- Home

- »

- Pharmaceuticals

- »

-

Clinical Laboratory Tests Market Size & Share Report, 2030GVR Report cover

![Clinical Laboratory Tests Market Size, Share & Trends Report]()

Clinical Laboratory Tests Market Size, Share & Trends Analysis Report By Type (Complete Blood Count, HGB/ HCT testing), By End-Use (Primary Clinics, Central Laboratories), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-361-4

- Number of Report Pages: 104

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Clinical Laboratory Tests Market Trends

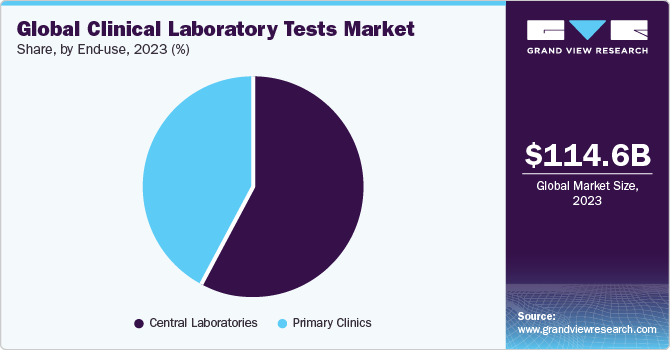

The global clinical laboratory tests market size was estimated at USD 114.63 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.2% from 2024 to 2030. The clinical laboratory tests market is witnessing growth due to factors such as the rising geriatric population, growing prevalence of target diseases, and introduction of innovative solutions to meet the growing demand of market for clinical lab testing. The increasing prevalence of diseases such as cardiovascular diseases and diabetes is expected to be a significant driver of market growth over the forecast period.

According to the WHO, globally cardiovascular diseases cause approximately 17.9 million deaths each year, primarily due to heart disease and stroke as of 2021. Additionally, the prevalence of diabetes is constantly increasing, creating a substantial patient pool for the clinical laboratory test market. Drastic lifestyle changes, such as a growing number of smokers globally, rising obesity rates, and dietary irregularities, are major contributors to the high global prevalence of cardiovascular diseases. The added risk of developing cardiovascular conditions due to SARS-CoV-2 emphasizes the significant use of clinical laboratory tests for risk stratification. The increasing disease burden indicates market growth during the forecasted period.

According to WHO, life expectancy is now exceeding 80 years in most developed economies. Aging is influenced by the interaction of several environmental and genetic factors that affect immunity and metabolism, affecting the function of organs, and is characterized as a substantial risk factor for infectious disease development. The general purpose of clinical laboratory tests is to assist in identifying signs of nutrient deficiencies, detecting changes in health, evaluating bodily functions such as those of the kidney, liver, or thyroid, and monitoring the progression of treatment or disease. Thus, screening and diagnostics can play important role in the management of overall health. Thus, with an increase in the geriatric population, the need for acute and long-term healthcare is also rising, thereby driving the growth of market globally.

Moreover, introduction of innovative solutions for maximizing efficiency and minimizing errors is expected to serve this market as a high-impact rendering driver. Integrated workflow management systems, database management tools, and patient test records are gaining importance in healthcare industry with companies processing as many as 100 to 150 billion samples per year. Implementation and development of data management and informatics solutions for facilitating smooth operations are expected to drive the growth of this market. Additionally, technological innovation is expected to reduce the cost of tests in clinical medical laboratories.

However, the market growth is being restrained by the ambiguous regulatory framework associated with clinical laboratory tests. The healthcare industry is largely dependent upon regulatory frameworks established by organizations such as the U.S. FDA and EMA. There are no clear regulatory guidelines for diagnostic sector in developing countries such as China and India. The FDA has authority of regulation over laboratory-developed tests that refer to delivering efficient and rapid results and in-house clinical laboratories developing tests. Risks associated with LDTs may have a negative effect on profit margins and may lead to delays in commercialization of newly developed tests.

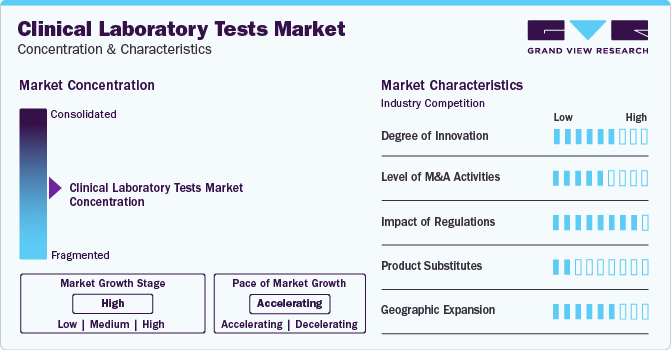

Market Concentration & Characteristics

The clinical laboratory tests market is in a high-growth stage, and the industry trends suggest that the pace of this growth is accelerating. It is characterized by a high degree of innovation driven by technological advancements and novel solutions. For instance, in February 2023, Hurdle announced the commercial availability of the Hemoglobin A1c (HbA1c) Test. This test enables adult consumers to take a simple at-home blood sample for diabetes screening and monitoring, showcasing ongoing innovation in testing methods and accessibility.

