- Home

- »

- Organic Chemicals

- »

-

Chlorinated Polyethylene Market Size & Share Report, 2030GVR Report cover

![Chlorinated Polyethylene Market Size, Share & Trends Report]()

Chlorinated Polyethylene Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (CPE 135A), By Application (Impact Modifier, Wire & Cable Jacketing, Hose & Tubing, Adhesives), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-875-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Chlorinated Polyethylene Market Trends

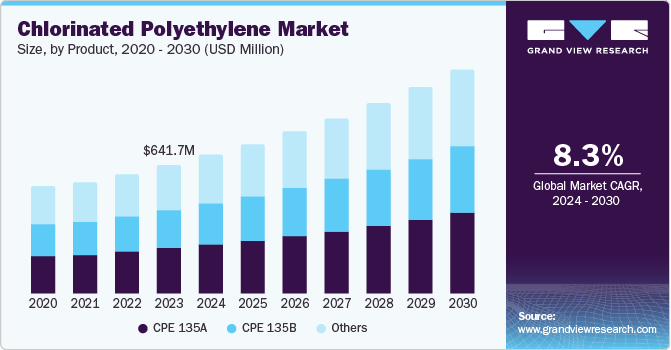

The global chlorinated polyethylene market size was valued at USD 641.7 million in 2023 and is projected to grow at a CAGR of 8.3% from 2024 to 2030. This growth is attributed to the utilization of plastics in many industries worldwide. In addition, increasing demand for durable and weather-resistant materials across industries such as construction, automotive, and consumer goods is significant. Chlorinated polyethylene’s (CPE) ability to withstand extreme environmental conditions enhances product longevity, making it a preferred choice.

In addition, the rise in infrastructure development, particularly in Asia-Pacific, coupled with technological advancements and stringent environmental regulations, further propels market expansion. The versatility of CPE in various applications, including as an impact modifier, also contributes to its growing adoption globally.

Furthermore, various properties of chlorinated polyethylene make it right for several applications across different industries and continue to play a vital role in influencing the modern industrial scenario with innovative solutions to fulfill the shifting requirements of customers for numerous applications. It is also widely used in wire and cable, hoses and tubing jackets, and coatings and adopted as an impact modifier in polyvinyl chloride (PVC) formulations that augment the effect of the resistance of PVC items, propelling the demand for chlorinated polyethylene.

With the superior properties of chlorinated polyethylene, such as impact-resistivity, durable strength, and resistance from extreme conditions, there is an increasing demand for flexible roofing and sheeting, electrical wires and cables, rubber products, and other significant applications, increasing production volumes. Furthermore, chlorinated polyethylene has a rising demand in the construction & manufacturing and automotive industries to surge rapidly.

Product Insights

CPE 135A dominated the market and accounted for the largest revenue share of 35.7% in 2023 as it is broadly utilized in PVC plastic processing and producing products, sheets, pipes, pipe fitting components, wire and cable sheathing, waterproof membranes, sealing, PVC laminated, and other plastics and rubber products. CPE 135A, as a flexible and watertight membrane, is in high demand in the construction industry. Furthermore, it is UV resistant and provides an overall enhanced look to the roof, making it preferred by contractors as a building item. There is growth in the global market of the CPE 135A segment due to the demand for the CPE 135A type in the application of impact modifiers and in specialty polyvinyl chloride electrical conduits for flexibility and characteristics, which influences positive market growth.

CPE 135B is expected to grow at a CAGR of 8.5% over the forecast period. CPE-135B has properties of heat resistance, flexibility, better processing performance, wear resistance, durability, etc. They are widely utilized in producing extruded, molded, and sheet goods. CPE 135B has significant uses in liquid transfer hoses, flame-retardant conveyor belts, and other components. In addition, the increasing implementation in industrial manufacturing of different goods and growing demand for the rubber CPE 135A as adhesive rubbers in adhesive tapes fuel market growth over the forecast period.

