- Home

- »

- Medical Devices

- »

-

Catheter Introducer Sheaths Market Size, Share Report 2030GVR Report cover

![Catheter Introducer Sheaths Market Size, Share & Trends Report]()

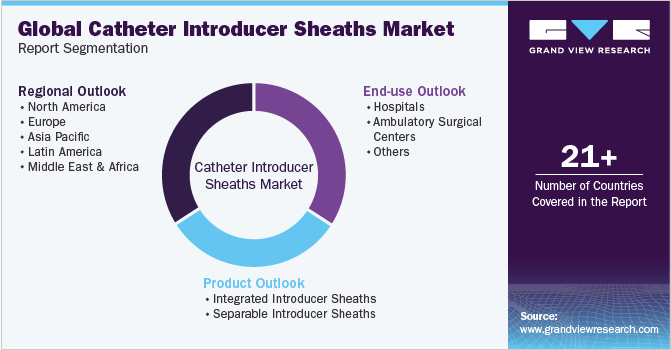

Catheter Introducer Sheaths Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Integrated Introducer Sheaths, Separable Introducer Sheaths), By End-use (Hospitals, Ambulatory Surgical Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-121-6

- Number of Report Pages: 175

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Catheter Introducer Sheaths Market Summary

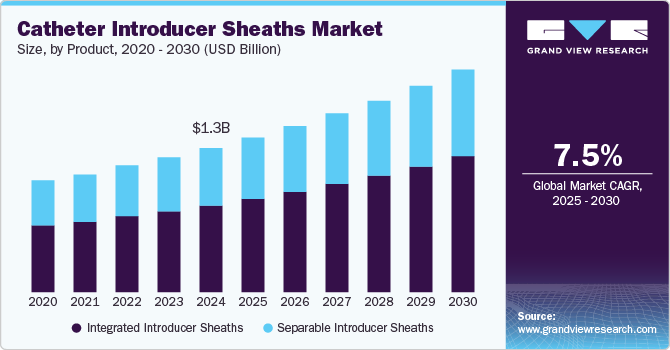

The global catheter introducer sheaths market size was estimated at USD 1.25 billion in 2024 and is projected to reach USD 1.93 billion by 2030, growing at a CAGR of 7.5% from 2025 to 2030. The growing prevalence of CVDs drives the market growth. Subsequently, there is a rising demand for advanced medical devices to manage cardiovascular conditions.

Key Market Trends & Insights

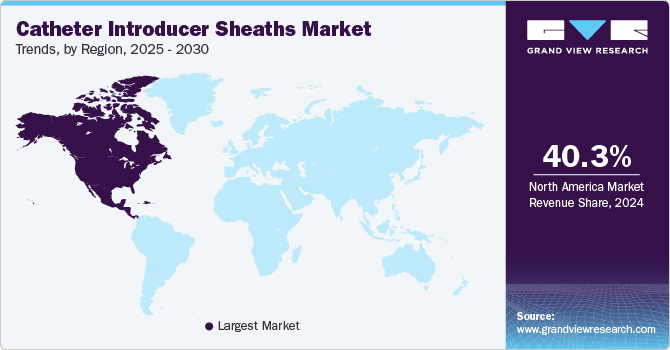

- North America catheter introducer sheaths market dominated with a share of 40.3% in 2024.

- The U.S. accounted for the largest share of North America's market in 2024.

- By product, the integrated introducer sheaths segment held the largest share of over 60.2% in 2024.

