Trends Report]()

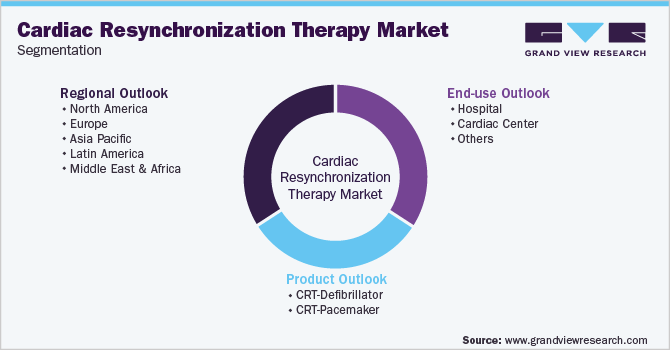

Cardiac Resynchronization Therapy Market Size, Share & Trends Analysis Report By Product (CRT-Defibrillator, CRT-Pacemaker), By End-use (Hospitals, Cardiac Centers, Others), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-347-8

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The cardiac resynchronization therapy market size was valued at USD 4.26 billion in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. Growing product developments, an aging population, initiatives by key companies, and the prevalence of cardiovascular diseases are some of the key drivers of this market. Boston Scientific, for instance, reported cumulative distribution of around 389,000 CRT-Ds globally as of January 2021. During 2020, the company sold around 33,000 CRT-Ds; out of which, about 16,500 were registered in the U.S., which is indicative of high demand.

The COVID-19 pandemic adversely impacted the cardiac resynchronization therapy market with dampened demand and sales. This was due to pandemic-induced deferred or canceled elective procedures, delays in clinical trials, supply chain challenges, and reduced sales and marketing activities. Several key companies such as Medtronic, Boston Scientific, and Microport reported a negative impact of COVID-19 on their financial performance and business activities. For instance, Microport reported a 16.2% decline in its cardiac rhythm management business in 2020. The company attributed the decline to postponed outpatient visits and surgical procedures due to COVID-19, thus resulting in a decreased number of implants.

After the initial shock and confusion about COVID-19 effects, companies and governments began taking corrective actions to help the economy and businesses recover. These initiatives included lowering conditional exemptions, limitations, and other tactical steps, in addition to policy and monetary support. In April 2020, COVID-19 task force update, the Heart Rhythm Society released guidelines for managing patients with cardiac implantable electronic devices with an emphasis on limiting exposure to patients and providers. It indicated that only major issues involving device leads, generators, or reprogramming need in-person visits. This was used by Biotronik to promote its line of implanted devices for cardiac rhythm management that feature home monitoring technology for continuity of care. Following the peak of COVID-19, the American College of Cardiology (ACC), the Canadian Association of Interventional Cardiology (CAIC), and other North American cardiology organizations presented suggestions for ethically and safely resuming invasive cardiovascular procedures. The market for CRT devices was aided by these regulations.

The aging population is a key factor estimated to fuel market growth. Statistics Korea estimated that about 8.53 million individuals are aged 65 years and older in 2021. This number is expected to reach 12.98 million by 2030. The aging population indicates a growing number of people at risk of chronic diseases, such as congestive heart failure, hypertension, and arrhythmia. This is anticipated to contribute to market growth in the country. According to a survey conducted by the European Society of Cardiology and published in the Archives of Cardiovascular Diseases in 2019, French patients were found to be more likely to receive a CRT-P implant compared to the rest of Europe. The patients were identified to be comparatively older, with about 44.7% aged 75 years and above, had fewer co-morbidities, and less severe heart failure symptoms.

Rising product improvements, R&D initiatives by market players, and the prevalence of cardiovascular diseases are expected to fuel market growth. For instance, in February 2020, Abbott received CE Marking for its Gallant ICDs and CRT-D devices. These technologies enhance the company's solutions by enabling remote monitoring through Abbott's myMerlinPuls App. MultiPoint Pacing and SyncAV feature further enhance the Gallant CRT-D system to improve patient response to CRT therapy. This supported the company’s growth objectives. The Spanish Pacemaker Registry reported that, in 2020, about 3,850 CRT devices were implanted in Spain. Out of the implanted devices, 2,387 were CRT-D devices and 1,463 were CRT-P devices. It was reported that recipients were 78.8 years old on average. Syncope was found to be the symptom that led to implantation in 41.8% of cases. Dizziness and heart failure were found to be the other symptoms.

