- Home

- »

- Disinfectants & Preservatives

- »

-

Chlorine Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Chlorine Market Size, Share & Trends Report]()

Chlorine Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (EDC/PVC, Organic Chemicals, Inorganic Chemicals, Isocyanates, Chlorinated Intermediates, Others), By Region, And Segment Forecasts

- Report ID: 978-1-68038-988-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Chlorine Market Summary

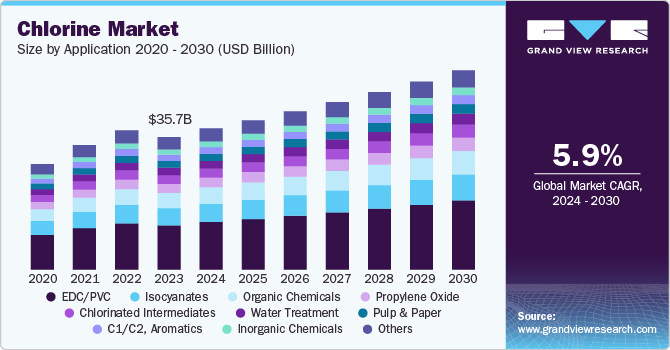

The global chlorine market size was estimated at USD 35.75 billion in 2023 and is projected to reach USD 53.88 billion by 2030, growing at a CAGR of 5.9% from 2024 to 2030. The market is driven by increasing demand for chlorine derivatives from various industries such as pharmaceutical, plastic, cosmetic, food processing, paints & coatings, and others.

Key Market Trends & Insights

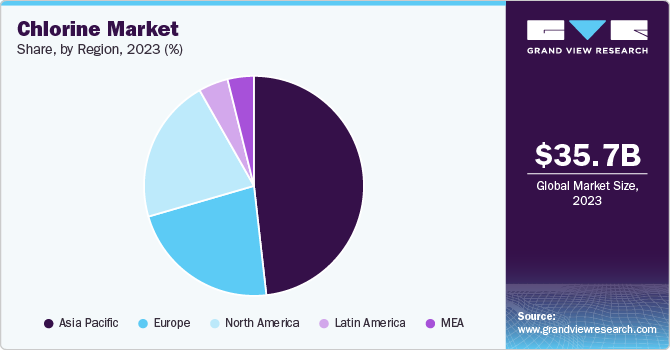

- Asia Pacific chlorine market dominated the global market with a market share of 48.2% in 2023.

- China chlorine market is expected to grow significantly.

- By application, the Ethylene Dichloride/ Polyvinyl Chloride (EDC/PVC) segment dominated the market and accounted for the largest revenue share of 33.4% in 2023.

- By application, the isocyanate segment is expected to experience a significant CAGR during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 35.75 Billion

- 2030 Projected Market Size: USD 53.88 Billion

- CAGR (2024-2030): 5.9%

- North America: Largest market in 2023

Moreover, rapid infrastructure development has been accelerating the demand for construction materials such as pipes, roofing shits, insulation, paints, plastics, and other infrastructure products. The increasing inclination towards water disinfection practices is driving the demand for chlorine in the market.

The growing pharmaceutical industry is discovering various uses of chlorine, contributing significantly to the growth of this market. Major chlorine manufacturers have been catering to the increasing demand for chlorine derivatives by incorporating technological advancements. Growth in the pharmaceutical industry, growing inclination towards the use of chlorine, and rapid pace of scientific advancements are expected to generate greater growth for the chlorine market in the approaching years. According to the India Brand Equity Foundation, the Indian Pharma Industry is projected to grow to USD 130 billion by 2030 and USD 450 billion by 2047 in total market size.

According to the World Health Organization (WHO), one in four individuals worldwide does not have availability of safe drinking water. Government regulations promote the use of chlorine in water treatment to disinfect and purify wastewater. It encourages prominent chlorine producers to provide chlorine to these facilities, driving growth in the chlorine market. These producers collaborate with non-profit organizations and contribute to the lack of access to the clean water crisis. For instance, Occidental Chemical Corporation (OxyChem) collaborated with Water Mission, a non-profit organization, to address the growing need for clean water around the globe.

Application Insights

The Ethylene Dichloride/ Polyvinyl Chloride (EDC/PVC) segment dominated the market and accounted for the largest revenue share of 33.4% in 2023. The increasing need for polyvinyl chloride (PVC) industries such as construction, automotive, packaging, and other sectors is driving the demand for the chlorine market. PVC is highly durable, available at low cost, and is widely available as a raw material. In addition, it is non-toxic and resistant to moisture. Therefore, it is commonly used in construction materials, manufacturing hearing aids, syringe tubes, ventilation and electrical systems in buildings, and more, driving the market expansion for chlorine.

The isocyanate segment is expected to experience a significant CAGR during the forecast period. Isocyanates are preferred over other chlorine products due to their low molecular weight and highly reactive nature. Growing demand for isocyanates in producing fibres, flexible and rigid foams, coatings such as elastomers, paints, and varnishes, in industries such as auto body repair, automotive industry, and construction insulation materials, driving the chlorine market growth. Spray-on polyurethane products with isocyanates are available in the market for various commercial, retail, and industrial applications, widely used to safeguard materials such as wood, cement, fiberglass, and aluminium, including protective coatings for trailers, truck beds, foundations, boats, and decks.