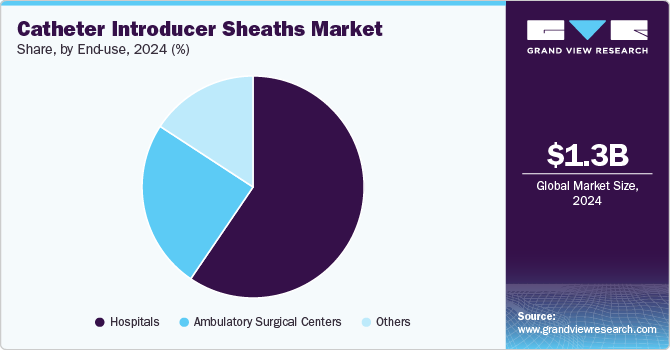

- By end-use, the hospitals segment held the largest share at 59.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.25 Billion

- 2030 Projected Market Size: USD 1.93 Billion

- CAGR (2025-2030): 7.5%

- North America: Largest market in 2024

For instance, as per a report published in January 2024 by the World Heart Federation, the global incidence of CVD mortality increased from 12.1 million in 1990 to 20.5 million in 2021. CVD emerged as the predominant cause of global mortality, with a notable prevalence in low- and middle-income countries, accounting for 80% of CVD-related fatalities. Central Europe, Eastern Europe, and Central Asia region exhibited the highest CVD death rates. The surge in the overall count of CVD deaths over the past 30 years directly impacts the catheter introducer sheaths industry.

Increasing cardiac surgical procedures drives the growth of the market. According to the Elsevier Inc. article published in June 2024, an estimated 1 to 1.5 million cardiac surgical procedures are performed yearly. In high-income nations, this translates to an average of 123.2 procedures per 100,000 people annually. Such a substantial volume of cardiac surgeries underscores the increasing demand for critical medical devices, including catheter introducer sheaths. These devices are vital for ensuring efficient access to the vascular system during various cardiac interventions, emphasizing their role in enhancing patient outcomes and contributing to the expansion of the cardiac surgery market.

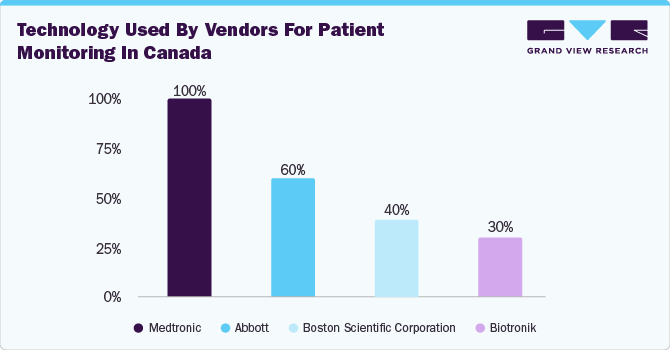

Government initiatives aimed at reducing the burden of cardiovascular diseases across all 50 states and the District of Columbia drives the growth of the catheter introducer sheaths industry in Canada. According to the American Heart Association, Inc. article published in June 2023, programs such as the CDC’s Stroke and Heart Disease Prevention Programs and the Million Hearts 2022 initiative work to prevent 1 million heart attacks and strokes over five years through evidence-based strategies, including the promotion of aspirin use, blood pressure control, cholesterol management, and smoking cessation.

By allocating resources to execute these strategies and enhancing healthcare access, these efforts foster a greater demand for interventional procedures, thereby boosting the requirement for catheter introducer sheaths. Programs like the Well-Integrated Screening and Evaluation for Women Across the Nation (WISEWOMAN) also contribute significantly by offering risk factor screenings and linking uninsured and underinsured women aged 40 to 64 with lifestyle interventions, health counseling, and community support. These initiatives promote market growth as more individuals pursue preventive and therapeutic cardiovascular care.

Technological advancements drive the growth of the market. For instance, In February 2024, BioCardia, Inc., a developer of cellular and cell-derived treatments for cardiovascular and pulmonary diseases, announced that it had submitted a 510(k) application for its Morph DNA Steerable Introducer Sheath. This innovative product line is engineered to deliver a range of medical instruments, including balloon dilatation catheters, guidewires, and other therapeutic devices, into both the peripheral vasculature and the chambers and coronary arteries of the heart.

