- Home

- »

- Medical Devices

- »

-

Cardiovascular Ultrasound Market Size & Share Report, 2030GVR Report cover

![Cardiovascular Ultrasound Market Size, Share & Trends Report]()

Cardiovascular Ultrasound Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Transthoracic Echocardiography, Fetal Echocardiography), By Technology (2D, 3D/4D, Doppler), By Display (B/W, Color), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-697-4

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cardiovascular Ultrasound Market Trends

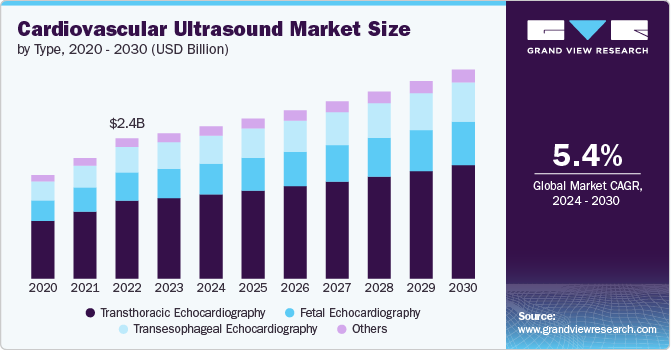

The global cardiovascular ultrasound market size was estimated at USD 2.44 billion in 2023 and is projected to grow at a CAGR of 5.41% from 2024 to 2030. Major factors contributing to the market growth include the increasing prevalence of cardiovascular diseases (CVDs), which are among the leading causes of death globally. Furthermore, the aging population, which is more susceptible to heart conditions, technological advancements in ultrasound imaging, growing awareness of early diagnosis and preventive healthcare, coupled with rising healthcare expenditures and government initiatives to improve healthcare infrastructure, are propelling market expansion.

The increasing prevalence of cardiovascular diseases directly contributes to the growth of the ultrasound market as it increases the demand for effective, non-invasive diagnostic tools. Cardiovascular diseases are the leading cause of death worldwide, accounting for about 17.9 million deaths annually. Ultrasound, particularly cardiovascular ultrasound or echocardiography is essential for diagnosing and monitoring heart conditions, enabling early detection and intervention. As CVDs become more common, especially in aging populations, the demand for accurate, accessible, and cost-effective diagnostic methods rises. Ultrasound meets these needs by providing real-time images of the heart, helping clinicians assess heart function, detect abnormalities, and guide treatment options without the risks associated with more invasive procedures.

Technological advancements in cardiac ultrasound are further expected to significantly contribute to market growth by enhancing the capabilities and applications of cardiovascular ultrasound devices. Advancements such as 3D and 4D imaging, improved Doppler techniques, and the development of portable and handheld devices have revolutionized cardiac ultrasound, making it more accurate, efficient, and accessible. These advancements allow for better visualization of heart structures, improved assessment of cardiac function, and earlier detection of abnormalities. Additionally, the integration of artificial intelligence (AI) in ultrasound technology aids in more precise and automated interpretation of results. For instance, in June 2024, Philips unveiled its next-generation AI-powered cardiovascular ultrasound platform, designed to accelerate cardiac ultrasound analysis using advanced AI technology and alleviate the workload in echocardiography labs.

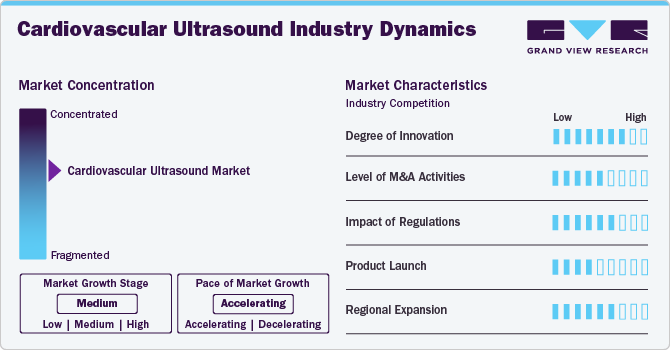

Market Concentration & Characteristics

The cardiovascular ultrasound industry is experiencing moderate growth, propelled by a combination of technological advancements and increasing awareness of the importance of early diagnosis and preventive care in cardiovascular health. Innovations such as enhanced imaging techniques, portable devices, and AI integration are making ultrasound technology more accurate, efficient, and accessible, thereby expanding its clinical applications.

