- Home

- »

- Semiconductors

- »

-

Chip-on-Board LED Market Size, Industry Report, 2030GVR Report cover

![Chip-on-Board LED Market Size, Share & Trends Report]()

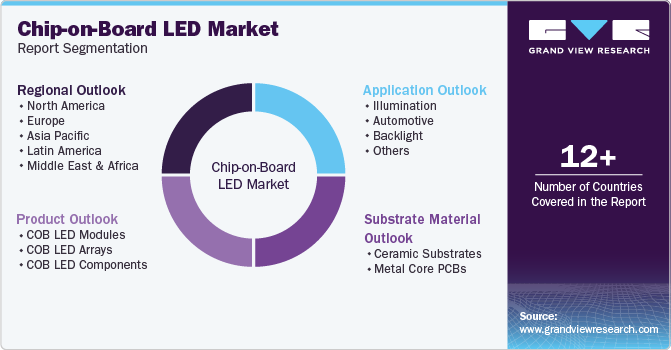

Chip-on-Board LED Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (COB LED Modules, COB LED Arrays, COB LED Components), By Substrate Material, By Application (Illumination, Automotive), By Region, And Segment Forecasts

- Report ID: 978-1-68038-177-1

- Number of Report Pages: 99

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Chip-on-board LED Market Summary

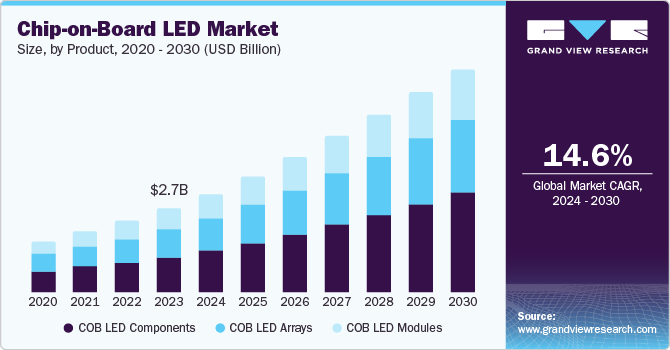

The global chip-on-board led market size was estimated at USD 2,697.0 million in 2023 and is projected to reach USD 7,205.8 million by 2030, growing at a CAGR of 15.1% from 2024 to 2030. The growing need for energy-efficient lighting sources, increasing use of IoT-enabled devices, superior quality of output from chip-on-board (COB) LED devices, and use of these devices across various industries are major factors driving market growth.

Key Market Trends & Insights

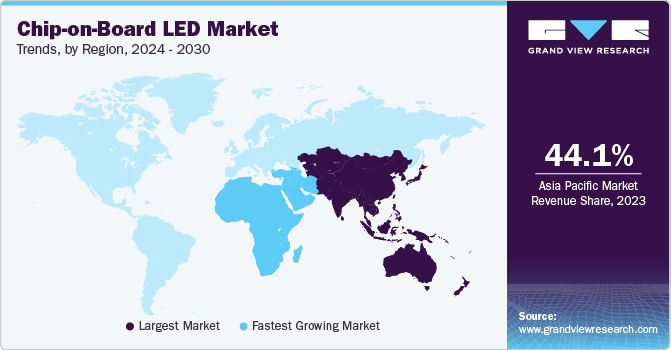

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- In terms of segment, COB LED modules accounted for a revenue of USD 2,697.0 million in 2023.

- COB LED Modules is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 2,697.0 Million

- 2030 Projected Market Size: USD 7,205.8 Million

- CAGR (2024-2030): 15.1%

- Asia Pacific: Largest market in 2023

Chip-on-board technology is a technique in which red, green, and blue chips are directly mounted on a thermal substrate or printed circuit board (PCB). This method enables a high chip density and creates a flat, uniform LED surface. A notable shift from traditional lighting solutions to solid-state lighting technologies has resulted in the increased adoption of COB LEDs, which is expected to fuel growth for this market during the forecast period.

