- Home

- »

- Medical Devices

- »

-

Clinical Trial Investigative Site Network Market Size Report, 2030GVR Report cover

![Clinical Trial Investigative Site Network Market Size, Share & Trends Report]()

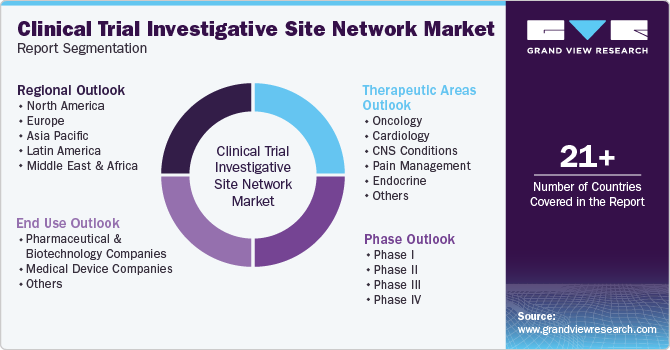

Clinical Trial Investigative Site Network Market Size, Share & Trends Analysis Report By Therapeutic Areas (Oncology, Cardiology), By Phase (Phase I, Phase II), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-986-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

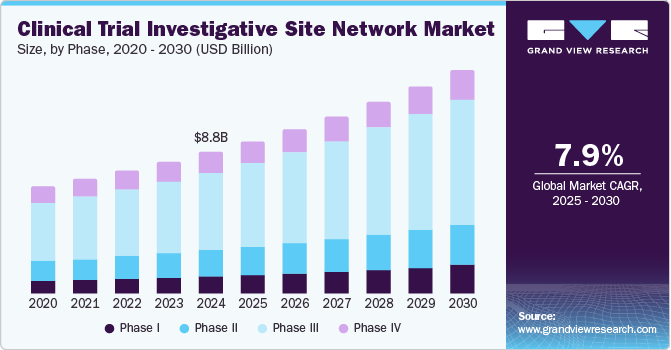

The global clinical trial investigative site network market size was estimated at USD 8.77 billion in 2024 and is projected to grow at a CAGR of 7.85% from 2025 to 2030. The market growth is mainly driven by increasing demand for clinical trials, the growing prevalence of chronic diseases, constant technological advancements, and growing government support. Moreover, increasing funding for the development of innovative therapies, particularly in oncology, rare diseases, and immunotherapy, is also accelerating the demand for efficient site networks to conduct proper clinical trials.

Furthermore, technological innovations have significantly transformed the landscape of clinical trials, making them more efficient and cost-effective. The integration of electronic health records (EHRs), telemedicine, and data analytics into clinical trial protocols has enabled sites to enhance patient engagement and improve data collection methods. For instance, in June 2024, Medidata announced the launch of Clinical Data Studio, an innovative platform designed to connect the full potential of clinical research data. This unified solution enhances stakeholder control over data quality, enabling faster and safer trials for patients. By integrating data from both Medidata and external sources it streamlines decision-making and improves understanding of patient data through AI-driven insights, allowing for data review and reconciliation to occur up to 80% faster.

Increasing government support for accelerating drug development processes while ensuring patient safety is also one of the factors driving the market growth. For instance, the FDA’s Real-World Evidence (RWE) program encourages the use of real-world data in clinical trials, which can lead to more efficient study designs and quicker approvals. For instance, in June 2023 , the U.S. FDA announced new initiatives aimed at modernizing clinical trials, which are expected to drive market growth significantly. By implementing streamlined regulatory processes and encouraging innovative trial designs, such as decentralized trials and adaptive designs, the FDA aims to enhance efficiency and improve patient access. These advancements will not only facilitate faster recruitment and data collection but also address challenges like patient diversity and retention. This supportive regulatory environment fosters collaboration between sponsors and investigative sites, enhancing the overall efficiency of clinical research.