Leading companies in the industry are consistently involved to enhance their product portfolios to expand their customer base and capture a larger industry share. This effort includes upgrading their existing products, pursuing acquisitions, securing government approvals, and engaging in significant collaborative initiatives. For instance, in April 2024, GE HealthCare launched Caption AI on the Vscan Air SL wireless handheld ultrasound system to enable more clinicians to capture diagnostic-quality cardiac images.

“With the increase of cardiovascular disease and shortage of sonographers around the globe, innovations like the Vscan Air SL with Caption AI are hugely transformative in cardiac care, supporting rapid and confident assessments at the point of care.”

"AI guidance has enormous potential in ultrasound due to its ability to guide experts and relatively new users in retrieving diagnostic-quality information to make timely and accurate decisions and get patients on the right path sooner."

- Cardiologist Jordan B. Strom, M.D., MSc.

The degree of innovation in cardiovascular ultrasound devices is remarkable, with advancements continually enhancing their capabilities. For instance, in May 2024, Siemens Healthineers introduced new cardiology applications incorporating artificial intelligence for the Acuson Sequoia ultrasound system and 4D transesophageal (TEE) transducer specifically designed for cardiology exams. These innovations hihglights the rapid progress in the field, improving diagnostic accuracy and expanding the range of clinical applications.

Companies in the cardiovascular ultrasound sector are actively pursuing mergers and acquisitions as a strategic move to strengthen their industry position, broaden their product offerings, and fuel growth. For instance, in July 2024, GE HealthCare announced an agreement to acquire Intelligent Ultrasound Group PLC’s clinical artificial intelligence (AI) software division for about USD 51 million. Intelligent Ultrasound is known for its advanced AI-driven image analysis tools that enhance the intelligence and efficiency of ultrasound imaging.

Regulations affecting cardiovascular ultrasound devices vary significantly across different regulatory agencies and regions. Key regulatory bodies, including the FDA in the U.S., the EMA in Europe, and other equivalent agencies globally, are essential in ensuring the safety, efficacy, and industry approval of these devices.

Manufacturers are actively involved in launching new products to meet evolving industry demands and technological advancements. For instance, in January 2024, Esaote introduced two new ultrasound systems at Arab Health: the MyLab A50 and MyLab A70. Featuring a compact footprint, lightweight and battery-operated design, these mobile systems are designed to meet the needs of a wide range of healthcare professionals.

The geographical reach of the cardiovascular ultrasound industry has been broadening due to population growth, increased healthcare investments, and evolving regulatory environments.

Type Insights

The transthoracic echocardiography (TTE) segment dominated the market by capturing a share of 55.4% in 2023.TTE is a non-invasive imaging method that delivers real-time, high-quality images of the heart’s structures and functions, making it crucial for diagnosing and managing various cardiovascular conditions. Its widespread use is fueled by its user-friendliness, cost-effectiveness, and the convenience of performing it at the bedside, especially beneficial in critical care environments. Moreover, advancements in TTE technology, including enhanced image resolution and improved Doppler capabilities, have increased its adoption among clinicians.

The Fetal Echocardiography segment is expected to grow at the fastest rate over the forecast period. This is due to increasing awareness of the importance of prenatal cardiac screening and advancements in imaging technology. As more expectant parents and healthcare providers recognize the benefits of early detection of congenital heart defects, the demand for detailed and accurate fetal heart assessments rises. Advances in fetal echocardiography, such as enhanced imaging techniques and greater resolution, allow for more precise evaluations of fetal heart health. Additionally, guidelines and recommendations from medical practitioners now emphasize routine fetal echocardiography for high-risk pregnancies, further driving its adoption.

Technology Insights

The doppler segment dominated the market by capturing a 42.6% share in 2023 and is further expected to grow at the fastest CAGR over the forecast period. This is primarily attributed to its advanced capabilities in providing detailed blood flow and velocity measurements. Doppler imaging techniques, such as Doppler ultrasound, offer significant advantages in diagnosing and monitoring various cardiovascular and ophthalmic conditions by allowing precise visualization of blood flow dynamics. This increased diagnostic accuracy and efficiency have driven the widespread adoption of Doppler technology in medical imaging. Additionally, ongoing advancements in Doppler technology, including improvements in sensitivity and resolution, are further expected to contribute to the market growth.

