Cashew Milk Market Size & Trends

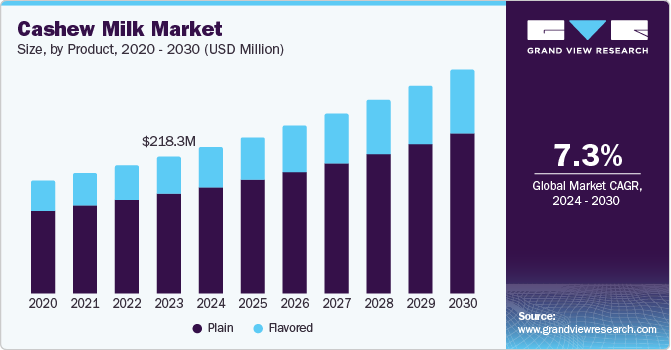

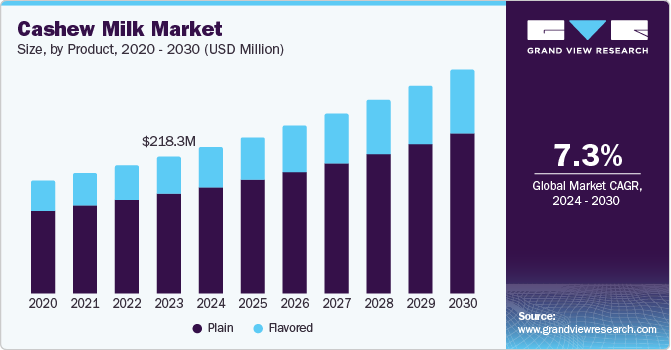

The global cashew milk market size was valued at USD 218.3 million in 2023 and is expected to expand at a CAGR of 7.3% from 2024 to 2030. Increasing consumer health consciousness leads to a higher demand for plant-based milk alternatives, such as cashew milk, which is perceived as a healthier option than traditional dairy milk. The rising prevalence of lactose intolerance and milk allergies also contributes to the shift towards non-dairy milk options. Additionally, the growing popularity of vegan and plant-based diets further boosts the demand for cashew milk.

The players also benefit from introducing new flavors and product innovations, making cashew milk more appealing to a broader audience. Moreover, the environmental benefits of plant-based milk, which requires fewer resources and produces lower greenhouse gas emissions than dairy milk, attract environmentally conscious consumers. These factors collectively are expected to drive the expansion of the market in the coming years.

The growing awareness of the nutritional benefits of cashew milk, such as its rich content of vitamins, minerals, and healthy fats, is attracting health-conscious consumers. Cashew milk is often fortified with additional nutrients like calcium and vitamin D, making it an appealing alternative to dairy milk. Furthermore, the rise in disposable incomes, especially in developing regions, enables more consumers to afford premium and specialty food products, including plant-based milk alternatives.

Product Insights

The plain cashew milk segment dominated the market with a revenue share of 73.1% in 2023. The growing consumer preference for plant-based milk alternatives is driven by increasing awareness of their health benefits, such as being lactose-free and low in saturated fats. The rising demand for nutritious and sustainable dairy substitutes has propelled plain cashew milk to the forefront, making it a popular choice among health-conscious consumers.

Flavored cashew milk is expected to grow at the fastest CAGR over the forecast period. Increasing consumer interest in diverse and innovative flavors enhances the appeal of cashew milk beyond its plain variant. As health-conscious consumers seek more variety in their plant-based milk options, flavored cashew milk offers an attractive alternative that combines the nutritional benefits of cashew milk with the enjoyment of unique and delicious tastes.

Type Insights

The conventional segment accounted for the largest revenue share in 2023. This dominance is attributed to the widespread availability and affordability of conventional cashew milk, making it a popular choice among consumers. Additionally, the established presence of conventional products in retail channels and their familiarity to consumers have further solidified their market position.

