- Home

- »

- Next Generation Technologies

- »

-

China E-cigarette And Vape Market, Industry Report, 2030GVR Report cover

![China E-cigarette And Vape Market Size, Share & Trends Report]()

China E-cigarette And Vape Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Disposable, Rechargeable, Modular Devices), By Category, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-219-2

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

China E-cigarette And Vape Market Trends

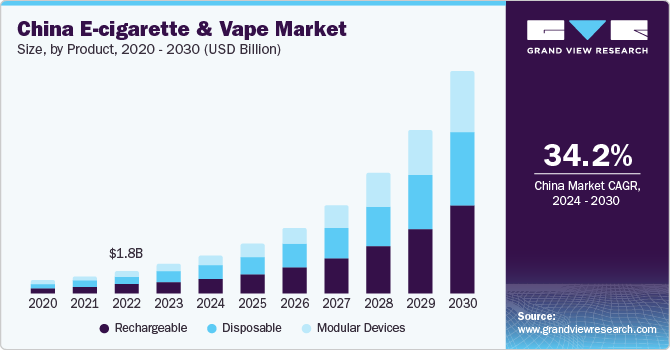

The China e-cigarette and vape market size was estimated at USD 2.27 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 34.2% from 2024 to 2030. The growth is aided by a rising awareness regarding their safety profile over conventional cigarettes. A significant proportion of the population in China smokes cigarettes, leading to health concerns generally associated with it. As per World Health Organization (WHO), China is the largest global producer and consumer of tobacco and more than 300 million people in the country are smokers, which is one-third of the global number. Although e-cigarettes have a strong manufacturing base in China, government regulations aimed at banning their usage means that a significant portion of the revenue is generated through exports.

E-cigarettes are considered a lot safer than tobacco products, particularly for adults and pregnant women who smoke regular cigarettes. The population of e-cigarette users has risen in China in recent years, aided by greater awareness about the product and increased sales opportunities for manufacturers. In recent years, there has been a significant growth in the number of small companies aiming to launch advanced products, which has helped generate more product sales. As per a report by the China Electronics Chamber of Commerce published in December 2021, the country produces around 95% of vaping products used globally. More than 90% of these products are eventually exported. Thus, significant awareness regarding e-cigarette manufacturing is expected to aid market growth in the foreseeable future.

Current e-cigarettes have seen the integration of several advanced features that have made it a more appealing market for adults and teenagers. For instance, they have a temperature control function that controls coil temperature, offering enhanced e-liquid flavor. This also improves device safety and improves its durability. Another notable mod that has been introduced in this market is the squonk mod which makes use of a bottle at the base of the atomizer to pump e-liquid through manual pressing. This offers the advantage of not having to refill the atomizer post every 6-7 puffs. The use of pod systems that are rechargeable, portable, and user-friendly is another popular trend. Chinese companies such as Innokin, SMOORE, and ALD have become notable for launching such innovative products for the global market.

The China e-cigarette and vape market has been significantly impacted by the government’s introduction of several new legislations in order to curb the problem of youth vaping and discourage unfair market practices by companies. For instance, in October 2022, the country’s government released a report stating e-cigarette products would be subject to a consumption tax, with the production and import rate standing at 36% and wholesale rate being 11%. However, product exports are expected to remain a major source of revenue, as this segment would remain eligible for tax refund and exemption. As a result, the market growth is expected to remain stable, with manufacturers aiming to use technological advances to launch new products for international markets.

Market Concentration & Characteristics

Market growth stage is high, and pace of the growth is accelerating. The e-cigarette and vape market in China has gained substantial pace over the past few years, aided by increasing production volumes of vapes and growing international demand for them. In order to address changing consumer requirements, companies in the country are manufacturing products with cutting-edge features such as temperature control options, airflow control settings, and larger batteries with displays.

The growing export volume seen in the Chinese e-cigarette & vape industry has compelled companies to launch products at a fast pace. Factors such as boosting revenue share and attracting new customers in global markets have become the base for forming new growth strategies aimed at product launches. Sustainability has also become a key trend when designing new products for companies. For instance, in January 2024, INNOKIN announced the launch of Trine, which has redesigned the pod structure of Atomizer, Control, and removable Battery to improve battery reusability.

The Chinese government has implemented several policies and regulations that have served to negatively impact sales of e-cigarettes in the country. For instance, a consumption tax was imposed on the production and import of e-cigarettes beginning November 2022. Meanwhile, sales and advertising of e-cigarettes online were also banned in late 2019 to protect minors from availing of these products. However, the government is still encouraging exports of e-cigarettes, ensuring that the industry remains on a positive growth path.

