- Home

- »

- Medical Devices

- »

-

Clinical Trial Biorepository & Archiving Solutions Market Report, 2030GVR Report cover

![Clinical Trial Biorepository & Archiving Solutions Market Size, Share & Trends Report]()

Clinical Trial Biorepository & Archiving Solutions Market Size, Share & Trends Analysis Report By Service (Biorepository Services, Archiving Solution Services), By Product, By Phase, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-532-8

- Number of Report Pages: 192

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

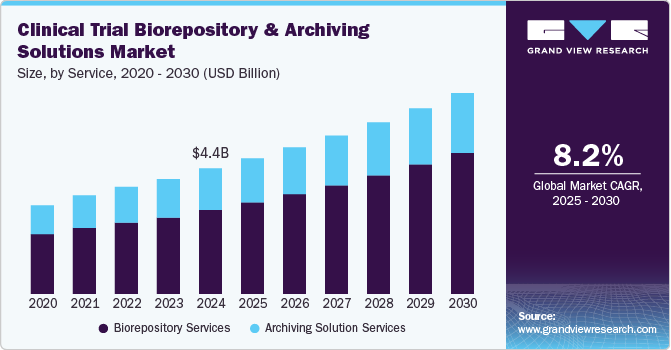

The global clinical trial biorepository & archiving solutions market size was valued at USD 4.0 billion in 2023 and is projected to grow at a CAGR of 8.17% from 2024 to 2030. Major pharmaceutical companies are focusing on outsourcing R&D activities to enhance their core competencies, which is expected to drive overall market growth. Furthermore, the economic benefits of outsourcing in comparison to investing in cold storage equipment and other related supplies are also expected to boost the demand over the forecast period. Maintaining pace with the growing storage and transportation technology, global regulatory requirements, and current bio-storage trends can immensely cost time and effort.

CROs are witnessing major revenue growth owing to rising R&D expenditure and increasing focus of pharmaceutical companies on novel drug development with reduced cost. Biopharmaceutical companies are increasingly outsourcing their clinical trials to CROs to reduce product development time and cost. This trend is expected to continue in the future due to an increase in the capabilities of CROs to perform complex research, which is expected to reduce additional efforts by biopharmaceutical companies to monitor complex processes of clinical trials. Collaborations between biopharmaceuticals and CROs are expected to have a positive impact on the global market, as it will ensure consistent clinical trials.

Furthermore, surge in the number of biotechnology & pharmaceutical companies is compelling manufacturers to provide effective and advanced drugs, leading to an increase in the number of clinical trials, as these companies are focusing on novel drug discoveries, thereby driving the overall market growth. Moreover, increase in the number of drug discoveries by pharmaceutical companies is promoting advancements in drug development technologies and increasing their adoption worldwide, which is fueling the demand for clinical trial biorepository & archiving solutions services, thereby propelling market growth over the forecast period.

Besides, growing demand for biologics, biosimilars, personalized medicine, adaptive trial designs, orphan drugs, and companion diagnostics is estimated to boost the demand for clinical trial biorepository & archiving solutions services. As biopharmaceutical companies explore new frontiers, the accelerating requirement to adhere to continuously evolving regulations drives the demand for specialized service providers. Furthermore, stringent regulatory requirements mandate the appropriate archiving of clinical trial data and samples, safeguarding their integrity & compliance. This expansion in the pharmaceutical and biotech sectors impelled the need for advanced biorepository and archiving solutions, promoting market growth. The adoption of cutting-edge technologies for sample storage, management, & retrieval further enhances the efficiency and reliability of these solutions, accelerating industry growth.

Market Concentration & Characteristics

The clinical trial biorepository & archiving solutions industry growth stage is moderate, and the market growth is accelerating. It is characterized by the level of merger and acquisition activities, degree of innovation, the impact of regulations, product expansions, and regional expansions.

The clinical trial biorepository & archiving solutions have observed advancements due to the R&D of advanced therapies by various pharmaceutical companies,increasing demand for personalized medicine and growing biotechnological research. This has led rise in sophisticated biorepository services capable of securely storing diverse biological samples.

The growing presence of market players has made the market more competitive, leading to a rise in mergers and acquisitions. Besides, the market has been proven to facilitate gains, leadership retention, or international expansion.

Increasing regulatory pressure, shorter time frame to complete the trials, and expiration of patents have led to an increase in the demand for clinical trials biorepository & archiving solutions, which further drives the market over the estimated time period.

