China Antiscalants Market Size & Trends

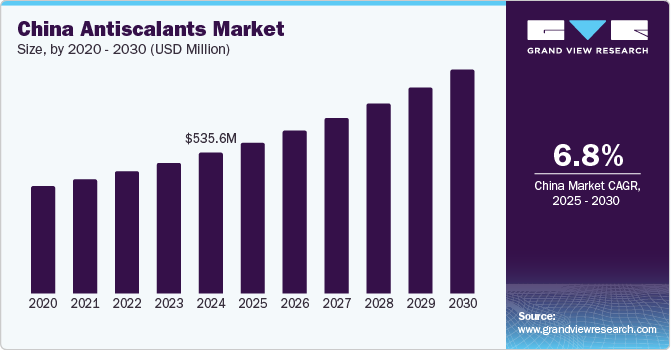

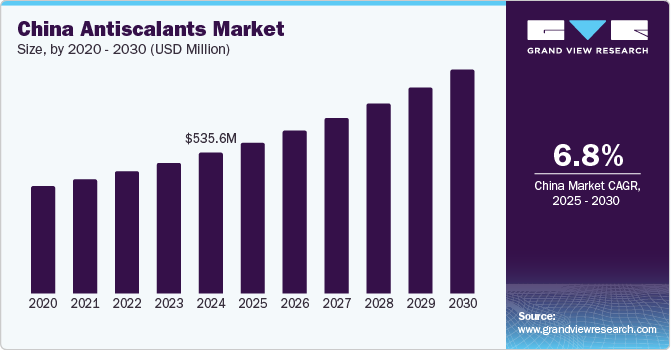

The China antiscalants market size was valued at USD 535.6 million in 2024 and is expected to grow at a CAGR of 6.8% from 2025 to 2030. This growth can be attributed to the increasing demand from various industries, particularly oil and gas, water treatment, and chemical manufacturing. In addition, rapid industrialization in the Asia-Pacific region and a growing need for efficient water management solutions significantly contribute to market growth. Furthermore, technological advancements in water filtration and reverse osmosis processes enhance the effectiveness of antiscalants, making them essential for preventing scale formation and ensuring operational efficiency.

Antiscalants are chemical agents used to prevent the formation of scale deposits in water systems, ensuring efficient operation and reducing maintenance costs. The expansion of various sectors, such as power generation, chemical production, mining, and food processing, significantly influences the demand for antiscalants. In power generation, they are essential for maintaining the efficiency of boilers and cooling systems by preventing scale accumulation, which can hinder energy performance and increase costs. Similarly, antiscalants protect equipment from scaling in chemical manufacturing, ensuring smooth production processes and minimizing costly downtime.

In mining operations, where water is heavily utilized for extraction and processing, antiscalants are vital in preventing scale deposits that can obstruct machinery and lower productivity. The food and beverage sector also relies on these chemicals to uphold strict hygiene standards and product quality by keeping processing equipment free from scale. The continuous growth of these industries, driven by urbanization and economic development, highlights a persistent need for effective antiscalant solutions.

Furthermore, technological advancements offer promising opportunities for the antiscalants market. As industries evolve, innovative technologies are crucial for effectively addressing scaling challenges. Ongoing research leads to the development of advanced formulations that enhance scale inhibition across diverse water qualities and conditions. Moreover, there is a growing trend toward environmentally friendly, biodegradable, and non-toxic antiscalants. The integration of digital solutions facilitates proactive management of scaling risks, allowing for tailored antiscalant applications in various industrial contexts.

Product Type Insights

The phosphonates segment dominated the market and accounted for the largest revenue share in 2024. This growth can be attributed to the increasing industrial activities and the demand for efficient water treatment solutions. In addition, phosphonates are effective in preventing scale formation in high-temperature and high-pressure environments, making them essential for applications such as cooling systems and boilers. Furthermore, their ability to enhance operational efficiency while meeting regulatory standards further drives their adoption across various industries, including oil and gas.