The organic segment is expected to grow at the fastest CAGR of 8.5% over the forecast period. Increasing consumer awareness and preference for organic products are driven by health and environmental concerns. As more consumers seek plant-based and organic alternatives to traditional dairy, the demand for organic cashew milk is expected to rise. Additionally, the perceived health benefits and the absence of synthetic pesticides and fertilizers in organic farming further bolster organic cashew milk's appeal.

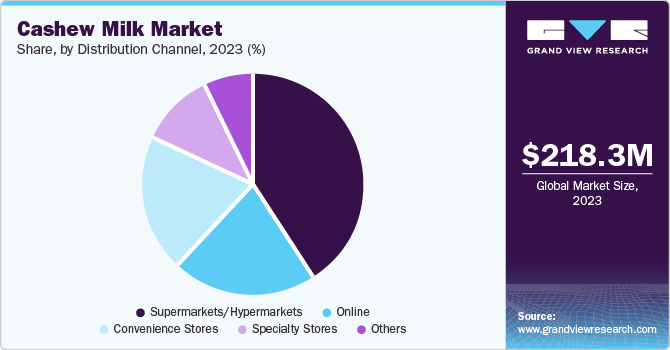

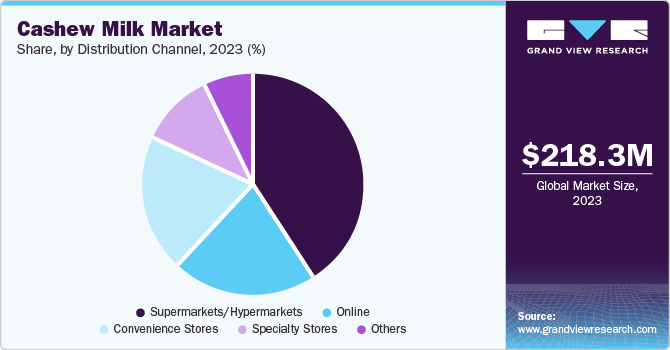

Distribution Channel

The supermarkets/hypermarkets segment dominated the market with the largest revenue share in 2023. This dominance is attributed to the widespread availability and accessibility of cashew milk in these retail outlets, which cater to a broad consumer base. Supermarkets and hypermarkets offer a convenient shopping experience, allowing consumers to find and purchase cashew milk alongside their regular groceries easily. Additionally, these large retail chains often engage in extensive marketing and promotional activities, further boosting the visibility and sales of cashew milk products.

The online channel segment is expected to grow at the fastest CAGR over the forecast period due to increasing consumer preference for the convenience and accessibility of online shopping. As more consumers turn to e-commerce platforms for their grocery needs, the demand for cashew milk through online channels is expected to surge. Additionally, the rise of digital marketing and targeted advertising has made it easier for brands to reach potential customers, further driving demand. The expansion of home delivery services and the growing trend of health-conscious consumers seeking plant-based alternatives online also contribute to the robust growth of this segment.

Regional Insights

North America cashew milk market dominated the global market with a revenue share of 37.1% in 2023 due to growing consumer awareness and preference for plant-based and dairy-free alternatives. Furthermore, the increasing incidence of lactose intolerance and the rising trend of veganism have further fueled the demand for cashew milk in North America.

U.S. Cashew Milk Market Trends

The U.S. cashew milk market is expected to grow significantly over the forecast period. The growing trend of veganism and the demand for sustainable food options further propel the market with continuous innovation in product offerings and expanding distribution channels. Furthermore, increasing consumer awareness of the health benefits of plant-based diets and the rising prevalence of lactose intolerance is expected to drive the market growth in the coming years.

Europe Cashew Milk Market Trends

Europe's cashew milk market was identified as a lucrative region in 2023. The growing demand for plant-based milk alternatives due to factors such as health concerns related to dairy consumption, lactose intolerance, and veganism. Furthermore, high spending capacity of European and presence of several market players are projected to drive market growth.

Germany cashew milk market is expected to grow rapidly in the coming years. Increasing consumer awareness of plant-based diets, health benefits associated with cashew milk, and a growing vegan population. Additionally, innovations in product offerings and expanding distribution channels are contributing to this upward trend.

