- Home

- »

- Clinical Diagnostics

- »

-

Clinical Laboratory Tests Market Size, Industry Report, 2030GVR Report cover

![Clinical Laboratory Tests Market Size, Share & Trends Report]()

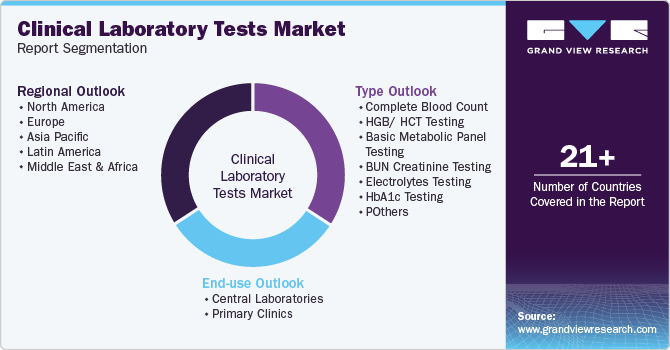

Clinical Laboratory Tests Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Complete Blood Count, HGB/HCT Tests), By End-use (Primary Clinics, Central Laboratories), By Region, And Segment Forecasts

- Report ID: 978-1-68038-361-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Clinical Laboratory Tests Market Summary

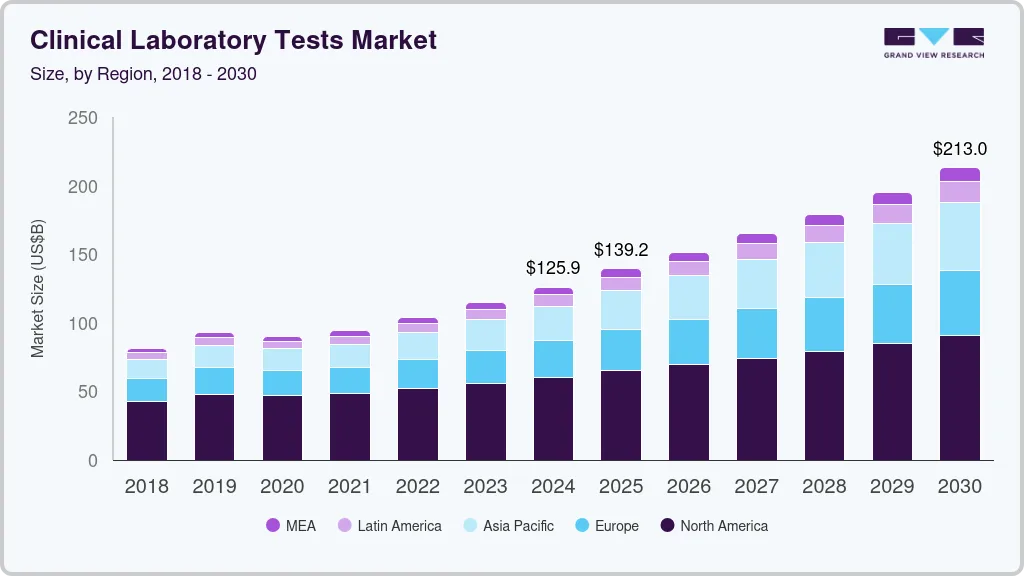

The global clinical laboratory tests market size was estimated at USD 125.94 billion in 2024 and is projected to reach USD 213.04 billion by 2030, growing at a CAGR of 8.88% from 2025 to 2030. As global life expectancy rises-most developed economies now witnessing averages exceeding 80 years-the demand for diagnostic testing is fueled by both the increasing burden of chronic conditions and the need for early disease detection and treatment management.

Key Market Trends & Insights

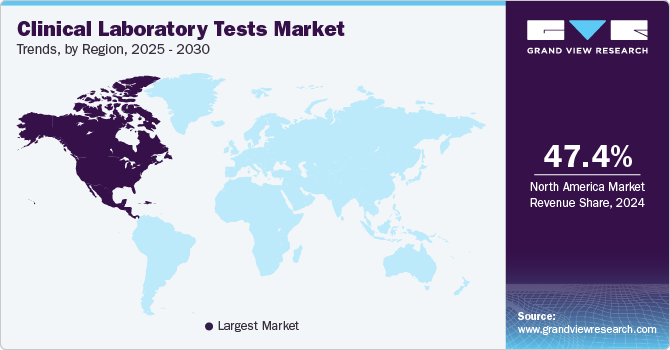

- North America clinical laboratory tests industry held the largest share of market in 2024

- Country-wise, U.S. is expected to register the highest CAGR from 2024 to 2030.

