- Home

- »

- Biotechnology

- »

-

Cell And Gene Therapy Manufacturing Market Report, 2030GVR Report cover

![Cell And Gene Therapy Manufacturing Market Size, Share & Trends Report]()

Cell And Gene Therapy Manufacturing Market (2023 - 2030) Size, Share & Trends Analysis Report By Therapy Type, By Scale (R&D), By Mode, By Workflow (Vector Production, Cell Banking), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-289-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell And Gene Therapy Manufacturing Market Summary

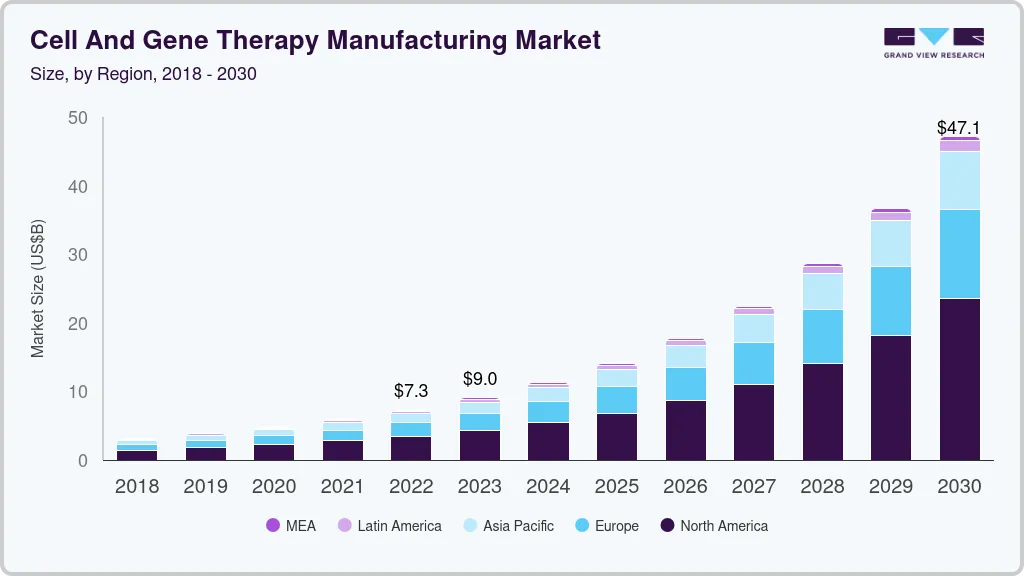

The global cell and gene therapy manufacturing market size was valued at USD 7.28 billion in 2022 and is projected to reach USD 47.1 billion by 2030, growing at a CAGR of 26.3% from 2023 to 2030. The emergence of advanced therapies has played a key role in transforming the treatment paradigm of several life-threatening and rare diseases and in reshaping the biopharmaceutical industry.

Key Market Trends & Insights

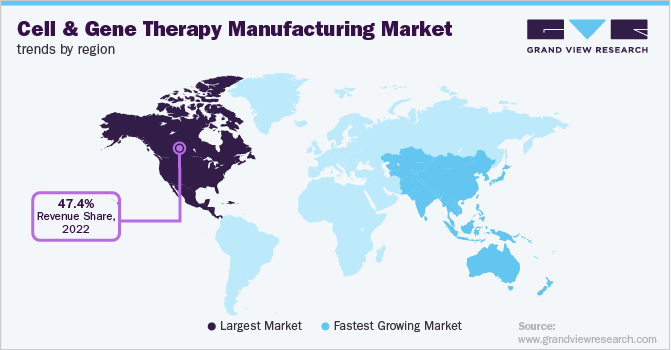

- North America dominated the global cell and gene therapy market with a revenue share of 47.42% in 2022.

- By therapy type, the cell therapy manufacturing segment dominated the market with a revenue share of 59.9% in 2022.

- By scale, the pre-commercial/R&D /R&D scale manufacturing segment captured a significant revenue share of 72.34% in 2022.

- By mode, the contract manufacturing mode segment held the highest revenue share of 66.3% in 2022.

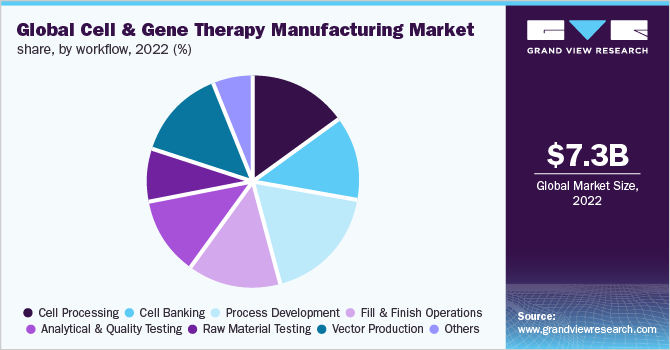

- By workflow, the process development segment accounted for a significant revenue share of 16.97% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 7.28 Billion

- 2030 Projected Market Size: USD 47.1 Billion

- CAGR (2023-2030): 26.3%

- North America: Largest market in 2022

The rapid growth of the advanced therapy landscape is a key driving factor for the growth of the cell and gene therapy manufacturing market. The COVID-19 pandemic also served as a driving factor for market growth. Several companies expanded their production capabilities for vector production as well as undertook various strategic initiatives to produce investigational therapies. For instance, in April 2022, BioCardia Inc. declared that the FDA approved the company’s IND applications for COVID-19 stem cell therapy for the treatment of patients recovering from Acute Respiratory Distress due to SARS-CoV-2.