The clinical laboratory tests market is also characterized by a high level of M&A activity by the leading players, reflecting strategic moves by key players. For instance, Cinven's involvement in the market signifies a proactive approach to capitalize on the industry's growth potential through acquisitions and partnerships.In May 2023, Cinven (SYNLAB) strengthened its regional presence and reinforced its leading position by investing in an advanced laboratory in Munich.

The clinical laboratory tests market is subject to increasing regulatory scrutiny. Regulatory bodies such as the U.S. FDA and EMA influence the industry, with potential negative effects on return margins and delays in commercialization. For instance, the FDA's authority over LDTs introduces risks and uncertainties. The FDA's oversight of LDTs implies that these tests need to meet certain regulatory standards to ensure efficiency, accuracy, and safety. The involvement of regulatory bodies introduces risks and uncertainties for companies operating in the clinical laboratory tests market. Adherence to regulatory guidelines and the potential need for adjustments to comply with evolving regulations can impact the financial aspects and timelines associated with bringing new tests to market.

There are a limited number of direct product substitutes for clinical laboratory tests. However, the launch of innovative tests such as OmegaQuant's HbA1c Test and LabCorp's LabCorp on demand demonstrates efforts to enhance testing methods, reducing the likelihood of substitutes.

The clinical laboratories test market sees a high degree of geographical expansion strategies, with key players such as Sonic Healthcare Limited and Fluxergy employing this approach to broaden their service reach. This strategy enhances service availability across diverse geographic areas, ensuring a more extensive presence in the industry.

Type Insights

There are various types of clinical laboratory tests such as HGB/ HCT testing, basic metabolic panel testing, BUN creatinine testing, electrolytes testing, HbA1c testing, comprehensive metabolic panel testing, liver panel testing, renal panel testing, lipid panel testing, and cardiovascular panel tests among others. HbA1c tests segment held the largest share of 12.29% in 2023. The rise in patient population with diabetes and cholesterol abnormalities is anticipated to propel segment growth as patients with fluctuations in HbA1c increase the risk of complications related to diabetes. Moreover, launch of newer laboratory tests is expected to further propel the market growth. For instance, in October 2023, Healthyr launched six at-home tests available at Walmart, making them the first to offer at-home dried blood spot tests in physical Walmart stores. The tests cover general health, cholesterol, HbA1c + glucose, thyroid, cholesterol and blood sugar, and STI. Such novel launches enable better access to a wide range of laboratory blood testing for evaluating sugar levels. In addition, in April 2023, FIND partnered with Abbott, i-SENS Inc, and Siemens Healthineers to enhance access to HbA1c testing for diabetes in low- and middle-income countries. The initiative aims to offer affordable point-of-care test kits, addressing limited access and improving diagnosis and management in these regions. Such initiatives by key players contribute to market expansion and growth during the forecasted period.

HGB/HCT tests segment is expected to show fastest growth rate over the forecast period.The growth of the segment is attributed to the occurrence of anemia and blood-related diseases among the population.The test is used to diagnose the presence of anemia or polycythemia. HGB/HCT test is also performed to monitor the drug responses and make decisions pertaining to blood transfusions or evaluation of dehydration. Increasing incidence rate of anemia & other blood disorders and introduction of noninvasive & technologically advanced products are expected to drive market growth during the forecast period.

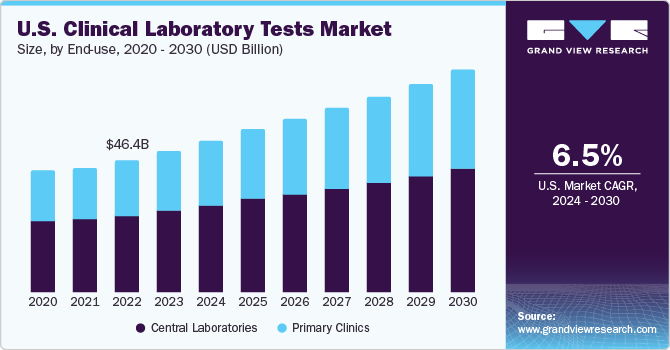

End-use Insights

Central laboratories segment held the largest share of clinical laboratory tests market in 2023. The dominance of the segment is attributed to theprocedure volumes and high market penetration. An increasing number of initiatives carried out by government to provide various services, such as reimbursement for clinical laboratory tests, is another major factor anticipated to drive the market. Many healthcare institutions are working with laboratories to integrate different tests, such as microbiology testing. Moreover, large number of laboratories in emerging and underdeveloped economies can be accounted for a large share. Furthermore, regulatory authorities are undertaking initiatives to improve laboratory services and ease the process of diagnosis.