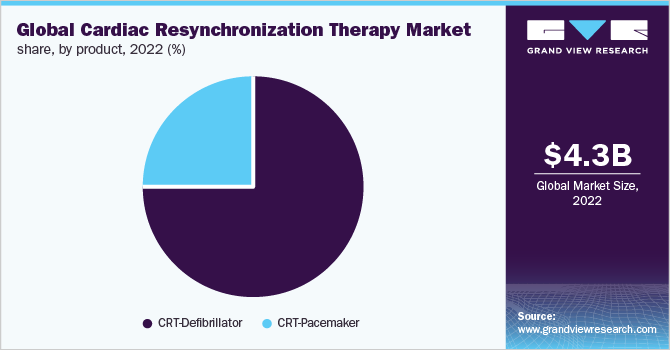

Product Insights

CRT-Defibrillators accounted for more than 74.71% share of the cardiac resynchronization therapy market by product in 2022. The CRT-P segment, on the other hand, is expected to expand at the fastest CAGR of over 6.0% during the forecast period. This is owing to include increasing geriatric population across the globe, the prevalence of cardiac conditions, and product advancements by key market players. Additionally, more doctors continue to suggest CRT-P usage for heart failure patients who would benefit more from pacing than defibrillation, resulting in driving the CRT-P to expand at the fastest CAGR during the forecast period.

Using information from the Japan Cardiac Device Treatment Registry, a study from 2020 was published in the Journal of Arrhythmia (JCDTR). In patients aged 75 years and older in Japan, the research showed an upward trend in the percentage of ICDs, CRT-Ds, and CRT-Ps implanted for the first time. Over a decade, researchers counted 17,564, 9,470, and 1,087 patients that had ICD implants, CRT-D implants, and CRT-P implants, respectively.

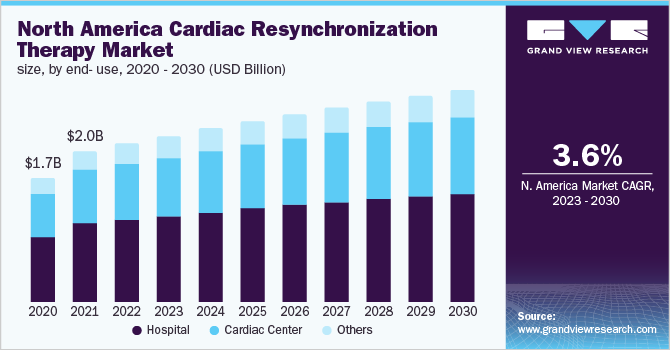

End-use Insights

By end-user, hospitals held the largest share of about 52.08% of the cardiac resynchronization therapy market in 2022. This is attributable to the high consumption of CRT devices in hospitals as most surgeries are performed in hospital settings. For instance, the UAE's Aster Hospital reported a 61-year-old man with significant heart failure who experienced regular episodes of fast and life-threatening heartbeats having CRT-D implanted.

The Cardiac Center segment is anticipated to register the fastest growth of 5.1% due to the increasing number of cardiac specialty centers and the prevalence of cardiovascular diseases. According to CDC, as of September 2020, around 6.2 million adults in the U.S. suffered from heart failure. Furthermore, according to the American College of Cardiology Foundation, the prevalence of cardiovascular diseases rose from 271 million to 523 million from 1990 to 2019.

