- Home

- »

- Next Generation Technologies

- »

-

China Testing, Inspection, And Certification Market Report, 2030GVR Report cover

![China Testing, Inspection, And Certification Market Size, Share & Trends Report]()

China Testing, Inspection, And Certification Market (2023 - 2030) Size, Share & Trends Analysis Report By Service (Testing, Inspection, Certification), By Sourcing Type (In-house, Outsourced), By Application, And Segment Forecasts

- Report ID: GVR-2-68038-453-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

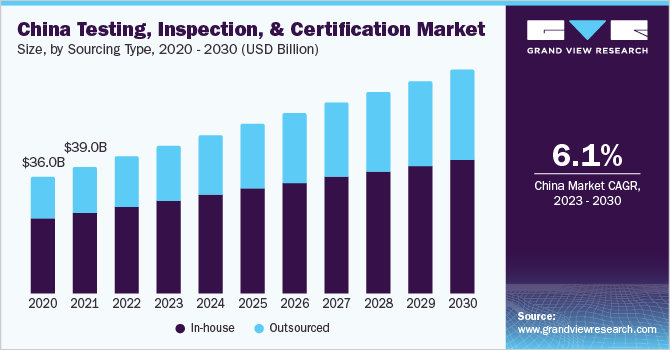

The China testing, inspection, and certification market size was valued at USD 42.29 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.1% from 2023 to 2030. Increasing foreign investments are expected to drive the growth of the China testing, inspection, and certification (TIC) market during the forecast period. In an attempt to achieve progressive liberalization, the Chinese government has laid down favorable policies for international players to establish their presence in the country. Moreover, increasing adoption and development of alternative fuel vehicles such as electric vehicles and hybrid vehicles are anticipated to increase the testing and inspection activities for such vehicles, thus, driving the growth of the TIC market in China over the forecast period.

For instance, in March 2022, TIC Council China, an international association representing TIC companies, announced free shipment inspection services. These services will help NGOs and Governments of the affected countries to ensure that the medical supplies sourced from China are of the highest quality and meet the necessary safety standards.

The testing, inspection, and certification market is expected to grow at a faster pace in China. This is attributed to increasing government investments focused on the growth of the transportation and energy sectors, as well as the construction industry. For instance, in 2021, the China Minister of Transport, Li Xiaopeng, said they would invest around USD 372 billion in the transportation industry.

Citizens' rising standard of living led to the rising demand for consumer goods, consequently catalyzing the growth of the TIC market. Furthermore, the growth in outsourcing testing, inspection, and certification services by prominent companies operating in the manufacturing, automotive, and consumer goods arenas is projected to propel market growth.

The Chinese government has eased the entry of foreign players by uplifting the barriers for international companies offering TIC solutions in the Chinese TIC market, which domestic players dominate. Moreover, the market is expected to grow substantially owing to the investments made by international players in China.

The growing popularity of testing and certification services for accelerating and developing intelligent technologies such as smart cities, smart vehicles, and so on is anticipated to support the growth of the Chinese TIC market. The increasing government alliances, implementation of new standards and regulations, and the increasing need for third-party inspection services are some of the key drivers that are estimated to propel the growth over the forecast period.

Many companies in the market are strategizing to acquire various companies to expand their footprints in the market. By acquiring these companies, the companies gain a strong presence in emerging markets, offer more TIC services in various sectors, and position themselves to meet the customers' evolving needs. For instance, in May 2021, Applus+, a Spanish testing and inspection company, acquired the IMA Materialforschung und Anwendungstechnik GmbH a material testing company.

The company has a presence in Asia Pacific, Europe, and North America with engineering and development sites. The acquisition aims to reinforce Applus+'s international market presence, including in China, expand its customer base, and be a global mechanical testing supplier.

Sourcing Type Insights

The in-house sourcing segment held the largest revenue share of over 63% in 2022. Previously, most Chinese manufacturers preferred in-house inspection as it saved costs involved in a company's third-party inspection. In-house sourcing is more cost-effective as organizations have the resources to invest in testing and inspection services.

Further, greater flexibility and customization would be done to meet the required needs of an organization. The companies can also tailor the process according to their needs and specifications rather than relying on third-party providers.

The outsourced segment is expected to register a high CAGR over the forecast period. This is due to the rise of third-party inspection regulation internationally and the rigorous application of CCC certification in China. Continuous updates and modifications of testing standards and regulations are further anticipated to boost the segment's growth.

This is because it helps save the cost of technology and resource investments in testing equipment and processes. Due to increased government policies, rules, and regulations, the major players have started opting to outsource their services to third-party service providers. Further, these services are gaining momentum in various sectors, including automotive, consumer goods, and manufacturing, among others.

Application Insights

The transportation application segment led the market in 2022, accounting for over 12% of the revenue share. The application segment has been further categorized into consumer goods & retail, agriculture & food, chemicals, infrastructure, energy & power, manufacturing, healthcare, mining, oil & gas and petroleum, public sector, transportation, supply chain & logistics, and others. The growth of self-driving, electric, and hybrid vehicles is expected to drive the growth of the TIC market in major Chinese cities such as Guangzhou and Shanghai.