The 3D/4D segment is also expected to grow at a significant level over the forecast period, this is primarily due to its ability to provide detailed and dynamic imaging of the heart's structure and function. Unlike traditional 2D ultrasound, 3D/4D imaging offers comprehensive three-dimensional views and real-time visualization of cardiac anatomy, which enhances diagnostic precision and aids in the assessment of complex cardiovascular conditions. The advanced imaging capabilities of 3D/4D technology facilitate more accurate evaluations of cardiac chamber volumes, valve function, and blood flow dynamics, leading to improved clinical decision-making and patient outcomes. Additionally, the increasing demand for non-invasive, high-resolution imaging techniques and technological advancements in 3D/4D ultrasound systems are driving segment growth.

Display Insights

The color segment dominated the market by capturing a share of 84.0% in 2023 and is expected to grow at the fastest rate over the forecast period. This is primarily attributed to its superior ability to visualize and assess blood flow dynamics within the heart and vascular system. These devices provide real-time, color-coded images that represent blood flow direction and velocity, enhancing the accuracy and interpretability of cardiovascular assessments. This capability is essential for diagnosing and monitoring a range of cardiovascular conditions, from congenital heart defects to valvular diseases. The widespread adoption of color Doppler technology is driven by its effectiveness in delivering detailed, non-invasive insights that support precise clinical evaluations and treatment planning.

B/W cardiac ultrasound, commonly known as 2D echocardiography, is a fundamental tool in cardiology. It delivers detailed grayscale images that help clinicians evaluate various aspects of cardiac anatomy, including chamber sizes, wall motion, and overall heart function. Despite the advancements in color Doppler and 3D/4D imaging technologies, B/W cardiac ultrasound is known for its simplicity, speed, and effectiveness in providing clear, real-time images. Its ability to assess cardiac structures without the additional complexity of color flow information makes it a dependable option for initial evaluations, routine assessments, and certain clinical decisions.

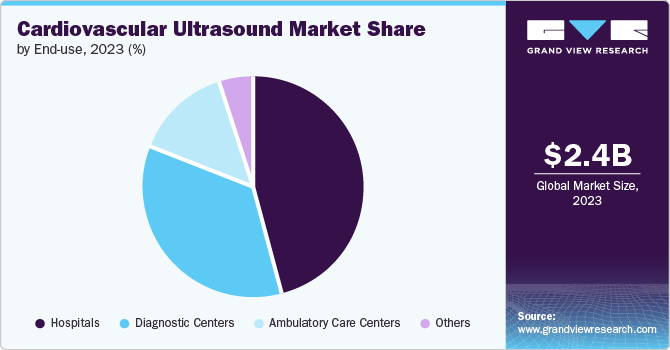

End-use Insights

The hospital segment dominated the market with a share of over 45.9% in 2023. This dominance is attributed to several factors, including the increasing number of outpatient department (OPD) visits and hospital admissions. Hospitals are central to cardiovascular care, offering a range of specialized diagnostic services that require advanced ultrasound technology. The growing prevalence of cardiovascular diseases, coupled with the rising demand for comprehensive diagnostic and monitoring services, has led to more frequent use of ultrasound imaging in hospital settings.

The ambulatory care centers segment is expected to grow at the fastest CAGR over the forecast period, due to their ability to offer convenient, cost-effective diagnostic services in a less invasive setting compared to traditional hospitals. These centers are designed to provide specialized care with a focus on efficiency and patient convenience, allowing for quicker, outpatient-based procedures. The increasing preference for outpatient care, driven by its lower costs and reduced need for hospital admission, is fueling this growth. Additionally, advancements in portable and compact ultrasound technologies make it feasible for ambulatory care centers to perform high-quality cardiovascular imaging, further boosting their adoption.

