- Home

- »

- Consumer F&B

- »

-

Cherry Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Cherry Market Size, Share & Trends Report]()

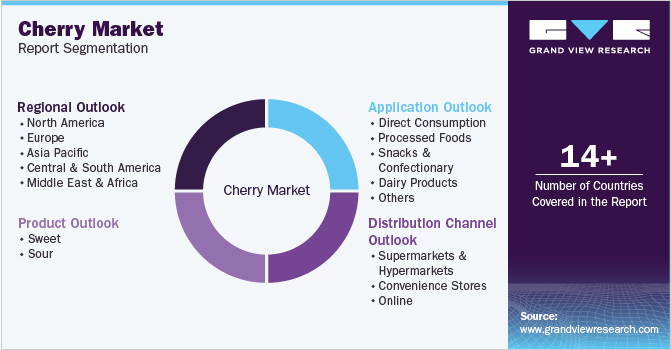

Cherry Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Sweet, Sour), By Application (Direct Consumption, Processed Products, Snacks & Confectionary, Dairy Products), By Form, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-511-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cherry Market Summary

The global cherry market size was estimated at USD 67.06 billion in 2024 and is projected to reach USD 102.34 billion by 2030, growing at a CAGR of 7.3% from 2025 to 2030. One of the primary reasons for the growth of the market is the rising health consciousness among consumers.

Key Market Trends & Insights

- The North America cherry industry was valued at USD 19.70 billion in 2023.

- The U.S. cherry industry is expected to exceed USD 25 billion by 2030.

- By product, the sour cherry segment is expected to grow at a CAGR of 8.8% from 2024 to 2030.

- By distribution channel, the sale of cherries through supermarkets and hypermarkets segment accounted for a market revenue of USD 26.89 billion in 2023.

Market Size & Forecast

- 2024 Market Size: USD 67.06 Billion

- 2030 Projected Market Size: USD 102.34 Billion

- CAGR (2025-2030): 7.3%

- Asia Pacific: Largest market in 2023

Cherries are recognized for their rich nutritional profile, containing antioxidants, vitamin C, and anti-inflammatory compounds. These attributes contribute to various health benefits, such as supporting heart health, reducing symptoms of arthritis and gout, and enhancing sleep quality. As consumers become more aware of the adverse effects of preservatives and processed foods, there is a growing preference for fresh fruits like cherries that are perceived as healthier options. This shift in dietary preferences has led to increased consumption of cherries, particularly in emerging economies where purchasing power is rising.

Economic conditions also play a crucial role in the growth of the market. Consumers are willing to spend more on fresh produce with higher disposable incomes in developed regions such as North America and emerging markets in Asia-Pacific. This economic empowerment has spurred demand for premium-quality fruits, including cherries. The increasing availability of various cherry varieties throughout the year has made it easier for consumers to incorporate them into their diets, further driving market growth.

The rise of urban farming is another significant factor contributing to the expansion of the fresh cherry industry. Limited land availability in urban areas has led to innovative farming techniques that allow for cultivating cherries in community spaces such as rooftops and school gardens. Urban agriculture reduces transportation costs and enhances local access to fresh produce. This trend aligns with consumer desires for locally sourced food options, increasing demand for fresh cherries grown within city limits.

Sustainability has become a key concern for many consumers, increasing demand for organic and sustainably farmed products. Cherry producers who adopt organic practices can cater to this market segment by offering pesticide-free cherries, which command higher prices due to their perceived health benefits. In addition, implementing eco-friendly practices such as biodegradable packaging and water conservation can further enhance a cherry farm's appeal to environmentally conscious consumers. This alignment with consumer values boosts sales and fosters brand loyalty among health-focused buyers.

Advancements in agricultural technology have also positively impacted the cherry industry. Innovations in production techniques have improved yield quality and quantity, allowing farmers to meet increasing consumer demand more effectively. These technological improvements include better pest management systems and enhanced packaging solutions that help maintain fruit quality during transportation. As a result, producers can offer fresher cherries to consumers while minimizing losses due to spoilage.

The dynamics of international trade have significantly influenced the market's growth. Regions known for cherry production, such as North America and Europe, have expanded their export capabilities, making cherries more accessible worldwide. As international trade continues to evolve, the market will likely see sustained growth driven by domestic consumption and export opportunities.

