- Home

- »

- Medical Devices

- »

-

Clinical Trial Supplies Market Size, Industry Report, 2030GVR Report cover

![Clinical Trial Supplies Market Size, Share & Trends Report]()

Clinical Trial Supplies Market (2025 - 2030) Size, Share & Trends Analysis Report By Clinical Phase (Phase I, Phase II, Phase III), By Product & Services, By End Use, By Therapeutic Area, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-514-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Clinical Trial Supplies Market Summary

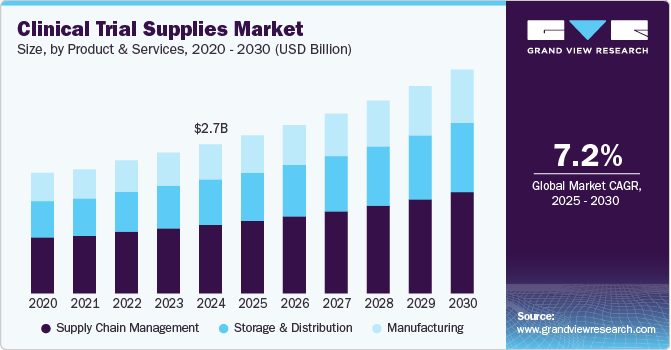

The global clinical trial supplies market size was estimated at USD 2.73 billion in 2024 and is projected to reach USD 4.10 billion by 2030, growing at a CAGR of 7.19% from 2025 to 2030. The market growth is primarily driven by increasing R&D investments, the rising prevalence of chronic diseases, and the globalization of clinical trials.

Key Market Trends & Insights

- North America dominated the global immersive virtual reality market with the largest revenue share of 34.6% in 2024.

- The immersive virtual reality market in the U.S. led North America and held the largest revenue share in 2024.

- Based on clinical phase, the phase III segment led the market with the largest revenue share of 53.03% in 2024.

- Based on product & service, the supply chain management segment accounted for the largest market revenue share in 2024.

- Based on therapeutic use, the oncology segment accounted for the largest market revenue share in 2024.

- Based on end use, the pharmaceuticals segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.73 Billion

- 2030 Projected Market Size: USD 4.10 Billion

- CAGR (2025-2030): 7.19%

- North America: Largest market in 2024

The expansion of biologics and personalized medicine heightened demand for complex supply chain solutions, including temperature-sensitive logistics and just-in-time delivery models.

In addition, regulatory advancements and digitalization, such as blockchain for supply chain transparency and AI-driven forecasting, are optimizing efficiency. Further, growing outsourcing trends among pharmaceutical and biotech firms to specialized supply providers further boost market expansion. However, logistical challenges, stringent regulatory requirements, and cost pressures remain key constraints. Emerging markets, particularly in Asia-Pacific, exhibit lucrative market growth opportunities due to lower trial costs and an expanding patient pool for recruitment.

The increasing focus on biologics and personalized medicine is accelerating the clinical trial supplies industry, requiring specialized supply chain solutions. Biologic drugs, such as monoclonal antibodies, cell therapies, and gene therapies, require highly controlled storage and transportation conditions, including cold chain logistics. As these treatments gain prominence, supply chain providers enhance their ability to manage temperature-sensitive materials efficiently.

Moreover, the rise of personalized medicine, which customizes treatments based on genetic profiles, increased the demand for just-in-time (JIT) manufacturing and delivery models. These approaches minimize waste, reduce costs, and ensure that patient-specific drugs reach clinical sites efficiently. Therefore, pharmaceutical companies collaborate with specialized logistics providers to streamline operations and maintain product integrity. The growing adoption of decentralized clinical trials (DCTs) further enhances the need for flexible supply chain strategies, supporting the broader market expansion by improving accessibility and efficiency in trial execution.

Most clinical trials are currently being conducted in developing economies. The increasing cost of clinical trials and complications in the recruitment of patients have encouraged biopharmaceutical companies to outsource clinical trials to regions such as Asia Pacific, Latin America, Central & Eastern Europe, and the Middle East. Disease variation in developing economies further aids biopharmaceutical companies in performing clinical trials on rare diseases. Some regions, such as Asia Pacific, also provide more significant economic benefits to biopharmaceutical companies, as governments in Singapore and China allocate funds to promote biomedical research. In Latin America, patient recruitment is easy due to reduced language barriers, which can help obtain informed consent easily, resulting in a faster clinical trial process.