Phase Insights

The phase III segment dominated the market, accounting for 54.3% of the total revenue share in 2024. The growth of the segment is mainly due to the increasing complexity of trials, coupled with regulatory demands for comprehensive evidence before approval, which has led pharmaceutical companies to invest heavily in Phase III studies. Furthermore, as more innovative therapies are developed, especially in areas like oncology and rare diseases, the demand for extensive phase III trials has increased significantly, further strengthening its dominance in the market.

Phase I is projected to witness the fastest growth during the forecast period owing to the increasing focus of biopharmaceutical companies on the development of personalized medicine and novel therapeutic modalities such as gene therapy and biologics. This has led to an increasing demand for early-phase trials that can quickly assess safety and pharmacokinetics in humans. In addition, advancements in technology and methodologies have streamlined patient recruitment processes and improved trial designs, making it easier for sponsors to initiate Phase I studies.

Therapeutic Areas Insights

The oncology segment dominated the market with a share of 35.1% in 2024, owing to the increasing prevalence of cancer globally coupled with the growing need for more effective treatment strategies. According to an article published by the American Cancer Society in January 2024, it is estimated that there are approximately 2,001,140 new cancer cases and 611,720 cancer-related deaths in the U.S. Moreover, the same article states that the number of cancer cases is predicted to reach 35 million by 2050. Thus, increasing cases of cancer have led pharmaceutical companies and research institutions to invest heavily in oncology research, leading to a surge in the number of investigational sites dedicated to this area.

The pain management segment is projected to witness considerable growth in the coming years owing to increasing cases of chronic pain coupled with growing demand for innovative treatment options. According to an article published by the American Psychological Association in March 2024 , approximately 1 in 20 U.S. adults experiences co-occurring chronic pain along with significant symptoms of anxiety and depression. This totaled approximately 12 million Americans, which represents about 5% of the adult population in the U.S. Thus, the factors above would further fuel the demand for effective pain management solutions that address both physical and mental health aspects.

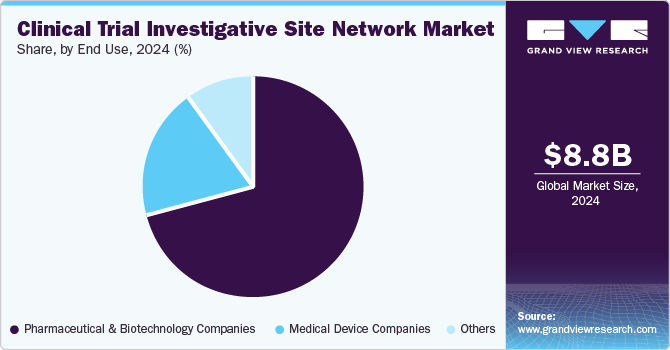

End Use Insights

The pharmaceutical & biopharmaceutical companies segment dominated the market in 2024 owing to increasing investment by these companies in research and development (R&D) to bring new drugs and therapies to market, which necessitates extensive trials. The average cost of developing a new drug can exceed USD 2.6 billion, making efficient trial management critical for these companies. In addition, regulatory requirements are stringent in this sector, leading pharmaceutical firms to rely on established investigative site networks that can ensure compliance with Good Clinical Practice (GCP) guidelines and facilitate patient recruitment. The increasing prevalence of chronic diseases and an aging population further drive demand for innovative treatment options.

The medical device companies’ segment is projected to witness considerable growth in the coming years, owing to several emerging trends and technological advancements. The rapid innovation in medical devices, particularly in areas such as minimally invasive surgery, wearable technology, and digital health solutions, has led to an increased need for trials that can validate these products’ safety and efficacy. Furthermore, regulatory bodies such as the FDA are streamlining approval processes for certain types of medical devices through initiatives like the Breakthrough Devices Program, which encourages faster access to innovative technologies.