One of the most pressing challenges for cherry producers is the impact of climate change. Unpredictable weather patterns, including frost, heavy rainfall, and extreme heat, have led to inconsistent harvests. For instance, in 2023, many cherry farmers experienced severe losses due to "weather whiplash," which resulted in unharvested fields and plummeting prices. Cherries are particularly vulnerable because they do not store well compared to other fruits, making them susceptible to market fluctuations caused by adverse weather conditions. This variability affects yield and compromises fruit quality, posing a risk to producers' livelihoods.

Substantial competition from imported cherries also challenges the market. Countries like Turkey and Chile have established themselves as major players in the global cherry industry, often offering lower prices due to their larger production scales. In markets such as the UK, domestic producers struggle to compete against these imports despite consumers' willingness to pay a premium for homegrown cherries. This competition can lead to price wars that further squeeze profit margins for local growers.

Product Insights

Sweet cherry was the most significant product category in the market, with a revenue of USD 58.38 billion in 2023. This dominance is primarily attributed to their versatility and high food and beverage industry demand. Sweet cherries are favored for their excellent taste and appearance, making them ideal for fresh consumption as well as for use in products like juices, jams, jellies, and desserts. The growing consumer preference for fresh, premium-quality fruits has further propelled the sweet cherry segment's growth. As health trends continue to influence dietary choices, sweet cherries are increasingly recognized for their nutritional benefits, including high antioxidant content and potential health advantages, which contribute to their sustained popularity.

The sour cherry segment is expected to grow at a CAGR of 8.8% from 2024 to 2030. This growth is driven by rising demand in the confectionery industry, where sour cherries are utilized in various products such as candies, chocolates, and ice creams. In addition, sour cherries are often processed into products like juices and canned goods, with a significant percentage of domestic production directed toward these uses. As consumer interest in unique flavors and artisanal products increases, sour cherries are gaining traction among food manufacturers looking to innovate with tart flavors. This trend suggests a promising future for sour cherry cultivation and processing as they carve out a niche in the broader market.

Distribution Channel Insights

The sale of cherries through supermarkets and hypermarkets accounted for a market revenue of USD 26.89 billion in 2023. Supermarkets and hypermarkets play a pivotal role in the distribution of cherries, accounting for a significant share of the market, approximately 45.30%. Several factors, including the extensive variety and availability of cherry types, drive this dominance. Consumers can find popular sweet varieties like Bing and Rainier and sour cherries, catering to diverse preferences and encouraging higher sales volumes. In addition, supermarkets often provide both fresh cherries and processed cherry products, such as jams and juices, enhancing their appeal to a broader audience.

The convenience supermarkets offering is another crucial factor contributing to their market share. These retail formats allow consumers to purchase cherries alongside other grocery items, making shopping more efficient for busy individuals. Supermarkets frequently employ strategically placed cherry displays to encourage impulse purchases, further boosting sales. Promotional strategies, including discounts, loyalty programs, and seasonal sales during peak harvest times, also attract customers and foster brand loyalty among shoppers seeking value.

Moreover, many supermarkets increasingly emphasize locally sourced produce as part of their sustainability initiatives. This trend resonates with health-conscious consumers who prefer fresh, locally grown cherries over imported options. Supermarkets can enhance their market position by promoting local cherries while supporting local farmers.

Convenience stores hold a more minor but notable share of the cherry industry, catering to on-the-go consumers. The increasing demand for quick and easy snack options drives the growth in this segment. As lifestyles become busier, consumers seek convenient access to fresh fruits like cherries without extensive shopping trips. Convenience stores often position cherries as impulse buys near checkout counters or in snack aisles, capitalizing on their appeal as a healthy snack alternative. In addition, expanding convenience store chains in urban areas enhances accessibility to fresh cherries for a wider audience.

Online sales of cherries are expected to grow at a CAGR of 7.6% from 2024 to 2030. E-commerce has transformed how consumers purchase fresh produce, including cherries. Online retailers provide the convenience of home delivery, allowing consumers to shop from the comfort of their homes. This trend has been accelerated by the COVID-19 pandemic, which shifted many consumers towards online shopping for groceries. Moreover, online platforms often offer detailed product descriptions and customer reviews that help buyers make informed choices about quality and freshness. The ability to compare prices across different retailers also encourages consumers to choose online channels for their cherry purchases.

