- Home

- »

- Semiconductors

- »

-

Circuit Breaker And Fuse Market Size & Share Report, 2030GVR Report cover

![Circuit Breaker And Fuse Market Size, Share & Trends Report]()

Circuit Breaker And Fuse Market Size, Share & Trends Analysis Report By Voltage (High Voltage, Medium Voltage, Low Voltage), By Type (Air, Vacuum, Oil, SF6), By Application, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-522-9

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Report Overview

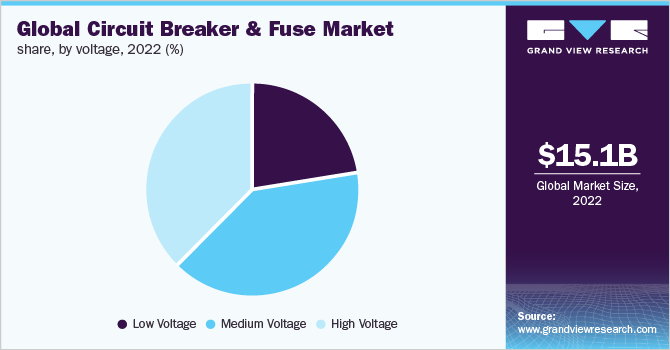

The global circuit breaker and fuse market size was valued at USD 15.05 billion in 2022 and is expected to advance at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030. Factors such as rising demand for access to effective networks and renewable energy sources are expected to contribute to the domain growth. The electronics, automotive, and telecommunications industries all need more creative equipment as a result of growing safety about short circuits and damage from power fluctuations. Circuit breakers and fuses will therefore continue to see major growth over the course of the projection period. These devices guard against unplanned power fluctuations driven by issues like overvoltage, overloads, and short circuits, which can affect equipment, including industrial machinery, residential appliances, IT products, and electric tools. By minimizing and controlling the equipment's electric load, the device also optimizes energy consumption. Thus, the rising usage of these gadgets throughout the forecast period will also increase demand.

The increased demand for electricity and consistent power delivery are the primary factors to empower industry growth. With rapid economic growth and technological advancements, the demand for power and electricity has grown immensely. To cater to such a huge demand for power, infrastructure with new upgrades and high capacity is required. However, electronic devices are susceptible to power fluctuation, further causing device failures. Hence, private agencies and governments across the globe are directed to the addition of device protection components such as circuit breakers and fuses. Electric equipment such as home appliances, IT products, industrial machinery, and electric tools are prone to damage owing to power fluctuations. A circuit breaker and fuse are utilized to reduce and manage the electric load on equipment, thereby protecting the circuit from unexpected power fluctuations under situations like short circuits, overvoltage, and overload. Additionally, the increasing need for renewable energy connectivity, up-gradation of adept networks, and advanced equipment in telecommunication, electronics, and automotive are expected to boost the circuit breaker and fuse market.

Several countries worldwide have power infrastructures that are lacking to uphold the standards of quality and bulk power movement that are required for various operations. Technologies that were developed in the early 1940s are now reflected as aging electric infrastructure. As per the U.S. Department of Energy, 70% of transmission and transformer lines are over 25 years old and 60% of circuit breakers are over 30 years old. Companies are focusing on modernizing or transforming such infrastructure to aid the new era of electric technology as well as to maintain reliability. Thus, inadequate electric power infrastructure is certain to offer growth opportunities to the circuit breaker and fuse market.

Circuit breaker consists of various components such as diodes and switching mechanisms, and the cost of raw materials. Some of these components make use of costly metals like silver and gold, resulting in a high cost of raw materials, along with an increase in the cost of the overall component. As per the World Gold Council, 7% of the total global demand for gold is utilized for technical applications. This is the reason why prices of such raw materials (gold and silver) have been rising subsequently over the past decade. Thus the high costs associated with raw materials are expected to hamper the market.

Component Insights

The market can be classified into circuit breaker and fuse, based on product types. The market for circuit breakers accounted for 78.75% of the overall share in 2022 and is anticipated to advance with a CAGR of 2.9% within the forecast period. The advantages of circuit breakers over fuses are their ease of resetting and safety due to the fact that all electrical connections are made inside the breaker box. When there is a rising load or input current, the circuit breaker automatically stops the current flow and can be quickly activated to restart the current flow. The increasing reliance on electric equipment and the efforts to electrify public infrastructure and transportation are augmenting the demand for circuit breakers. The significant growth in the development of smart cities and the refurbishment of transmission and distribution lines are further supporting the market growth.

