- Home

- »

- Plastics, Polymers & Resins

- »

-

Cellulose Bioplastic Market Size, Share & Growth Report, 2030GVR Report cover

![Cellulose Bioplastic Market Size, Share & Trends Report]()

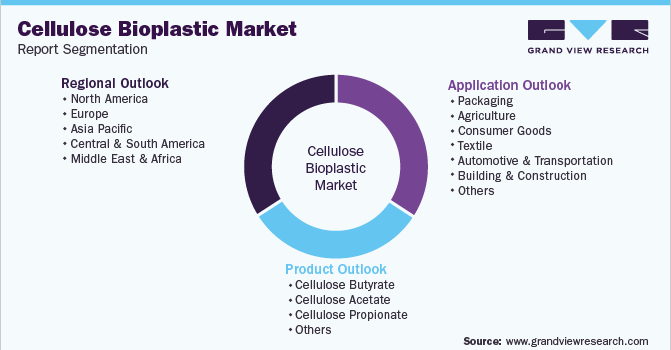

Cellulose Bioplastic Market Size, Share & Trends Analysis Report By Application (Packaging, Agriculture, Consumer Goods, Textile, Automotive & Transportation, Building & Construction, Others), By Product, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68040-008-9

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2019 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

Report Overview

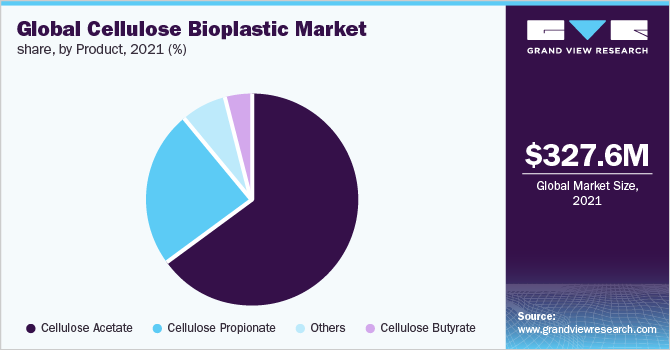

The global cellulose bioplastic market size was valued at USD 327.6 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 19.5% from 2022 to 2030. Cellulose bioplastic is a product of plastic that is made from cellulose esters (nitrocellulose, cellulose acetate) or cellulose derivatives. Cellulosic plastics are produced using coniferous trees as the main raw material. The bark of the tree is separated and can be used as an energy source in production. The separation of cellulose fibers comes from the tree where they are cooked or heated in a digester. The growing demand for packaging is expected to drive significant market growth during the forecast period.

The growing demand for cellulosic bioplastics is associated with the production of mobile phones, ophthalmic products, thermoplastic products, sheets, and toys, among others. Strict rules governing the use of conventional plastic materials owing to environmental concerns and the resulting damage are significant factors driving the need for more environmentally sustainable materials across sectors and applications. The introduction of various bans on the use of conventional plastics has led to an increase in demand for cellulosic bioplastics and other plastics made from renewable raw materials. cellulosic bioplastics are also biodegradable, which is another driving factor in their preference and their adoption.

The rising popularity of online shopping for a variety of packaged products, the emergence of e-commerce platforms, rapid urbanization, as well as changing lifestyles, are major factors supporting the demand for safe and sustainable plastics. The rapid growth in imports and exports has also created a strong demand for more durable plastics that meet environmental norms for packaging. The packaging industry is one of the fastest growing sectors across the globe, for instance, the UK packaging industry has annual sales of US$11.30 billion and is a major contributor to the country's GDP.

Conventional plastic has adverse environmental impacts, driving a strong demand for cellulose bioplastics. The food and beverage industry's high need for cellulose bioplastics has been a crucial element in the market's recent sales rise. The growing preference for ready-to-eat products and the demand for packaging materials that are safer are also driving factors in the growth of the market.

The rapid growth of using cellulose bioplastics in electronics such as transparent dials and screen protectors. Major market players are investing in research and development to produce low-cost packaging materials that are environmentally friendly and biodegradable. However, the market for cellulose bioplastics is somewhat constrained by the accessibility and affordability of traditional plastic raw materials. In addition, the complex process associated with the traditional plastic raw material is complex, which is another factor holding back the growth of the market.