Regional Insights

North America clinical trial investigative site network marketdominated globally in 2024 with a revenue share of 38.1%. The growth in the region is attributed to its advanced healthcare infrastructure and significant investments in research and development. The strong presence of pharmaceutical companies, contract research organizations (CROs), and well-established academic institutions is also contributing to the market growth. In addition, initiatives such as the U.S. National Institutes of Health's (NIH) funding for precision medicine and the implementation of patient-centered trial designs are further enhancing the region's capability to conduct efficient research.

U.S. Clinical Trial Investigative Site Network Market Trends

The clinical trial investigative site network market in the U.S. is projected to grow over the forecast period due to its robust healthcare infrastructure, significant investment in research and development, and large patient population. The U.S. Food and Drug Administration (FDA) has established streamlined processes for clinical trial approvals, which encourages pharmaceutical companies to conduct trials domestically. Furthermore, increasing government initiatives, such as the launch of the 21st Century Cures Act, aims to accelerate medical product development and bring innovations to patients faster.

Europe Clinical Trial Investigative Site Network Market Trends

The clinical trial investigative site network market in Europe is anticipated to witness lucrative growth over the projected period. The growth is due to the presence of a large and varied patient population that provides access to diverse demographics for conducting trials, making it an attractive destination for sponsors seeking robust data.

The UK clinical trial investigative site network market is anticipated to grow over the forecast period due to its strong regulatory framework and commitment to research excellence. The National Health Service (NHS) plays a crucial role by providing access to diverse patient populations for clinical studies. Initiatives such as the UK Clinical Trials Gateway enhance transparency and accessibility of information regarding ongoing trials, thereby increasing participation rates.

The clinical trial investigative site network market in Germany is expected to grow at a considerable rate over the forecast period. The market growth is mainly due to its strong emphasis on quality standards and regulatory compliance within its healthcare system. The Federal Institute for Drugs and Medical Devices (BfArM) ensures that these trials adhere to stringent guidelines, thereby further strengthening the trial process. This regulatory framework encourages more sponsors to initiate trials in Germany, knowing they will benefit from a transparent and efficient process.

Asia Pacific Clinical Trial Investigative Site Network Market

The Asia Pacific clinical trial investigative site network market is expected to grow at the fastest CAGR over the forecast period.The growth can be attributed to constant advancement and growth in the clinical research field. Furthermore, the growing presence of outsourcing firms is also improving trial management and operational efficiencies. Advancements in technology, such as digital health solutions and data analytics, are transforming how trials are conducted, enabling better patient engagement and real-time monitoring.

The clinical trial investigative site network market in China is projected to witness significant growth in the coming years owing to increasing government support aimed at streamlining the trial approval process, which facilitates faster study initiation. Moreover, the growing demand for innovative treatments and therapies, particularly in oncology and chronic diseases, is leading to an increase in the number of clinical trials conducted in the country.

The clinical trial investigative site network market in Japan is expected to witness lucrative growth over the forecast period. The growth of the market is due to the country’s advanced infrastructure and strong regulatory framework, making it a pivotal country for research and development activities. With a highly developed healthcare system and a large, aging population, Japan offers unique opportunities for studying age-related diseases and conditions.

The clinical trial investigative site network market in India is poised to grow in the coming years. The market is experiencing rapid growth, fueled by a robust pharmaceutical industry, regulatory reforms that streamline processes, and a diverse patient population that enhances recruitment efforts. Increasing awareness among patients about clinical trials is leading to higher participation rates, while the rising presence of contract research organizations (CROs) is improving trial efficiency. In addition, advancements in technology, such as electronic data capture and telemedicine, are further enhancing trial management and patient monitoring, positioning India as a key player in the global clinical research landscape.

MEA Clinical Trial Investigative Site Network Market Trends

The MEA clinical trial investigative site network market is projected to grow at a lucrative rate over the forecast period. Growth in the region can be attributed to rising incidence of chronic diseases. Furthermore, MEA is one of the emerging markets for conducting clinical trials owing to an increase in the demand for quality care, presence of a diverse population, and ease in patient recruitment. The region has much to offer with its untapped market for clinical trials with expanding pharmaceutical, biopharmaceutical, and medical devices companies. In addition, the number of CROs in the region has been experiencing an upsurge in the past years.