Rising expansions and increasing R&D activities have led to a rise in demand for clinical trial biorepository & archiving solutions, further influencing the market dynamics positively. Besides, innovations in biotechnology, including advanced storage and data management systems, are enhancing the capacity to store & manage diverse biological samples efficiently.

The increase in the number of temperature-sensitive drugs and biologics, rising outsourcing of clinical trials, and the existence of technologically advanced service providers have led the market growth.

Service Insights

On the basis of service segment, the market is classified into biorepository services and archiving solution services. The biorepository service is sub-segmented into transportation, warehousing & storage, sample processing, and others. In addition, the archiving solution services include database indexing and management and scanning & destruction. In 2023, the biorepository services segment dominated the market, accounting for a revenue share of 66.35%. The segment growth can be attributed to the rise in R&D of advanced therapies, such as regenerative medicine, personalized medicine, and cancer genomic studies, which require effective storage, distribution, and processing solutions. Moreover, the increasing complexity and scale of clinical trials necessitate robust storage & management solutions for biological samples. Regulatory requirements for sample traceability and quality assurance drive demand for specialized biorepository services.

The archiving solution services segment is also expected to grow significantly over the forecast period. The majority of clinical trials are currently being conducted in developing countries. The increasing cost of clinical trials & complications in the recruitment of patients in certain developed economies has encouraged biopharmaceutical companies to outsource clinical trials to regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East. This globalization of clinical trials is expected to trigger a need for several archiving solutions, such as material indexing, real-time material management systems, tracking solutions, and multi-site archiving solutions, thereby positively boosting segment growth.

Product Insights

On the basis of the product segment, the market is segmented into preclinical products and clinical products. In 2023, the clinical products segment accounted for the largest revenue share of 63.3% in 2023. The clinical products are sub-segmented into organs, human tissue, stem cells, and other biospecimen. The segment growth is driven by a highly competitive drug development market and growing demand for end-to-end global clinical services. The clinical services ideally provide support, expertise, and services for drug formulation, clinical trials (phase I-IV), scale-up, validation & large-scale commercial manufacturing, sourcing, management, packaging & labeling, storage, and distribution. Furthermore, increased clinical trial registrations in recent years will drive the segment growth. For instance, as of January 2023, ClinicalTrials.gov reported that 437,544 trials had been registered in 219 countries, compared to around 399,509 in 2022 and nearly 362,490 in 2021. Such factors are anticipated to drive the segment growth.

In 2023, the preclinical products segment is anticipated to grow at a CAGR of 7.96% over the forecast period. This can be attributed to increasing demand for the treatment of novel diseases such as COVID-19, Zika virus, & Ebola and the growing prevalence of existing diseases such as cardiovascular, cancer, & neurological diseases. Rising R&D activities have further fueled the segment growth. In addition, increasing molecules in the preclinical stage are anticipated to create significant opportunities for market players. Products such as peripheral blood mobilized peripheral blood, and bone marrow collected from multiple species such as non-human primates, non-rodent animals, & rodents are used to facilitate preclinical studies.

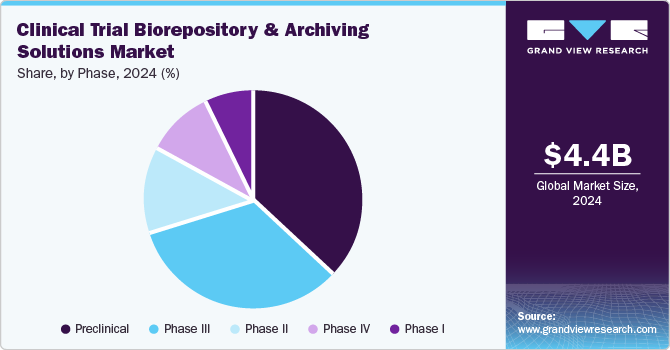

Phase Insights

On the basis of phase segment, the market is segmented into preclinical, phase I, phase II, phase III, and phase IV. The preclinical segment accounted for the largest revenue share of 36.7% in 2023. The segment growth can be attributed to the growing emphasis on data integrity & transparency. Moreover, advancements in biotechnological innovations and the increasing complexity of trial designs further highlight the importance of efficient biorepository & archiving solutions during preclinical trials to ensure reliable data preservation and accessibility for analysis & regulatory review.