Primary clinics segment is expected to show fastest growth over the forecast period. Primary clinics include standalone laboratories, laboratories in physician clinics & primary healthcare centers receiving samples directly from physicians, clinical research centers, and insurance companies. The test is made available to patients immediately with ease and the result is obtained quickly by care team, physician, and patients, enabling them to take clinical management decisions spontaneously. They provide a smaller test portfolio than hospital-based or standalone laboratories. These laboratories cater to the needs of a few specialties, and, hence, have a small share of revenue. Though these are smaller contributors, they are expected to make consistent contributions to market growth.

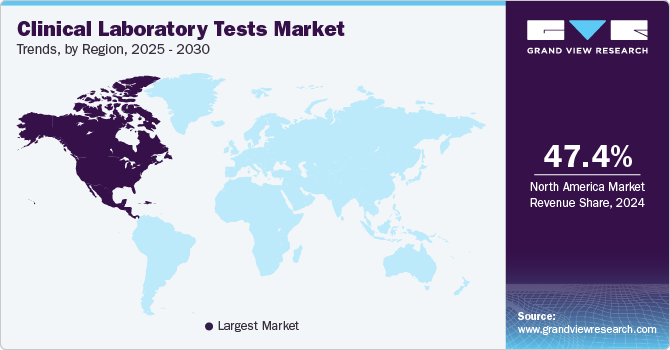

Regional Insights

North America held largest share of market in 2023 with a share of 48.8% and is expected to maintain its dominant position, in terms of share, throughout the forecast period. This can be attributed to the increasing geriatric population, rising prevalence of chronic diseases such as cancer, and high market penetration of technologically advanced diagnostic techniques are expected to drive market growth over the forecast period. According to the American Cancer Society, cancer is one of the leading causes of death in North America. The most commonly diagnosed cancers are prostate cancer in men and breast cancer in women. Increasing preference for novel approaches and rising patient awareness levels are also expected to drive the regional market. Moreover, key players are now focusing on improvised and software-enabled automated diagnostic systems that help in managing and processing hundreds of samples at a time and obtaining accurate results. Moreover, clinical laboratory tests save costs, lives, and time by enabling early detection and prevention of disease with U.S. performing more than 7 billion clinical lab tests per year.

Asia Pacific is estimated to show the fastest growth in clinical laboratory tests market over the forecast period. The growth of the market in the region is due to the presence of huge untapped opportunities in the form of unmet medical needs, increasing avenues of scientific research, rising awareness about bleeding disorder testing, and positive economic growth. Asia Pacific region comprises over one-third of the global population and has been affected the most by the COVID-19 pandemic. Due to this, clinical laboratories have gained importance owing to their crucial role in conducting tests. China and India have conducted the highest number of tests for SARS-CoV-2. However, testing capacity needs to increase to fulfill the unmet needs in the clinical laboratory segment.

Key Companies & Market Share Insights

Some of the key players operating in the market include Quest Diagnostics Incorporated., Sonic Healthcare Limited, Laboratory Corporation of America Holdings. These key players are involved adopting various strategies for increasing their market share. New test launches, acquisitions, and partnerships are some of the common strategies utilized by these players to maintain their market dominance.

Clinical Reference Laboratory, Cinven are some of the emerging participants in the clinical laboratory tests market. The emerging players focus on introducing innovative and differentiating solutions. These companies are focusing on geographic expansion and customer acquisition strategies. Strategic partnerships, acquisitions, or collaborations are also some major strategies adopted by emerging players to enhance their capabilities and market presence

Key Clinical Laboratory Tests Companies:

- Quest Diagnostics Incorporated.

- Abbott

- Cinven

- Laboratory Corporation of America Holdings

- ARUP Laboratories

- OPKO Health, Inc.

- UNILABS

- Clinical Reference Laboratory, Inc.

- Synnovis Group LLP

- Sonic Healthcare Limited.

Recent Developments

-

In March 2023, Quest Diagnostics announced the launch of Post-COVID-19 Expanded Test Panel, which includes CBC, BMP, and Hepatic Function Panel.

-

In March 2023, Fluxergy announced the acquisition of InnaMed's Blood Testing Tech for the development of metabolic panel.

-

In February 2023, Detact Diagnostics, a Dutch biotech company, announced that it is setting up a new Keene State College (U.S.) laboratory with a 2-year rental contract.

-

In January 2023, QIAGEN released EZ2 Connect MDx, an in vitro diagnostics platform for automated sample processing for diagnostic laboratories. The device allows labs to purify RNA and DNA samples in 30 minutes.

