- Home

- »

- IT Services & Applications

- »

-

Certificate Authority Market Size, Share, Growth Report, 2030GVR Report cover

![Certificate Authority Market Size, Share & Trends Report]()

Certificate Authority Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Certificate Type And Services), By Enterprise Size, By Certificate Validation Type, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-262-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Certificate Authority Market Summary

The global certificate authority market size was estimated at USD 173.1 million in 2023 and is projected to reach USD 401.4 million by 2030, growing at a CAGR of 13.1% from 2024 to 2030. With the increasing reliance on digital transactions, secure communication, and data protection, the demand for digital certificates issued by certificate authorities (CAs) is growing.

Key Market Trends & Insights

- North America led the certificate authority market with the largest revenue share of 33.7% in 2023.

- By component, the certificate type segment held the largest revenue share of 62.0% in 2023.

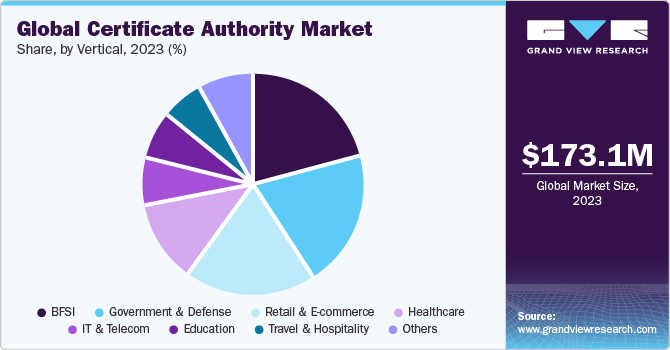

- By vertical, the BFSI segment held the largest revenue share of 21.5% in 2023.

- By enterprise size, the large enterprises segment held the largest revenue share of 74.7% in 2023.

- By certificate validation type, the domain validation segment held the largest revenue share of 46.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 173.1 Million

- 2030 Projected Market Size: USD 401.4 Million

- CAGR (2024-2030): 13.1%

- North America: Largest market in 2023

The rising popularity of e-commerce, online banking, and other internet-based services drives the market growth. Businesses are increasingly growing their online presence, which requires the security of online transactions and sensitive information. CAs offer the needed infrastructure to facilitate secure communication over the internet, safeguarding various cyber threats, including phishing, man-in-the-middle attacks, and data breaches.

The exponential growth of global internet usage has resulted in a significant rise in the demand for online security measures, mainly digital certificates offered by CAs. According to estimates by Atlas VPN, the number of internet users is expected to exceed 6 billion within the next five years. As of 2023, there are approximately 5.16 billion internet users globally, which accounts for 64.4% of the world's population, and by 2028, this number is expected to increase by nearly a fifth (19%) and reach 6.13 billion.

There is a growing awareness regarding encryption and data security among businesses. With cyberattacks becoming more advanced and widespread, businesses are giving more importance to implementing strong security measures to protect sensitive information. Digital certificates, such as SSL/TLS certificates, are essential in ensuring secure communication channels and safeguarding against unauthorized access. Regulatory compliance requirements, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S., require organizations to strengthen their cybersecurity posture and obey stringent data protection standards. Compliance with these regulations demands the use of SSL/TLS certificates to encrypt data transmissions and authenticate the identity of websites, thereby driving demand for CA services.

Emerging technologies such as the Internet of Things (IoT), artificial intelligence (AI), edge computing, and 5G networks have transformed the digital landscape, introducing new use cases and presenting new security challenges. As AI becomes more integrated into applications and services, there is a growing demand for authenticating AI models, algorithms, and training data sources. According to IBM's research published in January 2024, approximately 42% of large-scale organizations have implemented AI technology in their businesses.

The COVID-19 pandemic positively impacted the market, reforming demand and operational dynamics as the pandemic forced businesses to transition to remote work models rapidly, which increased reliance on digital communication channels and online services, leading to demand for digital certificates to secure these interactions. Organizations across various sectors, including finance, healthcare, education, and government, accelerated their digital transformation efforts to adapt to the new remote work paradigm, resulting in a surge in the deployment of certificates to secure websites, VPN connections, and cloud-based applications.

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The market is characterized by high competition and consolidation, with several established players competing for industry share alongside a growing number of niche providers specializing in specific certificate types or industry verticals. Strategic partnerships and acquisitions are common within the market, allowing companies to expand their product portfolios, enhance their technological capabilities, and strengthen their industry position.

In addition, the industry is characterized by increasing diversification and customization of certificate offerings to meet the specific requirements of different industries and use cases. For instance, healthcare organizations require specialized certificates that are compliant with Health Insurance Portability and Accountability Act (HIPAA) regulations. Also, financial institutions are prioritizing certificates with extended validation (EV) for enhanced customer trust and security.