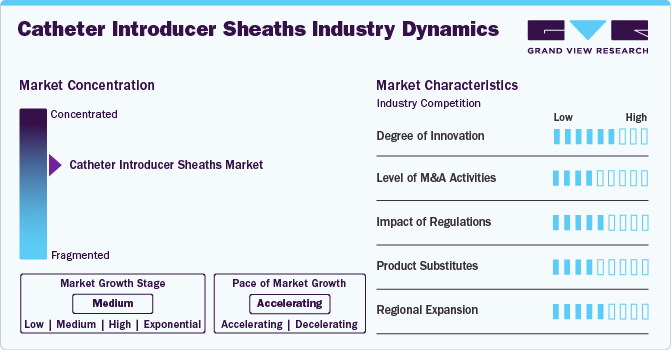

Market Concentration & Characteristics

The market is witnessing high innovation, with manufacturers developing advanced materials, bioactive coatings, and smart integration features. These enhancements enhance the durability, visibility, and performance of introducer sheaths used in various vascular procedures. In addition, incorporating digital technologies, such as imaging and navigation systems, improves the precision of catheter placements, ultimately leading to better patient outcomes and increased satisfaction in medical procedures.

Several market players, such as Terumo, Merit Medical, Medtronic, and Abbott are involved in merger and acquisition activities. Through M&A activity, these companies employ vital strategies such as product innovation, strategic collaborations, and geographical expansion to enhance their presence and address the growing demand for catheter introducer sheaths.

Regulations are crucial in shaping the catheter introducer sheaths market by establishing stringent safety, quality, and efficacy standards. While these rigorous regulatory frameworks can extend the approval timeline for new products, potentially hindering market entry and innovation, they also enhance patient confidence and product reliability. Ensuring that only safe and high-quality devices are available for clinical use, these regulations promote market growth while prioritizing patient safety and trust in medical procedures.

There are currently no direct substitutes. Their role in various vascular procedures is critical, providing essential access to diagnostic and therapeutic devices. These sheaths are vital for ensuring the success of minimally invasive interventions and maintaining optimal patient outcomes, reinforcing their indispensable position in the medical field.

Major companies in the catheter introducer sheaths market are broadening their influence by exploring new geographical territories, forming strategic partnerships with local distributors, and tailoring their product offerings to align with the specific healthcare requirements of various regions. This strategy allows them to address local market demands better and strengthens their presence in the global marketplace.

Product Insights

The integrated introducer sheaths segment held the largest share of over 60.2% in 2024 due to the increasing prevalence of CVD and technological advancements. Integrated introducer sheaths are single-unit devices designed to provide smooth and continuous access for catheter insertion during medical procedures. They remain intact throughout the procedure, ensuring stability and reducing the need for sheath removal or separation. Technological advancements drive the growth of the segment. For instance, in October 2023, EOSolutions Corporation revealed that the U.S. Food and Drug Administration (FDA) had granted clearance for its Thinline introducer sheath. This approval comes soon after the successful U.S. launch of the company’s innovative Dr. Banner balloon guide catheter (BGC).

The separable introducer sheaths segment will show lucrative growth during the forecast period. Increasing the prevalence of cardiovascular disease and the technologically advanced products offered by manufacturers drive the market's growth. For instance, Teleflex offers the COMPASS Guiding Introducer Sheath, a coil-reinforced device designed to enhance kink-resistant performance for complex vascular access procedures. This introducer sheath includes a detachable hemostatic valve and a side port, making it a separable introducer sheath that allows for component separation during use. It is available in sizes ranging from 4F to 8F and comes in various lengths, including 15, 45, and 60 cm. Key features of the COMPASS sheath include an atraumatic tip for smoother insertion, a radiopaque marker band that improves visibility during procedures, and a hydrophobic coating to facilitate navigation. In addition, it is equipped with a locking dilator for secure operation, providing enhanced flexibility and functionality during medical interventions.