Over the past few years, the healthcare industry has witnessed an improved ratio of clinical success to the number of clinical trials of cellular & gene-modified therapy products. This can be attributed to a better scientific and clinical understanding of safety risks related to the application of these products. As of May 2022, 329 cell and gene therapies are under clinical trial and are expected to increase significantly in the coming years.

Significant investments by government authorities and key market players are other factors fueling growth for cell and gene therapy manufacturing. Around USD 2.3 billion was invested in gene therapy companies over the last decade. This significantly high amount indicates that global pharmaceutical and biotechnology companies are investing in leading gene therapy companies. Major service providers, including CDMOs/CMOs, and in-house manufacturers consider gene & cell therapy as an active area of investment.

Therapy Type Insights

The cell therapy manufacturing segment dominated the market with a revenue share of 59.9% in 2022. The higher market share is attributed to the increasing number of products entering the marketplace and the high number of ongoing clinical trials. More than 360 clinical trials focusing on CAR-T cell therapies and other cell-based therapies are being studied to decipher the potential of these therapies for the treatment of various disease indications. Thus, the demand for advanced therapy manufacturing services is expected to increase in the coming years.

The gene therapy segment is expected to expand by a significant CAGR during the forecast period. With a large number of products currently in clinical trials, production process improvement has become a major need for the gene therapy manufacturing market. With an increase in investments from players and the clinical success of more products, several gene therapy companies are focusing on manufacturing and commercialization. Evaluating the existing process and its scalability, as well as for deciding on in-house or outsourced manufacturing, are some of the major factors to be considered while designing the manufacturing process for gene therapy products. Some of the key global companies are undertaking various strategic initiatives to boost their presence in the gene therapy manufacturing market. For instance, in September 2020, Pfizer collaborated with Vivet Therapeutics to manufacture Wilson's disease candidate.

Scale Insights

The pre-commercial/R&D scale manufacturing segment captured a significant revenue share of 72.34% in 2022. Certain factors such as the robust and constantly growing pipeline of gene and cell therapies along with the rise in investments are expected to have a positive impact on the segment growth. Till 2021, more than 2,073 clinical trials were ongoing for various cell therapies. Furthermore, according to an article published in September 2021, over 200 gene therapies are under clinical trials, which could translate to up to 40 new products being approved for clinical use in the next decade.

The commercial-scale manufacturing segment is projected to have the highest CAGR during the forecast period. With the increasing number of regulatory approvals for gene and cell therapy products, the demand for commercial production of these therapies is increasing rapidly. The major market players such as Thermo Fisher Scientific and AGC Biologics are undertaking various strategic initiatives to fulfill the changing market demands. For instance, in February 2022, Thermo Fisher Scientific launched new Patheon Commercial Packaging Services for cell and gene therapy across the U.S. and Europe. This integrated solution combines logistics, serialization compliance, and distribution globally. Such factors are expected to offer a favorable environment for segment growth by 2030.

Mode Insights

The contract manufacturing mode segment held the highest revenue share of 66.3% in 2022. With the growing demand for cell and gene therapies, the shortage of manufacturing capacity is creating growth opportunities for contract manufacturing service providers. As the market for cell and gene therapies is non-standardized and rapidly changing, outsourcing to a contract manufacturing service provider is expected to provide a competitive advantage in terms of experience and expertise. According to an article published in March 2020, approximately 35% of the process is outsourced with traditional biologics and more than 65% of the manufacturing process for cell and gene therapies is outsourced. This can be attributed to the fact that around two-thirds of the innovation in this space is achieved by small firms that lack the capacity, expertise, and resources for the commercialization of these products. The constantly growing clinical pipeline is another contributing factor expected to accelerate segment growth.

The in-house manufacturing segment is likely to register a considerable CAGR during the forecast period. The academic institutes with personalized patient treatment programs, as well as the presence of a substantial number of entities with large capital, are the largest contributors to this segment. Moreover, advantages over contract manufacturing are also expected to boost segment growth. Small biotechnology companies developing cell and gene therapies lack resources, capacity, and infrastructure, leading to strategic partnerships with contract manufacturers. This factor is expected to boost segment growth in the coming years. Moreover, the investments in this area are expanding by 30-35% per year, further propelling the market growth.

Workflow Insights

On the basis of workflow, the process development segment accounted for a significant revenue share of 16.97% in 2022. With an increasing number of therapies advancing from clinical trials to regulatory approval, the development of well-characterized and robust methods for cell therapy production has become increasingly important. Process development strategies provide efficiency while improving the quality and safety profiles of candidate programs. Process development can be applied to all process elements, such as cell characterization, cell isolation, optimization of cell culture media, removal of impurities, and scale-up.

