- Home

- »

- Medical Devices

- »

-

Chile Radiotherapy Market Size & Share Report, 2021-2028GVR Report cover

![Chile Radiotherapy Market Size, Share & Trends Report]()

Chile Radiotherapy Market (2021 - 2028) Size, Share & Trends Analysis Report By Type (External Beam, Internal Beam, Systemic Radiotherapy), By Application (Breast, Prostate, Lung, Colorectal, Head & Neck Cancer), And Segment Forecasts

- Report ID: GVR-4-68039-478-0

- Number of Report Pages: 61

- Format: PDF

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

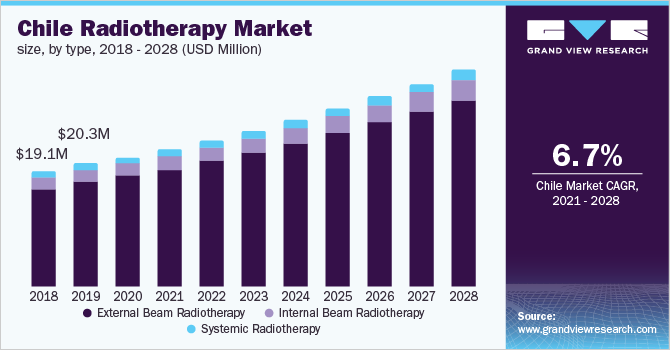

The Chile radiotherapy market size was valued at USD 21.3 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.7% from 2021 to 2028. The market growth can be attributed to the increase in the prevalence of cancer coupled with the growing adoption of radiotherapy. In addition, technological advancements in radiotherapy, and rising healthcare expenditure are some of the key factors responsible for the lucrative growth of the radiotherapy market. According to International Agency for Research on Cancer, in 2020, an estimated 54,227 newly diagnosed cancer cases were reported in Chile.

Aging is the most common factor that increases the risk of cancer. According to a study, around 60% of the cases were found in people with 65 or older age group. Among the preventable cases, smoking and obesity were found to be the leading cause in Chile in 2018 that is responsible for 18.3% and 8.7% of the cancer cases.

Certain factors, such as alcohol consumption, improper diet, and lack of exercise, also cause cancer. According to BMC Cancer, around 30% of all the cases and 36% of the deaths were attributed to lifestyle risk factors in the region and 15,097 cases are preventable if a healthy lifestyle was adopted. This is expected to lead to an increase in cancer incidence, which will, in turn, drive the market.

The government of Chile is increasing the healthcare expenditure to bridge the infrastructure gaps and to promote the healthy living of the population. According to OECD data, the total healthcare expenditure as a percent of GDP increased from 8.9% in 2018 to 9.1% in 2019.

The government introduced the National Cancer Plan that aims at increasing the survival of patients from 40% to 60% by the end of 2028. The strategy ensures that everyone has access to high-quality services and receives prompt and fair service by taking necessary measures. The National Oncology Network, especially facilities and equipment, ensures that all patients in Chile have access to high-quality, timely treatment, with comprehensive care given to the majority of people in their area. By 2028, the Chilean government intends to spend USD 27.72 million a year on oncology equipment and facilities. Thus, a rise in healthcare expenditure is expected to drive market growth.

Chile has sufficient radiation oncologists but lacks in equipment required to meet the current radiotherapy demand as per international standards. According to an article, 15 out of 42 LINACS in the country have been operational for more than 10 years and require replacement.

Type Insights

The external beam radiotherapy segment dominated the market and accounted for the largest revenue share of 86.5% in 2020. External beam radiotherapy is the most widely used form of radiotherapy. All external beam radiation therapy devices such as LINACs, CyberKnife, GammaKnife, and Tomotherapy equipment are expected to grow at a lucrative rate. An increase in awareness about treatment procedures and technological advancements are some of the factors contributing to market growth. External Beam Radiation Therapy (EBRT) is considered highly effective in various conditions, such as breast cancer, esophageal cancer, colorectal cancer, and prostate cancer.

The internal beam radiotherapy segment is anticipated to witness the fastest growth over the forecast period owing to the factors such as the ability to deliver precise doses, increased patient preference, and cost-effectiveness. As per data provided by ALATRO (Latin American Association of Radiation Oncological Therapy), Chile had 7 HDR and 2 LDR brachytherapy units installed as of 2017. As per DIRAC data, as of January 2021, there are around 12 brachytherapy units in Chile.