Clinical Laboratory Tests Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 125.95 billion

Revenue forecast in 2030

USD 213.04 billion

Growth rate

CAGR of 9.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in (USD Billion) Volume (Number of Tests Conducted) and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark, Sweden, Norway, China; Japan; India; Australia; Thailand, South Korea; Brazil; Mexico, Argentina; South Africa; Saudi Arabia; UAE, Kuwait;

Key companies profiled

Quest Diagnostics Incorporated., Abbott, Cinven, Laboratory Corporation of America Holdings, ARUP Laboratories, OPKO Health, Inc., UNILABS, Clinical Reference Laboratory, Inc., Synnovis Group LLP, Sonic Healthcare Limited.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Clinical Laboratory Tests Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the clinical laboratory tests market on thetype, end-use, and region:

-

Type Outlook (Revenue, USD Billion, Numbers of Tests Conducted, 2018 - 2030)

-

Complete Blood Count

-

HGB/ HCT testing

-

Basic Metabolic Panel Testing

-

BUN Creatinine Testing

-

Electrolytes Testing

-

HbA1c Testing

-

Comprehensive Metabolic Panel Testing

-

Liver Panel Testing

-

Hepatitis

-

Bile Duct Obstruction

-

Liver Cirrhosis

-

Liver Cancer

-

Bone Disease

-

Autoimmune Disorders

-

Others

-

-

Renal Panel Testing

-

Lipid Panel Testing

-

Cardiovascular Panel Tests

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Central Laboratories

-

Complete Blood Count

-

HGB/ HCT testing

-

Basic Metabolic Panel Testing

-

BUN Creatinine Testing

-

Electrolytes Testing

-

HbA1c Testing

-

Comprehensive Metabolic Panel Testing

-

Liver Panel Testing

-

Renal Panel Testing

-

Lipid Panel Testing

-

Cardiovascular Panel Tests

-

-

Primary Clinics

-

Complete Blood Count

-

HGB/ HCT testing

-

Basic Metabolic Panel Testing

-

BUN Creatinine Testing

-

Electrolytes Testing

-

HbA1c Testing

-

Comprehensive Metabolic Panel Testing

-

Liver Panel Testing

-

Renal Panel Testing

-

Lipid Panel Testing

-

Cardiovascular Panel Tests

-

-

-

Regional Outlook (Revenue, USD Billion, Numbers of Tests Conducted, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of Middle East and Africa

-

-

Frequently Asked Questions About This Report

b. The global clinical laboratory tests market size was estimated at USD 114.63 billion in 2023 and is expected to reach USD 125.95 billion in 2024.

b. The global clinical laboratory tests market is expected to witness a compound annual growth rate of 9.2% from 2024 to 2030 to reach USD 213.04 billion by 2030.

b. North America dominated the clinical laboratory tests market with a share of 48.8% in 2023 attributable to to rising penetration of advanced diagnostic techniques and increasing test volumes. Moreover, increasing geriatric population, rising incidences of cancer, and growing penetration of advanced diagnostic techniques are expected to drive the demand for clinical laboratory tests.

b. Key players in the market for clinical laboratory tests include Quest Diagnostics Incorporated., Abbott, Cinven, Laboratory Corporation of America Holdings, ARUP Laboratories, OPKO Health, Inc., UNILABS, Clinical Reference Laboratory, Inc., Synnovis Group LLP, and Sonic Healthcare Limited.

b. Key factors that are driving the market growth include the rising geriatric population, growing prevalence of target diseases, and introduction of innovative solutions to meet the growing demand of market for clinical tests.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Type

1.2.2. End-Use

1.2.3. Regional scope

1.2.4. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. GVR’s internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.4.5.1. Data for primary interviews in North America

1.4.5.2. Data for primary interviews in Europe

1.4.5.3. Data for primary interviews in Asia Pacific

1.4.5.4. Data for primary interviews in Latin America

1.4.5.5. Data for Primary interviews in MEA

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Type outlook

2.2.2. End-Use outlook

2.2.3. Regional outlook

2.3. Competitive Insights

Chapter 3. Clinical Laboratory Tests Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Increasing geriatric population

3.2.1.2. Growing prevalence of target disease

3.2.1.3. Introduction of innovative solutions

3.2.2. Market restraint analysis

3.2.2.1. Presence of ambiguous regulatory framework

3.2.2.2. COVID-19 pandemic

3.3. Clinical Laboratory Tests Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Technological landscape

3.3.2.3. Economic landscape

3.4. Pricing Analysis

Chapter 4. Clinical Laboratory Tests Market: Type Estimates & Trend Analysis

4.1. Type Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. Global Clinical Laboratory Tests Market by Type Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.4.1. Complete Blood Count

4.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

4.4.2. HGB/HCT Testing

4.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

4.4.3. Basic Metabolic Panel Testing

4.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

4.4.4. BUN Creatinine Testing

4.4.4.1. Market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

4.4.5. Electrolytes Testing

4.4.5.1. Market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

4.4.6. HbA1c Testing

4.4.7. Market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

4.4.8. Comprehensive Metabolic Panel Testing

4.4.8.1. Market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

4.4.9. Liver Panel Testing

4.4.9.1. Market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

4.4.9.2. Hepatitis

4.4.9.2.1. Market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

4.4.9.3. Bile Duct Obstruction

4.4.9.3.1. Market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

4.4.9.4. Liver Cirrhosis

4.4.9.4.1. Market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

4.4.9.5. Liver Cancer

4.4.9.5.1. Market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

4.4.9.6. Bone Disease

4.4.9.6.1. Market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

4.4.9.7. Autoimmune Disorders

4.4.9.7.1. Market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

4.4.9.8. Others

4.4.9.8.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.10. Renal Panel Testing