End-use Insights

The hospitals segment held the largest share at 59.5% in 2024. As healthcare facilities expand their capabilities and adopt advanced technologies, the need for reliable and effective introducer sheaths rises, driving the catheter introducer sheaths industry. Hospitals increasingly perform various interventional procedures, necessitating high-quality catheter introduction of sheaths that enhance procedural efficiency and patient outcomes. Furthermore, the growing prevalence of chronic diseases, such as cardiovascular conditions, requires frequent vascular access, further propelling the demand for these devices within hospital settings.

U.S. Hospital Database 2024

Total Number of U.S. Hospitals

6,120

Number of U.S. Community Hospitals

5,129

Number of Nongovernment Not-for-Profit Community Hospitals

2,987

Number of Investor-Owned (For-Profit) Community Hospitals

1,219

Number of State and Local Government Community Hospitals

923

Number of Federal Government Hospitals

207

Number of Nonfederal Psychiatric Hospitals

659

Other Hospitals

125

The ambulatory surgical centers segment is expected to grow during the forecast period due to several key factors. Rising cardiovascular surgical procedures and technological advancements drive the growth of the market. These facilities increasingly provide outpatient surgical procedures that do not require overnight stays. According to the MedPAC article published in 2024, approximately 6,100 ASCs treated around 3.3 million fee-for-service Medicare beneficiaries, with spending on ASC services reaching about USD 6.1 billion in 2022.

The rise in surgical procedures performed in ASCs, evidenced by a 2.8 percent increase in volume per beneficiary, reflects a shift toward more efficient and cost-effective healthcare solutions. Factors such as advancements in clinical practices and healthcare technology have facilitated this growth, enabling more procedures to be performed in ambulatory settings. ASCs offer patients benefits such as convenient locations, reduced waiting times, lower out-of-pocket costs, and streamlined scheduling. In addition, they provide physicians with specialized staff and greater control over their working environment, increasing the demand for catheter-introducing sheaths in these facilities.

Regional Insights

North America catheter introducer sheaths market dominated with a share of 40.3% in 2024, owing to an increased prevalence of CVD and the rising demand for surgical procedures and technological advancements. According to a Heart Rhythm Society article published in 2023, in the U.S., atrial fibrillation affects about 6 million population. Atrial fibrillation results in significant hospitalizations and deaths each year, emphasizing the urgent need for advanced cardiovascular devices.

U.S. Catheter Introducer Sheaths Market Trends

The U.S. catheter introducer sheaths market accounted for the largest share of North America's catheter introducer sheaths market in 2024. Rising CVD cases in the U.S. fuels the growth of the market. According to an American Heart Association article published in January 2024, daily in the U.S., cardiovascular disease (CVD) results in about 2,552 deaths each day, according to 2021 data. This significant burden of CVD on public health increased the critical need for effective management and treatment options within the U.S. cardiovascular devices market.

Europe Catheter Introducer Sheaths Market Trends

Europe's catheter introducer sheaths industry held the second-largest revenue market share in 2024. The high mortality of CVDs is boosting the demand for catheter introducer sheaths in Europe. According to a WHO article published in May 2024, CVDs are the leading cause of disability and premature death in Europe. It is responsible for over 42.5% of all deaths annually, accounting for approximately 10,000 deaths every day. The significant impact of CVD emphasizes the urgent need for advanced catheters to introduce sheath solutions.

Germany's catheter introducer sheaths market dominated with the highest revenue share of 23.6% in 2024. The rising number of cardiac surgery patients fuels market growth. According to a Georg Thieme Verlag KG article, in 2022, 93,913 heart surgical procedures were performed, accounting for a slight increase from 92,838 procedures in 2021. This minor increase in surgical interventions reflects the ongoing demand for cardiac care and treatment, indicating a continued need for advanced medical interventions to address heart-related conditions effectively.

UK's catheter introducer sheaths market held the second-largest market share in 2024. The rising cardiovascular disease-related deaths and the increasing number of arrhythmia cases highlight the need for continued innovation and advancements in healthcare technology to reduce this trend effectively. According to a Guardian News & Media Limited article published in January 2024, the premature death rate due to CVD in the UK rose to 80 per 100,000 individuals in 2022. This represents a significant increase from 83 per 100,000 individuals in 2011.