The vector development segment is estimated to register the fastest CAGR during the forecast period. The high penetration of manufacturing services in this space is the major factor contributing to the segment growth. With a growing market for gene therapies, the demand for viral vectors is increasing. Viral vectors have been used for the treatment of various disorders, such as metabolic, cardiovascular, muscular, infectious, hematologic, and ophthalmologic, as well as various types of cancer. The most widely used viral vectors are adenoviral, retroviral, AAV, lentiviral, and herpes simplex virus.

Regional Insights

North America accounted for the highest revenue share of 47.42% in 2022. This can be attributed to the growing engagement of entities in research and product development in gene and cell therapy, coupled with a substantial number of contract development organizations in the region. In addition, homegrown companies are expanding their manufacturing facilities in the region.

Asia Pacific is anticipated to be a growing market for cell and gene therapy manufacturing. The region accounted for a 20.1% revenue share in 2022 and is estimated to witness the fastest growth with a significant CAGR from 2023 to 2030. Over the past several years, the cell therapy market has gained momentum in Asia. This can be attributed to the establishment of accelerated approval pathways, increasing healthcare needs, and growing private and government investments.

Key Companies & Market Share Insights

The key entities in the market are undertaking several strategic initiatives such as licensing, partnership, and mergers and acquisitions to expand their market presence. Over the last few years, the market witnessed various remarkable mergers and acquisitions. For instance, in January 2022, Thermo Fisher acquired PeproTech, a manufacturer of recombinant proteins such as growth factors and cytokines, for USD 1.85 billion:

-

Lonza

-

Bluebird Bio Inc.

-

Catalent Inc.

-

F. Hoffmann-La Roche Ltd.

-

Samsung Biologics

-

Boehringer Ingelheim

-

Cellular Therapeutics

-

Hitachi Chemical Co., Ltd.

-

Bluebird Bio Inc.

-

Takara Bio Inc.

-

Miltenyi Biotec

-

Thermo Fisher Scientific

-

F. Hoffmann-La Roche Ltd

-

Novartis AG

-

Merck KGaA

-

Wuxi Advanced Therapies

Cell And Gene Therapy Manufacturing Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.1 billion

Revenue forecast in 2030

USD 47.1 billion

Growth rate

CAGR of 26.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume in the number of doses, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapy type, scale, mode, workflow, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark, Sweden, Norway, China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Lonza; Bluebird Bio; Catalent Inc.; F. Hoffmann-La Roche Ltd.; Samsung Biologics; Boehringer Ingelheim; Cellular Therapeutics; Hitachi Chemical Co., Ltd.; Bluebird Bio Inc.; Takara Bio Inc.; Miltenyi Biotec; Thermo Fisher Scientific; F. Hoffmann-La Roche Ltd; Novartis AG; Merck KGaA; Wuxi Advanced Therapies

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell And Gene Therapy Manufacturing Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cell and gene therapy manufacturing market report on the basis of therapy type, scale, mode, workflow, and region:

-

Therapy Type Outlook (Volume, Number of Doses; Revenue, USD Million, 2018 - 2030)

-

Cell therapy manufacturing

-

Stem cell therapy

-

Non-stem cell therapy

-

-

Gene therapy manufacturing

-

-

Scale Outlook (Volume, Number of Doses; Revenue, USD Million, 2018 - 2030)

-

Pre-commercial/ R&D scale manufacturing

-

Commercial scale manufacturing

-

-

Mode Outlook (Volume, Number of Doses; Revenue, USD Million, 2018 - 2030)

-

Contract manufacturing

-

In-house manufacturing

-

-

Workflow Outlook (Volume, Number of Doses; Revenue, USD Million, 2018 - 2030)

-

Cell processing

-

Cell banking

-

Process development

-

Fill & finish operations

-

Analytical and quality testing

-

Raw material testing

-

Vector production

-

Others

-

-

Regional Outlook (Volume, Number of Doses; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell and gene therapy manufacturing market size was estimated at USD 7.28 billion in 2022 and is expected to reach USD 9.1 billion in 2023.

b. The global cell and gene therapy manufacturing market is expected to grow at a compound annual growth rate of 26.6% from 2023 to 2030 to reach USD 47.71 billion by 2028.

b. The cell therapy manufacturing segment dominated the market for cell & gene therapy manufacturing and accounted for the largest revenue share of 57.32% in 2022.

b. Some key players in the cell & gene therapy manufacturing market are Thermo Fisher Scientific, Lonza AG, Fujifilm, Bluebird Bio Inc., Samsung Biologics, Takara Bio Inc., Catalent Inc., and Merck KGaA.

b. The pre-commercial/ R&D scale manufacturing segment dominated the market for cell & gene therapy manufacturing and accounted for the largest revenue share of 72.36% in 2022.

b. The in-house manufacturing segment dominated the market for cell & gene therapy manufacturing and accounted for the largest revenue share of 52.32% in 2022.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.