- Home

- »

- Next Generation Technologies

- »

-

Printed And Chipless RFID Market Size & Share Report 2030GVR Report cover

![Printed And Chipless RFID Market Size, Share & Trends Report]()

Printed And Chipless RFID Market Size, Share & Trends Analysis Report By Type (Ink Stripes, Radar Array, TFTC, SAW, Others), By Application (Retail, Transport & logistics, Aviation), By Region and Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-618-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2020 - 2023

- Forecast Period: 2024 - 2022

- Industry: Technology

Printed And Chipless RFID Market Trends

“2030 Printed and Chipless RFID Market value to reach USD 19.37 billion”

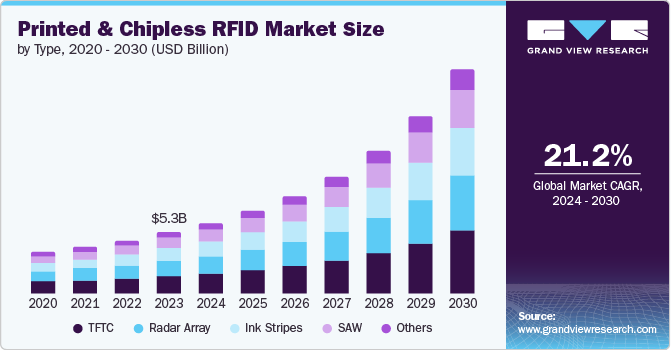

The global printed and chipless RFID market size was valued at USD 5.30 billion in 2023 and is projected to grow at a CAGR of 21.2% from 2024 to 2030. Advancements in printing technologies and materials science have significantly enhanced the performance and reliability of printed and chipless RFID tags. Innovations in ink formulations and printing techniques have allowed the production of RFID tags with improved conductivity and sensitivity, leading to enhanced read ranges that are increasingly comparable to those of traditional silicon-based RFID tags. These advancements have contributed to greater data capacity, enabling printed and chipless RFID tags to store more information, which is critical for applications requiring detailed tracking and identification.

Nano Dimension Ltd. partnered with renowned research centers in Canada and France for a groundbreaking project involving its state-of-the-art Fabrica micro-3D printing systems. This collaboration is intended to leverage Nano Dimension's precise AME capabilities to propel additive manufacturing and microelectronics technology forward. The initiative plans to significantly advance the creation of complex electrical components and functional prototypes by integrating new materials and high-resolution printing processes. With Nano Dimension's AME experience and the research institute's strong academic and industry backgrounds, this partnership is well-positioned to look for new applications in the telecommunications, healthcare, and aerospace industries.

RFID tags are often made from environmentally friendly materials, aligning with the global emphasis on sustainable and eco-friendly technologies. It particularly appeals to companies looking to reduce their carbon footprint and adhere to stricter environmental regulations. In October 2023, PulpaTronics introduced a revolutionary approach to dealing with single-use electronics' ecological impact. Their innovation involves the development of paper RFID tags devoid of traditional metal or silicon components. These chipless, paper-based RFID tags represent a significant leap forward in sustainable technology, aiming to reduce waste associated with electronic trackers commonly used in retail settings, such as clothing stores. By replacing conventional RFID tags with their eco-friendly counterparts, PulpaTronics maintains the functionality crucial for self-checkout systems, inventory management, and theft prevention in retail environments.

Type Insights

“SAW segment to witness the fastest market growth at CAGR 22.4%”

TFTC segment held the largest market revenue share in 2023. TFTC (Thin-Film Transistor Circuit) technology enables the production of RFID tags at a significantly lower cost compared to traditional silicon-based RFID tags. This cost reduction is primarily achieved using printed electronics and thin-film transistors, which streamline manufacturing by utilizing less expensive materials and simpler fabrication techniques. Unlike conventional RFID tags that rely on costly silicon chips and complex assembly procedures, TFTC RFID tags can be produced using roll-to-roll printing processes that are both efficient and scalable. Reducing material and manufacturing expenses translates to more affordable RFID solutions, making them accessible for broader applications. Industries that previously found RFID technology cost-prohibitive can now integrate these advanced tracking systems into their operations, from supply chain management and inventory control to smart packaging and consumer products.

The production process for SAW RFID tags is more cost-effective than that of traditional silicon-based RFID tags due to the ability to utilize low-cost materials and simplified manufacturing processes. Unlike silicon-based tags that require complex and expensive semiconductor fabrication techniques, SAW RFID tags can be produced using printing technologies that are less resource-intensive and more scalable. This cost-efficiency is further enhanced using readily available and inexpensive substrates, such as paper or polymer films, which reduce the overall material costs.