4.4.10.1. Market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

4.4.11. Lipid Panel Testing

4.4.11.1. Market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

4.4.12. Cardiovascular Panel Testing

4.4.12.1. Market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

Chapter 5. Clinical Laboratory Tests Market: End-Use Estimates & Trend Analysis

5.1. End-Use Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. Global Clinical Laboratory Tests Market by End-Use Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.4.1. Central Laboratories

5.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.2. Primary Clinics

5.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

Chapter 6. Clinical Laboratory Tests Market: Regional Estimates & Trend Analysis

6.1. Regional Market Share Analysis, 2023 & 2030

6.2. Regional Market Dashboard

6.3. Global Regional Market Snapshot

6.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030:

6.5. North America

6.5.1. U.S.

6.5.1.1. Key country dynamics

6.5.1.2. Regulatory framework/ reimbursement structure

6.5.1.3. Competitive scenario

6.5.1.4. U.S. market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.5.2. Canada

6.5.2.1. Key country dynamics

6.5.2.2. Regulatory framework/ reimbursement structure

6.5.2.3. Competitive scenario

6.5.2.4. Canada market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.6. Europe

6.6.1. UK

6.6.1.1. Key country dynamics

6.6.1.2. Regulatory framework/ reimbursement structure

6.6.1.3. Competitive scenario

6.6.1.4. UK market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.6.2. Germany

6.6.2.1. Key country dynamics

6.6.2.2. Regulatory framework/ reimbursement structure

6.6.2.3. Competitive scenario

6.6.2.4. Germany market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.6.3. France

6.6.3.1. Key country dynamics

6.6.3.2. Regulatory framework/ reimbursement structure

6.6.3.3. Competitive scenario

6.6.3.4. France market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.6.4. Italy

6.6.4.1. Key country dynamics

6.6.4.2. Regulatory framework/ reimbursement structure

6.6.4.3. Competitive scenario

6.6.4.4. Italy market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.6.5. Spain

6.6.5.1. Key country dynamics

6.6.5.2. Regulatory framework/ reimbursement structure

6.6.5.3. Competitive scenario

6.6.5.4. Spain market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.6.6. Norway

6.6.6.1. Key country dynamics

6.6.6.2. Regulatory framework/ reimbursement structure

6.6.6.3. Competitive scenario

6.6.6.4. Norway market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.6.7. Sweden

6.6.7.1. Key country dynamics

6.6.7.2. Regulatory framework/ reimbursement structure

6.6.7.3. Competitive scenario

6.6.7.4. Sweden market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.6.8. Denmark

6.6.8.1. Key country dynamics

6.6.8.2. Regulatory framework/ reimbursement structure

6.6.8.3. Competitive scenario

6.6.8.4. Denmark market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.7. Asia Pacific

6.7.1. Japan

6.7.1.1. Key country dynamics

6.7.1.2. Regulatory framework/ reimbursement structure

6.7.1.3. Competitive scenario

6.7.1.4. Japan market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.7.2. China

6.7.2.1. Key country dynamics

6.7.2.2. Regulatory framework/ reimbursement structure

6.7.2.3. Competitive scenario

6.7.2.4. China market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.7.3. India

6.7.3.1. Key country dynamics

6.7.3.2. Regulatory framework/ reimbursement structure

6.7.3.3. Competitive scenario

6.7.3.4. India market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.7.4. Australia

6.7.4.1. Key country dynamics

6.7.4.2. Regulatory framework/ reimbursement structure

6.7.4.3. Competitive scenario

6.7.4.4. Australia market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.7.5. South Korea

6.7.5.1. Key country dynamics

6.7.5.2. Regulatory framework/ reimbursement structure

6.7.5.3. Competitive scenario

6.7.5.4. South Korea market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.7.6. Thailand

6.7.6.1. Key country dynamics

6.7.6.2. Regulatory framework/ reimbursement structure

6.7.6.3. Competitive scenario

6.7.6.4. Thailand market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.8. Latin America

6.8.1. Brazil

6.8.1.1. Key country dynamics

6.8.1.2. Regulatory framework/ reimbursement structure

6.8.1.3. Competitive scenario

6.8.1.4. Brazil market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.8.2. Mexico

6.8.2.1. Key country dynamics

6.8.2.2. Regulatory framework/ reimbursement structure

6.8.2.3. Competitive scenario

6.8.2.4. Mexico market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.8.3. Argentina

6.8.3.1. Key country dynamics

6.8.3.2. Regulatory framework/ reimbursement structure

6.8.3.3. Competitive scenario

6.8.3.4. Argentina market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.9. MEA

6.9.1. South Africa

6.9.1.1. Key country dynamics

6.9.1.2. Regulatory framework/ reimbursement structure

6.9.1.3. Competitive scenario

6.9.1.4. South Africa market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.9.2. Saudi Arabia

6.9.2.1. Key country dynamics

6.9.2.2. Regulatory framework/ reimbursement structure

6.9.2.3. Competitive scenario

6.9.2.4. Saudi Arabia market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.9.3. UAE

6.9.3.1. Key country dynamics

6.9.3.2. Regulatory framework/ reimbursement structure

6.9.3.3. Competitive scenario

6.9.3.4. UAE market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

6.9.4. Kuwait

6.9.4.1. Key country dynamics

6.9.4.2. Regulatory framework/ reimbursement structure

6.9.4.3. Competitive scenario

6.9.4.4. Kuwait market estimates and forecasts 2018 to 2030 (USD Billion) (Numbers of Tests Conducted)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company/Competition Categorization