The market has a very low threat of substitutes or alternative products, as e-cigarettes themselves are perceived to be a healthier substitute for conventional cigarettes. Furthermore, continuous development of vaping technologies has also ensured that the chances of substitutes entering the market are minimal.

China is the leading exporter of e-cigarettes to global regions, as it has been developing this technology for a long time and has several established manufacturers launching innovative products. Although online sales have been banned in the country, there is a large number of branded stores and vaping outlets by leading names such as Yooz, Relx, and MOTI. Relx has a particularly strong presence and accounts for around 58% of the total vaping outlet count in Mainland China.

Product Insights

The rechargeable e-cigarette segment accounted for the highest revenue share of 38.20% in 2023. These products do not require cartridges, making them an affordable option in the long term. These vapes are generally made from durable materials and thus help reduce wastage that is common while using disposable e-cigarettes. They also offer fast charging options via Type-C charging ports that can quickly refill depleted vape batteries. Rising interest in vaping products globally, along with increasing awareness regarding the side effects of smoking, have driven the manufacturing of rechargeable e-cigarettes in the country mainly for exports.

On the other hand, the modular devices segment is expected to advance at the fastest CAGR of 36.2% through 2030. Modular vapes have witnessed strong demand in recent years, on account of a rising youth population that is attracted to such advanced products. They offer several innovative features such as battery monitoring, temperature control to control juice tastes, and the ability to try different e-liquids as well as choose their nicotine strength. The growing popularity of professional vaping competitions acts as a substantial segment driver, as many contestants aim to use advanced products that are mainly manufactured in China.

Distribution Channel Insights

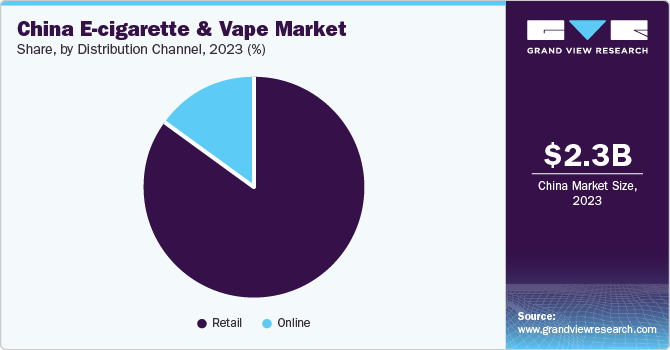

The retail segment dominated the China e-cigarette and vape market with a revenue share of 85.0% in 2023. The retail segment includes physical outlets such as convenience stores, drug stores, tobacconists, newsstands, and specialty e-cigarette stores. An extensive presence of companies, coupled with high growth potential is expected to drive the segment’s expansion. For instance, as per the China Electronics Chamber of Commerce, the retail market for vapes in mainland China saw a 36% year-on-year rise in 2022, with the number of manufacturers and brands estimated to be around 1,500. Furthermore, this sector is supplemented by around 100,000 logistics and supply businesses, indicating a strong product presence in the retail setting. Physical stores offer consumers the benefit of trying and testing products before making a purchase, making them a preferred buying mode.

The online segment is expected to advance at the fastest CAGR of 38.2% through 2030. The exponential growth of the e-commerce industry in China, coupled with the increasing presence of e-cigarette manufacturers, has created a strong competition for revenue share, making online presence important for them. An article published by HKTDC Research in April 2022, stating mainland media reports, found that e-commerce platforms were a preferred option for e-cigarette users aged between 15 to 24 years in 2019. This age group constitutes a leading smartphone user base, along with a strong social media presence that drives online sales. Online stores offer competitive pricing and discounts, while also carrying out different campaigns to attract an audience, boosting their reach.

Key China E-cigarette And Vape Company Insights

Notable companies that have strong presence in the Chinese market for e-cigarette and vapes include RELX International, YOOZ, MOTI, Shenzhen Kanger Technology Co., Ltd., and Shenzhen IVPS Technology Co., Ltd.

-

Shenzhen IVPS Technology Co., Ltd., based in Shenzhen, China, is mainly involved in the research & development, manufacturing, and marketing of e-cigarettes. SMOK is a leading brand owned by the company. Products offered under the brand are consumed by more 80 million customers globally. Notable offerings by the company include atomizers, coils, all-in-one kits, and pod kits.

-

Shenzhen KangerTech Technology Co., Ltd. (KangerTech) specializes in manufacturing e-cigarettes and related products such as coils and atomizers. KangerTech also provides software support for its products. The company designs and manufactures products that are CE, RoHS, ISO 9001, cGMP, and SGS certified. The company supplies e-cigarettes globally through several licensed distributors.