- By type, HbA1c testing segment held the largest market share at 12.39% in 2024.

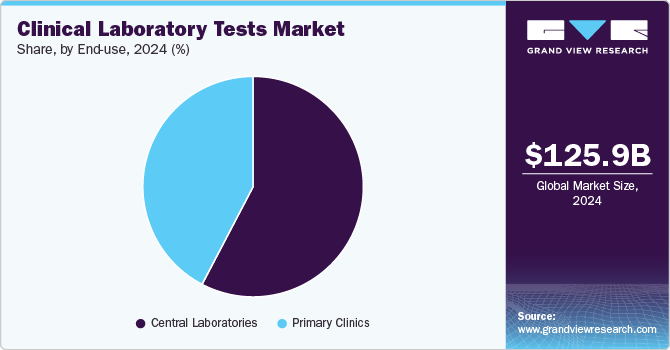

- By end use, the central laboratories segment held the largest share of the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 125.94 Billion

- 2030 Projected Market Size: USD 213.04 Billion

- CAGR (2025-2030): 8.88%

- North America: Largest market in 2023

A significant market driver is the high incidence of cardiovascular diseases and diabetes. The World Health Organization (WHO) reports that cardiovascular conditions, including heart disease and stroke, were responsible for roughly 17.9 million deaths globally in 2021. In parallel, the growing prevalence of diabetes has expanded the patient pool that requires clinical laboratory tests. Lifestyle changes, such as increased smoking rates, rising obesity levels, and irregular diets, have further contributed to the global burden of cardiovascular disease. Moreover, the increased risk of cardiovascular complications associated with SARS-CoV-2 infections underscores the critical role of laboratory tests in risk stratification and early intervention.

The aging population also significantly contributes to market expansion. Aging, influenced by a combination of genetic and environmental factors that affect immunity and metabolism, is associated with a progressive decline in organ function and an increased risk of infectious diseases. Clinical laboratory tests are essential in detecting nutrient deficiencies, monitoring organ functions (such as kidney, liver, or thyroid), and tracking the progression of various diseases. As demand for acute and long-term healthcare rises among the elderly, there is a proportional increase in the use of clinical laboratory testing for screening and diagnostic purposes.

Furthermore, technological innovations are transforming the clinical laboratory landscape. The development of integrated workflow management systems, advanced database management tools, and electronic patient test records has enabled laboratories to handle large volumes of samples-ranging from 100 to 150 billion annually-more efficiently and accurately. These innovations not only streamline operations but also contribute to lowering overall test costs. Enhanced data management and informatics solutions further support smooth laboratory operations and improved service delivery, positioning the market for sustained growth

However, market expansion is tempered by challenges related to regulatory ambiguities. The clinical diagnostics sector is highly dependent on regulatory frameworks set by bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). In many developing markets, including China and India, clear regulatory guidelines for diagnostic tests are lacking. Laboratory-developed tests (LDTs), which offer the promise of faster and more efficient testing in in-house settings, are under stringent FDA oversight. The risks associated with LDTs, including potential impacts on profit margins and delays in the commercialization of new tests, present significant hurdles for market players. Despite these regulatory challenges, the overall trajectory of the clinical laboratory tests industry remains positive, driven by both demographic shifts and continuous innovation in diagnostic technologies.

