- Home

- »

- Pharmaceuticals

- »

-

Cephalosporin Drugs Market Size And Share Report, 2030GVR Report cover

![Cephalosporin Drugs Market Size, Share & Trends Report]()

Cephalosporin Drugs Market Size, Share & Trends Analysis Report By Generation (First, Second, Third, Fourth, Fifth), By Route Of Administration (Oral, Injection), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-177-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Cephalosporin Drugs Market Size & Trends

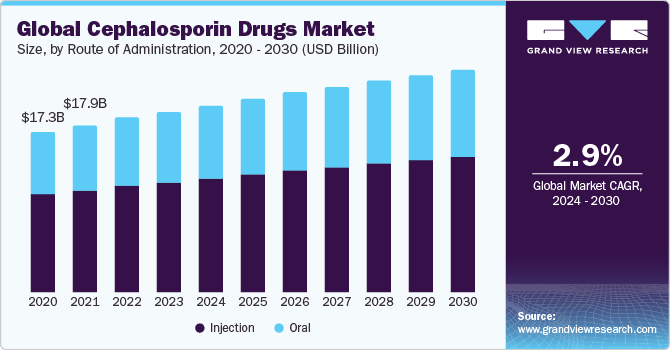

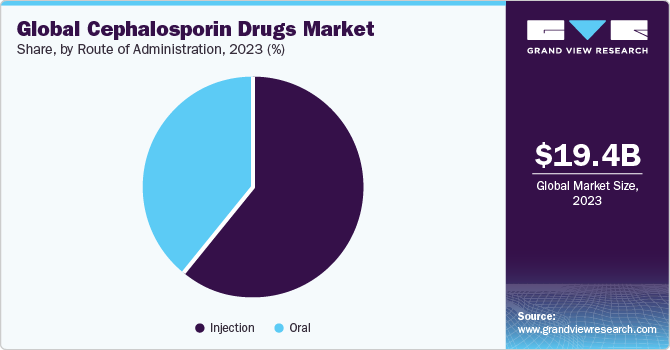

The global cephalosporin drugs market size was valued at USD 19.38 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 2.94% from 2023 to 2030. The high incidence of infectious diseases is prompting health authorities such as WHO, ANVISA, SAHPRA, and others to undertake containment efforts. These efforts include R&D initiatives to boost the development of improved antibiotics, supportive regulatory policies to expedite the approval process, and research funding for cephalosporin drugs. These factors are expected to propel the cephalosporin drugs market in the coming years.

Cephalosporin, a broad-spectrum β-lactam antibiotic, is derived from a fungus called Acremonium. Primarily utilized for the treatment of bacterial infections, including skin infections, otitis media, pneumonia, staph infections, tonsillitis, strep throat, bronchitis, gonorrhea, and others, cephalosporin serves both therapeutic and prophylactic purposes. First-generation cephalosporins find prominent use against gram-positive bacteria, including Staphylococcus and Streptococcus, aiming at preventing hospital-acquired infections and treating skin and soft tissue infections. On the other hand, second to fifth generation drugs are specifically designed to combat gram-negative bacteria. Additionally, these drugs are applicable in various drug induced allergic conditions, such as penicillin allergies.

However, these drugs' third, fourth, and fifth generations are conventional antibiotics used to combat resistant pathogens. Cefixime, a widely used third-generation broad-spectrum cephalosporin, is employed to treat infections caused by P. aeruginosa and N. gonorrhea and exhibits activity against S. aureus, S. pneumonia, and Enterobacteriaceae spp. However, several pathogenic strains, particularly those resistant to carbapenems, also demonstrate resistance to cephalosporins. Consequently, the development and launch of new cephalosporin drugs with the capability to combat resistance are anticipated to drive market growth over the forecast period.

Generation Insights

Based on the generation, the cephalosporin drugs market is segmented into first generation, second generation, third generation, fourth generation, and fifth generation. The second-generation segment held the largest market share in 2023. Members of the cephamycin subgroup include Cefoxitin, Cefotetan, and Cefmetazole. Cefuroxime, within the first subgroup, offers improved coverage against H. influenzae. Second-generation cephalosporins are frequently recommended for the treatment of bronchiolitis and pneumonia, both respiratory illnesses. Consequently, the increasing prevalence of respiratory illnesses is anticipated to drive the growth of this segment.

Route of Administration Insights

On the basis of route of administration, the market is segmented into oral and injection. The oral segment held the largest market share in 2023. This can be attributed to a rise in usability, and high preference is another important factor boosting the need for oral cephalosporin drugs globally.

Furthermore, growing patient-centric medicine demand is causing a substantial rise in demand for new oral solutions with the modified release (MR). This is a major opportunity for pharmaceutical companies to develop new oral cephalosporin drugs.

Application Insights

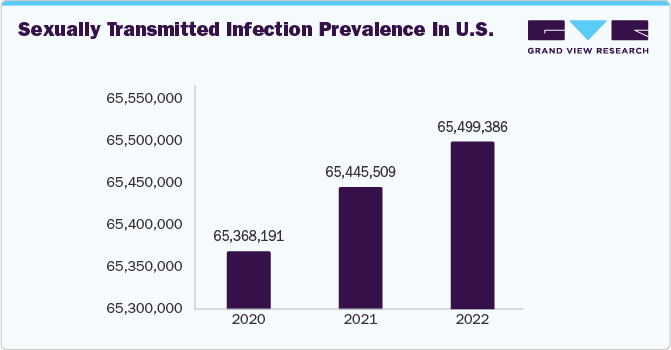

Based on the application, the cephalosporin drugs market is segmented into skin infections, respiratory tract infections, ear infections, urinary tract infections, and sexually transmitted infections. The skin infection segment held the largest market share in 2023. This can be attributed to the high incidence and prevalence of skin diseases such as Psoriasis worldwide. Currently, the estimated prevalence of Psoriasis was 4.27 million in 2021 and 4.30 million in 2022, and it is expected to reach 4.59 million by 2035. Thus, the increasing prevalence of skin infections is projected to fuel demand for cephalosporin drugs, driving segment growth.

Regional Insights

North America dominated the market in 2023. This can be attributed to the presence of a large number of generic antibiotic manufacturers offering products at competitive prices in the region. Companies such as AbbVie Inc., F. Hoffman-La Roche Ltd., Merck & Co., Inc., and Lupin have a strong presence in the market. Thus, the anticipation of developing and commercializing new drugs in the U.S. and Canada is expected to contribute to the region's growth. Asia-Pacific is expected to witness the fastest Compound Annual Growth Rate (CAGR) over the forecast period. The increasing prevalence of respiratory infections and high demand for cephalosporin drugs are among the key factors driving the Asia Pacific region.

Competitive Insights

This market is diversified and comprises several key pharmaceutical companies such as AbbVie Inc., Merck & Co. Inc., Novartis AG, F. Hoffmann-La Roche Ltd, GSK plc, Eli Lilly and Company, Bristol-Myers Squibb Company, and Lupin, all of which hold a substantial share in the market. These market players leverage new strategies to increase manufacturing capabilities and the geographic outreach of their products. Here are some instances of such initiatives.

-

In June 2022, Shionogi & Co., Ltd., GARDP, and the Clinton Health Access Initiative (CHAI) entered into a collaboration agreement to expand access to cefiderocol in around 70% of countries worldwide. This agreement is expected to increase the company's product reach globally, thereby boosting revenue generation.

-

In March 2023, Hikma Pharmaceuticals PLC (Hikma) launched Cefazolin injection for the treatment of various infections caused by bacteria, including those affecting the bone, skin, blood, genital, and joints. This product launch is anticipated to drive market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."