- Home

- »

- Homecare & Decor

- »

-

Cleaning Services Market Size, Share, Industry Report, 2030GVR Report cover

![Cleaning Services Market Size, Share & Trends Report]()

Cleaning Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Window Cleaning, Vacuuming, Floor Care, Maid Services, Carpet & Upholstery), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-072-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cleaning Services Market Summary

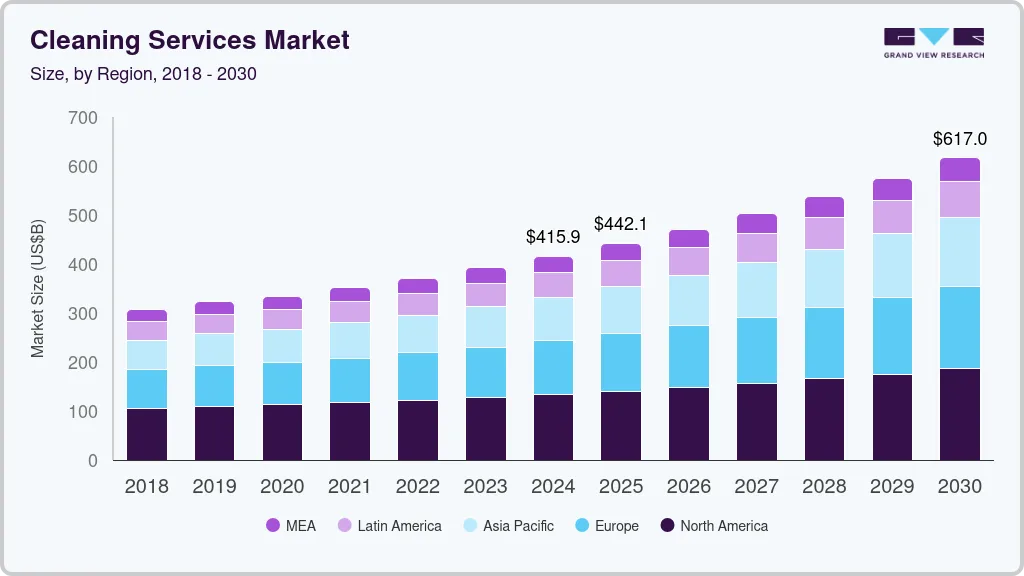

The global cleaning services market size was estimated at USD 415.93 billion in 2024 and is projected to reach USD 616.98 billion by 2030, growing at a CAGR of 6.9% from 2025 to 2030. The increased emphasis on hygiene and cleanliness, significantly influenced by the COVID-19 pandemic, has driven businesses to embrace advanced cleaning technologies.

Key Market Trends & Insights

- The North America cleaning services market held a global revenue share of 32.20% in 2024.

- The cleaning services market in the U.S. is expected to grow at a CAGR of 5.6% over the forecast period.

- Based on type, the floor care services accounted for a market share of 30.93% in 2024.

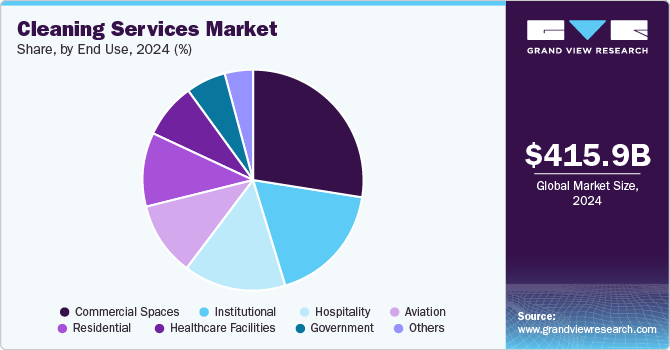

- By end-use, the commercial demand for cleaning services accounted for a market share of 27.51% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 415.93 Billion

- 2030 Projected Market Size: USD 616.98 Billion

- CAGR (2025-2030): 6.9%

- North America: Largest market in 2024

These innovations are designed to improve the efficiency and effectiveness of cleaning services while aligning with the rising demand for sustainable and health-focused practices. By integrating cutting-edge tools and solutions, janitorial service providers have positioned themselves as indispensable partners in maintaining safe and sanitary environments. This shift has not only enhanced confidence among businesses but also catalyzed the sustained growth of the cleaning services industry.

The global surge in large-scale leisure and hospitality construction projects, including initiatives such as the Champtown Commercial Development, JW Marriott Detroit Water Square, Jacksonville Shipyards Development, Jake’s 58 Casino Hotel Expansion and Renovation, Project Scarlet Mixed-Use Complex, and Gun Lake Casino Expansion III (U.S.), initiated in Q2 2022, is expected to significantly propel the growth of the cleaning services industry. These expansive developments, characterized by extensive floor areas and multifaceted facilities, necessitate robust cleaning and maintenance solutions to uphold exceptional standards of hygiene and aesthetics. As these entertainment hubs strive to deliver unparalleled guest experiences, the demand for professional cleaning services is poised to rise, driven by the imperative to ensure cleanliness, elevate customer satisfaction, and preserve the visual and functional appeal of these high-profile venues.