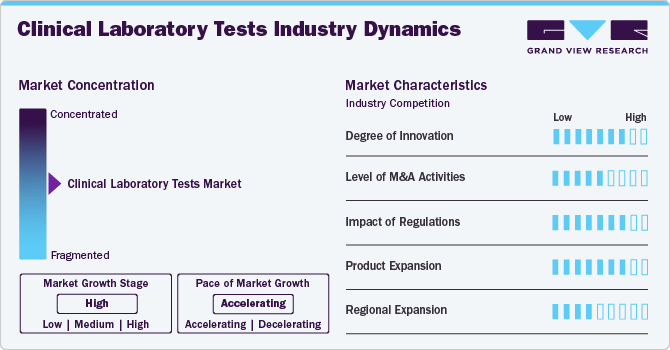

Market Concentration & Characteristics

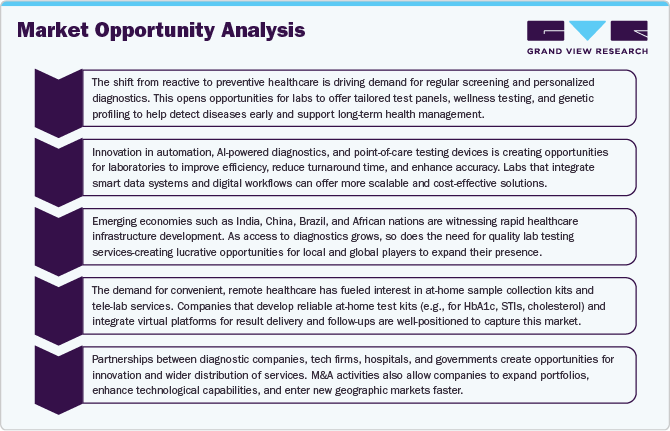

The clinical laboratory tests industry exhibits a high degree of innovation, driven by advancements in diagnostics and personalized healthcare. Innovations like at-home testing kits and AI-integrated diagnostic tools enhance accessibility and efficiency. Companies like Hurdle introducing HbA1c home testing reflect the growing trend toward patient-centric, decentralized solutions, improving early detection, chronic disease management, and the overall patient experience.

Mergers and acquisitions are central to the clinical lab market’s growth strategy. Key players engage in strategic deals to expand portfolios, access new technologies, and enter untapped markets. For example, Cinven’s investment in SYNLAB’s advanced Munich lab exemplifies how acquisitions strengthen capabilities, consolidate market share, and accelerate innovation, highlighting the competitive and fast-paced nature of the industry.

The market faces increasing regulatory oversight, especially from agencies like the U.S. FDA and EMA. Regulations around laboratory-developed tests (LDTs) demand compliance with evolving standards of safety, efficacy, and accuracy. While these measures safeguard public health, they can delay test approvals, raise costs, and affect commercialization timelines, posing strategic and operational challenges for clinical laboratories and test developers.

Product expansion in this market is robust, fueled by rising demand for specialized tests across chronic and infectious diseases. Companies are developing comprehensive test panels, integrating molecular diagnostics, and expanding point-of-care solutions. This diversification not only addresses various medical needs but also enhances diagnostic accuracy, operational efficiency, and responsiveness to emerging health threats, supporting sustained market growth and innovation.

Geographic expansion remains a key growth lever, with companies scaling services across global markets. Major players like Sonic Healthcare and Fluxergy are investing in infrastructure and partnerships to expand footprints in North America, Europe, and Asia-Pacific. These efforts improve access to quality diagnostics, enhance healthcare equity, and drive market penetration in underserved and high-potential regions, boosting overall market competitiveness.

Type Insights

The market for clinical laboratory testing encompasses a broad range of test types, including hemoglobin/hematocrit (HGB/HCT), basic metabolic panel, blood urea nitrogen (BUN) and creatinine, electrolyte levels, HbA1c, comprehensive metabolic panel, liver and renal panels, lipid profiles, and cardiovascular-specific tests, among others. Among these, the HbA1c testing segment held the largest market share at 12.39% in 2024, driven primarily by the rising global prevalence of diabetes and cholesterol-related conditions. Fluctuating HbA1c levels are closely associated with diabetes complications, prompting the need for regular monitoring and diagnosis. The growing diabetic population and increasing awareness of disease management have significantly boosted demand for these tests. In addition, innovative product launches are expanding market accessibility.

For example, in October 2023, Healthyr became the first to offer at-home dried blood spot tests in Walmart stores, covering multiple health metrics, including HbA1c, cholesterol, thyroid, blood sugar, and STIs. These initiatives bring convenient, affordable lab testing directly to consumers, making health monitoring more accessible. Further supporting market expansion, in April 2023, FIND partnered with Abbott, i-SENS Inc., and Siemens Healthineers to improve HbA1c testing availability in low- and middle-income countries. This global initiative aims to offer cost-effective, point-of-care diagnostic kits to strengthen early diagnosis and disease management, especially in resource-limited settings.

Meanwhile, the HGB/HCT testing segment is projected to grow at the fastest CAGR during the forecast period. This growth is attributed to the increasing prevalence of anemia and other blood disorders. HGB/HCT tests are commonly used to diagnose anemia or polycythemia, monitor drug therapies, determine the need for blood transfusions, and assess dehydration levels. The rising incidence of hematologic conditions, coupled with advancements in noninvasive and user-friendly testing technologies, is expected to fuel demand for these tests significantly in the coming years.