The France catheter introducer sheaths market is anticipated to witness a significant CAGR of 7.7% during the forecast period. The increased incidence of arrhythmia is boosting the market growth of catheter introducer sheaths. According to a CardioSignal by Precordior article published in December 2023, AFib affects over a million people in France, presenting a significant health challenge in the country. This widespread arrhythmia condition disrupts normal heart rhythm and poses risks such as stroke and heart failure. The high prevalence emphasizes the crucial need for advanced diagnostic tools and innovative treatment options to manage AFib effectively across diverse patient demographics in France.

Asia Pacific Catheter Introducer Sheaths Market Trends

Asia Pacific catheter introducer sheaths market is expected to grow fastest during the forecast period. The rising elderly population in the Asia Pacific region boosts market growth. According to the United Nations Economic and Social Commission for Asia and the Pacific, in 2023, approximately 697 million individuals aged 60 years or older live in Asia and the Pacific region, constituting approximately 60% of the global older population. The elderly population is more susceptible to cardiovascular diseases, and the increase in the population is leading to a higher demand for monitoring devices. The rise in healthcare expenditure in the region is also contributing to market growth. The governments and healthcare organizations in the Asia Pacific region are investing heavily in the healthcare sector to improve the healthcare infrastructure and services in the region.

China accounted for the largest share of the catheter introducer sheaths market in the Asia Pacific region in 2024. The growing burden of cardiovascular disease in China fuels the growth of the market. According to the NCBI article published in December 2023, China faces a substantial burden of cardiovascular diseases (CVD), with around 330 million patients in 2022 suffering from these conditions. This significant patient population underscores the urgent need for effective cardiovascular devices. As the prevalence of CVD continues to rise, the demand for advanced and catheter introducer sheath devices in China is expected to grow, driven by the necessity to manage and improve cardiovascular health outcomes for millions of individuals.

Japan catheter introducer sheaths industry held the second largest market share in the Asia Pacific region. Japan has one of the most rapidly aging populations globally. According to the World Economic Forum, in September 2023, in Japan, nearly a third of the population is over the age of 65, totaling approximately 36.23 million individuals. The country has a remarkable number of centenarians, reflecting its status as the nation with the oldest population globally. Japan surpasses Italy, the next oldest country, with a significantly higher proportion of people aged 65 and older. As people age, they become more susceptible to arrhythmia and other heart-related conditions. This demographic trend is a significant driver for the catheter introducer sheaths market, as there is a growing need for diagnostic & therapeutic interventions for cardiac rhythm disorders.

The India catheter introducer sheaths market is experiencing significant growth. Increasing CVD burden in India driving the growth of the market. According to the Economic Times article published in February 2024, the study reveals that India faces a significant cardiovascular disease (CVD) burden, with an age-standardized CVD death rate of 272 per 100,000 population. This elevated burden emphasizes the urgent need for advanced catheter introducer sheath solutions to address the growing challenges in cardiovascular health across the country.

Latin America Catheter Introducer Sheaths Market Trends

The Latin America catheter introducer sheaths market is growing, owing to the increasing incidence of CVD disorders and technological advancements. A study published in the NCBI in August 2022, provided insights into the incidence and mortality rates of CVD across various countries in Latin America. The study revealed variations in the incidence and mortality rates, with countries experiencing different levels of CVD burden. Brazil had the highest incidence of CVD (3.86 per 1000 person-years), indicating a significant disease prevalence. On the other hand, Argentina had the lowest incidence (3.07 per 1000 person-years). Regarding mortality rates, Argentina had the highest rate (5.98 per 1000 person-years), while Chile had the lowest rate (4.07 per 1000 person-years).