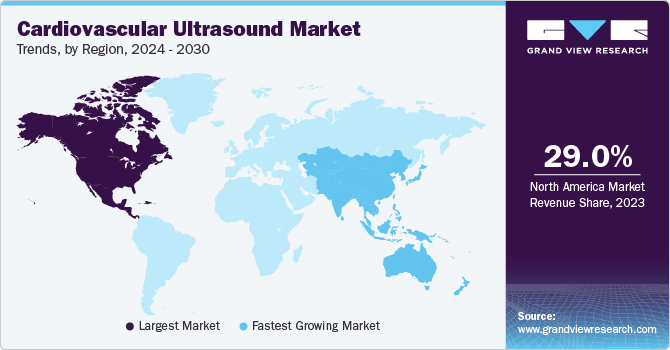

Regional Insights

North America cardiovascular ultrasound market held the largest share of 29.0% in 2023. This can be attributed to the presence of a robust healthcare infrastructure that facilitates the widespread adoption of advanced medical technologies, including cardiovascular ultrasound. Furthermore, market participants are introducing advanced cardiovascular ultrasound devices to address the increasing demand.

U.S. Cardiovascular Ultrasound Market Trends

The cardiovascular ultrasound market in the U.S. held the largest market share in 2023 in the North America region. This is owing to the increasing prevalence of cardiovascular diseases, coupled with a strong focus on early diagnosis and preventive care. For instance, according to the CDC, in 2022, heart disease caused the deaths of 702,880 individuals in the U.S. The presence of major medical device manufacturers and ongoing innovation in cardiovascular ultrasound technology further contribute to the market growth.

Europe Cardiovascular Ultrasound Market Trends

The cardiovascular ultrasound market in Europe held a significant market share in 2023. Europe's aging population and the rising incidence of cardiovascular diseases are driving the growing demand for precise and early diagnostic devices. According to the WHO, cardiovascular diseases (CVDs) are the leading cause of disability and premature death in the European Region, accounting for over 42.5% of all deaths annually equivalent to around 10,000 deaths each day. This high burden of disease, combined with a strong focus on preventive healthcare and early detection, is accelerating the adoption of advanced diagnostic technologies throughout the region.

UK cardiovascular ultrasound market is anticipated to expand due to the increasing emphasis on early diagnosis and management of cardiovascular conditions, supported by advancements in imaging technology and growing healthcare investments.

The cardiovascular ultrasound market in France is expected to grow over the forecast period due to the technological advancements that enhance diagnostic capabilities and improve patient outcomes. Innovations such as high-resolution imaging, 3D/4D ultrasound, and advanced Doppler techniques are driving the adoption of more precise and efficient cardiovascular diagnostic tools.

Germany cardiovascular ultrasound market is expected to grow over the forecast period this can be attributed to the country’s advanced healthcare infrastructure and strong emphasis on integrating innovative medical technologies into clinical practice. Government initiatives and funding aimed at improving cardiovascular care and enhancing diagnostic capabilities further support market growth.

Asia Pacific Cardiovascular Ultrasound Market Trends

The cardiovascular ultrasound market in Asia Pacific is estimated to witness the fastest CAGR of 5.82% during the forecast period, primarily due to the rapid expansion of healthcare infrastructure and increasing investments in advanced medical technologies across the region. The growing prevalence of cardiovascular diseases, driven by rising urbanization, lifestyle changes, and an aging population, is fueling demand for effective diagnostic tools. Additionally, the rising emphasis on improving healthcare access and quality, combined with the adoption of advanced ultrasound technologies and increasing healthcare expenditures, contributes to the market growth.

China cardiovascular ultrasound market is expected to grow over the forecast period, driven largely by the increasing incidence of cardiac diseases across the country. For instance, the World Heart Federation reports that approximately one in five adults in China suffers from cardiovascular disease. China has one of the highest rates of cardiovascular disease-related deaths globally.

The cardiovascular ultrasound market is expected to grow, over the forecast period. This growth is mainly driven by increasing awareness about cardiovascular disease and the benefits of cardiovascular ultrasound devices in the country.

Latin America Cardiovascular Ultrasound Market Trends

The cardiovascular ultrasound market in Latin America is expected to see moderate growth during the forecast period, largely due to rising investments in healthcare infrastructure throughout the region. This encompasses the expansion and modernization of hospitals and diagnostic centers, which improves access to advanced cardiovascular imaging services and drives demand for advanced ultrasound technology.