End-use Insights

The central laboratories segment held the largest share of the market in 2024, primarily due to high test volumes and widespread market penetration. This dominance is further supported by government-led initiatives aimed at improving access to healthcare services, including reimbursement for clinical lab tests, which is driving adoption. In addition, numerous healthcare institutions are partnering with laboratories to integrate a broad range of testing services, such as microbiology diagnostics, further expanding the role of central labs in routine and specialized testing. Moreover, the presence of a large number of laboratories, particularly in emerging and underserved regions, contributes significantly to the segment’s overall share. Regulatory bodies are also taking active steps to enhance laboratory infrastructure and streamline diagnostic procedures, making central labs a critical component of healthcare delivery systems.

On the other hand, the primary clinics segment is expected to register the fastest CAGR during the forecast period. This segment includes standalone labs, laboratories within physician clinics and primary healthcare centers, as well as facilities associated with clinical research organizations and insurance providers. One of the key advantages of these laboratories is the immediate availability of tests, allowing physicians, patients, and care teams to receive results quickly and make timely clinical decisions. While primary clinics typically offer a more limited range of testing services compared to hospital-based or large-scale laboratories, they are highly focused on specific specialties. As a result, they generate smaller revenue shares, but their agility, accessibility, and direct patient interaction are expected to drive steady and impactful contributions to market growth over time.

Regional Insights

North America clinical laboratory tests industry held the largest share of market in 2024 and is expected to maintain its dominant position, in terms of share, throughout the forecast period. This can be attributed to the increasing geriatric population, the rising prevalence of chronic diseases such as cancer, and high market penetration of technologically advanced diagnostic techniques. According to the American Cancer Society, cancer is one of the leading causes of death in North America. The most commonly diagnosed cancers are prostate cancer in men and breast cancer in women. Increasing preference for novel approaches and rising patient awareness levels are also expected to drive the regional market. Moreover, market players are now focusing on improvised and software-enabled automated diagnostic systems that help in managing and processing hundreds of samples at a time and obtaining accurate results. Moreover, clinical laboratory tests save costs, lives, and time by enabling early detection and prevention of disease, with the U.S. performing more than 7 billion clinical lab tests per year.

U.S. Clinical Laboratory Tests Market Trends

The U.S. clinical laboratory tests industry continues to expand, driven by strict regulatory standards and a large number of accredited labs. In March 2023, Fluxergy accelerated this growth by acquiring InnaMed’s blood testing technology to develop an advanced metabolic panel, reinforcing innovation, enhancing diagnostic accuracy, and meeting the increasing demand for efficient and reliable proficiency testing solutions.

Europe Clinical Laboratory Tests Market Trends

The European clinical laboratory tests industry is experiencing steady growth, driven by advancements in diagnostic technologies and increasing healthcare demand. In January 2023, QIAGEN launched the EZ2 Connect MDx, an innovative in vitro diagnostics platform that automates sample processing in diagnostic laboratories. This system enables rapid purification of RNA and DNA in just 30 minutes, significantly enhancing lab efficiency and accuracy. Such innovations are strengthening Europe’s laboratory infrastructure and supporting the growing demand for high-throughput, precise diagnostic testing.

The UK clinical laboratory tests industry is witnessing notable growth, driven by rising healthcare expenditure, a growing elderly population, and increased prevalence of chronic diseases such as diabetes and cardiovascular conditions. The emphasis on early disease detection and preventive healthcare is boosting demand for diagnostic testing. In addition, technological advancements, expanding R&D activities, and strong government support for public health initiatives contribute to the market’s sustained expansion and modernization of clinical laboratory services.

Germany clinical laboratory tests industry is expanding steadily, supported by its advanced healthcare infrastructure and increasing demand for early and accurate diagnostics. A high prevalence of chronic conditions, coupled with an aging population, is fueling the need for routine testing. Moreover, government investments in healthcare digitization, rising adoption of automation in labs, and strong regulatory frameworks are further driving market growth and enhancing laboratory efficiency and service quality.