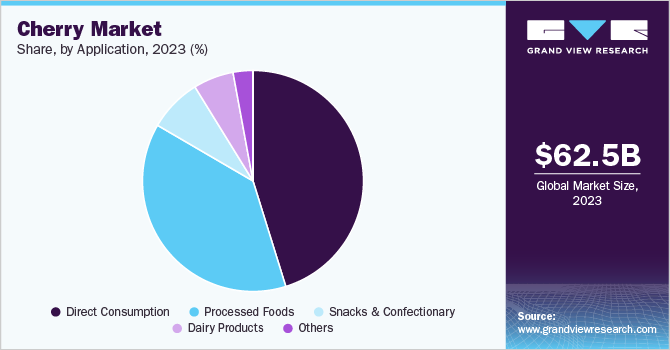

Application Insights

Direct consumption was the most extensive application for cherry, accounting for a market revenue of USD 28.28 billion in 2023. The direct consumption of cherries has emerged as a dominant segment in the market, accounting for a substantial share due to various factors that cater to consumer preferences and health trends. This growth is driven by the increasing health consciousness among consumers, who increasingly opt for fresh fruits as convenient and nutritious snack options. Cherries are celebrated for their rich nutritional profile, including high levels of antioxidants, vitamin C, and anti-inflammatory compounds, making them an attractive choice for health-oriented individuals. The rising trend of outdoor eating and social gatherings has also contributed to the popularity of cherries for direct consumption. Producers strategically associate cherries with summer picnics, outdoor events, and beverages, enhancing their appeal as a go-to snack during warmer months.

The DIY (Do-It-Yourself) recipe trend has gained traction, with consumers looking for creative ways to incorporate fresh cherries into their meals and snacks. This includes adding them to salads, smoothie bowls, and desserts, further driving demand in this segment. The convenience of consuming cherries without any preparation makes them an ideal option for on-the-go snacking, aligning perfectly with modern consumer lifestyles. As a result, the direct consumption of cherries is expected to maintain its upward trajectory in the global market.

Processed food is another vital application of cherries and is expected to grow at a CAGR of 7.4% from 2024 to 2030. This segment is experiencing robust growth due to several factors that align with changing consumer preferences and market trends. The global processed cherry industry is expected to benefit from the rising demand for convenience foods, where cherries are utilized for flavor and nutritional benefits. As consumers increasingly seek out healthy and natural ingredients in their diets, processed cherries are becoming a popular choice for manufacturers looking to innovate their product offerings.

The growth in processed products can be attributed to the increasing popularity of beverages like smoothies and cherry-infused drinks. Cherries' health benefits, including their high antioxidant content and potential anti-inflammatory properties, drive consumer interest in incorporating them into various food and beverage applications. In addition, advancements in food preservation technologies allow for better retention of flavor and nutrients in processed cherry products, enhancing their appeal. As a result, processed product application is poised for significant expansion within the market over the coming years.

Regional Insights

The North America cherry industry was valued at USD 19.70 billion in 2023. In North America, the demand for cherries is significantly driven by a rise in health-conscious consumers who prefer organic and fresh foods over processed options. This shift is evident as consumers increasingly seek out fruits known for their health benefits, such as cherries, which are rich in antioxidants and vitamins. The trend towards healthier eating is further supported by the growing popularity of cherries in various culinary applications, including smoothies, salads, and desserts. Additionally, the increasing disposable income among consumers allows for greater spending on premium-quality fresh produce, contributing to the overall growth of the market. The expansion of e-commerce platforms has also made it easier for consumers to access fresh cherries, enhancing their availability and convenience.

U.S. Cherry Market Trends

The U.S. cherry industry is expected to exceed USD 25 billion by 2030 and grow at a CAGR of 7.1% from 2024 to 2030. The U.S. cherry industry has seen a significant rise in production, particularly in states like Washington and California, which are major contributors to sweet cherry output. The growing demand for cherries in processed forms, such as juices and jams, is also fueling market growth. Moreover, the popularity of fruit-based beverages among millennials has led to an uptick in cherry consumption as an ingredient in craft beers and cocktails. This diversification of cherry applications is helping to expand its market presence.

Asia Pacific Cherry Market Trends

Asia Pacific cherry industry was the largest in 2023 in terms of revenues exceeding USD 21 billion in 2023. In the Asia Pacific region, the growth of cherry demand is primarily influenced by rising urban populations and increasing disposable incomes. As urbanization accelerates, consumers seek convenient and nutritious food options, including fresh fruits like cherries.