The 13th Five-Year Plan of China states the development of green transportation solutions, such as electric and hybrid vehicles, to advance the country’s transportation sector. Furthermore, the Plan elaborates on implementing innovative smart transportation solutions such as autonomous cars and connected trucks. The growth of such technologies is expected to increase the need for supporting services such as research, testing, and inspection over the forecast period. These factors will drive the growth of the market in the forecast period.

The healthcare segment is expected to exhibit the highest CAGR over the forecast period. The growth is attributed to rising healthcare spending and technological advancements leading to a higher demand for testing, inspection, and certification services in the industry. The growth of the e-commerce market in China is expected to drive the demand for the consumer goods & retail segment.

Additionally, Chinese consumers are becoming more accustomed to online shopping and are increasingly looking for more convenient, efficient, and personalized shopping experiences. This shift in consumer behavior is driving the demand for new products and services. Further, it will increase product inspection and verification needs of products before their delivery to customers.

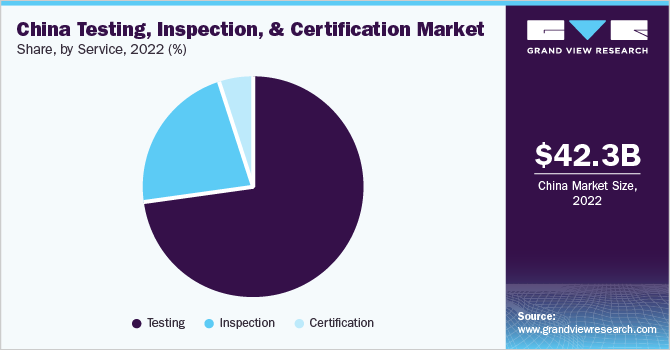

Service Insights

The testing segment led the China testing, inspection, and certification market in 2022, accounting for over 73% of the revenue share, owing to the demand for such services in various industry verticals. These verticals include manufacturing, automotive, and construction for quality and safety analysis of materials, components, chemicals, and electronic & consumer products.

Testing is the process of determining one or more characteristics of an object of conformity assessment, following a fixed procedure. The end-users are more concerned with transparency and quality, focusing on producing high-quality goods, leading to increasing demand for testing services.

The inspection service segment is expected to exhibit the highest CAGR over the forecast period. The increasing number of construction and infrastructure development projects is further expected to drive the growth of the inspection segment in the Chinese TIC market. Vendors in the market are focusing on expanding the number of stations for emission inspection.

To support this, they are focusing on acquisition. For instance, in March 2021, SGS Société Générale de Surveillance SA, a Swiss-based TIC company, announced the acquisition of The Lab (Asia) Limited, a material testing and inspection company. The acquisition aims to expand further their expertise in materials and construction testing business and their geographical presence.

Key Companies & Market Share Insights

Well-established and emerging players have exhibited traction for organic and inorganic strategies to tap into the global markets. In doing so, industry players are poised to focus on mergers & acquisitions, innovation, geographical expansion, product offerings, and technological advancements to expand and explore growth opportunities in the market. For instance, in March 2022, Cotecna Inspection SA, a testing inspection and certification company, acquired ShenZhenTobyTechnologyCo., Ltd. a China-based electronic and electrical testing and certification advisory services provider. The acquisition aims to reinforce Cotecna Inspection SA’s presence in China market and expand services in electronic and electrical testing services. Some prominent players in the China testing, inspection, and certification market include:

-

American Bureau of Shipping.

-

Asia Quality Focus

-

Asian Inspection Services Private Ltd

-

AsureQuality.

-

Bureau Veritas

-

China Inspection Service Co., Ltd.

-

China Inspection and Certification (Group) Co., Ltd.

-

China Special Equipment Inspection And Research Institute

-

China Building Material Test & Certification Group Qinhuangdao Co., Ltd

-

China Classification Society

-

Centre Testing International

-

DEKRA

-

DNV GL

-

HQTS Group Ltd.

-

Intertek Group plc

-

Larsen & Toubro Limited

-

Lloyd's Register Group Limited

-

SGS Société Générale de Surveillance SA

-

TÜV Rheinland

-

TÜV SÜD

-

TÜV NORD GROUP

-

The Hartford Steam Boiler Inspection and Insurance Company.

-

UL LLC

-

V-Trust

China Testing, Inspection, And Certification Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 45.66 billion

Revenue forecast in 2030

USD 69.09 billion

Growth rate

CAGR of 6.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, sourcing type, application

Country scope

China

Key companies profiled

American Bureau of Shipping; Asia Quality Focus, Asian Inspection Services Private Ltd; AsureQuality.Bureau Veritas; China Inspection Service Co., Ltd.; China Inspection and Certification (Group) Co., Ltd; China Special Equipment Inspection And Research Institute; China Building Material Test & Certification Group Qinhuangdao Co., Ltd; China Classification Society; Centre Testing International; DEKRA, DNV GL; HQTS Group Ltd.; Intertek Group plc; Larsen & Toubro Limited; Lloyd's Register Group Limited; SGS Société Générale de Surveillance SA; TÜV Rheinland; TÜV SÜD; TÜV NORD GROUP; The Hartford Steam Boiler Inspection and Insurance Company; UL LLC V-Trust