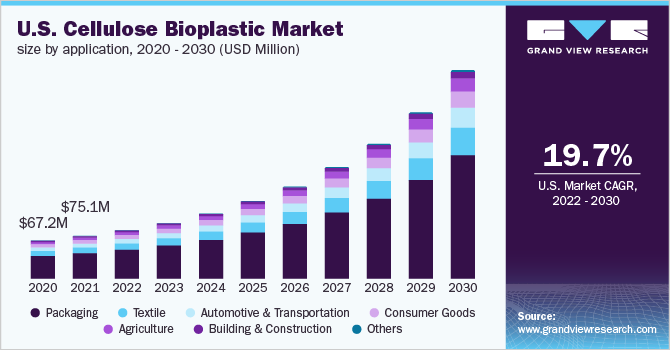

The US market for cellulosic bioplastics is expected to grow significantly over the forecast period due to the growing demand for bio-based packaging in the food and consumer products sectors. Biopackages and biobased plastics are environmentally friendly in nature and have higher tensile strength. As a result, further growth in demand for cellulosic bioplastics is projected in the forecast period.

Furthermore, over the forecast period, there is expected to be an increase in demand for bio-bags or biodegradable bags used to collect food scraps and other organic waste due to expanding composting infrastructure and growing government efforts to lessen landfilling, such as the US goal of reducing food loss and waste by 2030.

Growing concerns about petrochemical toxicity issues, along with the depletion of crude oil reserves, have spurred the development of cellulose-based plastics. Factors including stringent environmental norms such as EN 14995, EN 13432, and EN 17033; growing environmental concerns among consumers; The growing interest of market key players in the production of cellulose bioplastics is expected to be a key growth driver during the forecast period.

Moreover, not all cellulosic bioplastics decompose easily in nature, as they require a specific environment in terms of temperature and humidity. Some cellulosic bioplastics decompose in a way that releases greenhouse gases, which are harmful to the environment. These factors are likely to serve as a stumbling block to the growth of the market.

Furthermore, the COVID-19 outbreak has negatively affected the demand for cellulosic bioplastics in various fields, including packaging, agriculture, consumer goods, textiles, automobiles and transportation, construction, and others, due to production shutdowns, supply and transportation restrictions, and economic downturn around the world in 2020. In addition, the resumption of industrial operations is predicted to positively influence the demand in the cellulosic bioplastics market in the coming years.

Application Insights

Packaging was the largest application segment for the cellulose bioplastic market in 2021 with a revenue share of more than 62%. Packaging is one of the leading application sectors for cellulose bioplastics, utilizing it in both flexible and rigid packaging. The market for cellulosic bioplastics is expanding as more and more traditional plastics are being replaced in food packaging materials such as boxes, wrappers, cups, and plates.

Demand for cellulosic bioplastics in the agricultural sector is expected to increase significantly due to the growing focus on reducing pollution and creating favorable conditions for composting. The use of cellulose bioplastic mulching film ensures soil water retention, weed suppression, and favorable soil temperature, which contributes to faster crop development. Cellulosic bioplastics are increasingly being used in nurseries and horticulturists due to their excellent properties, such as stimulating plant seedling growth and preventing fruit rot. It is expected that this will affect the expansion and increase in the penetration of cellulosic bioplastics in the agricultural sector. The growth in the use of cellulosic bioplastics in consumer products is also evident in advanced economies.

Product Insights

The cellulose acetate product segment led the market and accounted for more than 65% of the revenue share in 2021 because it is widely produced and readily available. Cellulose acetate is a biomass material obtained by chemical modification (esterification) of hydroxyl groups with acetic acid in cellulosic materials derived from inedible plant parts such as wood fibers and cotton. It has some physical properties such as fire resistance with a high melting point, low electrical conductivity, moderate hydrophilicity, solvent and chemical resistance, and high UV resistance.

Cellulose acetate is widely used in packaging, textiles, and consumer products. Plastics made of cellulose are also employed in food-contact materials (FCM) as an alternative to fossil fuel-based plastics. Fresh food and baked items are frequently packaged with them. Films made of cellulose acetate are robust, have high gloss and transparency, and are dimensionally stable. Moreover, the rapid usage of cellulose acetate in the packaging sector is due to the properties of cellulose acetate-made films such as tearing quickly, being sturdy, and being puncture-resistant, making them perfect for food packing. Hence, it can help to drive the cellulose bioplastic market across the globe. It is also used in the textile industry to create filtration filters and clothing fibers through dry spinning.

In addition, Cellulose acetate has low plasticity, and it is not easy to thermoform therefore, it is mixed with a melt-molding plasticizer. It has traditionally been used in consumer goods applications. It can also be formed into a film or hollow filament for use in things like optical films for LCDs and filtration membranes.