Application Insights

“Aviation segment is expected to witness fastest growth at 22.7%”

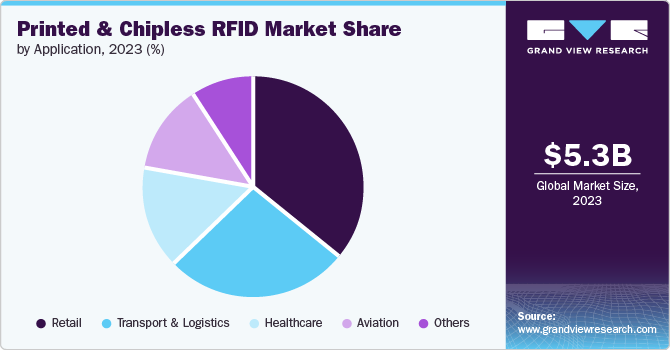

The retail segment accounted for the largest market revenue share in 2023. Printed and Chipless RFID tags enable retailers to streamline inventory management processes significantly. These tags can be integrated into product packaging or labels, allowing for quick and accurate identification and tracking of items throughout the supply chain and in-store. It improves inventory accuracy, reduces stockouts, and minimizes the need for manual inventory counts, thereby optimizing operational efficiency.

RFID (Radio Frequency Identification) tags play a crucial role in enhancing safety and security within the aviation industry by providing accurate identification and tracking capabilities for passengers, luggage, and cargo. These tags enable airlines and airport authorities to maintain real-time visibility and control over critical assets throughout their journey within the airport and beyond. For passengers, RFID tags embedded in boarding passes or travel documents facilitate seamless and efficient check-in processes, reducing wait times and enhancing the overall travel experience.

Additionally, the market players in the industry are entering into strategic partnerships and merger & acquisition activities, driving the segment growth. For instance, in May 2024, Descartes, a supply chain and logistics technology company acquired Ireland-based software Aerospace Software Developments (ASD). It specializes in RFID solutions and customs compliance under the Thyme-IT brand. The acquisition is expected to enhance Descartes' capabilities in the aviation industry by using ASD's RFID AeroCheck technology. AeroCheck eliminates the requirement for human equipment inspection by allowing aviation companies to track RFID-tagged assets on airplanes effectively.

Regional Insights

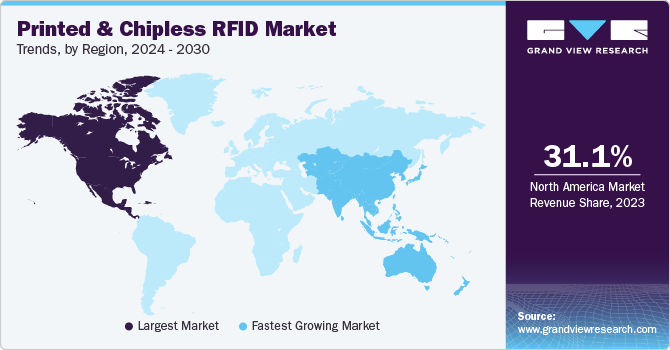

“North America is the leading region for printed and chipless RFID”

North America held the highest market revenue share in 2023. RFID technology integration with IoT systems is rapidly accelerating in North America, driven by the need for precise identification and tracking capabilities that enhance the functionality of connected devices and systems. RFID tags, by offering real-time data on the location and status of items, significantly improve the efficiency and accuracy of IoT applications across various industries. In retail, RFID-enabled IoT systems streamline inventory management, automate restocking processes, and enhance the customer shopping experience through features like smart shelves and automated checkouts. In healthcare, the combination of RFID and IoT ensures accurate tracking of medical equipment, supplies, and patient movements, thereby improving operational efficiency, reducing errors, and enhancing patient care.

U.S. Printed And Chipless RFID Market Trends

The U.S. contributed 75.8% of the regional market in 2023 and is estimated to grow at a significant CAGR over the forecast period. The U.S. Department of Defense (DOD) and the Food and Drug Administration (FDA) have strongly encouraged the adoption of RFID technology to enhance supply chain management and improve tracking and tracing of products. For the DOD, RFID technology plays a critical role in maintaining the integrity and efficiency of military logistics, ensuring that equipment and supplies are accurately tracked from manufacturing to deployment, thereby reducing the risk of misplacement and improving inventory accuracy. This capability is crucial for mission readiness and operational efficiency. The FDA has advocated for using RFID in the pharmaceutical and food industries to ensure the safety and integrity of products. RFID technology aids in combating counterfeiting, providing traceability from production to end consumer, and managing recalls efficiently.