The phase II segment is anticipated to grow at the fastest CAGR over the forecast period. Among phases, phase II clinical trials had the highest number of projects and are expected to continue over the forecast period due to increasing investments in research and development by industry & non-industry sponsors. A high number of sponsored & non-sponsored industry clinical trials in phase II, the complexity associated with phase II clinical trials, and the globalization of clinical trials are expected to drive the growth of the clinical trial biorepository & archiving solutions market. For instance, in June 2024, Bay Area Research Logistics mentioned its expansion by opening a new depot in the U.S. The expanded facility is expected to provide clinical trial supplies services across the U.S. and the globe. This new capacity will be added to the company’s existing walk-in cold rooms, standard & ultra-low freezers, & controlled warehousing, providing a range of temperature storage (20ºC, -80°C, 2-8ºC, 15-25ºC) options. Such factors are anticipated to drive the market over the estimated time period.

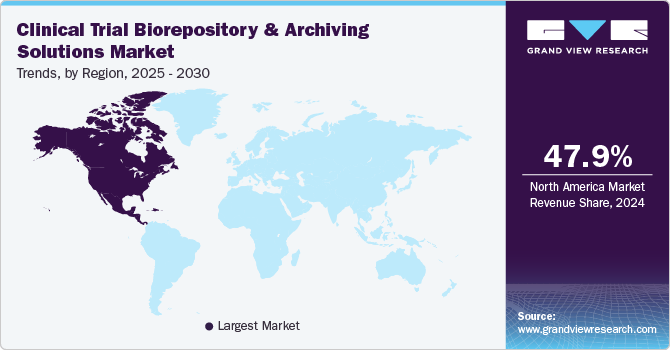

Regional Insights

North America clinical trial biorepository & archiving solutions market accounted for the largest share of 47.99% in 2023. The increase in the number of clinical trials and several market players in the region aiming to expand their existing services are further contributing to the growth of clinical trial biorepository & archiving solutions. Moreover, the availability of advanced technology in the region is contributing to the region's market growth. For instance, in June 2024, Thermo Fisher Scientific, Inc. announced the expansion of its central laboratory operations in the U.S., which aims to expand its sample management and biorepository operations, further enabling the company to strengthen its business in the region.

U.S. Clinical Trial Biorepository & Archiving Solutions Market Trends

The clinical trial biorepository & archiving solutions market in the U.S. accounted for the largest share of the North American market. An increasing number of clinical trials and a rising number of companies offering clinical trial biorepository & archiving solutions are among the major factors driving the market growth in the U.S. For instance, according to the data published by Atlassciences LA, as of July 2022, approximately 422,201 clinical studies were registered on ClinicalTrials.gov. Out of these studies, 32% were conducted in the U.S. Furthermore, the presence of several CROs such as Quintiles, Covance, Inc., and PAREXEL International Corporation offering a wide range of services is contributing to the clinical trial biorepository & archiving solutions market growth.

Europe Clinical Trial Biorepository & Archiving Solutions Market Trends

The clinical trial biorepository & archiving solutions market in Europe is expected to grow significantly due to advancements in technology, the increasing number of clinical trials in this region, and the presence of key players offering clinical trial biorepository & archiving solutions is expected to contribute to the increasing demand for the market in this region.

Germany clinical trial biorepository & archiving solutions market the largest share in 2023, owing to advancements in technology and the availability of high-quality clinical resources are some of the main factors responsible for the country's market growth. Besides, rising demand for clinical trials in Germany and several CROs in the country are among the major factors boosting the demand for clinical trial biorepository & archiving solutions, thereby boosting the market growth over the forecast period.

The clinical trial biorepository and archiving solutions market in the UK is anticipated to grow over the forecast period owing to the high demand for clinical trials in the country. Several players, such as Bristol Biomedical Research Center and Biocentre, are offering these solutions in the country. These factors are anticipated to drive market growth over the forecast period.

Asia Pacific Clinical Trial Biorepository & Archiving Solutions Market Trends

The clinical trial biorepository & archiving solutions market in Asia Pacific is expected to grow at a CAGR of 14.22% during the forecast period. The market is driven by constant advancement and growth in the clinical research field. Low cost per patient in Asia Pacific countries and a diverse group of patients that are easy to recruit contribute to the market growth.

China clinical trial biorepository & archiving solutions market held the largest share in 2023 due to the diverse pool of patients and the growing pharmaceutical market. Moreover, reforms in policy, such as the adoption of Goods Supply Practices for pharmaceutical products, are expected to contribute to market growth in China.