Further, the global clinical trial supplies industry is significantly driven by increasing R&D investments in drug development and the rising prevalence of chronic diseases. Pharmaceutical and biotechnology companies are allocating higher budgets to clinical trials, increased by the growing need for novel therapeutics across oncology, cardiovascular, and rare diseases. This has led to an increase in the number and complexity of clinical trials, requiring efficient supply chain management.

Furthermore, the rise in chronic diseases, driven by aging populations and lifestyle changes, has expanded the demand for clinical trials, further propelling the need for reliable supply solutions. As a result, clinical trial supply providers are investing in advanced logistics, temperature-controlled storage, and real-time monitoring technologies to ensure the integrity of trial materials. The growing regulatory highlighting on Good Manufacturing Practices (GMP) and Good Distribution Practices (GDP) also imposes robust supply chain solutions to ensure compliance, further stimulating market growth.

The increasing complexity of clinical trials is prompting pharmaceutical and biotechnology companies to outsource their supply chain management to specialized clinical trial supply providers. Outsourcing allows sponsors to utilize the expertise of third-party logistics (3PL) providers, contract manufacturing organizations (CMOs), and contract research organizations (CROs) that offer specialized solutions for investigational drug distribution, packaging, and regulatory compliance.

By partnering with specialized vendors, companies can optimize costs, streamline operations, and mitigate risks associated with supply chain disruptions. The rising adoption of flexible outsourcing models, including functional service provider (FSP) partnerships and end-to-end supply chain solutions, further accelerates market growth. As clinical trials expand into emerging markets and decentralized models, there is rising demand for specialized logistics partners with global reach and regulatory expertise.

Market Opportunities

The global clinical trial supplies industry presents substantial opportunities driven by advancements in biologics and personalized medicine, increasing digitalization, outsourcing trends, and expansion into emerging markets. The growing utilization of AI-driven forecasting, blockchain for transparency, and just-in-time logistics to enhance operational efficiency in the supply chain drives overall market growth. As clinical trial models evolve, stakeholders investing in digital innovation, regulatory compliance solutions, and global distribution networks are poised for long-term industry growth.

-

The increasing adoption of biologics, gene therapies, and personalized medicine drives demand for specialized cold chain logistics, just-in-time delivery, and direct-to-patient supply models. Future advancements in cryogenic storage and monitoring technologies will enhance supply chain efficiency.

-

The integration of blockchain, AI-powered forecasting, and IoT tracking is improving supply chain transparency and efficiency. Predictive analytics and smart logistics will further optimize inventory management, reducing trial delays and compliance risks.

-

Pharma companies are increasingly outsourcing clinical trial supply management to specialized logistics providers, optimizing costs and streamlining operations. AI-driven logistics automation and scalable outsourcing solutions will enhance supply chain efficiency and resilience.

-

Expansion into Asia-Pacific, Latin America, and Eastern Europe offers cost advantages and larger patient pools. Future investments in regional cold chain logistics and automated distribution networks will improve trial execution and accessibility.