Europe Printed And Chipless RFID Market Trends

The growing demand for automation across various industries is significantly propelling the use of RFID technology. Automated systems integrated with RFID tags enhance operational efficiency by enabling seamless tracking and management of assets, inventory, and workflows. These systems reduce human error through accurate, real-time data capture and processing, ensuring that information is always up-to-date and reliable. In manufacturing, logistics, healthcare, and retail sectors, RFID-enabled automation streamlines processes, minimizes manual intervention and accelerates decision-making. It leads to substantial productivity and operational performance improvements, cost savings from reduced labor, minimized losses, and optimized resource utilization. In Germany, the robotics and automation sector generated sales of €13.4 billion in 2021, an 11% year-on-year increase, according to the VDMA Robotics and Automation Association. The automotive industry remains the most significant customer of industrial robots, followed by the electrical/electronics industry. The European Union launched a €198.7 million robotics-related work program under Horizon Europe in the spring of 2021, which is driving the growth of the market in Europe.

Asia Pacific Printed And Chipless RFID Market Trends

The rapid expansion of e-commerce in the Asia-Pacific region has significantly increased the demand for efficient logistics and inventory management systems, leading to an increase in the adoption of RFID technology. RFID systems provide real-time visibility and tracking of products throughout the supply chain, from manufacturing to delivery. This enhanced visibility allows for better inventory management, reducing the chances of stockouts and overstock situations. RFID technology streamlines warehouse operations by automating sorting, packing, and shipping processes, which minimizes human errors. The data collected through RFID systems can be analyzed to optimize supply chain strategies, improve demand forecasting, and enhance overall operational efficiency. As e-commerce continues to grow, the reliance on RFID technology for efficient logistics and inventory management is expected to increase, driving further advancements and innovations in the field.

Key Printed And Chipless RFID Company Insights

Some of the key companies in the Printed and Chipless RFID market include 3M , Alien Technology Corporation, Confidex Ltd., Impinj, Siemens, TOPPAN Holdings Inc., Vubiq Networks, Inc., Xerox Corporation, Zebra Technologies Corp., Invengo Information Technology Co., Ltd.

-

Zebra Technologies offers healthcare, retail, field mobility, manufacturing, warehouse, hospitality and transportation, location, and logistics solutions. Its product line includes mobile computer supplies, accessories, Radio-Frequency Identification Wristbands, printer parts, Radio-Frequency Identification solutions, barcode scanners, printers, software, wireless networks, location solutions, and tablets.

-

Alien Technologies serves the consumer packaged goods, corporate, manufacturing, apparel, pharmaceutical, retail, government and defense, universities, airports and cargo logistics, transportation, life sciences, chemical, and healthcare industries worldwide.

Key Printed And Chipless RFID Companies:

The following are the leading companies in the printed and chipless RFID market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Alien Technology Corporation

- Confidex Ltd.

- Impinj

- Siemens

- TOPPAN Holdings Inc.

- Vubiq Networks, Inc.

- Xerox Corporation

- Zebra Technologies Corp.

- Invengo Information Technology Co., Ltd.

Recent Developments

-

In September 2023, Amazon opened a new Just Walk Out technology store, where customers can buy a variety of products without waiting in long queues. RFID technology enabled hassle-free payments, extending the advantages of technology beyond sellers and retailers.

-

In April 2024, Avery Dennison unveiled the digital solutions lab at the Microsoft Technology Center. The lab provides business solutions based on RFID in different verticals, such as food, apparel, and healthcare. The application focuses on lean customer experience and prospects of supply chain innovations using this technology.

Printed And Chipless RFID Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.12 billion

Revenue forecast in 2030

USD 19.37 billion

Growth Rate

CAGR of 21.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2020 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Argentina, UAE, Saudi Arabia, South Africa

Key companies profiled

3M , Alien Technology Corporation, Confidex Ltd., Impinj, Siemens , TOPPAN Holdings Inc., Vubiq Networks, Inc., Xerox Corporation, Zebra Technologies Corp. , Invengo Information Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Printed And Chipless RFID Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the printed and chipless RFID market report based on type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Ink Stripes

-

Radar Array

-

TFTC

-

SAW

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Transport & logistics

-

Aviation

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."