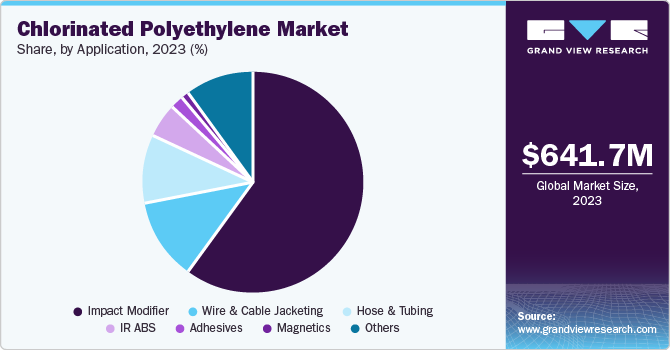

Application Insights

The Impact modifiers dominated the market and held the largest revenue share of 59.9% in 2023 as they are extensively used in the automotive, construction, and packaging sectors. They possess superior impact resistance and are inexpensive than equivalent goods. Impact modifiers are additive to increase flexibility and durable strength to meet the physical property requirements of inelastic parts. Furthermore, a huge demand for plastic packaging in various businesses and its increasing demand for impact modifiers in the plastics industry for lightweight materials with enhanced results is estimated to propel the demand for impact modifiers.

Wire and cable jacketing is expected to grow at a CAGR of 8.3% over the forecast period. With its resistance to heat, flame, and oil and durability against chemicals. Chlorinated polyethylene (CPE) is generally used to insulate wire and control cables, mainly for appliance wire, industrial power plant applications, and motor lead wires. It is often reasonable and more environmentally friendly, resulting in its market growth in upcoming years.

Regional Insights

The North America chlorinated polyethylene market is expected to grow substantially owing to the rapid urbanization, industrialization, and adoption in various industries, with a focus on key companies in the region along with government initiatives to boost the market of chlorinated polyethylene in regions of North America.

U.S. Chlorinated Polyethylene Market Trends

The U.S. chlorinated polyethylene (CPE) market held a significant market share in 2023. The country has a strong and well-established construction sector, and chlorinated polyethylene is used in applications in construction and building for pipes and roofing materials. In addition, the automotive industry has a demand for chlorinated polyethylene for impact modifiers, contributing to market expansion. In addition, the government's stricter regulations encourage the adoption of CPE, which ascertains stability in performance and environmental sustainability.

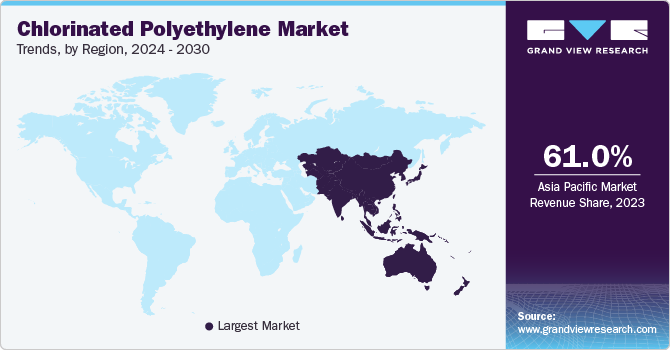

Asia Pacific Chlorinated Polyethylene Market Trends

The Asia Pacific chlorinated polyethylene (CPE)market dominated, with an accounting market share of 61.0% in 2023. The presence of major manufacturers, rapid industrialization, growing construction activities, and increasing automotive production are driving the demand for chlorinated polyethylene in countries such as Japan, India, and China.

The chlorinated polyethylene (CPE)market in China dominated the Asia Pacific market and accounted for the largest revenue share of 63.9% in 2023 attributed to the rise in the construction and automotive sectors contributes to market growth. Its extraordinary properties make it an ideal choice for construction applications.

Middle East & Africa Chlorinated Polyethylene Market Trends

The MEA chlorinated polyethylene (CPE)market is expected to grow at a CAGR of 8.8% over the forecast period driven by the rising demand for CPE in various applications, particularly in the automotive and construction sectors, where it is valued for its durability and weather resistance. Furthermore, increasing urbanization and infrastructure development in the region are propelling the need for effective packaging solutions. The expansion of the packaging industry, coupled with technological advancements in CPE production, further supports market growth in this region.

Europe Chlorinated Polyethylene Market Trends

The chlorinated polyethylene (CPE) market in Europe is expected to grow substantially owing to the rising demand for good-quality plastics in the automotive and industrial sectors, aligned with technological enhancements and sustainability advantages, is anticipated to raise the market but with steady growth.

The growth of the UK chlorinated polyethylene (CPE) market is driven by technological enhancements, and continuous research is expected to provide growth opportunities to manufacturers and companies during the forecast period. The market is experiencing the development of formulations of CPE to extend its application end-use. Furthermore, manufacturers invest in research and development to create innovative CPE products with enhanced and improved performance.