The carboxylates segment is expected to grow at a CAGR over the forecast period, owing to their versatility and effectiveness in a range of industrial applications. Carboxylate antiscalants are effective in preventing scale deposits in water treatment processes, making them popular in sectors such as power generation and chemical manufacturing. In addition, the trend towards environmentally friendly solutions boosts their appeal, as many carboxylate formulations are biodegradable and less harmful to the environment.

Application Insights

The chemical industry led the market with the largest revenue share in 2024, primarily driven by the need for efficient water treatment solutions to prevent scale formation in various processes. In addition, antiscalants are essential in maintaining equipment performance and minimizing downtime, particularly in chemical manufacturing, where scaling can disrupt operations and lead to increased maintenance costs. Furthermore, the industry's focus on sustainability and regulatory compliance also encourages the adoption of effective antiscalant solutions to enhance productivity and reduce environmental impact.

The power industry is expected to grow at the fastest CAGR from 2025 to 2030, owing to its critical role in preventing mineral scaling in cooling systems, boilers, and heat exchangers. As power generation facilities strive for improved efficiency and reliability, antiscalants help mitigate scale buildup that can impair system performance. Furthermore, the increasing emphasis on energy efficiency and stringent environmental regulations further drives the adoption of antiscalants, ensuring that power plants operate optimally while adhering to sustainability goals.

Key Chemical Indicator Inks Company Insights

Key companies in the Vietnam antiscalants industry include BASF SE, Kemira Oyj, and others. These companies adopt various strategies to enhance their competitive edge. These include investing heavily in research and development to transform and improve product formulations. Strategic partnerships and collaborations with industrial stakeholders are also common, enabling companies to expand their market reach and diversify their offerings. Furthermore, mergers and acquisitions are utilized to strengthen market presence and enhance operational capabilities, while a focus on sustainability drives the development of eco-friendly products that meet regulatory standards.

-

Avista Technologies, Inc. manufactures liquid antiscalants and other membrane treatment chemicals for reverse osmosis (RO) systems. Their flagship products, such as the Vitec series, are designed to prevent scale formation from various minerals, including calcium and silica, ensuring optimal performance in water treatment processes. Operating primarily in the water treatment segment, the company focuses on providing solutions that enhance system efficiency and longevity while addressing challenges posed by different feedwater sources.

-

Shangdong Great Lake New Material Co. Ltd. produces a range of products that inhibit scale formation and corrosion in water systems, particularly in cooling towers and boilers. Operating within the chemical manufacturing segment, the company emphasizes innovation and quality to meet the evolving needs of industries reliant on efficient water management solutions.

Key China Antiscalants Companies:

- Avista Technologies, Inc.

- BASF SE

- Kemira Oyj

- Henan Yuguan Chemical Technology Co. Ltd.

- Nalco Water

- Shangdong Great Lake New Material Co. Ltd.

- ZaozhungKerui Chemicals Co. Ltd.

Recent Developments

-

In April 2024, Nalco Water, a subsidiary of Ecolab, introduced its Premium Cooling Water Program, which aims to enhance reliability and sustainability in industries such as power and chemicals. This program integrates advanced antiscalants and innovative deposit sensing technology to optimize cooling water processes, reduce scale and corrosion, and ensure compliance with environmental regulations. By leveraging digital intelligence and predictive analytics, Nalco Water seeks to minimize downtime and maintenance costs, providing a comprehensive solution for cooling water management in critical sectors.

China Antiscalants Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 576.1 million

|

|

Revenue forecast in 2030

|

USD 854.1 million

|

|

Growth rate

|

CAGR of 6.8% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Report updated

|

January 2025

|

|

Quantitative units

|

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product type, application, and country.

|

|

Country scope

|

China

|

|

Key companies profiled

|

Avista Technologies, Inc.; BASF SE; Kemira Oyj; Henan Yuguan Chemical Technology Co. Ltd.; Nalco Water; Shangdong Great Lake New Material Co. Ltd.; and ZaozhungKerui Chemicals Co. Ltd.

|

|

Customization scope

|

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

China Antiscalants Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the China antiscalants market report based on product type and application.

-

Product Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Carboxylates

-

Phosphonates

-

Sulfonates

-

Fluorides

-

Others

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Coal Gasification

-

Power

-

Chemical