The clinical trial biorepository and archiving solutions market in Japan is expected to grow over the forecast period due to growing government support. Faster clinical trial approval is expected to encourage market players to invest in the country's market, as it would be easy for companies to accelerate their product launches. Such factors are anticipated to drive the market over the estimated period.

India clinical trial biorepository & archiving solutions market is anticipated to grow at the fastest CAGR over the forecast period. An increasing number of clinical trials in India, owing to growing demand for treatment options for cardiovascular diseases, kidney diseases, and diabetes, is one of the major factors driving market growth.

Key Clinical Trial Biorepository & Archiving Solutions Company Insights

Several key players are adopting various strategic initiatives to strengthen their market position, offering clinical trial biorepository & archiving solutions for innovating various pharmaceutical vaccines and drugs. The prominent strategies companies adopt are agreements, new launches, partnerships, mergers & acquisitions/joint ventures, expansions, and others to increase market presence and revenue and gain a competitive edge, driving market growth.

Key Clinical Trial Biorepository & Archiving Solutions Companies:

The following are the leading companies in the clinical trial biorepository & archiving solutions market. These companies collectively hold the largest market share and dictate industry trends.

- Medpace

- American Type Culture Collection (ATCC)

- Cell&Co BioServices (Cryoport)

- Brooks Life Sciences (Azenta, Inc.)

- Patheon (Thermo Fisher Scientific, Inc.)

- Precision Medicine Group, LLC.

- Labcorp Drug Development

- Q2 Solutions

- LabConnect

- Charles River Laboratories

Recent Developments

-

In June 2024, Cryoport expanded its Pont-du-Chateau facility in France. This expansion more than doubled the facility's capacity, enhancing its biostorage and bioservice capabilities.

-

In April 2024, LabConnect acquired a scientific consulting company, A4P Consulting Ltd (A4P). A4P Consulting Ltd specializes in biomarker strategy, biosample & bioanalytical project management, and logistics solutions for preclinical & clinical trials.

Clinical Trial Biorepository & Archiving Solutions Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.38 billion

Revenue forecast in 2030

USD 7.0 billion

Growth rate

CAGR of 8.17% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, Product, Phase, Region

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Mexico, Argentina, Colombia, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Medpace, American Type Culture Collection (ATCC), Cell&Co BioServices (Cryoport), Brooks Life Sciences (Azenta, Inc.), Patheon (Thermo Fisher Scientific, Inc.), Precision Medicine Group, LLC., Labcorp Drug Development, Q2 Solutions, LabConnect, Charles River Laboratories

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Clinical Trial Biorepository & Archiving Solutions Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clinical trial biorepository & archiving solutions market report on the basis of service, product type, phase and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Biorepository Services

-

Warehousing & storage

-

Transportation

-

Sample Processing

-

Others

-

-

Archiving Solution Services

-

Database Indexing and Management

-

Scanning & Destruction

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Preclinical Products

-

Clinical Products

-

Human Tissue

-

Organs

-

Stem cells

-

Other biospecimens

-

-

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Preclinical

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical trial biorepository & archiving solutions market size was estimated at USD 4.0 billion in 2023 and is expected to reach USD 4.38 billion in 2024.

b. The global clinical trial biorepository & archiving solutions market is expected to grow at a compound annual growth rate of 8.17% from 2024 to 2030 to reach USD 7.0 billion by 2030.

b. North America dominated the global clinical trial biorepository and archiving solutions market in 2023, accounting for a revenue share of 48.43%. The increase in the number of clinical trials and several market players in the region aiming to expand their existing services are further contributing to the growth of clinical trial biorepository & archiving solutions.

b. Some key players operating in the clinical trial biorepository & archiving solutions market include Medpace; American Type Culture Collection (ATCC); Cell&Co BioServices (Cryoport); Brooks Life Sciences (Azenta, Inc.); Patheon (Thermo Fisher Scientific Inc.); Precision Medicine Group, LLC.; LabCorp; Q2 Solutions; LabConnect; and Charles River Laboratories International, Inc.

b. Key factors driving the clinical trial biorepository & archiving solutions market growth include outsourcing R&D activities, the growing number of pharmaceutical and biotechnology companies, the high disease variation and prevalence rate, increasing R&D investments, and rising growth in the CRO market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."