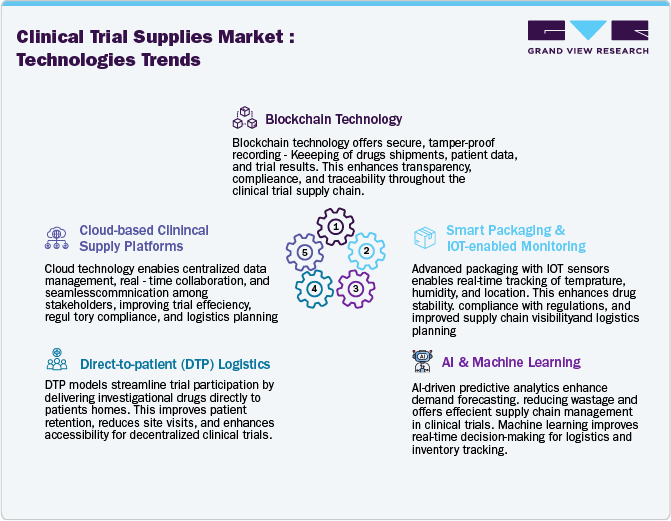

Technology Landscape

The clinical trial supplies industry is witnessing rapid digital transformation, with innovative technologies enhancing supply chain efficiency, compliance, and transparency. Blockchain technology transforms supply chain security by enabling tamper-proof record-keeping, improving data integrity and regulatory compliance. AI-driven forecasting and machine learning algorithms optimize demand planning, reduce wastage, and prevent supply shortages. In addition, IoT-enabled sensors and RFID tracking improve real-time monitoring of temperature-sensitive investigational drugs, boosting compliance with Good Distribution Practices (GDP). These advancements are significantly reducing logistical risks and enhancing the efficiency of global clinical trial operations.

Decentralized trials and direct-to-patient (DTP) supply models are reshaping clinical trial logistics, requiring sophisticated digital solutions for remote patient monitoring and supply chain coordination. The adoption of cloud-based platforms and digital twin technology is streamlining inventory management, site coordination, and regulatory compliance. Furthermore, robotic process automation (RPA) improves packaging, labeling, and shipment processes, minimizing errors and reducing operational costs. As clinical trials become more complex and globalized, service providers investing in AI-driven logistics, predictive analytics, and automated distribution networks will gain a competitive advantage in the clinical trial supplies industry.

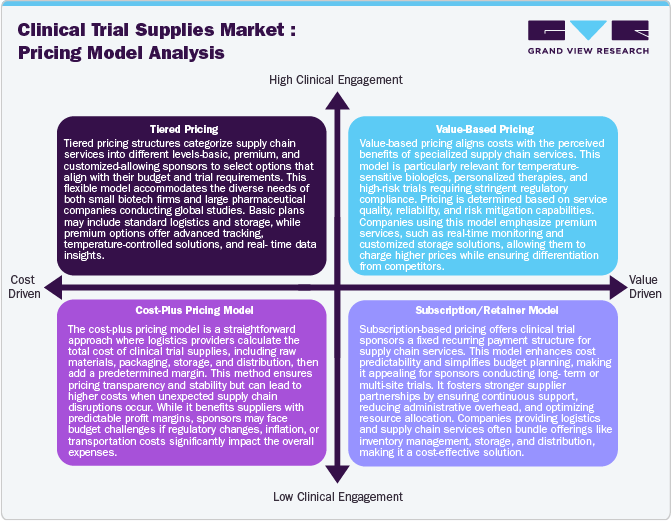

Pricing Model Analysis

The diverse pricing models in the clinical trial supplies industry offer cost flexibility, scalability, and efficiency for healthcare companies. Cost-plus pricing enhances transparency and predictable profit margins, making it ideal for long-term budgeting. Subscription-based models provide stability, especially for biotech firms streaming multiple trials, enabling access to specialized logistics without high upfront costs. Pay-per-use pricing offers financial flexibility, reducing expenses for early-phase trials with variable supply needs. These models help optimize budgets while increasing regulatory compliance and operational efficiency.

Value-based and tiered pricing models enhance service customization, aligning costs with trial complexity and performance. Value-based pricing ensures premium services, such as AI-driven monitoring and blockchain transparency, reducing trial disruptions. Tiered pricing structures cater to trials of different scales, offering tailored logistics solutions based on site numbers and regulatory requirements. As decentralized trials and emerging markets expand, flexible pricing models will drive affordability, efficiency, and innovation in the clinical trial supplies industry.