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

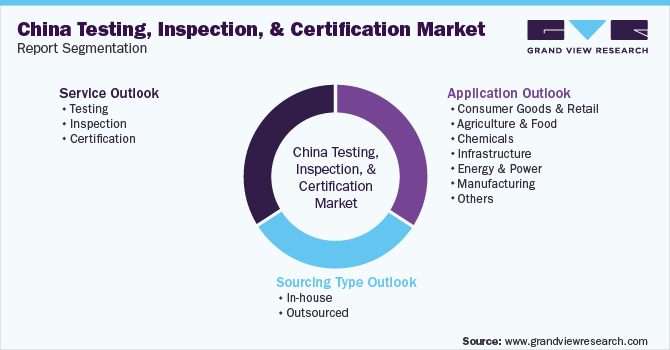

China Testing, Inspection, And Certification Market Segmentation

This report forecasts growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the China testing, inspection, and certification market report based on service, sourcing type, and application:

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

Testing

-

Inspection

-

Certification

-

-

Sourcing Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

In-house

-

Outsourced

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Consumer Goods & Retail

-

Personal Care & Beauty Products

-

Hard Goods

-

Soft-liners & Accessories

-

Toys & Juvenile Products

-

Electrical & Electronics

-

Others (Detergents and Non-woven products)

-

-

Agriculture & Food

-

Seed & Crop

-

Fertilizers

-

Commodities

-

Beverages

-

Others

-

Alcoholic

-

Beer

-

Spirits

-

Wine

-

Others (Cider and Cocktails)

-

-

Non-alcoholic

-

Carbonated Soft Drinks

-

Fruit Drinks

-

Bottled Water

-

Functional Beverages

-

Sports Drinks

-

Others

-

-

-

Others (Forestry and Food packaging)

-

-

Chemicals

-

Asset Integrity Management Services

-

Project Life Cycle Services

-

Finished Product Services

-

Chemical Feedstocks Services

-

Others

-

-

Infrastructure

-

Project Management

-

Material Services

-

Construction Machinery & Equipment Services

-

Facilities Management & Inspection Services

-

Others

-

-

Energy & Power

-

Energy Sources

-

Nuclear

-

Wind

-

Solar

-

Alternative Fuels

-

Fuel Oil & Gases

-

Coal

-

Hydropower

-

Others

-

-

Power Generation

-

Power Distribution

-

Asset Integrity Management Services

-

Project Life Cycle Services

-

Others

-

-

Manufacturing

-

Suppliers Related Services

-

Production & Products Related Services

-

Projects Related Services

-

Others

-

-

Healthcare

-

Medical Devices

-

Health, Beauty, And Wellness

-

Clinical Services

-

Laboratory Services

-

Biopharmaceutical & Pharmaceutical Services

-

Others

-

-

Mining

-

Inspection & Sampling Service

-

Analytical Service

-

Exploration Service

-

Metallurgy & Process Design

-

Production & Plant Services

-

Project Risk Assessment & Mitigation

-

-

Oil & Gas And Petroleum

-

Upstream

-

Midstream

-

Downstream

-

Biofuels & Feedstock

-

Petrochemicals

-

Asset Integrity Management Services

-

Project Life Cycle Services

-

Others

-

-

Public Sector

-

Product Conformity Assessment

-

Monitoring Services

-

Valuation Services

-

Others

-

-

Transportation

-

Automotive

-

Electrical Systems & Components

-

Electric Vehicles, Hybrid Electric Vehicles, And Battery Systems

-

Telematics

-

Fuels, Fluids, and Lubricants

-

Interior & Exterior Materials And Components

-

Vehicle Inspection Services (VIS)

-

Homologation Testing

-

Others

-

-

Aerospace & Defense

-

Services for Airports

-

Services for Aviation

-

Services for Aerospace

-

-

Marine

-

Marine Fuel Systems & Component Services

-

Ship Classification Services

-

Marine Materials & Equipment Services

-

Others

-

-

Rail

-

Rail Testing Services

-

Rail Inspection Services

-

Rail Certification Services

-

Others

-

-

-

Supply Chain & Logistics

-

Packaging & Handling

-

Risk Management

-

Others

-

-

Others

-

Frequently Asked Questions About This Report

b. The china testing inspection and certification market size was estimated at USD 42.29 billion in 2022 and is expected to reach USD 45.66 billion in 2023.

b. The china testing inspection and certification market is expected to grow at a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 69.09 billion by 2030.

b. Testing dominated the china TIC market with a share of 73.5% in 2022. This is due to the demand for such services in various industry verticals.

b. Some key players operating in the china TIC market include AsureQuality Limited; Bureau Veritas SA; DEKRA SE; DNV GL Group AS; Intertek Group PLC; Lloyd’s Register Group Limited; SGS S.A; TUV Rheinland AG Group; Underwriters Laboratories Inc.

b. Key factors that are driving the china testing inspection and certification market growth include the increasing number of government investments that are focused on the growth of the transportation and energy sectors, as well as the construction industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.