Regional Insights

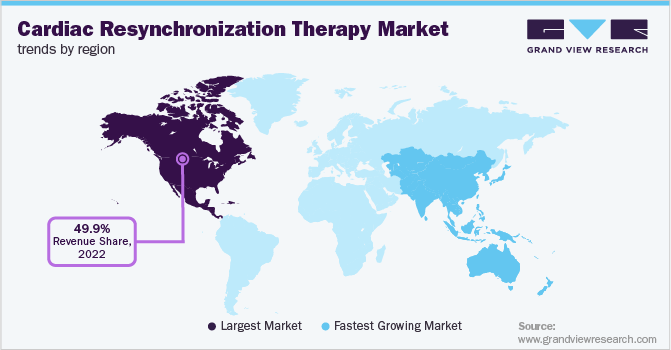

North America held more than 49.9% share of the cardiac resynchronization therapy market in 2022. The large share of the North American region is its increasing geriatric population and growing regulatory approvals. Physical inactivity due to a sedentary lifestyle can increase the risk of developing chronic cardiac conditions, which may propel the need for cardiovascular care.

Asia Pacific is projected to expand at the fastest CAGR of 6.3% over the next few years. This is owing to developing healthcare infrastructure, an aging population, improvement in economic conditions, strategic initiatives by key companies, and the growing prevalence of cardiac diseases. For example, MicroPort is a Chinese company specializing in a variety of medical devices, including CRT-Ds and CRT-Ps. The company is a domestic leader in the cardiac rhythm management market. It registered a 95% year-on-year growth in revenue during H1 2021 (with a revenue of about USD 6 million) in China, owing to a wide portfolio and robust product pipeline. This growth was driven by cost-effectiveness and brand recognition, facilitating the company to cover 584 hospitals across the country.

Key Companies & Market Share Insights

Competition in the CRT market is expected to be moderate during the forecast period. The top 5 companies take up approximately 90% of market shares. In addition, these companies have extensive resources, market expertise, and distribution network, and are involved in deploying strategic initiatives to increase market share and profits. Strategies including regional expansion, partnerships, mergers and acquisitions, the launch of new products, and R&D activities are used for market expansion. This results in moderate competitive rivalry across the CRT market.

Given the increasing adoption of CRT devices, companies are improving their product portfolio to strengthen their positioning in the CRT device market. For instance, Boston Scientific and BIOTRONIK both introduced new CRT devices in 2017, the Resonate CRT-D device and the EDORA quadripolar CRT-P device, while Abbott Laboratories got CE marking for their Gallant CRT devices in February 2020. Consequently, these products are assisting businesses in strengthening their positions in the lucrative CRT devices market. Some prominent players in the cardiac resynchronization therapy market include:

-

Medtronic

-

Abbott

-

Boston Scientific Corporation

-

Biotronik SE & Co., KG

-

MicroPort Scientific Corporation

-

Livanova plc.

Cardiac Resynchronization Therapy Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.49 billion

Revenue forecast in 2030

USD 6.23 billion

Growth rate

CAGR of 4.8% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Medtronic; Abbott; Boston Scientific Corporation; Biotronik SE & Co., KG; MicroPort Scientific Corporation; Livanova, plc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cardiac Resynchronization Therapy Market Segmentation

This report forecasts revenue growth at the regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cardiac resynchronization therapy market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

CRT-Defibrillator

-

CRT-Pacemaker

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Cardiac Center

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global cardiac resynchronization therapy market size was estimated at USD 4.26 billion in 2022 and is expected to reach USD 4.49 billion in 2023.

b. The global cardiac resynchronization therapy market is expected to grow at a compound annual growth rate of 4.8% from 2023 to 2030 to reach USD 6.23 billion by 2030.

b. North America dominated the cardiac resynchronization therapy market with a share of 49.9% in 2022. This is attributable to well-established healthcare infrastructure, the increasing prevalence of cardiac diseases, and the geriatric population susceptible to cardiac dysfunction.

b. Some key players operating in the cardiac resynchronization therapy market include Medtronic, Abbott, Boston Scientific Corporation, Biotronik SE & Co., KG, MicroPort Scientific Corporation, Livanova, plc.

b. Key factors that are driving the cardiac resynchronization therapy market growth include rising product advancements, growing initiatives by key companies, and increasing product adoption by end-users.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."