MEA Cardiovascular Ultrasound Market Trends

The cardiovascular ultrasound market in the Middle East and Africa (MEA) is anticipated to witness growth due to various factors. These include increasing investments in healthcare infrastructure, the expansion of medical facilities, and advancements in diagnostic technology across the region. Additionally, a growing focus on improving healthcare services and addressing the rising prevalence of cardiovascular diseases are contributing to the increased demand for advanced cardiovascular ultrasound solutions. The efforts to enhance healthcare accessibility and quality in MEA are further driving the market's growth.

Key Cardiovascular Ultrasound Company Insights

Major players in the cardiovascular ultrasound market are actively enhancing their product portfolios through various strategies to remain competitive and expand their market share. These strategies include continuous product upgrades to incorporate the latest technological advancements, strategic collaborations, and exploring opportunities for acquisitions. Additionally, obtaining government approvals for their products is crucial to ensure compliance with regulatory standards.

Key Cardiovascular Ultrasound Companies:

The following are the leading companies in the cardiovascular ultrasound market. These companies collectively hold the largest market share and dictate industry trends.

- Koninklijke Philips N.V.

- GE Healthcare

- Siemens Healthineers AG

- Canon Medical Systems

- Mindray Medical International Limited

- Samsung Medison Co., Ltd.

- FUJIFILM SonoSite, Inc.,

- Konica Minolta Inc.

- Esaote

- Trivitron Healthcare

Recent Developments

-

In August 2024, the FDA cleared UltraSight’s AI-powered cardiac ultrasound software. This real-time AI guidance tool helps medical professionals without sonography experience capture cardiac ultrasound images at the point of care across various settings. It enables broader detection of heart disease and offers patients improved access to cardiac monitoring.

-

In February 2024, FUJIFILM India announced the launch of the ALOKA ARIETTA 850 Diagnostic Ultrasound System in India, with its inaugural installation at Fortis Hospital in Bengaluru, Karnataka, a leading healthcare services provider in the state.

-

In April 2022, Trivitron Healthcare, a leading global manufacturer of medical devices, established its second ultrasound manufacturing facility in India, located in the Patalganga Industrial Area, Mumbai.

Cardiovascular Ultrasound Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.56 billion

Revenue forecast in 2030

USD 3.52 billion

Growth rate

CAGR of 5.41% from 2024 to 2030

Actual period

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, display, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Koninklijke Philips N.V.; GE Healthcare; Siemens Healthineers AG; Canon Medical Systems; Mindray Medical International Limited; Samsung Medison Co., Ltd.; FUJIFILM SonoSite, Inc.; Konica Minolta Inc.; Esaote, Trivitron Healthcare

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cardiovascular Ultrasound Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cardiovascular ultrasound market report on the basis of type, technology, display, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Transthoracic echocardiography

-

Transesophageal echocardiography

-

Fetal echocardiography

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

2D

-

3D/4D

-

Doppler

-

-

Display Outlook (Revenue, USD Million, 2018 - 2030)

-

B/W

-

Color

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Diagnostic centers

-

Ambulatory care centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cardiovascular ultrasound in the healthcare market size was estimated at USD 2.44 billion in 2023 and is expected to reach USD 2.56 billion in 2024.

b. The global cardiovascular ultrasound in healthcare market is expected to grow at a compound annual growth rate of 5.41% from 2023 to 2030 to reach USD 3.52 billion by 2030.

b. In 2023, North America dominated the market in terms of revenue share of 29.0%. The market's growth in the region is increasing due to increase in cardiovascular diseases across the region.

b. Some of the key market players are Koninklijke Philips N.V.; GE Healthcare; Siemens Healthineers AG; Canon Medical Systems; Mindray Medical International Limited; Samsung Medison Co., Ltd.; FUJIFILM SonoSite, Inc.; Konica Minolta Inc.; Esaote, Trivitron Healthcare

b. Increasing cardiovascular diseases which has led to an increased demand for diagnostic tools, such as cardiovascular ultrasound, to detect and monitor cardiovascular disease

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.