Circuit Breaker Voltage Insights

The circuit breaker market can be segmented based on voltage type into low, medium, and high-voltage products. The medium voltage segment accumulated a majority market share of 39.38% in 2022. Medium voltage circuit breaker generally operates between the voltage of 10 KV and 35 KV. The medium-range circuit breakers generally find application in airports, nuclear power plants, power generation stations, distribution substations, urban infrastructure settings, and data centers. The segment is on a positive growth trajectory owing to increasing dependency on electricity for cooling data centers, the development of airports in major or emerging cities, and the establishment of power stations for efficient electricity distribution.

The demand for low-voltage products was high in 2022; the segment is projected to expand at a CAGR of over 7% from 2023 to 2030. Low-voltage products have a substantial demand in the residential segment as it allows the usage of smaller filaments and is efficient for small-scale applications. The growing urbanization rate in smart cities is a driving factor. Its usage in powering low voltage devices with low operation costs and increased safety through renewable energy sources such as wind power, solar power, and hydropower are expected to propel the market growth.

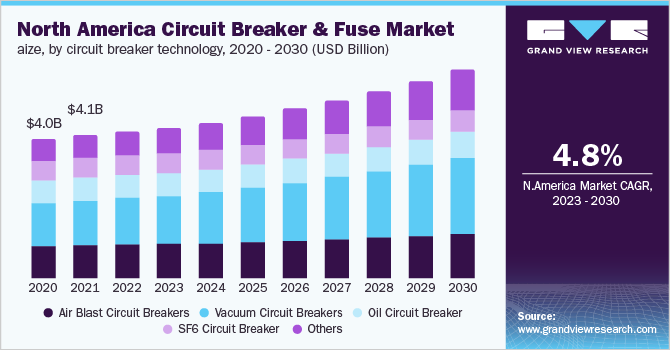

Circuit Breaker Technology Insights

Based on the circuit breaker technology, the segmentation includes air, vacuum, oil, SF6, and other types. All these technologies are used in circuit breakers for arc quenching or as an insulator to avoid circuit arcs from generating. The other circuit breaker technology segment, which includes MCB (Miniature circuit breaker), MCCB (Moulded case circuit breakers), Single pole circuit breaker, Double pole circuit breaker, GFI or GFCI circuit breaker (Ground fault interrupter), Arc Fault circuit interrupter (AFCI), is expected to advance at a CAGR of 4.2% in 2030. These technologies are compact and have limited downtime while having lower operational costs.

The vacuum circuit breaker technology segment covered 31.73% of the market share in 2022. Vacuum circuit breakers having different voltage types are reliable, have a compact size and high dielectric strength, low sound & vibration, and offer safety from fire hazards. Its use in commercial and residential settings is enabled with a longer life span and is cost-effective, which is a growth-supporting factor.

Fuse Voltage Insights

The high voltage segment accounted for a 61.72% share of the overall market in 2022. High voltage fuse is more efficient in providing protection against short circuits and power fluctuations, whereas low voltage fuse allows the usage of thinner filament, but is broken easily with a minute increase of current inflow. Thus, most industrial and commercial end-users prefer high voltage fuse, whereas residential customers choose low voltage fuse.

The low voltage fuse segment is classified into two types - plug-in fuse, and cartridge fuse. The low-voltage fuse segment has a projected growth of 2.4% by 2030. Cartridge fuses are mostly used in heavy applications at the commercial and industrial levels. These are more reliable fuse types and offer better protection from current fluctuations. On the other hand, the plug-in fuse is utilized for residential and small-scale applications and is less efficient than the cartridge fuse, thus accounting for a relatively smaller market share. Moreover, plug-in fuses are rapidly being replaced by circuit breakers; thus their market share is declining over the forecast period.

Application Insights

Based on application, the market can be classified into industrial, transport, consumer electronics, construction, power generation, and other sectors. The other application segment comprises applications such as healthcare, defense & military. The power generation segment employed the majority of circuit breakers and fuse in 2022, accounting for over 29.16% revenue share, and is expected to expand at a CAGR of 1.8% in the forecast period. Circuit breakers and fuses have high consumption in the power generating sector as a result of increased usage of IT services for a variety of processes, which require effective power management for IT accessories. The demand for protection devices will increase due to the requirement for efficient power generation on account of an increase in the demand for electricity.