Chip-on-board LEDs produce better lighting and color-mixing effects, thus enhancing consumer experience. Moreover, they are well suited for various high-power applications, providing high intensity and homogeneous luminosity. The superior technology in COB LED chips offers advantages over other technologies, such as better energy efficiency. Additionally, their dust and waterproof capabilities make them highly reliable in harsher environments, expanding their application scope. A higher density of LEDs on a smaller substrate area leads to a higher resolution of pictures, a better contrast ratio, and wider viewing angles, improving the viewing experience for users.

Significant cost reductions in developing these products and further technological advances are anticipated to positively shape this market’s growth. The wider application scope across various industries has fueled increased adoption of COB LEDs in several sectors, such as for illumination purposes in residential buildings, office spaces, supermarkets, and hospitals. In the automotive industry, these solutions are incorporated in the display screens on dashboards, headlights, taillights, and indicators for backlight display screens of various electronic devices.

Product Insights

The COB LED modules segment accounted for the largest revenue share of 41.4% of the global industry in 2023. The high demand for these products in the residential sector is expected to assist this segment in growing at a rapid pace in the approaching years. The ease of availability and versatility of lighting products have increased the adoption of this product in recent years. A COB LED module integrates multiple LED chips onto a single substrate. It creates a single, uniform light source that is brighter and more efficient than traditional LED packages. COB LED modules consist of silicon, a large LED chip, and a gold wire connecting the circuit. The gold wire constitutes most of the cost of the circuit module and is responsible for its expensive nature.

The COB LED arrays segment is expected to grow substantially during the forecast period. As COB LED arrays can pack more chips into a smaller area, they produce a higher light output than traditional LEDs. The proximity of chips in a COB LED array results in a comparatively uniform light output than conventional LEDs, which are known to produce a spotty appearance. Moreover, COB LED arrays can achieve a higher color-rendering index (CRI) than traditional LEDs, which makes colors appear more natural under their light. Companies such as Luminus, Cree, Excelitas, and others offer a wide range of products, ensuring more user options and aiding segment expansion.

Substrate Material Insights

The ceramic substrates segment dominated the market in 2023. Growth of this segment is attributed to the advantages offered by ceramic substrates over other materials, such as superior thermal conductivity, typically 10-100 times better than fiberglass-reinforced epoxy-laminated sheets, amount of heat, and better electrical performance. In addition, enhanced resistance capacity for humidity, high temperature, and other environmental changes has resulted in the growing use of ceramic-based COB LEDs in multiple climate conditions worldwide. Durability adds more value to ceramic substrates. These aspects are expected to increase demand for this segment in the coming years.

The metal core PCBs segment is expected to experience significant growth during the forecast period. The extraordinary thermal conductivity offered by MCPCBs drives the development of this segment. The ability to effectively dissipate COB LED chips generates heat. Growing demand for high-brightness and high-power lighting products and increasing adoption in commercial buildings, industrial facilities, and automotive lighting are expected to influence the growth of this segment during the forecast period.

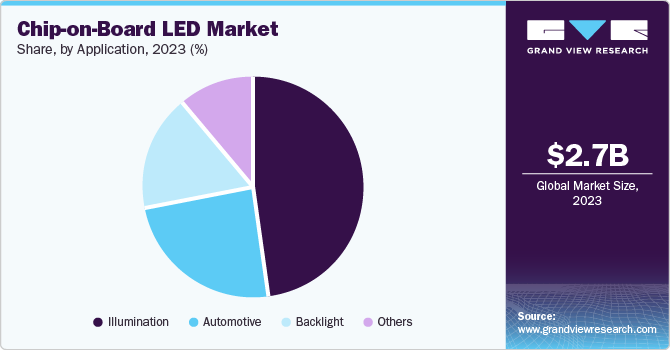

Application Insights

The illumination segment accounted for the largest market revenue share in 2023. This segment is further classified into residential, office space, industrial, shops, hospitality, outdoor, and architectural categories. The demand for COB LEDs in this application area is attributed to the wider use of lighting devices across settings such as hospitals, hotels, residential buildings, streetlights, governments, private commercial offices, and others. COB LEDs appear as a single light source, making them aesthetically pleasing for general lighting applications. Moreover, the compact size of COB LEDs allows the implementation of slimmer fixture designs. COB LEDs achieve a higher Color Rendering Index, making colors appear more natural and vibrant under COB lighting. This increases their suitability in facilities such as retail displays, museums, and areas where precise color representation is important.

