- Home

- »

- Advanced Interior Materials

- »

-

Cladding Market Size, Share, Trends & Growth Report, 2030GVR Report cover

![Cladding Market Size, Share & Trends Report]()

Cladding Market Size, Share & Trends Analysis Report By Product (Fiber Cement, Composite Material, Terracotta, Ceramics), By Application (Residential, Commercial, Industrial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-477-2

- Number of Report Pages: 198

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Cladding Market Size & Trends

The global cladding market size was estimated at USD 237.70 billion in 2023 and is expected to grow at a CAGR of 7.3% from 2024 to 2030. The cladding industry has seen significant technological advancements in recent years, including the development of lightweight prefabricated cladding systems. These innovations have made cladding systems easier to install, less labor-intensive, and more efficient overall. Advancements in digital design tools and computer-aided manufacturing have increased the precision and customization capabilities of coating systems in many urban areas. Existing buildings need to be retrofitted to modern standards and made more energy efficient. Cladding provides a practical solution for these renovation projects, as it can transform old buildings into visually appealing buildings. Sustainable buildings with good insulation. Increasing focus on urban regeneration and renovation efforts is contributing to the growth of the facade cladding market.

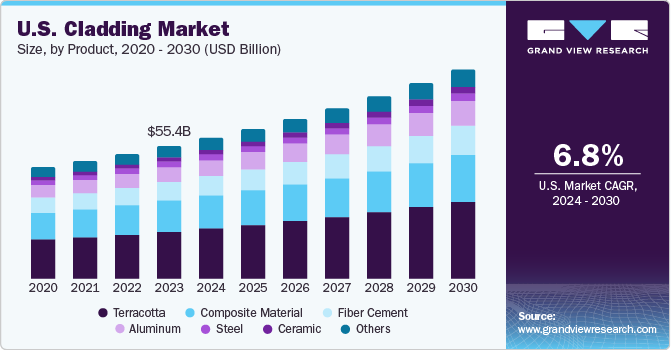

The U.S. cladding market is expected to witness sustainable growth over the forecast period, owing to the growth in the construction sector in the country. The product aids in increasing energy efficiency of a structure, leading to a decrease in energy requirement for heating, ventilation, and air conditioning. Increased demand for energy-efficient construction solutions is one of the primary factors driving the overall growth.

Increasing construction spending in developing countries owing to population expansion and strong economic and industrial developments are expected to positively affect the demand for cladding products in the forecast period. The global construction industry, following its recovery, is expected to witness steady growth. The cladding industry is highly competitive in terms of product differentiation, quality of claddings, and pricing.

The market players focus on improving product quality in terms of durability, aesthetic appeal, and energy efficiency and are expected to undergo mergers and acquisitions in order to strengthen their position in domestic and international markets, Middle East & Africa, and Central & South America. Cladding is used in several applications in the automotive industry, such as oil intake, cabin air filtration, and emission filtration.

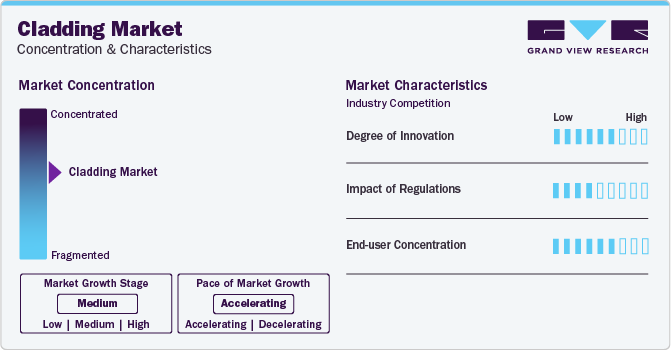

Market Concentration & Characteristics

The degree of innovation is higher as technological developments are aimed at manufacturing products that offer better cleaning properties, longer operational life, and low maintenance, which, in turn, are expected to play an important role in ascending the market over the forecast period.