The cleaning services sector is further set to benefit from ongoing construction projects such as the Potrero Power Plant Mixed-Use Community in California and The American Heartland Theme Park and Resort in Oklahoma, which commenced in Q4 2023. As these facilities approach completion in the coming years, the demand for janitorial services to maintain operational standards and cleanliness will intensify, creating substantial growth opportunities for market participants. This heightened focus on post-construction maintenance aligns with the growing emphasis on the importance of cleanliness in sustaining the long-term operational efficiency and appeal of newly developed properties.

Maintaining a clean environment also plays a critical role in fostering employee health and safety. Studies, such as those by Fidelis Contract Services Ltd., highlight that clean workplaces mitigate the risk of illness, reduce absenteeism, and enhance operational productivity. Additionally, they contribute to hazard prevention, ensuring a secure and efficient working environment. These factors are driving the growing reliance on cleaning services within commercial and office settings.

In October 2023, SC Johnson Professional released findings from a workplace hygiene survey, underscoring the increasing prioritization of regular cleaning in professional environments. The survey revealed that 94% of respondents identified the need for more frequent cleaning in high-usage areas such as washrooms and kitchens. Decision-makers, particularly those in small and medium-sized enterprises (SMEs), emphasized the importance of selecting cleaning products that offer effectiveness, user-friendliness, and multi-functional capabilities, reflecting a shift towards practical and comprehensive hygiene solutions.

The commercial cleaning industry is undergoing a transformation fueled by technological innovation and evolving customer demands. The adoption of advanced technologies, such as robotics exemplified by SoftBank Robotics' Whiz, enhances efficiency by automating routine cleaning tasks and enabling personnel to focus on complex responsibilities. Additionally, innovative software solutions, such as Swept, leverage data-driven insights to optimize scheduling, improve operational workflows, and facilitate informed decision-making. As the industry faces a projected shortage of skilled labor, integrating automation is expected to become essential for ensuring productivity and cost-efficiency, presenting significant growth avenues for forward-looking cleaning service providers.

Type Insights

Floor care services accounted for a market share of 30.93% in 2024. Floor care services encompass the comprehensive cleaning, maintenance, and restoration of diverse flooring materials across residential and commercial environments. These services include a range of specialized tasks such as sweeping, mopping, vacuuming, stripping, waxing, buffing, and polishing, tailored to surfaces including tile, hardwood, carpet, and vinyl. Leveraging advanced techniques and equipment, these services are designed to uphold the integrity of flooring, extend its lifespan, and ensure a polished and professional aesthetic.

In the U.S., the demand for floor care services is underpinned by multiple factors. The expansion of commercial activities necessitates meticulous upkeep of high-traffic areas to sustain both hygiene standards and visual appeal. Furthermore, an increasing focus on creating clean and health-conscious environments, particularly in public and workplace settings, has amplified the need for routine and specialized floor care solutions. The diversification of flooring materials and the corresponding requirement for tailored maintenance methods further bolster demand, as preserving the appearance and durability of different surfaces demands precise and material-specific care.

The demand for carpet & upholstery cleaning services is projected to grow at a CAGR of 8.4% from 2025 to 2030. In residential environments, a heightened awareness of indoor air quality and its impact on health has driven homeowners to prioritize the regular cleaning of carpets and upholstered furniture to eliminate allergens, dust, and pollutants. Additionally, the desire to maintain the visual appeal and durability of these assets has made professional cleaning services an essential part of routine home maintenance.

Similarly in commercial settings, the high foot traffic in offices, hospitality venues, and retail spaces necessitates consistent carpet and upholstery maintenance to preserve a clean and professional ambiance. This not only enhances the overall customer and employee experience but also aligns with increasing regulatory and corporate standards for workplace cleanliness and safety. Moreover, advancements in cleaning technologies and eco-friendly solutions have further fueled the adoption of these services, meeting the growing preference for sustainable practices in both sectors.

End Use Insights

The commercial demand for cleaning services accounted for a market share of 27.51% in 2024. Retail complexes, which attract high foot traffic, require meticulous cleaning to ensure a welcoming and visually appealing environment for customers. Cleanliness plays a pivotal role in enhancing the shopping experience and fostering customer loyalty. For instance, luxury retail destinations such as The Galleria in Houston or The Mall of America in Minnesota prioritize comprehensive cleaning programs to uphold their premium brand image and accommodate the heavy influx of visitors. In office spaces, the demand is driven by the need to create a clean and health-conscious workplace that promotes employee well-being and productivity. A clean office not only enhances employee morale but also reduces the risk of illness, minimizing absenteeism. Notably, corporate hubs like the Salesforce Tower in San Francisco or One Vanderbilt in New York integrate professional cleaning services into their operational frameworks to ensure a pristine environment that reflects the company’s commitment to quality and professionalism.