The automotive segment, meanwhile, is expected to witness the fastest growth during the forecast period. This segment is further categorized into interior and exterior components. The use of COB LEDs in exterior automotive components is expected to remain strong in the coming years. COB LEDs are extensively used in the dashboard, cabin ambient lighting, headlights, taillights, turn indicators, and DRLs. Notable advantages of COB LEDs over other alternatives include enhanced visibility and safety with brighter and more uniform light output, design flexibility and aesthetics, reduced battery consumption, durability, and longevity. Automobile manufacturers use COB LEDs in headlamps and DRLs for safety reasons.

Regional Insights

Asia Pacific chip-on-board LED market dominated the global chip-on-board LED market and accounted for a revenue share of 44.1% in 2023. This is attributed to increasing COB LED production in South Korea and China, with the latter being a major hub for manufacturing organizations specializing in developing these products. The region is also home to several small- and medium-sized companies that assemble electronic devices and require COB backlights for various gadgets. Additionally, government initiatives to boost the production of advanced electronic components across economies are further anticipated to encourage manufacturers to increase their production.

India Chip-on-Board LED Market Trends

India chip-on-board LED market is expected to grow significantly during the forecast period. This market is primarily influenced by unceasing urbanization, increasing adoption in commercial buildings, industrial sites, and other key user settings, and ease of availability and enhanced accessibility assisted by the effective distribution strategies implemented by major market participants. Growing awareness regarding climate change and efficient energy solutions is fueling the demand for COB LED products. In addition, government support, policies, and initiatives that encourage the use of energy-efficient solutions for lighting have been influencing this market in recent years. For instance, to make the Indian manufacturing industry globally competitive, the Government of India has introduced the Production Linked Incentive (PLI) Scheme for White Goods (Air Conditioners and LED Lights), which offers 4-6% incentives calculated on incremental turnover over base year (2019-20) for both exported goods and goods sold in India. According to Invest India, the 16 selected applicants working in the LED lights manufacturing sector have committed to significant investments in the country.

North America Chip-on-Board LED Market Trends

North America chip-on-board LED market held a significant revenue share of the global chip-on-board LED market in 2023. This market is primarily driven by the growing adoption of commercial buildings, rising concerns regarding energy efficiency, growth in awareness about using energy-efficient lighting solutions and increasing use of newer industries such as horticulture. The ease of availability and accessibility also play a vital role in the growing opportunities for this product in the regional market. Increasing focus on developing aesthetically appealing appearances in commercial buildings, offices, clinics, and hospitality sites has also influenced the demand for COB LEDs in North America.

The U.S. chip-on-board market dominated the market in 2023. The growth of this market is mainly driven by factors such as increasing focus on technological advances by companies, the establishment of stringent environmental policies and energy conservation measures by the government, and growing adoption by commercial users and multiple industries, including manufacturing, services, hospitality, entertainment, facility management, and others. The presence of prominent electronics industry participants and effective distribution accomplished by the major companies has also contributed to the growth of this market in recent years.

Middle East & Africa Chip-on-Board LED Market Trends

The Middle East & Africa chip-on-board LED market is expected to experience the fastest CAGR of 16.0% during the forecast period. Stringent environment-related norms in several economies have led to the extensive adoption of sustainable practices in the lighting industry, shifting focus towards innovative solutions such as chip-on-board LEDs. The automotive sector is highly advanced in Middle Eastern countries, leading to increased awareness regarding the benefits of COB LEDs in car headlights, taillights, and interior lighting due to their compactness, design flexibility, and energy efficiency. Various country-specific regulations, such as the UAE's Emirates Conformity Assessment Scheme (ECAS), have propelled the demand for energy-saving LEDs.