Asia Pacific Cashew Milk Market Trends

Asia Pacific cashew milk market is expected to grow at the fastest CAGR of 8.2% over the forecast period. This growth is driven by increasing consumer awareness of the health benefits of cashew milk, such as its rich nutritional profile, including essential fatty acids, vitamins, and minerals. Additionally, the rising popularity of plant-based diets and lactose intolerance among consumers contribute to the demand for non-dairy milk alternatives like cashew milk. Countries like China, Japan, and India are leading this growth.

Key Cashew Milk Company Insights

Some key companies in the cashew milk market include Danone (Silk), Elmhurst Milked Direct, LLC, Forager Project LLC, Nutcase, and others. Companies are focusing on launching new flavors and increasing product ranges. Moreover, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Silk, a brand owned by Danone, offers a variety of plant-based dairy alternatives, including cashew milk. The company offers several products which include coconut, almond, cashew and oat milks.

-

Elmhurst Milked Direct, LLC, offers a variety of plant-based milks, including cashew milk. Elmhurst’s cashew milk is also known for its simple ingredients and high nut content.

Key Cashew Milk Companies:

The following are the leading companies in the cashew milk market. These companies collectively hold the largest market share and dictate industry trends.

- Danone (Silk)

- Elmhurst Milked Direct, LLC

- Forager Project LLC

- Nutcase

- Edward & Sons Trading Co.

- Pacific Foods

- JOI

- Plant Veda

- Alpro

- RITA Food & Drink Co. Ltd.

Recent Developments

-

In March 2023, Forager Project, at Natural Products Expo West, announced a new bee-free Honey Alternative Cashewmilk Yogurt and its innovation in its cashew milk yogurt pouches product line, including Peach flavor & four-pack size.

Cashew Milk Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 233.3 million

|

|

Revenue forecast in 2030

|

USD 356.7 million

|

|

Growth rate

|

CAGR of 7.3% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, type, distribution channel, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia & New Zealand, Brazil UAE, and South Africa

|

|

Key companies profiled

|

Danone (Silk); Elmhurst Milked Direct, LLC; Forager Project LLC; Nutcase; Edward & Sons Trading Co.; Pacific Foods; JOI; Plant Veda; Alpro; RITA Food & Drink Co. Ltd.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

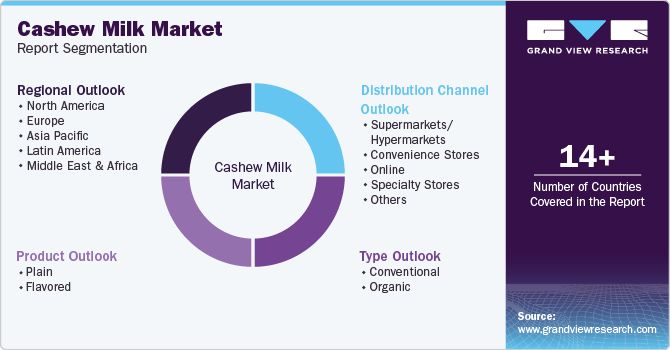

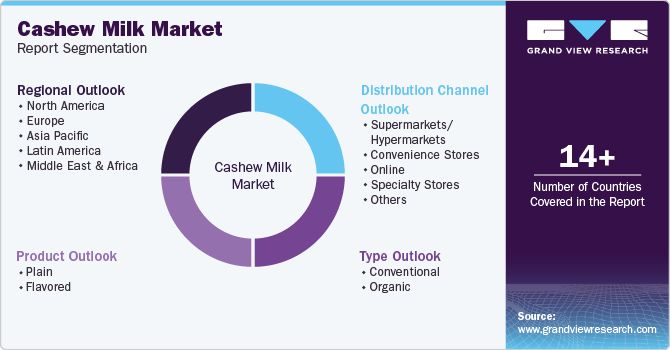

Global Cashew Milk Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cashew milk market report based on product, type, distribution channel and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)