Furthermore, the COVID-19 pandemic has heightened awareness of the importance of stringent hygiene standards, resulting in an increased emphasis on sanitization protocols in both retail and office settings. This shift has led to the adoption of advanced cleaning technologies, such as electrostatic sprayers and antimicrobial surface treatments, which cater to the growing expectations of stakeholders for thorough and effective cleaning solutions. The combination of these factors continues to fuel robust growth in the demand for cleaning services within the commercial sector.

The demand for cleaning services in the hospitality sector is projected to grow at a CAGR of 8.6% from 2025 to 2030. Hotels, resorts, and other hospitality venues rely on comprehensive cleaning solutions to maintain the pristine environments that underpin their brand reputations and guest experiences. Cleanliness is increasingly a decisive factor for travelers when selecting accommodations, with online reviews and ratings often reflecting the state of hygiene. For instance, luxury hotel chains such as the Ritz-Carlton and Four Seasons have implemented rigorous cleaning protocols, including daily room sanitization and enhanced cleaning of high-touch areas, to meet and exceed guest expectations.

The COVID-19 pandemic amplified the focus on hygiene, compelling hospitality providers to adopt advanced cleaning technologies and practices. Measures such as UV-C disinfection systems, antimicrobial treatments, and electrostatic spraying have become integral to ensuring guest safety. Properties like the Marriott Bonvoy and Hilton Hotels have introduced "CleanStay" and "Commitment to Clean" programs, respectively, to provide visible assurance of their adherence to elevated cleaning standards. Additionally, the hospitality sector’s expansion—evidenced by the rise of mega-resorts, boutique hotels, and destination properties—has increased the scope and complexity of cleaning requirements. High-profile projects like the Wynn Al Marjan Island Resort in the UAE or the American Heartland Theme Park and Resort in Oklahoma necessitate extensive cleaning operations to maintain operational readiness and create unforgettable guest experiences. These trends underscore the indispensable role of professional cleaning services in supporting the growth and sustainability of the hospitality industry.

Regional Insights

The cleaning services market in North America held a global revenue share of 32.20% in 2024. The regional market benefits from advancements in cleaning technologies and a heightened emphasis on sustainability. Canada, for instance, has implemented initiatives like the Clean Canada Strategy, which encourages eco-friendly cleaning practices, leading to a surge in demand for green-certified cleaning services. Corporate facilities across the region are increasingly outsourcing cleaning tasks to specialized service providers to improve operational efficiency. Additionally, the hospitality industry's growth, paired with evolving consumer expectations for cleanliness, has amplified the requirement for professional cleaning services, making the sector a critical contributor to the region’s economic landscape.

U.S. Cleaning Services Market Trends

The cleaning services market in the U.S. is expected to grow at a CAGR of 5.6% from 2025 to 2030. The demand for cleaning services in the U.S. is witnessing substantial growth due to the rising awareness of hygiene standards, driven by the lingering impacts of the COVID-19 pandemic. The commercial sector, particularly healthcare facilities and corporate offices, has intensified its focus on sanitization to ensure compliance with stringent health regulations, such as those outlined by the Occupational Safety and Health Administration (OSHA). Additionally, government initiatives, including local grants for small cleaning businesses, and the increasing adoption of green cleaning practices have further propelled industry expansion. Residential cleaning services are also experiencing heightened demand, fueled by dual-income households seeking time-saving solutions, thereby creating a robust market environment.

Asia Pacific Cleaning Services Market Trends

Asia Pacific accounted for a revenue share of around 21.31% in the year 2024. Asia Pacific is experiencing an accelerated demand for cleaning services due to rapid urbanization, industrial growth, and increasing health awareness among the population. Governments in countries like India and China are investing in cleanliness drives, exemplified by initiatives such as India’s Swachh Bharat Abhiyan (Clean India Mission), which have elevated the importance of professional cleaning services. Moreover, the burgeoning hospitality and real estate sectors across major economies are creating substantial opportunities for the commercial cleaning segment. The rising middle-class population, coupled with busy lifestyles, further contributes to the growth of the residential cleaning services industry in the region, solidifying the industry's regional expansion.

Europe Cleaning Services Market Trends

The Europe cleaning services market is projected to grow at a CAGR of 7.5% from 2025 to 2030. The market is expanding due to the enforcement of rigorous hygiene regulations under directives such as the European Union’s Hygiene of Foodstuffs Regulation (EC 852/2004). These mandates have elevated demand across food processing units, healthcare facilities, and public spaces. The region also observes growing demand for eco-friendly cleaning services, supported by initiatives like the European Green Deal, which promotes sustainable practices. Additionally, urbanization and the rise of co-working spaces are driving commercial cleaning needs, while an aging population in countries like Germany and Italy is boosting demand for residential cleaning services tailored to senior citizens.