Brazil's catheter introducer sheaths market is expanding due to several distinct growth drivers. Rising healthcare expenditures and government initiatives aim to improve cardiac care infrastructure. For instance, in September 2023, the Brazilian government and various institutions launched initiatives to enhance care and outcomes for cardiovascular disease (CVD) patients. An important example includes Mount Sinai's collaboration with the Brazilian Clinical Research Institute to advance cardiovascular disease research and medical education. These efforts reflect a concerted push towards improving healthcare standards, fostering innovation, and expanding knowledge in managing CVD within Brazil.

MEA Catheter Introducer Sheaths Market Trends

The MEA catheter introducer market is expected to grow lucratively due to the rise in the prevalence of CVDs. Several countries in MEA are increasing their healthcare expenditure to improve healthcare access and quality. Higher healthcare spending is expected to create lucrative opportunities for investment in advanced medical technologies, including catheter introducer sheath devices, to meet the needs of patients with CVDs, driving market growth.

Saudi Arabia's catheter introducer sheaths market is growing at a CAGR of 6.2% over the forecast period. The growing prevalence of CVD cases drives the growth of the market. According to the article published by BMC Cardiovascular Diseases in March 2024, the prevalence of cardiovascular disease (CVD) among individuals aged 15 years and older in Saudi Arabia is 1.6%. This figure represents the percentage of the population within this age group affected by various cardiovascular conditions, including heart disease and related disorders. The data emphasizes a notable aspect of the country's health profile, providing insights into the extent of cardiovascular issues impacting Saudi Arabia's population.

Key Catheter Introducer Sheaths Company Insights

Some of the key players operating in the industry include Terumo Corporation, Merit Medical, and Medtronic. The company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences. For instance, Stryker and BD are emerging players in catheter introducer sheaths.

Key Catheter Introducer Sheaths Companies:

The following are the leading companies in the catheter introducer sheaths market. These companies collectively hold the largest market share and dictate industry trends.

- Terumo Corporation

- Merit Medical

- Medtronic

- Galt Medical Corporation

- Cordis Corporation

- Oscor Inc

- Abbott

- Stryker

- BD

- B. Braun Interventional Systems Inc.

Recent Developments

-

In September 2024, Argon Medical Devices, a prominent provider of medical device solutions, launched the Intara Introducer Sheath alongside the (TLAB) Transvenous Liver Biopsy System.

-

In June 2023, Merit Medical recently broadened its portfolio by purchasing AngioDynamics' dialysis catheter line and BioSentry biopsy tract sealant solution. Additionally, Merit has added the Surfacer Inside-Out access catheter solution through an acquisition from Bluegrass Vascular Technologies.

-

In February 2023, Abbott and Cardiovascular Systems, Inc. (CSI) disclosed a definitive agreement under which Abbott will acquire CSI. CSI is recognized for its innovative atherectomy system, which treats peripheral and coronary artery disease.

Catheter Introducer Sheaths Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.34 billion

Revenue forecast in 2030

USD 1.93 billion

Growth rate

CAGR of 7.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Mexico; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Terumo Corporation; Merit Medical; Medtronic; Galt Medical Corporation; Cordis Corporation; Oscor Inc; Abbott; Stryker; BD; B. Braun Interventional Systems Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Catheter Introducer Sheaths Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global catheter introducer sheaths market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Integrated Introducer Sheaths

-

Separable Introducer Sheaths

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory surgical centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

Japan

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global catheter introducer sheaths market size was estimated at USD 1.25 billion in 2024 and is expected to reach USD 1.34 billion in 2025.

b. The global catheter introducer sheaths market is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2030 to reach USD 1.93 billion by 2030.

b. North America dominated the catheter introducer sheaths market with a share of 40.3% in 2024. This is attributed to advanced healthcare facilities and the presence of government support through medical reimbursement policies.

b. Some key players operating in the catheter introducer sheaths market include Terumo Corporation, Merit Medical, Medtronic, Galt Medical Corporation, Cordis Corporation, Oscor Inc., Abbott, Stryker, BD, B. Braun Interventional Systems Inc.

b. Key factors driving the catheter introducer sheaths market growth include the increasing prevalence of cardiovascular diseases across regions and the growing adoption of minimally invasive procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.