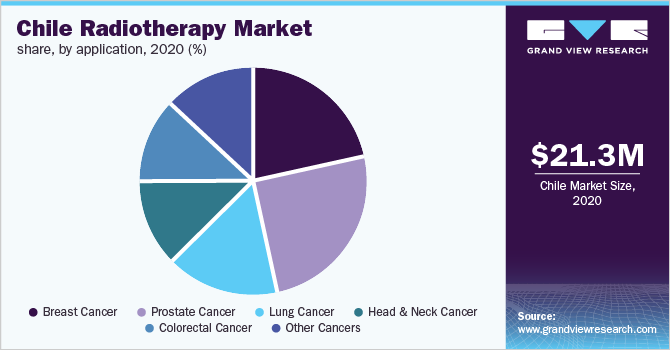

Application Insights

The prostate cancer segment dominated the Chile radiotherapy market and accounted for the largest revenue share of 24.9% in 2020. The segment is expected to witness the fastest growth over the forecast period owing to the high incidence and treatment rate of the indication in Chile. According to IARC statistics, the incidence of the disease in Chile is estimated to be around 8,157 in 2020; this number is expected to reach 11,700 by 2030.

The lung cancer segment is expected to grow at a significant rate in the coming years owing to changes in the lifestyle of the population. According to the IARC, the estimated number of new lung cancer cases in Chile was around 4,000 in 2020. The number is expected to reach around 5,500 by 2030. The rising incidence of the disease can be attributed to an increase in smoking. As per the national health survey, currently, 32.5% of the people in Chile are active smokers.

Key Companies & Market Share Insights

Companies are adopting strategies that allow them to use their resources to aid in the development of new products. For instance, in March 2018, Elekta AB entered into research collaboration with Universidad de La Frontera (UFRO) for the development of innovative equipment for radiation therapy treatments. The researchers have developed a compact device that emits a convergent beam of X photons in external radiotherapy that enhances the efficacy by better dose distribution. Most of the companies do not directly sell their products in the Chilean market but sell the products via local distribution partners. Some of the prominent players in the Chile radiotherapy market include:

-

Varian Medical Systems, Inc.

-

Elekta AB

-

Accuray Incorporated

-

Becton, Dickinson and Company

-

Isoray Medical

-

NTP Radioisotopes SOC Ltd.

Chile Radiotherapy Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 22.7 million

Revenue forecast in 2028

USD 36.0 million

Growth Rate

CAGR of 6.7% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application

Key companies profiled

Varian Medical Systems, Inc.; Elekta AB; Accuray Incorporated; Becton, Dickinson and Company; NTP Radioisotopes; Isoray Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the Chile radiotherapy market report on the basis of type and application:

-

Type Outlook (Revenue, USD Million, 2016 - 2028)

-

External Beam Radiotherapy

-

Internal Beam Radiotherapy

-

Systemic Radiotherapy

-

-

Application Outlook (Revenue, USD Million, 2016 - 2028)

-

Breast Cancer

-

Prostate Cancer

-

Lung Cancer

-

Head and Neck Cancer

-

Colorectal Cancer

-

Others

-

Frequently Asked Questions About This Report

b. The Chile radiotherapy market size was estimated at USD 21.3 million in 2020 and is expected to reach USD 22.7 million in 2021.

b. The Chile radiotherapy market is expected to grow at a compound annual growth rate of 6.7% from 2021 to 2028 to reach USD 36.0 million by 2028.

b. Based on type, the external beam radiotherapy segment dominated the Chile radiotherapy market with a share of 86.54% in 2020. The high price and installed base of EBRT equipment are some of the major factors for its dominance.

b. Some key players operating in the Chile radiotherapy market include Varian Medical Systems, Inc.; Elekta AB; Accuray Incorporated; Becton, Dickinson and Company; Isoray Medical; NTP Radioisotopes SOC Ltd.

b. Key factors that are driving the Chile radiotherapy market growth include growing demand for radiotherapy, adoption of technologically advanced products, and rising incidence of cancer.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.