The cultural shift towards health-oriented diets has increased the emphasis on antioxidant-rich foods, making cherries an attractive choice for health-conscious consumers. In addition, emerging economies in this region are witnessing a surge in demand for premium-quality fruits, with consumers willing to pay higher prices for specialty varieties. The growing interest in organic produce and local sourcing further supports the expansion of cherry consumption in these markets.

Key Cherry Company Insights

The competitive landscape of the market is characterized by a mix of established players and emerging companies, with significant activity in both domestic and international markets. North America, particularly the United States, and the Asia Pacific region are key areas of focus due to their increasing demand for fresh cherries. The U.S. is a major producer and exporter, with Washington and California leading in sweet cherry production. The market is marked by a concentration of exports, notably from Chile, which has established itself as a dominant player, especially in the Chinese market, where over 88% of its cherry exports are directed. This reliance on a single market presents both opportunities and risks, highlighting the need for diversification strategies to mitigate dependency.

Key Cherry Companies:

The following are the leading companies in the cherry market. These companies collectively hold the largest market share and dictate industry trends.

- Stemilt Growers

- Washington Fruit Growers

- Driscoll's Inc.

- Borton Fruit

- Zirkle Fruit Company

- Chelan Fresh

- Columbia Fruit Packers Inc.

- Domex Superfresh Growers

- Rainier Fruit Co.

- Valley Fresh Produce

- Naturipe Fruits

- Smeltzer Orchard Company LLC

- CMI Orchards LLC

- Leelanau Fruit Co.

- Diva Agro Ltd

- SICA SAS SICODIS

- Cherry Hill Orchards

- Perfecta Produce

- Northstar Organics

- Vitin Fruits

Cherry Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 71.96 billion

Revenue forecast in 2030

USD 102.34 billion

Growth Rate (Revenue)

CAGR of 7.3% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, UAE

Key companies profiled

Stemilt Growers; Washington Fruit Growers; Driscoll's Inc.; Borton Fruit; Zirkle Fruit Company; Chelan Fresh; Columbia Fruit Packers Inc.; Domex Superfresh Growers; Rainier Fruit Co.; Valley Fresh Produce; Naturipe Fruits; Smeltzer Orchard Company LLC; CMI Orchards LLC; Leelanau Fruit Co.; Diva Agro Ltd; SICA SAS SICODIS; Cherry Hill Orchards; Perfecta Produce; Northstar Organics; Vitin Fruits

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cherry Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cherry market report based on product, application, distribution, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sweet

-

Sour

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Consumption

-

Processed Foods

-

Snacks & Confectionary

-

Dairy Products

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

- Middle East & Africa

- UAE

-

Frequently Asked Questions About This Report

b. The global cherry market was valued at USD 62.50 billion in 2023.

b. The global cherry market is expected to grow at a CAGR of 7.3% from 2024 to 2030.

b. Sweet cherry was the most significant product category in the market, with a revenue of USD 58.38 billion in 2023. This dominance is primarily attributed to their versatility and high food and beverage industry demand. Sweet cherries are favored for their excellent taste and appearance, making them ideal for fresh consumption as well as for use in products like juices, jams, jellies, and desserts. The growing consumer preference for fresh, premium-quality fruits has further propelled the sweet cherry segment's growth.

b. Some of the key players operating in the market include: - • Stemilt Growers • Washington Fruit Growers • Driscoll's Inc. • Borton Fruit • Zirkle Fruit Company • Chelan Fresh • Columbia Fruit Packers Inc. • Domex Superfresh Growers • Rainier Fruit Co. • Valley Fresh Produce • Naturipe Fruits • Smeltzer Orchard Company LLC • CMI Orchards LLC • Leelanau Fruit Co. • Diva Agro Ltd • SICA SAS SICODIS • Cherry Hill Orchards • Perfecta Produce • Northstar Organics • Vitin Fruits

b. One of the primary reasons for the growth of the cherry market is the rising health consciousness among consumers. Cherries are recognized for their rich nutritional profile, containing antioxidants, vitamin C, and anti-inflammatory compounds. These attributes contribute to various health benefits, such as supporting heart health, reducing symptoms of arthritis and gout, and enhancing sleep quality. As consumers become more aware of the adverse effects of preservatives and processed foods, there is a growing preference for fresh fruits like cherries that are perceived as healthier options. This shift in dietary preferences has led to increased consumption of cherries, particularly in emerging economies where purchasing power is rising.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.