Asia Pacific Clinical Laboratory Tests Market Trends

The Asia Pacific clinical laboratory tests industry is witnessing rapid growth due to rising healthcare awareness, increasing healthcare expenditure, and expanding access to diagnostic services. The growing burden of chronic diseases, aging populations, and rising demand for early disease detection are driving test volumes. In addition, government initiatives to strengthen healthcare infrastructure, the expansion of private diagnostic chains, and increasing adoption of advanced technologies are fostering market expansion across emerging economies such as India, China, and Southeast Asian nations.

Japan clinical laboratory tests industry is driven by its aging population and high prevalence of age-related diseases such as cancer, cardiovascular issues, and diabetes. The country’s strong healthcare system and adoption of advanced diagnostic technologies support consistent market demand. Innovations in precision medicine, rising demand for personalized diagnostics, and strategic collaborations between public and private entities are influencing growth. In addition, the integration of AI and digital solutions in diagnostics is streamlining workflows and enhancing diagnostic accuracy across Japanese laboratories.

China clinical laboratory tests industry is expanding rapidly due to urbanization, a growing middle class, and increasing prevalence of non-communicable diseases. Government policies promoting healthcare reform, improved insurance coverage, and investments in diagnostic infrastructure are driving market growth. The adoption of high-throughput testing, automation, and digital platforms is rising. Local and global players are expanding their footprint through partnerships and new lab setups. The demand for molecular diagnostics and personalized testing is also contributing significantly to market trends.

Latin America Clinical Laboratory Tests Market Trends

Latin America clinical laboratory tests industry is seeing steady growth in clinical laboratory tests, driven by rising healthcare needs, greater access to healthcare services, and improved health insurance coverage. The burden of infectious and chronic diseases is boosting diagnostic demand. Countries like Brazil and Mexico are investing in healthcare reforms and digitalization. However, regional disparities, economic instability, and regulatory challenges affect uniform growth. Public-private partnerships and the introduction of cost-effective testing solutions are gradually enhancing laboratory capacities and service reach.

Brazil clinical laboratory tests industry is experiencing notable growth due to its large population, government healthcare programs, and high burden of both infectious and lifestyle-related diseases. The Unified Health System (SUS) plays a vital role in improving access to diagnostic testing. Rapid urbanization, private sector investments, and increased use of telemedicine are expanding laboratory outreach. Moreover, technological upgrades and growing public awareness of preventive healthcare are boosting demand for regular and advanced laboratory testing services.

Middle East and Africa Clinical Laboratory Tests Market Trends

The Middle East and Africa clinical laboratory tests industry is expanding gradually, fueled by rising investments in healthcare infrastructure, increased awareness of preventive diagnostics, and growing demand for early disease detection. Countries like the UAE and South Africa are leading innovation while others are catching up. Public health campaigns and international collaborations are improving diagnostic accessibility. However, limited infrastructure in remote areas and workforce shortages remain challenges. Advances in digital diagnostics are expected to address some regional barriers.

Saudi Arabia's clinical laboratory tests industry is growing rapidly, driven by Vision 2030's healthcare transformation goals, which emphasize preventive care and diagnostics. The rising prevalence of diabetes, cardiovascular diseases, and obesity is accelerating demand for laboratory testing. Investments in hospital infrastructure, digital health initiatives, and strategic partnerships with global diagnostic firms are boosting capabilities. Increased insurance penetration and government-funded screening programs are further supporting market expansion, along with the adoption of AI and automation in testing processes.

Key Clinical Laboratory Tests Company Insights

The clinical laboratory tests industry is driven by a mix of established leaders and emerging innovators, each employing distinct strategies to enhance their market footprint. Major players such as Quest Diagnostics Incorporated, Sonic Healthcare Limited, and Laboratory Corporation of America Holdings maintain dominance through continuous test innovations, acquisitions, and strategic partnerships aimed at expanding service offerings and reinforcing their global presence.

On the other hand, emerging participants like Clinical Reference Laboratory and Cinven are rapidly gaining traction by introducing novel, differentiated solutions. These companies are heavily focused on geographic expansion, customer acquisition, and strategic collaborations to strengthen their technological capabilities and market relevance. For example, Omega Laboratories, in December 2022, introduced Urine Drugs of Abuse testing services in Canada-an expansion complementing their existing molecular testing portfolio and underscoring the shift toward integrated, multi-modal diagnostics.

Across the industry, both key and emerging players are continually investing in the development and evolution of laboratory technologies. Their shared goal is to improve patient outcomes while boosting the overall effectiveness and efficiency of healthcare services.