SMOORE, ALD, Innokin, and IMiracle are some other notable companies that are increasing their presence in the country’s e-cigarette and vape market.

-

Innokin, launched in 2011, is a leading vape manufacturer that sells its products in more than 80 countries globally. The company offers child-resistant certified and advanced products such as pod systems, vape kits, vape tanks, and CRC products. Notable devices offered by the company include Kroma, MVP, Coolfire, Sceptre, and the ENDURA series. Additionally, the company has also partnered with global experts in e-cigarettes and launched products such as Zenith, Ares, and Zlide.

-

Smoore International Holdings Ltd., established in 2019, is mainly involved in the research, designing, manufacturing, and sale of vaping components and devices, as well as APVs (Advanced Personal Vaporizers). The company mainly distributes products to independent vaping companies, tobacco companies, and retail clients. Its businesses are located in Mainland China, the U.S., Japan, Switzerland, and the UK, among other nations.

Key China E-cigarette And Vape Companies:

- RELX International

- YOOZ

- MOTI

- Shenzhen Kanger Technology Co., Ltd.

- Shenzhen IVPS Technology Co., Ltd.

- Smoore International Holdings Ltd.

- ALD

- Innokin

- IMiracle Shenzhen Technology Co. Ltd.

- Shenzhen Joyetech Electronics Co. Ltd.

Recent Developments

-

In February 2024, MOTI unveiled a range of disposable vapes at the CHAMPS TRADE SHOWS held in Las Vegas. Products included the MOTI Beast Pro 10000, MOTI Go (Pro), and MOTI TRIPLUS 20000. The MOTI Beast Pro 10000 is an 18ml e-liquid disposable vape that can be used for up to 10,000 puffs. The Moti Go( Pro) has a lightweight and compact design that aims to offer improved performance and portability for vapors. The MOTI TRIPLUS 20000 is an advanced disposable vape has a full-sized screen through which users can monitor remaining e-liquid, battery life, and power output levels

-

In May 2023, INNOKIN announced a partnership with Kingston E-liquids, a UK-based brand to launch the Podbar Salts Endura S1 kit. The Endura S1 is a refillable and rechargeable device offered in a package that contains Kingston's Podbar Salts e-liquid. It claims to have a longer lifecycle than its industry counterparts, making it an economical and environment-friendly option to users

-

In April 2023, ALD Group announced the launch of its FRESOR technology brand and unveiled the FRESOR NOVA and FRESOR MAX technology platforms. The former leverages a flat mesh vaping technology to offer quality taste for users, while the latter uses a smart dual mesh technology to improve the vaping experience

China E-cigarette And Vape Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 17.27 billion

Growth rate

CAGR of 34.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion,volume in units, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, category, distribution channel

Country scope

China

Key companies profiled

RELX International; YOOZ; MOTI; Shenzhen Kanger Technology Co., Ltd.; Shenzhen IVPS Technology Co., Ltd.; Smoore International Holdings Ltd.; ALD; Innokin; IMiracle Shenzhen Technology Co. Ltd.; Shenzhen Joyetech Electronics Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China E-cigarette And Vape Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the China e-cigarette and vape market report based on product, category, and distribution channel:

-

Product Outlook (Revenue, USD Million;Volume, Units, 2018 - 2030)

-

Disposable

-

Rechargeable

-

Modular Devices

-

-

Category Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Open

-

Closed

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Retail

-

Convenience Store

-

Drug Store

-

Newsstand

-

Tobacconist Store

-

Specialty E-cigarette Store

-

-

Frequently Asked Questions About This Report

b. The China e-cigarette and vape market size was estimated at USD 2.27 billion in 2023 and is expected to reach USD 2.96 billion in 2024.

b. The China e-cigarette and vape market is expected to grow at a compound annual growth rate of 34.2% from 2024 to 2030 to reach USD 17.27 billion by 2030

b. The rechargeable segment led the market and accounted for 38.2% in 2023. The growing awareness about the health hazards associated with conventional smoking, the widespread availability of rechargeable e-cigarettes on online platforms, and the growing interest in vaping among the youth.

b. Some key players operating in the China e-cigarette and vape market include RELX International, YOOZ, MOTI, Shenzhen Kanger Technology Co., Ltd., Shenzhen IVPS Technology Co., Ltd., Smoore International Holdings Ltd., ALD, Innokin, IMiracle Shenzhen Technology Co. Ltd., Shenzhen Joyetech Electronics Co. Ltd.

b. The population of e-cigarette users has risen in China in recent years, aided by greater awareness about the product and increased sales opportunities for manufacturers. In recent years, there has been a significant growth in the number of small companies aiming to launch advanced products, which has helped in generating more product sales.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.