Regional Insights

Asia Pacific chlorine market dominated the global market with a market share of 48.2% in 2023 due to the significant growth in the demand for polymers, plastics, and several other chlorine derivatives. Factors such as abundant resources and affordable labor attract several market players to develop their regional production plants. Moreover, the growing pharmaceutical, agrochemicals, specialty chemicals, and water treatment industries in the country, such as India, are driving market growth due to the excessive use of chlorine for various purposes.

China Chlorine Market Trends

China chlorine market is expected to grow significantly due to the presence of key manufacturers. According to the U.S. Environmental Protection Agency, China, one of the largest chlor-alkali-producing nations is anticipated to drive future expansion in chlor-alkali production. Moreover, the rising focus on sewage water treatment in the nation is driving the demand for chlorine during the forecast period. These factors drive market expansion during the forecast period.

Europe Chlorine Market Trends

Europe chlorine market was identified as a lucrative region in this industry in 2023. The market is primarily driven by the versatility of chlorine and its derivatives, as it is used in various industries. Over the past few years, there has been a consistent rise in the need for chlorine in the water and wastewater treatment sector, driven by various reasons significant for preserving public health and environmental sustainability. The increase in population results in higher water usage and wastewater production, placing significant strain on water sources. The increasing growth of industrial zones and a greater demand for managing higher amounts of water and wastewater drive the need for chlorine in water purification.

The UK chlorine market is expected to grow significantly due to rapid urbanization and industrialization, necessitating water purification and proper sewage treatment. Several government policies to reduce waste production encourage manufacturers to innovate new chlorine derivatives with low harmful effects on the environment. Moreover, excessive use of PVC and other chlorine products in various industries such as packaging, electronics, and automotive drives the chlorine market in the nation.

North America Chlorine Market Trends

North America chlorine market accounted for a significant revenue share of global industry in 2023. The market is anticipated to experience significant opportunities due to the growing end use industries such as pulp & paper, water & wastewater treatment, pharmaceuticals, plastic manufacturing, and chemicals. The water treatment sector in North America significantly contributes to the need for chlorine. Chlorine is commonly used for disinfection at water treatment facilities to guarantee a clean and drinkable water supply to the public. As the population grows and more people move to urban areas, the need for clean and safe water increases, resulting in higher use of chlorine-based water disinfection products in North America.

The U.S. chlorine market dominated the regional industry in 2023. This is attributed to technology used in chemical manufacturing to improve the process of extracting and storing chemicals. In addition, the strong presence of prominent market players, such as Olin Corporation and Westlake Corporation, drives the market due to the urge to expand their regional production facilities. Continuous export and import trades of chlorine have contributed to the growth of this market in recent years.

Key Chlorine Company Insights

Some of the key participants in the chlorine market are Olin Corporation, Solvay, Tosoh Bioscience, Hanwha Group, Occidental Petroleum Corporation, INEOS, and others. The major market participants are adopting strategies such as facility expansions, geographical expansion, technology adoption and collaboration with other organisations to address the rising competition in the industry.

-

Olin Corporation, a global producer and supplier of various chemical products, specializes in the manufacturing of chlorine, epoxy, and ammunition. The company offers chlor alkali products, vinyl and chlorine derivatives, and global customer service.

-

Occidental Petroleum Corporation, a multinational energy company, specializes in the production and exploration of oil, gas, and chemicals. The product portfolio includes chlor-alkali, vinyl, chlorinated organics, and other essential chemicals.

Key Chlorine Companies:

The following are the leading companies in the chlorine market. These companies collectively hold the largest market share and dictate industry trends.

- Olin Corporation

- Solvay

- Tosoh Corporation

- Hanwha Group

- Occidental Petroleum Corporation

- INEOS

- Westlake Corporation

- Covestro AG

- Gujarat Fluorochemicals (GFL)

- Grasim Industries Limited (India) and Aditya Birla Chemicals (Thailand) Pvt. Ltd.

Recent Developments

-

In February 2024, INEOS Inovyn launched newly developed range of Chlor-Alkali products, Ultra Low Carbon (ULC). This has ability to offer lower carbon footprint of caustic potash, caustic soda, and chlorine by up to 70% compared to industry standards. With this strategic initiative, the company aims to contribute to sustainability.

Chlorine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 38.14 billion

Revenue forecast in 2030

USD 53.88 billion

Growth rate

CAGR of 5.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in Million, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Indonesia, Brazil, Argentina, South Africa, and Saudi Arabia

Key companies profiled

Olin Corporation; Solvay; Tosoh Corporation; Hanwha Group; Occidental Petroleum Corporation; INEOS; Westlake Corporation; Covestro AG; Gujarat Fluorochemicals (GFL); Grasim Industries Limited

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chlorine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyses the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global chlorine market report based on application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

EDC/PVC

-

Organic Chemicals

-

Inorganic Chemicals

-

Isocyanates

-

Chlorinated Intermediates

-

Propylene Oxide

-

Pulp & Paper

-

C1/C2, Aromatics

-

Water Treatment

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.