7.3. Vendor Landscape

7.3.1. List of key distributors and channel partners

7.3.2. Key customers

7.3.3. Key company market share analysis, 2023

7.3.4. Abbott

7.3.4.1. Company overview

7.3.4.2. Financial performance

7.3.4.3. Product benchmarking

7.3.4.4. Strategic initiatives

7.3.5. CINVEN

7.3.5.1. Company overview

7.3.5.2. Financial performance

7.3.5.3. Product benchmarking

7.3.5.4. Strategic initiatives

7.3.6. QUEST DIAGNOSTICS INCORPORATED

7.3.6.1. Company overview

7.3.6.2. Financial performance

7.3.6.3. Product benchmarking

7.3.6.4. Strategic initiatives

7.3.7. OPKO HEALTH, INC.

7.3.7.1. Company overview

7.3.7.2. Financial performance

7.3.7.3. Product benchmarking

7.3.7.4. Strategic initiatives

7.3.8. F. Laboratory Corporation of America Holdings

7.3.8.1. Company overview

7.3.8.2. Financial performance

7.3.8.3. Product benchmarking

7.3.8.4. Strategic initiatives

7.3.9. UNILABS

7.3.9.1. Company overview

7.3.9.2. Financial performance

7.3.9.3. Product benchmarking

7.3.9.4. Strategic initiatives

7.3.10. Synnovis Group LLP

7.3.10.1. Company overview

7.3.10.2. Financial performance

7.3.10.3. Product benchmarking

7.3.10.4. Strategic initiatives

7.3.11. SONIC HEALTHCARE

7.3.11.1. Company overview

7.3.11.2. Financial performance

7.3.11.3. Product benchmarking

7.3.11.4. Strategic initiatives

7.3.11.5. Strategic initiatives

List of Tables

Table 1 List of abbreviation

Table 2 North America clinical laboratory tests market, by region, 2018 - 2030 (USD Billion)

Table 3 North America clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 4 North America clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 5 U.S. clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 6 U.S. clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 7 Canada clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 8 Canada clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 9 Europe clinical laboratory tests market, by region, 2018 - 2030 (USD Billion)

Table 10 Europe clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 11 Europe clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 12 Germany clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 13 Germany clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 14 UK clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 15 UK clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 16 France clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 17 France clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 18 Italy clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 19 Italy clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 20 Spain clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 21 Spain clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 22 Denmark clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 23 Denmark clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 24 Sweden clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 25 Sweden clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 26 Norway clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 27 Norway clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 28 Asia Pacific clinical laboratory tests market, by region, 2018 - 2030 (USD Billion)

Table 29 Asia Pacific clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 30 Asia Pacific clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 31 China clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 32 China clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 33 Japan clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 34 Japan clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 35 India clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 36 India clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 37 South Korea clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 38 South Korea clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 39 Australia clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 40 Australia clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 41 Thailand clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 42 Thailand clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 43 Latin America clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 44 Latin America clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 45 Brazil clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 46 Brazil clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 47 Mexico clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 48 Mexico clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 49 Argentina clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 50 Argentina clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 51 MEA clinical laboratory tests market, by region, 2018 - 2030 (USD Billion)

Table 52 MEA clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 53 MEA clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 54 South Africa clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 55 South Africa clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 56 Saudi Arabia clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 57 Saudi Arabia clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 58 UAE clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 59 UAE clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

Table 60 Kuwait clinical laboratory tests market, by type, 2018 - 2030 (USD Billion) (Numbers of Tests Conducted)

Table 61 Kuwait clinical laboratory tests market, by end-use, 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Primary interviews in North America