Growing environmental concerns and changing consumer behavior have prompted various governments to implement regulations and initiatives in order to safeguard the environment. Various regulations are driven by a focus on improving building safety, particularly regarding fire resistance. This often involves restrictions on the use of combustible materials in cladding systems, particularly on high-rise buildings. Compliance with building codes is mandatory for all construction projects, and non-compliance can lead to legal consequences and this has further mandated every construction project to implement cladding market during the forecast period.

End-user concentration is a significant factor in the cladding demand. Moderately growing demand for cladding products owing to factors such as rising disposable incomes, rising standards of living, and switching consumer trends for owning a separate house in developing regions such as Asia Pacific are likely to positively affect the market growth in near future.

Product Insights

The terracotta segment led the market and accounted for more than 35% share of the global revenue in 2023. This can be attributed to the product’s durability, recyclability, resistance to ultraviolet radiation, weatherproof & fireproof, and fast & easy installation properties. These panels provide continuous insulation outside the primary wall and improve a building's thermal performance.

Demand for fiber cement-based cladding is likely to witness a high growth during the forecast period, due to its high durability, cost-effectiveness, and low maintenance cost. It is manufactured using cement, water, cellulose fiber, and pulverized limestone. These panels are gaining increasing acceptance as they are weatherproof and can easily resist high-pressure winds and rainwater. There is an increasing demand for aluminum cladding in the construction industry, owing to its beneficial properties such as lightweight, recyclability, resistance to fungi & algae, and easy installation. These panels are widely utilized for sound & thermal insulation, fire resistance, and improving the aesthetic appeal of buildings.

The demand for ceramic cladding is likely to witness growth on account of its maintenance-free and pollution-resistance properties as well as the ability to enhance aesthetic appeal. The panels are manufactured using an unalterable color that is weatherproof in nature.

Application Insights

The office construction segment led the market and accounted for a revenue share of 33.9% in 2023. The segment is inclusive of working spaces including government and private offices. Claddings are used in these constructions to provide thermal insulation, weather resistance, fire resistance, and aesthetic appeal to the building.

Cladding demand is predicted to increase significantly in the residential construction sector as a result of rising consciousness about energy-efficient structures, the need for rehabilitation of old buildings, increasing over-cladding operations, and government mandates for green buildings.

Rapid industrial expansion and increased government and private sector investment are projected to promote the growth of the industrial construction industry. Business expansion by multinational companies, combined with newly built manufacturing plants and processing units, is driving demand for industrial buildings. These factors are projected to fuel the need for industrial claddings.

The commercial construction segment is inclusive of buildings for hypermarkets, supermarkets, departmental stores, shopping malls, hospitals & clinics, restaurants & hotels, resorts, and others. Increasing urbanization and investments from the government in tourism and commercial construction are expected to drive the demand for claddings.

Regional Insights

The North America cladding market is expected to rise significantly over the forecast period, owing to the increasing demand from the residential sector, extensively developed manufacturing industry, and government initiatives to develop social infrastructure in the U.S. and Mexico. The rising awareness regarding the benefits of weather protection of building structures is also expected to benefit the market growth.

U.S. Cladding Market Trends

Demand for cladding in U.S. is expected to witness sustainable growth over the forecast period owing to the growth in construction sector in country. Increased demand for energy-efficient construction solutions is one of the primary factors driving the market growth. In addition, increased incidents of natural calamities, including hurricanes and wildfire, hitting different parts of the U.S. is anticipated to have a positive effect on construction sector in the country, thereby driving the demand for cladding over the forecast period.