The clinical trial investigative site network market in Saudi Arabia is projected to witness the fastest growth rate over the forecast period in the MEA region, owing to increasing awareness of the advantages of effective pharmaceutical solutions and rising investments in research and development. The pharmaceutical sector in the country is poised to benefit significantly during the forecast period due to the rising prevalence of diseases, the presence of outsourcing firms, and an increasing number of clinical trials.

Key Clinical Trial Investigative Site Network Company Insights

Key players operating in the clinical trial investigative site network industry are undertaking various initiatives to strengthen their market presence and increase the reach of their services. For instance, in June 2024, Velocity Clinical Research entered into a partnership agreement with Luminis Health to enhance clinical research initiatives within Luminis Health, facilitating greater access for patients to community-based research programs.

Key Clinical Trial Investigative Site Network Companies:

The following are the leading companies in the clinical trial investigative site network market. These companies collectively hold the largest market share and dictate industry trends.

- ICON Plc

- Velocity Clinical Research

- IQVIA Inc.

- Elligo Health Research

- WCG Clinical

- ClinChoice

- Access Clinical Trials Inc.

- FOMAT Medical Research, Inc.

- SGS Société Générale de Surveillance SA.

- KV Clinical Research

- SMO-Pharmina

- Xylem Research LLP

- The Aurum Institute.

Recent Developments

-

In June 2024, IQVIA Inc. announced the launch of its “One Home” clinical trial technology platform, designed to address challenges and alleviate the burden faced by research sites. This innovative platform aims to streamline trial processes, enhance efficiency, and improve overall site management, making it easier for investigators to conduct studies effectively.

-

In August 2024, WCG acquired Array, a leading content engagement partner for life sciences companies. This acquisition aims to enhance WCG's offerings, providing comprehensive training resources that support the development of skilled professionals in the clinical research field.

-

In July 2024, SGS North America announced the expansion of its biologics testing services, enhancing its capacity and capabilities to better serve the American biopharmaceutical market. This development aims to support clients with improved testing solutions and accelerate the delivery of biologic products

Clinical Trial Investigative Site Network Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.43 billion

Revenue forecast in 2030

USD 13.76 billion

Growth Rate

CAGR 7.85% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Phase, therapeutic areas, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China, India, South Korea, Thailand, Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

ICON Plc, Velocity Clinical Research, IQVIA Inc., Elligo Health Research, WCG Clinical, ClinChoice, Access Clinical Trials Inc., FOMAT Medical Research, Inc., SGS Société Générale de Surveillance SA., KV Clinical Research, SMO-Pharmina, Xylem Research LLP, The Aurum Institute

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Trial Investigative Site Network Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clinical trial investigative site network market report based on phase, therapeutic areas, end use, and region.

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Therapeutic Areas Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiology

-

CNS Conditions

-

Pain Management

-

Endocrine

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biopharmaceutical Companies

-

Medical Device Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical trial investigative site network market size was estimated at USD 8.77 billion in 2024 and is expected to reach USD 9.43 billion in 2025.

b. The global clinical trial investigative site network market is expected to grow at a compound annual growth rate of 7.85% from 2025 to 2030 to reach USD 13.76 billion by 2030.

b. Based on therapeutic areas, the oncology segment dominated the market and accounted for the largest revenue share of 35.1% in 2024. The growth of the market is mainly due to increasing cases of cancer globally further fueling the demand for effective therapeutic treatment options.

b. Some key players operating in the market include ICON Plc, Velocity Clinical Research, IQVIA Inc., Elligo Health Research, WCG Clinical, ClinChoice, Access Clinical Trials Inc., FOMAT Medical Research, Inc., SGS Société Générale de Surveillance SA., and few others.

b. Key factors that are driving the clinical trial investigative site network market growth include increasing investment in R&D programs, preference for outsourcing activities due to time and cost constraints, and increasing partnerships amongst the clinical research sites.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."