Fig. 5 Primary interviews in Europe

Fig. 6 Primary interviews in APAC

Fig. 7 Primary interviews in Latin America

Fig. 8 Primary interviews in MEA

Fig. 9 Market research approaches

Fig. 10 Value-chain-based sizing & forecasting

Fig. 11 QFD modeling for market share assessment

Fig. 12 Market formulation & validation

Fig. 13 Clinical laboratory tests market: market outlook

Fig. 14 Clinical laboratory tests competitive insights

Fig. 15 Parent market outlook

Fig. 16 Related/ancillary market outlook

Fig. 17 Penetration and growth prospect mapping

Fig. 18 Industry value chain analysis

Fig. 19 Clinical laboratory tests market driver impact

Fig. 20 Clinical laboratory tests market restraint impact

Fig. 21 Clinical laboratory tests market strategic initiatives analysis

Fig. 22 Clinical laboratory tests market: Type movement analysis

Fig. 23 Clinical laboratory tests market: Type outlook and key takeaways

Fig. 24 CBC market estimates and forecast, 2018 - 2030

Fig. 25 HGB/HCT test market estimates and forecast, 2018 - 2030

Fig. 26 Basic metabolic panel market estimates and forecast, 2018 - 2030

Fig. 27 BUN creatinine test market estimates and forecast, 2018 - 2030

Fig. 28 Electrolyte tests market estimates and forecast, 2018 - 2030

Fig. 29 HbA1c tests market estimates and forecast, 2018 - 2030

Fig. 30 Comprehensive metabolic panel market estimates and forecast, 2018 - 2030

Fig. 31 Liver panel test market estimates and forecast, 2018 - 2030

Fig. 32 Hepatitis liver panel tests market estimates and forecast, 2018 - 2030

Fig. 33 Bile duct obstruction liver panel tests market estimates and forecast, 2018 - 2030

Fig. 34 Liver cirrhosis liver panel tests market estimates and forecast, 2018 - 2030

Fig. 35 Liver cancer liver panel tests market estimates and forecast, 2018 - 2030

Fig. 36 Bone disease liver panel tests market estimates and forecast, 2018 - 2030

Fig. 37 Autoimmune disorders liver panel tests market estimates and forecast, 2018 - 2030

Fig. 38 Others liver panel tests market estimates and forecast, 2018 - 2030

Fig. 39 Renal panel test market estimates and forecast, 2018 - 2030

Fig. 40 Lipid panel tests market estimates and forecast, 2018 - 2030

Fig. 41 Cardiovascular panel test market estimates and forecast, 2018 - 2030

Fig. 42 Clinical laboratory tests market: End-Use movement Analysis

Fig. 43 Clinical laboratory tests market: End-Use outlook and key takeaways

Fig. 44 Central Laboratories market estimates and forecasts, 2018 - 2030

Fig. 45 Primary Clinics market estimates and forecasts,2018 - 2030

Fig. 46 Global clinical laboratory tests market: Regional movement analysis

Fig. 47 Global clinical laboratory tests market: Regional outlook and key takeaways

Fig. 48 Global clinical laboratory tests market share and leading players

Fig. 49 North America market share and leading players

Fig. 50 Europe market share and leading players

Fig. 51 Asia Pacific market share and leading players

Fig. 52 Latin America market share and leading players

Fig. 53 Middle East & Africa market share and leading players

Fig. 54 North America: SWOT

Fig. 55 Europe SWOT

Fig. 56 Asia Pacific SWOT

Fig. 57 Latin America SWOT

Fig. 58 MEA SWOT

Fig. 59 North America, by country

Fig. 60 North America

Fig. 61 North America market estimates and forecasts, 2018 - 2030

Fig. 62 U.S.