The trend towards customization indicates the growing recognition of the importance of personalized security solutions in mitigating industry-specific risks and addressing regulatory compliance obligations. For instance, in June 2023, DigiCert, Inc. announced a partnership with ReversingLabs, a software company. The partnership aims to incorporate DigiCert's secure code signing solution with binary analysis and threat detection solutions of ReversingLabs. The combined solution is designed to offer users protection from software-based attacks.

Component Insights

Based on components, the market is further bifurcated into certificate type and services. The certificate type segment led the market with the largest revenue share of 62.0% in 2023. The increasing adoption of cloud computing services and hybrid IT infrastructures has propelled the need for scalable and flexible security solutions, including digital certificates provided by CAs. As businesses migrate their operations to the cloud and embrace multi-cloud environments, there is a heightened focus on securing data in transit and at rest, driving demand for SSL/TLS certificates to encrypt data transmissions and authenticate cloud-based services.

The services segment is anticipated to grow at the fastest CAGR during the forecast period. The increasing emphasis on privacy-enhancing technologies and data protection measures, represented by initiatives such as the Privacy Sandbox and the European Data Protection Board's recommendations, drives the adoption of encryption and authentication solutions offered by CAs. Organizations can enhance data privacy and mitigate the risk of unauthorized access or data breaches by encrypting sensitive data and ensuring secure communication channels.

Vertical Insights

Based on enterprise size, the market is further bifurcated into BFSI, retail and e-commerce, government and defense, healthcare, IT and telecom, travel and hospitality, education, and others. The BFSI segment led the market with the largest revenue share of 21.5% in 2023. BFSI institutions are broadening their service offerings and increasingly relying on online banking platforms and digital financial services. Certificate authorities provide SSL/TLS certificates that secure online banking transactions, encrypt sensitive data, and authenticate the legitimacy of banking websites. It encourages trust and confidence in customers, vital for maintaining a competitive edge and ensuring customer loyalty in the BFSI sector.

The healthcare segment is anticipated to witness at the fastest CAGR during the forecast period. Healthcare organizations face increasing cybersecurity threats due to adopting electronic health records and telemedicine platforms. Using SSL/TLS certificates is crucial for complying with regulations such as HIPAA, protecting patient privacy, and securing medical records. The COVID-19 pandemic has accelerated the digital transformation of healthcare delivery, driving the adoption of remote patient monitoring solutions, virtual consultations, and digital health platforms. It has increased the demand for secure communication channels and authentication mechanisms to protect patient data during virtual healthcare interactions. In December 2023, the European Commission partnered with WHO/Europe. The European Commission funded a USD 12.9 Million project to support healthcare services across 53 regional countries, benefiting nearly 1 billion people. The project aims to strengthen health information systems and improve health data governance in the WHO European region. This 4-year project aims to support healthcare services for people in 53 regional countries. Its objective is to enhance the interoperability and quality of health information systems and improve health data use and reuse by healthcare providers, policymakers, and patients.

Enterprise Size Insights

Based on enterprise size, the market is further bifurcated into small and medium enterprises (SMEs) and large enterprises. The large enterprises segment led the market with the largest revenue share of 74.7% in 2023. As large enterprises undergo digital transformation initiatives to modernize their operations and adapt to evolving customer expectations, the demand for digital certificates issued by CAs has surged. To address the security challenges faced by large enterprises, CAs are innovating their offerings by providing scalable, customizable solutions tailored to the specific requirements of enterprise customers.

The SME segment is anticipated to witness at the fastest CAGR during the forecast period. SMEs deploy IoT devices for various purposes, such as inventory management, asset tracking, and environmental monitoring, which has led to secure device authentication and communication becoming vital. CAs offer digital certificates for IoT devices, enabling SMEs to establish secure connections and prevent unauthorized access or tampering with IoT data. This drives the demand for CA services within SMEs.

Certificate Validation Type Insights

Based on certificate validation type, the market is further bifurcated into domain validation, organization validation, and extended validation. The domain validation segment led the market with the largest revenue share of 46.0% in 2023. Advancements in technology, such as automation and improved validation processes, have simplified the issuance and management of domain validation certificates, making them more accessible to organizations. Automated validation methods, such as domain control validation (DCV) via email or domain name system (DNS) records, reduced the time and effort required to obtain and deploy SSL/TLS certificates. For instance, in February 2024, Axians Switzerland partnered with Sectigo to introduce their customers to cloud-native Certificate Lifecycle Management (CLM) solutions. Through this partnership, Axians Switzerland aims to empower its clients to proactively address cyber risks while mitigating the risks associated with expired or rogue certificates, thereby preventing business disruptions. Axians and Sectigo aim to seamlessly align with the growth strategies of their client companies by using domain-validation certificates, automation, and tailored pricing models.

The organization validation segment is anticipated to witness at the fastest CAGR during the forecast period. The rise of mobile applications and the growing adoption of mobile-first approaches by businesses have increased the demand for OV certificates to secure app communications and transactions. OV certificates are critical in establishing a secure connection between mobile apps and backend servers, protecting sensitive data such as user credentials, payment details, and personally identifiable information (PII) from any unauthorized access or tampering.

Regional Insights

North America dominated the certificate authority market with the largest revenue share of 33.7% in 2023 and is projected to grow at the fastest CAGR over the forecast period, owing to increasing concerns over cybersecurity threats and regulatory compliance. The region has witnessed a rise in data breaches and cyberattacks, leading businesses and government agencies to prioritize cybersecurity investments, including the deployment of SSL/TLS certificates to encrypt data transmissions and authenticate the identities of websites and online platforms.

Regulatory frameworks such as the Health Insurance Portability and Accountability Act (HIPAA), the Payment Card Industry Data Security Standard (PCI DSS), and the Federal Information Security Management Act (FISMA) mandate stringent security measures, including the use of digital certificates, to protect sensitive information and ensure regulatory compliance.

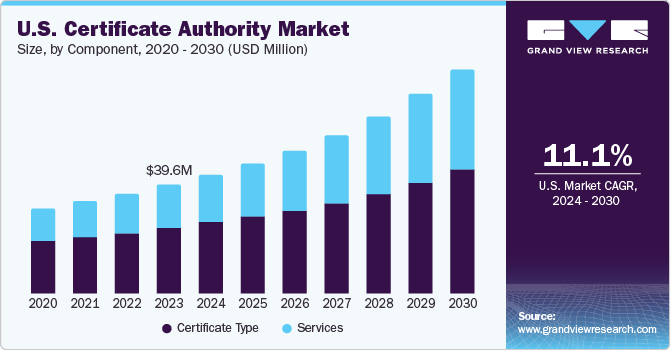

U.S. Certificate Authority Market Trends

The certificate authority market in U.S. accounted for largest revenue share of 23.6% in 2023. It is attributed to the increasing number of high-profile data breaches, ransomware attacks, and cybersecurity incidents that have raised awareness among businesses and consumers about the importance of strong cybersecurity measures. For instance, in 2022, the Internet Crime Complaint Center received 2,385 complaints of ransomware attacks, resulting in adjusted losses exceeding USD 34.3 Million. Ransomware infections can affect individuals and businesses, regardless of size or industry, and can cause service disruptions, financial losses, and possibly permanent loss of valuable data.

Asia Pacific Certificate Authority Market Trends

The certificate authority market in the Asia Pacific region is expected to grow at a significant CAGR during the forecast period, due to the growing e-commerce sector and digital payment system. Consumers in the Asia Pacific are choosing online shopping platforms, and the need for secure online transactions has become vital. Consequently, businesses are under immense pressure to enhance their cybersecurity measures, which has led to a surge in the adoption of digital certificates to establish trust and secure online transactions. This trend is also present in the financial and logistics services that have undergone digital transformation in recent years. For instance, in May 2023, Visa, a digital payments enabler, announced a partnership with seven new startups as part of its Visa Accelerator Program in Asia Pacific. The startups are from China, Thailand, India, Singapore, and Germany. They are expected to work on solutions such as Web 3.0, global money movement, small business enablers, embedded finance, and open banking services. This partnership highlights the need and opportunity for strong cybersecurity measures, including digital certificates provided by CAs, to facilitate secure and trusted digital transactions, thereby driving regional growth and innovation.

The China certificate authority market is expected to grow at the fastest CAGR over the forecast period, as the Chinese government implements stringent cybersecurity laws and regulations to safeguard data privacy and protect against cyber threats. Compliance with these regulations often requires organizations to use digital certificates issued by accredited CAs. Therefore, CAs in China are experiencing increased demand for their services from organizations seeking to comply with regulatory requirements and avoid penalties. For instance, In February 2023, the Cyberspace Administration of China (the "Cyberspace Administration") introduced regulations concerning Standard Contractual Clauses for the transfer of personal information to third countries under China's Personal Information Protection Law (PIPL SCCs). These rules, outlined by the Cyberspace Administration, were enforced in June 2023.

The certificate authority market in Japan is expected to grow at the fastest CAGR over the forecast period. With the increasing number of IoT devices in Japan, there is a growing need for secure communication between these devices and their corresponding servers or platforms. This led to an increased demand for CA services that can provide device authentication and secure data transmission through digital certificates. Companies such as Entrust and GlobalSign are addressing this need by offering specialized IoT security solutions, including certificate provisioning and management features tailored to IoT applications.