The UAE chip-on-board LED market is expected to experience noteworthy growth during the forecast period. The economy strongly promotes sustainable practices and energy efficiency across various industries. This has led to a more expansive adoption of COB LEDs compared to other nations. Supportive government policies, such as subsidies and tax breaks for energy-efficient lighting solutions, have stimulated product demand in the UAE. Additionally, stricter regulations about using traditional lighting sources have driven noticeable market growth. The development of several innovative projects, such as NEOM, is expected to offer further growth avenues for this industry.

Key Chip-on-Board LED Company Insights

Some key companies involved in the chip-on-board LED market include Bridgelux, Inc, WOLFSPEED, INC., EPISTAR Corporation, EVERLIGHT ELECTRONICS CO., LTD., Lumileds Holding B.V. and others. To address growing competition in the industry, major market participants have adopted strategies such as increased research & development, enhanced innovation, new product launches, expansions in multiple application industries and more.

-

Bridgelux, Inc., a designer and manufacturer of energy-efficient and high-performance solid-state lighting solutions, offers various products in the COB LED segment, such as LED arrays under the VERO series, VERO SE series, Décor Series, V Series, and VESTA series. It also offers modules and subsystems under the VESTA and EB series, driver controls, and surface mounts. Bridgelux also develops application-specific LED chips for LED luminaires, such as signage boards, automotive components, and camera flashes for mobile devices.

-

Epistar Corporation specializes in manufacturing high-brightness products used in LED lighting, LED backlighting, automotive applications, flash LEDs, surveillance LEDs, horticulture, and LED sensors. The company offers products under the AlGaInP Series, InGaN Series, PEC Series, and SWIR Series.

Key Chip-on-Board LED Companies:

The following are the leading companies in the chip-on-board LED market. These companies collectively hold the largest market share and dictate industry trends.

- Bridgelux, Inc

- WOLFSPEED, INC.

- EPISTAR Corporation

- EVERLIGHT ELECTRONICS CO., LTD.

- SAVANT TECHNOLOGIES LLC (GE Lighting)

- Lextar Electronics Corporation

- Lumileds Holding B.V.

- NICHIA CORPORATION

- ams-OSRAM AG

- Signify Holding

- SAMSUNG

- Seoul Semiconductor Co., Ltd.

Recent Developments

-

In August 2024, Cree LED launched its upgraded XLamp XE-G LEDs, a high-performance product that offers improved energy efficiency through lower forward voltage and higher light output. The newly launched products are expected to receive a larger response from architectural lighting, indoor directional lighting, and aftermarket automotive lighting.

-

In May 2024, ams-OSRAM AG announced the release of its high-power horticulture LED, the OSCONIQ P 3737. This LED can provide energy efficiency and long-term stable photon flux for plants and vegetables. It ensures significant reductions in greenhouse energy costs while also addressing a diverse range of lighting requirements. The high photon flux is expected to substantially increase photosynthesis rates, shorten harvest cycles, and maximize crop yields.

Chip-on-Board LED Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.18 billion

Revenue Forecast in 2030

USD 7.21 billion

Growth Rate

CAGR of 14.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, substrate material, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; Australia; South Korea; India; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Bridgelux, Inc; WOLFSPEED, INC.; EPISTAR Corporation; EVERLIGHT ELECTRONICS CO., LTD.; SAVANT TECHNOLOGIES LLC (GE Lighting); Lextar Electronics Corporation; Lumileds Holding B.V.; NICHIA CORPORATION; ams-OSRAM AG; Signify Holding; SAMSUNG; Seoul Semiconductor Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chip-on-Board LED Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global chip-on-board LED market report based on product type, substrate material, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

COB LED Modules

-

COB LED Arrays

-

COB LED Components

-

-

Substrate Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Ceramic Substrates

-

Metal Core PCBs

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Illumination

-

Residential

-

Office Space

-

Industrial

-

Shop Area

-

Hospitality Industry

-

Outdoor

-

Architectural

-

-

Automotive

-

Interior

-

Exterior

-

Headlamp

-

Side lamp

-

DRLs

-

Rear Light

-

-

-

Backlight

-

LED Television

-

Monitor

-

Handhelds

-

Screen Display Lighting

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.