The construction segment includes residential and commercial buildings and is poised to advance at the highest market CAGR of 4.0%. The growing construction market is anticipated to spur the demand for circuit breakers and fuses. There are increasing investments in construction projects such as rail transport, roads, and water supply in developing countries such as India, Indonesia, and others, which further propels the demand for these devices. The construction segment is projected to expand at a CAGR of 7% over the next seven years.

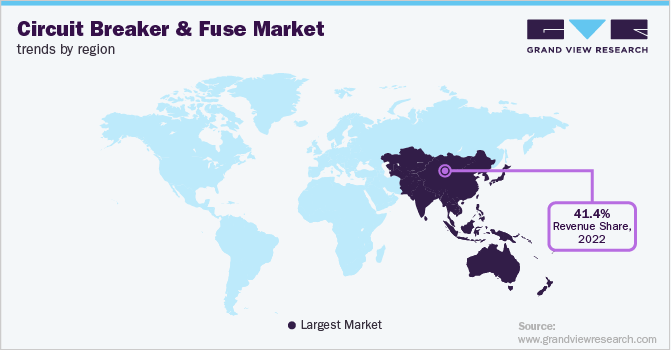

Regional Insights

The demand for circuit breakers was highest in the Asia Pacific in 2022, owing to its significant share of 41.42% and an expected rapid growth at 7.3% CAGR by 2030 in the construction market. The increasing adoption of alternative energy generation sources such as wind and solar, which require huge investments in distribution and transmission, is driving the opportunities for this market. Extensive growth in the end-user segments such as the oil & gas sector, petrochemicals sector, steel, and cement sector is anticipated to increase demand for circuit breakers and fuse in the Asia Pacific.

The Asia Pacific regional market is expected to advance at a CAGR of 6.5% in the forecast period. Also, the European government has taken various initiatives such as the European Electricity Grid Initiative (EEGI), for accelerating the innovation and development of electricity networks, which is anticipated to boost volume demand in this region.

Competitive Insights

The industry is anticipated to follow the trend of innovation, with frequent strategic alliances, mergers, partnerships, and acquisitions adopted as the key strategies by players to increase their industry presence. Some of the prominent players in the global circuit breaker and fuse market include:

-

ABB Ltd.

-

Bel Fuse Inc.

-

Schneider Electric SE

-

Mitsubishi Electric Corporation

-

Eaton Corporation plc

-

General Electric Company

-

Siemens AG

-

Rockwell Automation, Inc.

-

Larsen & Toubro Limited

-

NXP Semiconductors N.V.

-

SCHURTER Holding AG

-

Sensata Technologies Holding plc

-

Texas Instruments Incorporated

Circuit Breaker And Fuse Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 15.53 billion

Revenue forecast in 2030

USD 22.45 billion

Growth rate

CAGR of 5.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, voltage, technology, fuse voltage, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Eaton; Alstom; ABB; Schneider Electric; General Electric; Maxwell Technologies; Pennsylvania Breaker LLC; Mitsubishi Electric

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Circuit Breaker And Fuse Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global circuit breaker and fuse market report based on component, circuit breaker voltage, circuit breaker technology, fuse voltage, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Circuit Breaker

-

Fuse

-

-

Circuit Breaker Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Voltage

-

Medium Voltage

-

High Voltage

-

-

Circuit Breaker Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Air Blast Circuit Breakers

-

Vacuum Circuit Breakers

-

Oil Circuit Breaker

-

SF6 Circuit Breaker

-

Others

-

-

Fuse Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Low voltage

-

High voltage

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Consumer Electronics

-

Industrial

-

Power Generation & Distribution

-

Transport

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global circuit breaker and fuse market size was estimated at USD 15.05 billion in 2022 and is expected to reach USD 15.53 billion in 2023.

b. The global circuit breaker and fuse market are expected to grow at a compound annual growth rate of 5.4% from 2023 to 2030 to reach USD 22.45 billion by 2030.

b. The Asia Pacific dominated the circuit breaker and fuse market with a share of 41.42% in 2022. This is attributable to the extensive growth in the end-user segment such as the oil & gas sector, petrochemicals sector, steel, and cement sector.

b. Some key players operating in the circuit breaker and fuse market include Eaton; Alstom; ABB; Schneider Electric; General Electric; Maxwell Technologies; Pennsylvania Breaker LLC; Mitsubishi Electric; and G&W Electric Company amongst others.

b. Key factors that are driving the circuit breaker and fuse market growth include the increasing demand for advanced equipment in electronics, automotive, and telecommunication segments owing to increasing safety concerns related to short circuits and damage due to power fluctuations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."