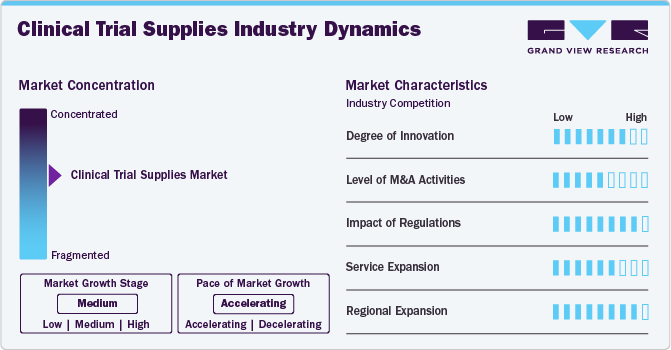

Market Concentration & Characteristics

The market growth stage is medium, and the pace is accelerating. The clinical trial supplies industry is characterized by a high degree of innovation, level of M&A activities, impact of regulations, service expansion, and regional expansion.

The clinical trial supplies industry is witnessing rapid innovation driven by AI-powered demand forecasting, blockchain-based supply chain transparency, and IoT-enabled temperature monitoring. Advanced packaging, cryogenic storage solutions, and direct-to-patient logistics improve supply chain efficiency. Continuous technological advancements are enhancing compliance, reducing trial delays, and improving the management of biologics and personalized therapies.

Mergers and acquisitions (M&A) are reshaping the market as pharmaceutical companies and logistics providers seek to expand capabilities and global reach. Strategic acquisitions of contract research organizations (CROs) and supply chain service providers are streamlining operations and enhancing service offerings. This consolidation trend improves efficiency, strengthens competitive positioning, and accelerates the adoption of advanced clinical supply solutions.

Stringent global regulations, including Good Distribution Practices (GDP) and evolving compliance frameworks, drive the need for standardized clinical trial supply solutions. Regulatory requirements for temperature-sensitive biologics and patient-centric trial models are increasing operational complexities, propelling market demand.

Growing demand for end-to-end clinical trial supply solutions is driving service expansion among logistics providers. Companies are offering integrated packaging, labeling, storage, and just-in-time distribution to optimize trial efficiency. Increasing adoption of decentralized and virtual trials further enhances service diversification, with enhanced direct-to-patient delivery models and AI-driven supply chain optimization.

The shift toward emerging markets, particularly in Asia-Pacific, Latin America, and Eastern Europe, is driving regional expansion in clinical trial supplies. Cost advantages, diverse patient recruitment, and improving regulatory frameworks attract global clinical trials. Companies investing in localized supply chain infrastructure, cold storage facilities, and streamlined customs clearance processes are gaining a competitive edge in these high-growth regions.

Clinical Phase Insights

Based on clinical phase, the phase III segment led the market with the largest revenue share of 53.03% in 2024. The segment growth is owing to its large-scale patient recruitment, extended trial duration, and complex logistics. Increased R&D investments, demand for biologics, and stringent regulatory requirements drive demand for clinical trial supplies. Advanced cold chain logistics, just-in-time inventory management, and global site distribution further accelerate demand for efficient clinical trial supplies.

The Phase I segment is anticipated to register at the fastest CAGR over the forecast period. The high segment growth is due to rising early-stage drug development investments and increasing clinical trials for biologics and personalized medicine. The need for rapid patient recruitment, adaptive trial designs, and specialized logistics for small-batch investigational drugs fosters market growth. Advanced cold chain solutions and regulatory compliance further enhance demand for clinical trial supplies in phase I.

Product & Service Insights

Based on product & service, the supply chain management segment accounted for the largest market revenue share in 2024, driven by the increasing complexity of global trials and the demand for efficient logistics solutions. This segment includes inventory management, packaging, labeling, storage, and distribution. Advanced technologies such as AI-driven forecasting, blockchain for transparency, and IoT-enabled tracking enhance supply chain flexibility. As decentralized trials and biologics expand, optimized supply chain solutions are vital for timely and compliant trial execution.

The manufacturing segment is anticipated to grow at a significant CAGR during the forecast period, driven by increasing demand for biologics, personalized medicine, and complex trial designs. This segment includes the production of investigational drugs, placebo manufacturing, and customized dosage forms. Advancements in automated manufacturing, adaptive trial protocols, and sterile packaging solutions are enhancing efficiency. As clinical trials expand globally, the need for scalable, high-quality manufacturing capabilities is accelerating, positioning this segment.