Key Cleaning Services Company Insights

The cleaning services industry is characterized by a highly fragmented competitive landscape, with the presence of numerous global, regional, and local players catering to diverse customer needs. Large multinational companies dominate the commercial cleaning segment, leveraging advanced technologies, robust supply chains, and specialized offerings such as green cleaning solutions and integrated facility management services. Companies like ISS Facility Services, ABM Industries, and Sodexo have established strong footholds by entering long-term contracts with corporate, healthcare, and hospitality sectors, underscoring their operational scalability and service quality. These players often focus on innovation, employing AI-driven tools for predictive cleaning and IoT-enabled devices to enhance operational efficiency and client satisfaction. Their ability to bundle services and customize solutions further consolidates their market position.

Regional and local service providers play a critical role, particularly in the residential and small-scale commercial sectors, offering cost-effective and flexible cleaning services. These companies capitalize on their understanding of localized demands, agility in service delivery, and competitive pricing strategies. Many have begun integrating eco-friendly cleaning products and technologies to cater to the growing consumer preference for sustainable practices. The competitive dynamics are further influenced by the rise of tech-enabled startups offering on-demand cleaning services through digital platforms, reshaping customer expectations around accessibility and convenience. Intense competition in the market has led to a surge in strategic initiatives, including mergers, acquisitions, and partnerships, enabling companies to expand their geographic footprint and diversify their service portfolios.

Key Cleaning Services Companies:

The following are the leading companies in the cleaning services market. These companies collectively hold the largest market share and dictate industry trends.

- ABM Industries Inc.

- The Service Master Company, LLC

- CleanNet

- Anago Cleaning Systems

- Aramark Corporation

- Sodexo

- Jani-King Inc.

- Stanley Steemer International, Inc.

- ChemDry

- Pritchard Industries Inc.

Recent Developments

-

In June 2024, Aramark announced a partnership with Pringle Robotics to deploy autonomous floor cleaning robots across its facilities management operations. The collaboration includes installing CC1 and CC3 robotic floor scrubbers and integrated software solutions in key customer sites, such as the Kay Bailey Hutchison Convention Center in Texas. This initiative is aimed at improving cleaning efficiency and standardizing high-quality results, aligning with Aramark's goals of innovation and automation within the janitorial services market.

-

In February 2024, The ServiceMaster Company, LLC, and Ace Hardware announced a multi-year partnership allowing ServiceMaster franchise owners to purchase business supplies from Ace Hardware with exclusive benefits. This collaboration enhances operational efficiency for ServiceMaster’s local franchisees by providing streamlined access to high-quality tools and janitorial supplies. The partnership is likely to boost growth in the U.S. janitorial services market by improving supply chain efficiency and cost-effectiveness for ServiceMaster franchisees. This can lead to enhanced service delivery and competitive pricing, benefiting both the franchisees and their clients.

Cleaning Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 442.09 billion

Revenue forecast in 2030

USD 616.98 billion

Growth rate

CAGR of 6.9% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

ABM Industries Inc.; The Service Master Company, LLC; CleanNet; Anago Cleaning Systems; Aramark Corporation; Sodexo; Jani-King Inc.; Stanley Steemer International, Inc.; ChemDry; Pritchard Industries Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cleaning Services Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cleaning services market report based on type, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Window Cleaning

-

Vacuuming

-

Floor Care

-

Maid Services

-

Carpet & Upholstery

-

Others (Surface Cleaning, Damage Restoration Cleaning, etc.)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial Spaces

-

Institutional

-

Government

-

Healthcare Facilities

-

Hospitality

-

Aviation

-

Others (Convention Centers, Museums, Stadiums & Arenas, etc.)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cleaning services market was estimated at USD 415.93 billion in 2024 and is expected to reach USD 442.09 billion in 2025.

b. The global cleaning services market is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2030 to reach USD 616.98 billion by 2030.

b. The North American region dominated the cleaning services market, with a share of over 32.20% in 2024. This is owing to the growing hybrid work culture, strong real estate and commercial sector, increase in disposable income, and presence of well-established market players in the region.

b. Some key players operating in the cleaning services market include ABM Industries Inc., The Service Master Company, LLC, CleanNet, Anago Cleaning Systems, Aramark Corporation, Sodexo, Jani-King Inc., Stanley Steemer International, Inc., ChemDry, and Pritchard Industries Inc.

b. Key factors driving the cleaning services market growth include an increase in dual-income households, an aging population, growing awareness about hygiene, especially after the pandemic, and the growth of the real estate sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.