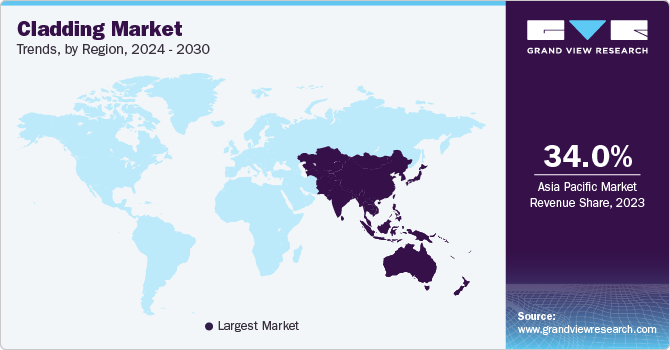

Asia Pacific Cladding Market Trends

Asia Pacific region led the market and accounted for more than 34% share of the global revenue in 2023, on account of rising per capita income, rapid urbanization, and growing population coupled with rising construction activities in the emerging economies including China, India, and Japan. Asia Pacific cladding market is expected to exhibit fastest growth over the forecast period owing to the massive potential of the construction industry in the region. Construction industry in Asia Pacific is expected to outperform on account of rising per capita income, rapid urbanization, and growing population. Economies in the region are anticipated to flourish over the forecast period on account of massive investments by various governments for the development of public infrastructure and the expansion of residential construction sector, which is expected to benefit the overall market in Asia Pacific.

The China cladding market is expected to witness an increased demand for cladding over the forecast period owing to government emphasis on reducing the overall energy consumption. Increasing urbanization and commitments at the national level to conserve energy resources in order to reduce the greenhouse gas emissions are the key factors anticipated to propel the product demand in China.

Europe Cladding Market Trends

The demand for claddings in Europe is expected to gain momentum over the forecast period owing to the growth in commercial construction activities. Increasing utilization of cladding to enhance the aesthetic appeal of a structure is further expected to propel product demand over the forecast period.

The cladding market in Germany is anticipated to witness growth over the forecast period. Germany is one of the major consumers of claddings owing to increased demand from residential spaces, commercial stores, cafes & outdoor places, hospitals, educational institutes, sports complexes, hotels & hospitality, commercial offices, and industrial areas. Additionally, rising awareness regarding the benefits associated with claddings including high durability, low cost of maintenance, easy installation, water and stain resistance, and thermal resistance is projected to augment the market growth over the forecast period.

Latin America Cladding Market Trends

The construction industry in Latin America is expected to witness substantial growth on account of the increasing investments in various infrastructure projects by foreign and domestic private players in the region. The economies contributing significantly to the regional growth include Argentina, Brazil, Chile, Colombia, Mexico, and Peru. Therefore, a growing construction industry is expected to drive the demand for cladding in the region.

The cladding market in Brazil is expected to witness growth over the forecast period. Growing demand for temperature insulation in the buildings is expected to increase the demand for wall and roof cladding in the country. In addition, rising trend of improving the aesthetic appearance of walls coupled with increasing the green cover in the buildings is expected to propel the demand for wall claddings in country.

Middle East & Africa Cladding Market Trends

The demand for cladding in Middle East & Africa is expected to be driven by increase in product adoption levels. In addition, use of advanced technologies for construction in the region is expected to benefit the market growth. Construction sector in Middle East & Africa is expected to observe a growth in forecast period owing to factors such as increase in investments, expansion of oil production, and improved weather conditions. These factors are further expected to support the market growth in the region.

The cladding market in Qatar is projected to grow from 2024 to 2030. Government’s emphasis on economic growth, with focus on non-oil sectors is expected to drive the funding towards construction projects over the forecast period. In addition, government’s efforts to enhance regional connectivity by focusing on development of transport infrastructure is expected to aid the industry growth. Increasing regional connectivity is expected to further boost the residential and commercial developments, thereby driving the product demand in the country.

The Saudi Arabia cladding market is expected to grow in the forthcoming years. Increase in tourism, population growth, and urbanization is the primary driving factor for the growth of construction sector in the country. Residential and leisure construction activities are expected to gain momentum over the forecast period, owing to the increase in population and tourism. Hence, growth in building & construction is anticipated to propel the demand for cladding over the forecast period.