Regional Insights

Europe dominated the regional segment for the cellulose bioplastic market in 2021 with a revenue share of more than 44%. It is estimated that people's high awareness of plastic waste, coupled with the European Union's ban on single-use plastic, will drive the regional market over the forecast period. The European market for cellulosic bioplastics is expected to experience significant growth in the coming years due to various factors such as the presence of stringent environmental laws, growing consumer concern for the environment, and increased investment in research and development in the cellulosic bioplastics sector by private and public organizations. In addition, government initiatives such as the EU decision to minimize the overall consumption of single-use plastic products in the region by around 80% by 2021 are expected to boost demand for cellulosic bioplastics over the forecast period. On the other hand, the Asia-Pacific region is expected to become the fastest-growing market on the global stage. Rising disposable income and rising living standards in developing countries such as China and India are expected to increase the market in the region.

Central and South America are promising areas in the cellulose bioplastics market. The availability of cheap raw materials is likely to bode well for the market in the region. The rising demand for bio-based packaging in the food & beverage, and consumer goods industries is likely to drive the US market for cellulosic bioplastics to expand considerably over the course of the forecast period. Products such as bio-based plastics and bio-bags are easier to use than conventional plastics, have higher tensile strength, and are environmentally friendly in nature. As a result, demand for cellulosic bioplastics is projected to increase over the forecast period.

Key Companies & Market Share Insights

Companies in the market compete based on the quality of products offered. Leading market players compete based on their product development capabilities and new technologies used in product formulations.

Established players such as Celanese Corporation and Solvay are investing in the development of innovative and sustainable solutions for formulating new and advanced technology that gives them an edge over their competitors. For instance, in October 2020, Celanese Corporation launched Cellulosic Pellets with the brand name BlueRidge which aligns with circular economy and environmental, social, and corporate governance (ESG), with a product that is generally compostable and bio-based. This product works as a potential replacement for single-use plastic applications and hard-to-recycle which is made up of wood pulp and vinegar-based material.

Similarly, in April 2021, Packaging Matters signed an agreement with Origin Materials, Inc. to develop advanced packaging materials, with a new generation polymer named polyethylene furanoate (PEF). Through this agreement, Origin Materials Inc. will use the patented technology of Packaging Matters that converts pulp from sustainable wood waste into carbon-negative, cost-effective materials that reduce the need for fossil resources. The partnership will revolutionize a wider range of end products, including textiles, apparel, plastics, and others. Some of the prominent players in the cellulose bioplastic market include:

-

Celanese Corporation

-

Solvay

-

Daicel Chemical Industries

-

Mitsubishi Rayon Company Limited

-

Eastman Chemical Company

-

SK Chemicals Co. Ltd.

-

Rayonier Advanced Materials

-

Sappi

-

Merck Millipore

-

Haihang Industry

Cellulose Bioplastic Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 370.6 million

Revenue forecast in 2030

USD 1,536.7 million

Growth rate

CAGR of 19.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2019 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S., Canada, Mexico, Germany, France, UK, China, India, Japan, Brazil

Key companies profiled

Celanese Corporation; Solvay; Daicel Chemical Industries; Mitsubishi Rayon Company Limited; Eastman Chemical Company; SK Chemicals Co. Ltd.; Rayonier Advanced Materials; Sappi; Merck Millipore; Haihang Industry

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cellulose Bioplastic Market Segmentation

This report forecasts revenue and volume growth at global, and regional levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the global cellulose bioplastic market report based on application, product, and region:

-

Application Outlook (Revenue, USD Million, 2019 - 2030)

-

Packaging

-

Agriculture

-

Consumer Goods

-

Textile

-

Automotive & Transportation

-

Building & Construction

-

Others

-

-

Product Outlook (Revenue, USD Million, 2019 - 2030)

-

Cellulose Butyrate

-

Cellulose Acetate

-

Cellulose Propionate

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global cellulose bioplastic market size was estimated at USD 327.6 million in 2021 and is expected to reach USD 370.6 million in 2022.

b. The global cellulose bioplastic market is expected to grow at a compound annual growth rate of 19.5% from 2022 to 2030 to reach USD 1,536.7 million by 2030.

b. The packaging application led the market with a revenue share of more than 62% in 2021. Increasing utilization of cellulose bioplastics to produce bags for compost, agricultural foils, horticultural products, nursery products, toys, and textiles is the key factor responsible for segment growth.

b. Some key players operating in the cellulose bioplastics market include Celanese Corporation, Solvay, Daicel Chemical Industries, Mitsubishi Rayon Company Limited, Eastman Chemical Company, SK Chemicals Co. Ltd.

b. Key factors that are driving the market growth include the increasing demand for cellulose bioplastics from the packaging industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."