Key Clinical Laboratory Tests Companies:

The following are the leading companies in the clinical laboratory tests market. These companies collectively hold the largest market share and dictate industry trends.

- Quest Diagnostics Incorporated

- Abbott

- Cinven

- Laboratory Corporation of America Holdings

- ARUP Laboratories

- OPKO Health, Inc.

- UNILABS

- Clinical Reference Laboratory, Inc.

- Synnovis Group LLP

Recent Developments

-

In April 2025, Quest Diagnostics introduced a new laboratory-based blood test aimed at assisting physicians in confirming amyloid brain pathology linked to Alzheimer’s disease (AD) in individuals showing signs of mild cognitive impairment (MCI) or dementia.

-

In June 2024, PHASE Scientific launched its latest innovation in preventive healthcare with the introduction of the INDICAID health At-Home Collection Kits for Diabetes - HbA1c and Heart Health - Lipid Panel. These new offerings reflect the company’s commitment to empowering individuals with accessible tools to monitor their health, enabling early detection and proactive management of chronic conditions from the comfort of home.

-

In September 2024, Roche introduced the cobas Respiratory flex test, marking the debut of its innovative TAGS technology. Developed by Roche scientists, TAGS leverages multiplex PCR along with color, temperature, and data processing to detect up to 15 respiratory pathogens in a single test-significantly enhancing diagnostic capabilities in clinical laboratories.

Clinical Laboratory Tests Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 139.24 billion

Revenue forecast in 2030

USD 213.04 billion

Growth rate

CAGR of 8.88% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Quest Diagnostics Incorporated; Abbott; Cinven; Laboratory Corporation of America Holdings; ARUP Laboratories; OPKO Health, Inc.; UNILABS; Clinical Reference Laboratory, Inc.; Synnovis Group LLP; Sonic Healthcare Limited.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Laboratory Tests Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global clinical laboratory tests market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Complete Blood Count

-

HGB/ HCT testing

-

Basic Metabolic Panel Testing

-

BUN Creatinine Testing

-

Electrolytes Testing

-

HbA1c Testing

-

Comprehensive Metabolic Panel Testing

-

Liver Panel Testing

-

Hepatitis

-

Bile Duct Obstruction

-

Liver Cirrhosis

-

Liver Cancer

-

Bone Disease

-

Autoimmune Disorders

-

Others

-

-

Renal Panel Testing

-

Lipid Panel Testing

-

Cardiovascular Panel Tests

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Central Laboratories

-

Complete Blood Count

-

HGB/ HCT testing

-

Basic Metabolic Panel Testing

-

BUN Creatinine Testing

-

Electrolytes Testing

-

HbA1c Testing

-

Comprehensive Metabolic Panel Testing

-

Liver Panel Testing

-

Renal Panel Testing

-

Lipid Panel Testing

-

Cardiovascular Panel Tests

-

-

Primary Clinics

-

Complete Blood Count

-

HGB/ HCT testing

-

Basic Metabolic Panel Testing

-

BUN Creatinine Testing

-

Electrolytes Testing

-

HbA1c Testing

-

Comprehensive Metabolic Panel Testing

-

Liver Panel Testing

-

Renal Panel Testing

-

Lipid Panel Testing

-

Cardiovascular Panel Tests

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical laboratory tests market size was estimated at USD 125.95 billion in 2024 and is expected to reach USD 139.24 billion in 2025.

b. The global clinical laboratory tests market is expected to witness a compound annual growth rate of 8.88% from 2025 to 2030 to reach USD 213.04 billion by 2030.

b. North America dominated the clinical laboratory tests market with a share of 47.40% in 2024 attributable to to rising penetration of advanced diagnostic techniques and increasing test volumes. Moreover, increasing geriatric population, rising incidences of cancer, and growing penetration of advanced diagnostic techniques are expected to drive the demand for clinical laboratory tests.

b. Key players in the market for clinical laboratory tests include Quest Diagnostics Incorporated., Abbott, Cinven, Laboratory Corporation of America Holdings, ARUP Laboratories, OPKO Health, Inc., UNILABS, Clinical Reference Laboratory, Inc., Synnovis Group LLP, and Sonic Healthcare Limited.

b. Key factors that are driving the market growth include the rising geriatric population, growing prevalence of target diseases, and introduction of innovative solutions to meet the growing demand of market for clinical tests.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.