Fig. 63 U.S. market estimates and forecasts, 2018 - 2030

Fig. 64 Canada

Fig. 65 Canada market estimates and forecasts, 2018 - 2030

Fig. 66 Europe

Fig. 67 Europe market estimates and forecasts, 2018 - 2030

Fig. 68 UK

Fig. 69 UK market estimates and forecasts, 2018 - 2030

Fig. 70 Germany

Fig. 71 Germany market estimates and forecasts, 2018 - 2030

Fig. 72 France

Fig. 73 France market estimates and forecasts, 2018 - 2030

Fig. 74 Italy

Fig. 75 Italy market estimates and forecasts, 2018 - 2030

Fig. 76 Spain

Fig. 77 Spain market estimates and forecasts, 2018 - 2030

Fig. 78 Denmark

Fig. 79 Denmark market estimates and forecasts, 2018 - 2030

Fig. 80 Sweden

Fig. 81 Sweden market estimates and forecasts, 2018 - 2030

Fig. 82 Norway

Fig. 83 Norway market estimates and forecasts, 2018 - 2030

Fig. 84 Asia Pacific

Fig. 85 Asia Pacific market estimates and forecasts, 2018 - 2030

Fig. 86 China

Fig. 87 China market estimates and forecasts, 2018 - 2030

Fig. 88 Japan

Fig. 89 Japan market estimates and forecasts, 2018 - 2030

Fig. 90 India

Fig. 91 India market estimates and forecasts, 2018 - 2030

Fig. 92 Thailand

Fig. 93 Thailand market estimates and forecasts, 2018 - 2030

Fig. 94 South Korea

Fig. 95 South Korea market estimates and forecasts, 2018 - 2030

Fig. 96 Australia

Fig. 97 Australia market estimates and forecasts, 2018 - 2030

Fig. 98 Latin America

Fig. 99 Latin America market estimates and forecasts, 2018 - 2030

Fig. 100 Brazil

Fig. 101 Brazil market estimates and forecasts, 2018 - 2030

Fig. 102 Mexico

Fig. 103 Mexico market estimates and forecasts, 2018 - 2030

Fig. 104 Argentina

Fig. 105 Argentina market estimates and forecasts, 2018 - 2030

Fig. 106 Middle East and Africa

Fig. 107 Middle East and Africa market estimates and forecasts, 2018 - 2030

Fig. 108 South Africa

Fig. 109 South Africa market estimates and forecasts, 2018 - 2030

Fig. 110 Saudi Arabia

Fig. 111 Saudi Arabia market estimates and forecasts, 2018 - 2030

Fig. 112 UAE

Fig. 113 UAE market estimates and forecasts, 2018 - 2030

Fig. 114 Kuwait

Fig. 115 Kuwait market estimates and forecasts, 2018 - 2030

Fig. 116 Market share of key market players- ClinicalWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Complete Blood Count

- HGB/ HCT Testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- End-Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Central Laboratories

- Regional Outlook (Revenue, USD Billion, 2018- 2030)

- North America

- North America Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Complete Blood Count

- HGB/ HCT Testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- North America Market: End-Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Central Laboratories

- U.S.

- U.S. Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Complete Blood Count

- HGB/ HCT Testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- U.S. Market: End-Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Central Laboratories

- U.S. Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Canada

- Canada Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Complete Blood Count

- HGB/ HCT Testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Canada Market: End-Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Central Laboratories

- Canada Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- North America Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Europe

- Europe Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Complete Blood Count

- HGB/ HCT Testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Europe Market: End-Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Central Laboratories

- U.K.

- UK Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Complete Blood Count

- HGB/ HCT Testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- UK Market: End-Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Central Laboratories

- UK Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Germany

- Germany Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Complete Blood Count

- HGB/ HCT Testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Germany Market: End-Use Outlook (Revenue in USD Billion, 2018 - 2030) Central Laboratories

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Central Laboratories

- Germany Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- France

- France Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Complete Blood Count

- HGB/ HCT Testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- France Market: End-Use Outlook (Revenue in USD Billion, 2018 - 2030) Central Laboratories

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Central Laboratories

- France Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Italy

- Italy Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Complete Blood Count

- HGB/ HCT Testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Italy Market: End-Use Outlook (Revenue in USD Billion, 2018 - 2030) Central Laboratories

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Central Laboratories

- Italy Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Spain

- Spain Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Complete Blood Count

- HGB/ HCT Testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Spain Market: End-Use Outlook (Revenue in USD Billion, 2018 - 2030) Central Laboratories

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Central Laboratories

- Spain Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Denmark

- Denmark Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Complete Blood Count

- HGB/ HCT Testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Denmark Market: End-Use Outlook (Revenue in USD Billion, 2018 - 2030) Central Laboratories

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Central Laboratories

- Denmark Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Sweden

- Sweden Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Complete Blood Count

- HGB/ HCT Testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Sweden Market: End-Use Outlook (Revenue in USD Billion, 2018 - 2030) Central Laboratories

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Central Laboratories

- Sweden Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Norway

- Norway Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Complete Blood Count

- HGB/ HCT Testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Norway Market: End-Use Outlook (Revenue in USD Billion, 2018 - 2030) Central Laboratories

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Central Laboratories

- Norway Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Europe Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Asia Pacific

- Asia Pacific Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Complete Blood Count

- HGB/ HCT Testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Asia Pacific Market: End-Use Outlook (Revenue in USD Billion, 2018 - 2030) Central Laboratories

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Central Laboratories

- Japan

- Japan Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Complete Blood Count

- HGB/ HCT Testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Japan Market: End-Use Outlook (Revenue in USD Billion, 2018 - 2030) Central Laboratories

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Central Laboratories

- Japan Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- China

- China Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Complete Blood Count

- HGB/ HCT Testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- China Market: End-Use Outlook (Revenue in USD Billion, 2018 - 2030) Central Laboratories

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Central Laboratories

- China Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- India

- India Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Complete Blood Count

- HGB/ HCT Testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- India Market: End-Use Outlook (Revenue in USD Billion, 2018 - 2030) Central Laboratories

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Central Laboratories

- India Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Australia

- Australia Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Complete Blood Count

- HGB/ HCT Testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Australia Market: End-Use Outlook (Revenue in USD Billion, 2018 - 2030) Central Laboratories

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Central Laboratories

- Australia Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Thailand

- Thailand Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Complete Blood Count

- HGB/ HCT Testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Thailand Market: End-Use Outlook (Revenue in USD Billion, 2018 - 2030) Central Laboratories

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Central Laboratories

- Thailand Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- South Korea

- South Korea Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Complete Blood Count

- HGB/ HCT Testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- South Korea Market: End-Use Outlook (Revenue in USD Billion, 2018 - 2030) Central Laboratories

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Central Laboratories

- South Korea Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Asia Pacific Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Latin America

- Latin America Market: Type Outlook (Revenue in USD Billion, Numbers of Tests Conducted, 2018 - 2030)

- Complete Blood Count

- HGB/ HCT Testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Latin America Market: End-Use Outlook (Revenue in USD Billion, 2018 - 2030) Central Laboratories

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing