- Home

- »

- Pharmaceuticals

- »

-

Chemotherapy-Induced Neutropenia Treatment Market Report 2030GVR Report cover

![Chemotherapy-Induced Neutropenia (CIN) Treatment Market Size, Share & Trends Report]()

Chemotherapy-Induced Neutropenia (CIN) Treatment Market Size, Share & Trends Analysis Report, By Type, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-198-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

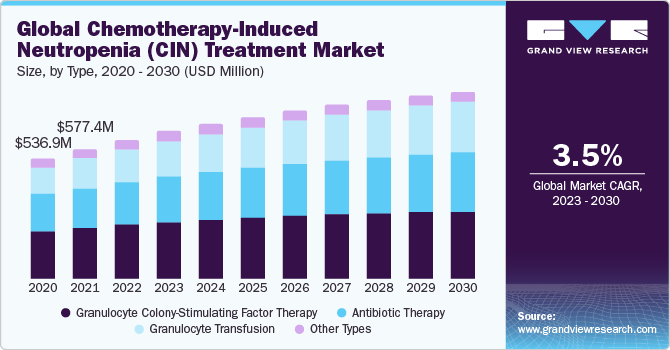

The global chemotherapy-induced neutropenia (CIN) treatment market size was valued at USD 617.8 million in 2022 and is expected to grow at a CAGR of 3.45% over the forecast period. The global market is mainly driven by the rising prevalence of cancer, the increased use of chemotherapy in treatment, and the growing research and development activities.

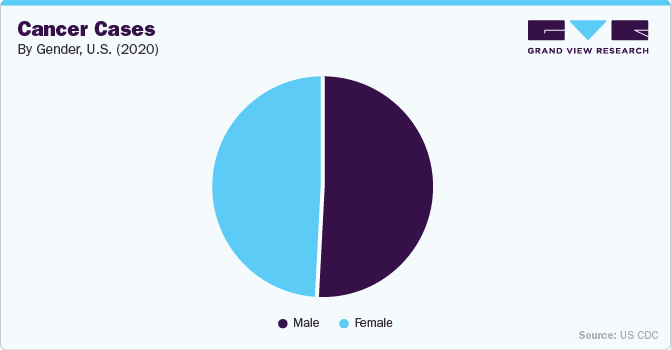

The rising prevalence of cancer serves as a significant driving factor. As cancer cases continue to rise, chemotherapy remains a common treatment approach. However, a notable side effect of chemotherapy is chemotherapy-induced neutropenia (CIN), which weakens the immune system and raises the risk of infections. For instance, according to an article published in eCancer Medical Science in February 2021, the study reported that one in three breast cancer patients involved in the research developed neutropenia while undergoing chemotherapy. This has generated a heightened demand for CIN treatment options, including growth factors and supportive care therapies, to enable cancer patients to continue their chemotherapy treatments safely. Consequently, the increasing occurrence of cancer underscores the critical need for effective CIN management, prompting the market to innovate and provide solutions that mitigate the associated risks. As a result, it improves cancer patients' overall quality of life.

Furthermore, the market is driven by increasing research and development activities focusing on enhancing treatment options and outcomes for cancer patients undergoing chemotherapy. For instance, research published in BMC Cancer has identified chemotherapy-induced neutropenia (CIN) as a prognostic factor in advanced non-small-cell lung cancer (NSCLC). The study showed that CIN is connected to poorer overall survival among patients with NSCLC receiving first-line chemotherapy. As cancer treatment strategies continue to evolve, R&D efforts lead to the discovery of novel therapies and supportive care approaches aimed at effectively preventing and managing CIN.

Type Insights

On the basis of type, the market is segmented into granulocyte colony-stimulating factor therapy, antibiotic therapy, granulocyte transfusion, and others. The granulocyte colony-stimulating factor therapy segment held the largest market share in 2022 due to its well-established effectiveness and widespread clinical acceptance. Granulocyte colony-stimulating factor (G-CSF) stimulates the production of neutrophils, a key component of the immune system, and helps mitigate the risk of infection in patients undergoing chemotherapy, thereby contributing to the overall segment growth.

On the other hand, granulocyte transfusion is expected to witness lucrative growth over the forecast period since granulocyte transfusion becomes essential in situations where patients experience exceptionally low neutrophil counts and are at high risk of life-threatening infections.

Distribution Channel Insights

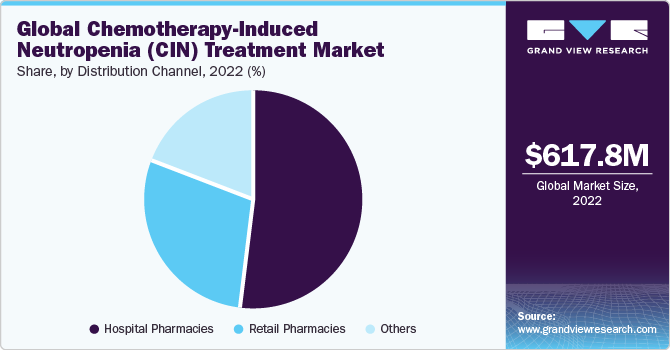

Based on distribution channels, the market is segmented into hospital pharmacies, retail pharmacies, and others. The hospital pharmacies segment dominated the market in 2022. Chemotherapy-induced Neutropenia (CIN) typically requires immediate treatment and close monitoring, making hospitals the primary point of care for cancer patients. Moreover, hospital pharmacies are well-equipped to provide the necessary medications, including G-CSF therapies and granulocyte transfusions, and ensure their safe and timely administration. On the other hand, the retail pharmacies segment is expected to witness lucrative growth over the forecast period due to their easy accessibility.

Regional Insights

North America dominated the market in 2022 as the region has a high prevalence of cancer and a well-established healthcare infrastructure, resulting in a substantial pool of patients requiring CIN management. Moreover, the region's strong emphasis on healthcare quality, coupled with robust reimbursement systems, ensures accessibility to advanced CIN treatments and contribute to the overall market growth.

On the other hand, Asia Pacific is expected to witness lucrative growth over the forecast period. The region has a rapidly expanding population, and cancer incidence is on the rise due to factors such as lifestyle changes and an aging demographic. This growing patient pool generates a substantial demand for CIN management, thereby contributing to the overall market growth in the region.

Key Chemotherapy-Induced Neutropenia Treatment Companies

Some key players operating in the market include AbbVie Inc. (Allergan PLC), Merck & Co., Inc., Aurobindo Pharma, GlaxoSmithKline PLC., Coherus BioSciences, Spectrum Pharmaceuticals, Lupin, G1 Therapeutics, Inc., and Novartis AG. Market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain new market avenues.

In March 2023, Coherus BioSciences secured U.S. FDA approval for Udencya, a biosimilar of pegfilgrastim, which is utilized to manage febrile neutropenia resulting from chemotherapy.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."