Key Cladding Company Insights

Some of the key players operating in the market include Kingspan Group, Carea Group, GB Architectural Cladding Products Ltd.

- Kingspan is the global leader in high-performance insulation and building envelope solutions. Company provides products that brings performance and sustainability benefits to remarkable buildings in various sectors from all around the world.

Key Cladding Companies:

The following are the leading companies in the cladding market. These companies collectively hold the largest market share and dictate industry trends.

- Kingspan Group

- Carea Group

- GB Architectural Cladding Products Ltd

- Rieger Architectural Products

- OmniMax International, Inc.

- CGL Systems Ltd.

- SFS Group

- Cladding Corp

- Centria

- Trespa International B.V.

- Middle East Insulation LLC

- Shildan, Inc.

- Avenere Cladding LLC

Recent Developments

-

In June 2023; Saint-Gobain announced that it had entered into a definitive agreement for the acquisition of Building Products of Canada Corp., a privately owned manufacturer of residential roofing shingles and wood fiber insulation panels in Canada.

-

June 2023. Etex has completed its acquisition of UK-based insulation manufacturer Superglass. With this agreement, the company expanded its European footprint in sustainable insulation materials and complements its existing presence as a manufacturer of glass mineral wool and extruded polystyrene through URSA.

Cladding Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 253.33 billion

Revenue forecast in 2030

USD 386.04 billion

Growth Rate

CAGR of 7.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

April 2024

Quantitative units

Volume in million square meters and revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy;China; India; Japan; Brazil; Mexico; Bahrain; Kuwait; Qatar; Oman; Saudi Arabia; UAE; Jordan; Iraq; Iran; Egypt; Turkey; Libya; Sudan

Key companies profiled

Kingspan Group; Carea Group; GB Architectural Cladding Products Ltd; Rieger Architectural Products; OmniMax International, Inc.; CGL Systems Ltd.; SFS Group; Cladding Corp; Centria; Trespa International B.V.; Middle East Insulation LLC; Shildan, Inc.; Avenere Cladding LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cladding Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cladding market report based on product, application, and region:

-

Product Outlook (Volume, Million Sq. Meters; Revenue, USD Million, 2018 - 2030)

-

Steel

-

Aluminum

-

Composite Material

-

Fiber Cement

-

Terracotta

-

Ceramic

-

Others

-

-

Application Outlook (Volume, Million Sq. Meters; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Industrial

-

Commercial

-

Offices

-

Institutional

-

-

Regional Outlook (Volume, Million Sq. Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Bahrain

-

Kuwait

-

Qatar

-

Oman

-

Saudi Arabia

-

UAE

-

Jordan

-

Iraq

-

Iran

-

Egypt

-

Turkey

-

Libya

-

Sudan

-

-

Frequently Asked Questions About This Report

b. The global cladding market size was estimated at USD 237.70 billion in 2023 and is expected to reach USD 253.33 billion in 2024.

b. The global cladding market is expected to grow at a compound annual growth rate of 7.3% from 2024 to 2030 to reach USD 386.04 billion by 2030.

b. Terracotta product segment dominated the market and accounted for more than 35.5% share of the global revenue in 2023. The growth can be attributed to its durability, resistance to ultraviolet radiation, recyclability, fast & easy installation, and weatherproof & fireproof properties.

b. Some of the key players operating in the cladding market include Kingspan Group; Carea Group; GB Architectural Cladding Products Ltd; Rieger Architectural Products; OmniMax International, Inc.; CGL Systems Ltd.; SFS Group; Cladding Corp; Centria; Trespa International B.V.; Middle East Insulation LLC; Shildan, Inc.; Avenere Cladding LLC

b. The key factors driving the cladding market include increasing products use in several residential, industrial and commercial sectors owing to the growing requirement for high energy efficiency, aesthetics, and enhanced thermal management.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."