Key Certificate Authority Company Insights

Some of the key players operating in the market include IdenTrust, Inc., Sectigo Limited, GlobalSign, DigiCert, Inc., and Network Solutions, LLC, and others.

-

IdenTrust, Inc. is a U.S.-based company that offers a wide range of digital certificate services, including SSL/TLS certificates, code signing certificates, and identity verification solutions, to facilitate secure online transactions and communications for businesses and individuals

-

Sectigo Limited offers SSL certificates and certificate management services for online presence. They specialize in automated Certificate Lifecycle Management solutions and digital certificates, managing user and device identity authentication across the IT ecosystem

-

GlobalSign offers identity and security solutions to businesses, large enterprises, cloud service providers, and IoT innovators. It secures online communications, manages verified digital identities, and automates authentication and encryption

-

DigiCert, Inc. is a provider of digital certificate solutions specializing in SSL/TLS certificates, code signing certificates, and certificate management services. DigiCert serves a diverse range of industries, helping organizations secure their online communications and transactions with digital certificates

-

Network Solutions, LLC is a company that provides domain name registration, web hosting, website design, and online marketing services. The company offers various services to help businesses establish and maintain their online presence. It includes domain registration, where customers can register and manage their domain names through Network Solutions’ platform

Key Certificate Authority Companies:

The following are the leading companies in the certificate authority market. These companies collectively hold the largest market share and dictate industry trends.

- ACTALIS S.p.A.

- Asseco Data Systems S.A.

- DigiCert, Inc

- Entrust Corporation

- GlobalSign

- GoDaddy Operating Company, LLC

- IdenTrust, Inc

- Network Solutions, LLC

- Newfold Digital Inc.

- Sectigo Limited

- SSL.com

- WISeKey International Holding Ltd

Recent Developments

-

In October 2023, GMO GlobalSign, Inc., specializing in identity security, digital signing, and IoTsolutions announced a strategic partnership with airSlate to enhance business productivity and automation solutions by expanding the range of advanced electronic signatures, particularly in Europe and Latin America. Integrating GMO GlobalSign's advanced electronic signatures with sign now, the partnership aims to boost users' security, compliance, and authentication measures, especially those in highly regulated industries such as financial services and public administration

-

In May 2023, DigiCert announced a partnership with a digital trust platform on Oracle Cloud Infrastructure (OCI) for offering DigiCert ONE. This collaboration aims to provide customers with the combined advantages of DigiCert ONE's rapid time-to-value and OCI's high-performance, security-centric architecture, catering to single and multi-cloud deployments. As part of this partnership, DigiCert and Oracle will work closely to integrate DigiCert ONE into the OCI ecosystem further, facilitating joint customers in managing their digital trust initiatives within a unified architecture

-

In April 2023, Entrust Corporation introduced significant enhancements to its Identity and Access Management (IAM) solution, integrating new passwordless, certificate-based authentication features with smart keys and FIDO2 passkeys. This move aims to boost security measures while providing users with seamless and convenient authentication methods

Certificate Authority Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 192.2 million

Revenue forecast in 2030

USD 401.4 million

Growth rate

CAGR of 13.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, enterprise size, certificate validation type, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; China; India; Japan; South Korea; Australia; Brazil; Mexico; Chile; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

ACTALIS S.p.A.; Asseco Data Systems S.A.; DigiCert, Inc.; Entrust Corporation; GlobalSign; GoDaddy Operating Company; LLC; IdenTrust, Inc.; Network Solutions, LLC; Newfold Digital Inc.; Sectigo Limited; SSL.com; WISeKey International Holding Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Certificate Authority Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the certificate authority market report based on, component, enterprise size, certificate validation type, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Certificate Type

-

Services

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Certificate Validation Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Domain Validation

-

Organization Validation

-

Extended Validation

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Retail and E-commerce

-

Government and Defense

-

Healthcare

-

IT and Telecom

-

Travel and Hospitality

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global certificate authority market size was estimated at USD 173.1 million in 2023 and is expected to reach USD 192.2 million in 2024

b. The global certificate authority market is expected to grow at a compound annual growth rate of 13.1% from 2024 to 2030, reaching USD 401.4 million by 2030

b. North America dominated the certificate authority market with a revenue share of 33.7% in 2023. Regional growth is attributed to the increasing concerns over cybersecurity threats and regulatory compliance.

b. Some key players operating in the certificate authority market include ACTALIS S.p.A., Asseco Data Systems S.A., DigiCert, Inc, Entrust Corporation, GlobalSign, GoDaddy Operating Company, LLC, IdenTrust, Inc., Network Solutions, LLC, Newfold Digital Inc., Sectigo Limited, SSL.com, WISeKey International Holding Ltd.

b. Factors such as the rising popularity of e-commerce, online banking, and other internet-based services are driving the growth of the certificate authority market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.