Key Chlorinated Polyethylene Company Insights

Some of the key companies in the chlorinated polyethylene market include Dow, Arkema, Resonac Holdings Corporation., Weifang Yaxing Chemical Co., Ltd., Sundow Polymers Co., Ltd., NIPPON SHOKUBAI CO., LTD., INEOS Group Limited, Shandong Novista Chemicals Co., Ltd.;in the market focusing on development & to gain a competitive edge in the industry.

-

Arkema is an expert in manufacturing chemicals and plastics that are widely used in various industrial applications and pharmaceutical industries for high-performance and sustainable solutions. Their offerings are solvents, thinners, thickeners, reagents, and reaction initiators, which are demanded in pharmaceuticals and cosmetology for manufacturing plastics, pesticides, textiles, paints, rubber, and others.

-

Sundown Polymers Co., LTD. specializes in professional thermoplastic polyurethane and specialty chemical manufacturers, including chlorinated polyethylene (CPE), acrylic impact modifier (AIM), acrylic processing aid (AIP), MBS impact modifier, chlorinated polyvinyl chloride (CPVC), chloroprene rubber(CR), blowing agent, PVC compound stabilizers, and many more.

Key Chlorinated Polyethylene Companies:

The following are the leading companies in the chlorinated polyethylene (CPE) market. These companies collectively hold the largest market share and dictate industry trends.

- Dow

- Arkema

- Resonac Holdings Corporation.

- Weifang Yaxing Chemical Co., Ltd.

- Sundow Polymers Co., Ltd.

- NIPPON SHOKUBAI CO., LTD.

- INEOS Group Limited

- Shandong Novista Chemicals Co., Ltd.

- Hangzhou Keli Chemical Co., Ltd.

- Shandong Xuye New Materials Co., Ltd.

- Focus Technology Co., Ltd.

- Shandong Pujie Rubber & Plastic Co., Ltd.

- Qingdao Hongjun Plastic Products Co., Ltd.

- Weifang Polygrand Chemical Co., Ltd.

Recent Developments

-

In May 2024, Arkema finalized an agreement to acquire Dow's flexible packaging laminating adhesives business. Dow is a leading player in the adhesive market, with annual revenues of about USD 250 million. This acquisition is likely to enhance Arkema's offerings in flexible packaging, positioning the company as a major competitor in the industry.

-

In January 2023,

Showa Denko K.K. and Showa Denko Materials Co., Ltd. merged to form a new entity named "Resonac." In a separate development, this rebranding marks what the company describes as a "second inauguration," with aspirations to become a global leader in advanced functional materials.

Chlorinated Polyethylene Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 692.4 million

Revenue forecast in 2030

USD 1.12 billion

Growth rate

CAGR of 8.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, Denmark, Sweden, Norway, China, India, Japan, South Korea, Australia, Thailand, Indonesia, Vietnam, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Dow; Arkema; Resonac Holdings Corporation.; Weifang Yaxing Chemical Co., Ltd.; Sundow Polymers Co., Ltd.; NIPPON SHOKUBAI CO., LTD.; INEOS Group Limited; Shandong Novista Chemicals Co., Ltd.; Hangzhou Keli Chemical Co., Ltd.; Shandong Xuye New Materials Co., Ltd.; Focus Technology Co., Ltd.; Shandong Pujie Rubber & Plastic Co., Ltd.; Qingdao Hongjun Plastic Products Co., Ltd.; Weifang Polygrand Chemical Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

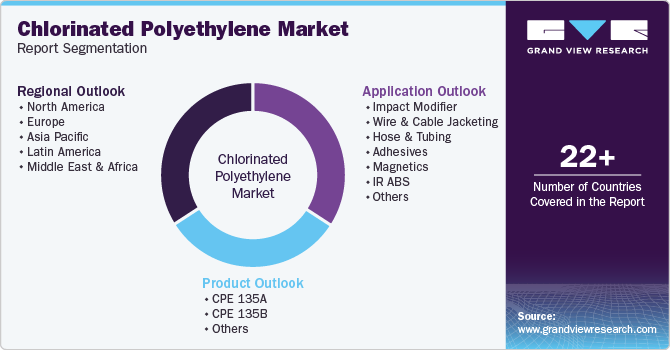

Global Chlorinated Polyethylene Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global chlorinated polyethylene market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

CPE 135A

-

CPE 135B

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Impact Modifier

-

Wire & Cable Jacketing

-

Hose & Tubing

-

Adhesives

-

Magnetics

-

IR ABS

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.