Therapeutic Use Insights

Based on therapeutic use, the oncology segment accounted for the largest market revenue share in 2024. The growing demand for biologics, immunotherapies, and personalized medicine requires specialized logistics, including temperature-controlled storage and just-in-time delivery. Advancements in decentralized trials and biomarker-driven drug development further increase supply chain complexities, demanding efficient clinical trial supplies services. As oncology trials expand globally, optimized clinical supply strategies are essential for accelerating drug development and regulatory compliance.

On the other hand, the cardiovascular disease segment is anticipated to register at the second fastest CAGR over the forecast period, driven by rising global prevalence and increasing R&D investments in novel therapies. Advancements in biologics, gene therapies, and personalized medicine are fueling demand for specialized logistics solutions. Stringent regulatory requirements and complex trial designs necessitate efficient supply chain management, including temperature-controlled storage and real-time tracking.

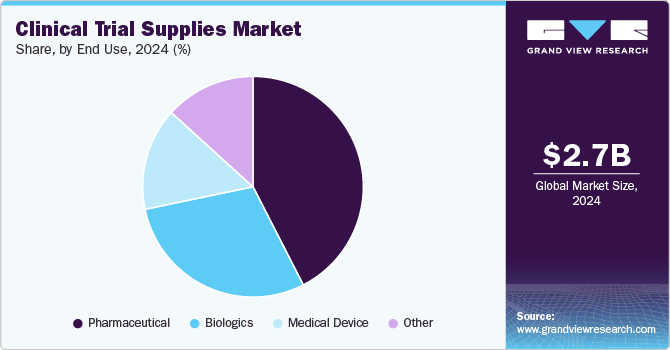

End Use Insights

Based on end use, the pharmaceuticals segment accounted for the largest market revenue share in 2024. Pharmaceutical companies invest heavily in R&D to create novel medications and treatments. Pharmaceutical companies require efficient supply chain solutions for investigational drugs, biologics, and personalized medicine. Advanced logistics, temperature-controlled storage, and regulatory-compliant distribution are critical for trial success. As clinical trials expand globally and decentralized models gain traction, pharmaceutical firms outsource ancillary services, including clinical trial supplies, to streamline supply chain management and bolster segmental growth.

The biologics segment is anticipated to grow at the fastest CAGR during the forecast period, driven by the increasing demand for complex therapies like monoclonal antibodies, gene therapies, and personalized medicine. These products require stringent temperature-controlled logistics, specialized packaging, and advanced storage solutions. Innovations in cryogenic transport, just-in-time delivery, and real-time monitoring are enhancing supply chain efficiency. As regulatory frameworks evolve and precision medicine developments, the biologics segment will continue to drive significant growth in the clinical trial supplies industry.

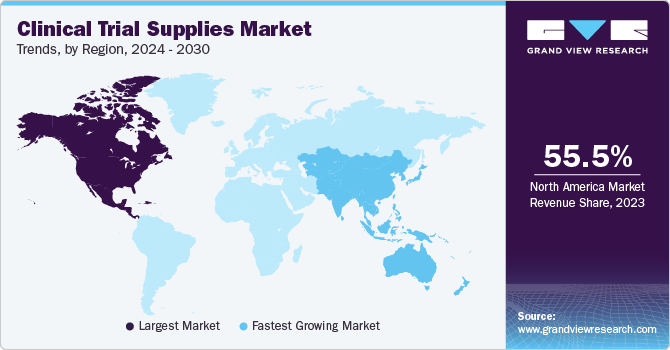

Regional Insights

North America clinical trial supplies market dominated the largest revenue share of 43.83% in 2024. The regional growth is owing to its strong pharmaceutical and biotech industry, extensive clinical research activities, and advanced logistics infrastructure. Growing adoption of decentralized trials and strategic outsourcing to specialized supply providers are enhancing market expansion. Investments in digital supply chain solutions, including AI-driven forecasting and blockchain for compliance, are further improving operations. Continuous innovation and strong government funding maintain North America’s market leadership.

U.S. Clinical Trial Supplies Market Trends

The clinical trial supplies market in the U.S. is driven by a high volume of drug development activities, significant R&D investments, and strong regulatory support from the FDA. The presence of major pharmaceutical companies and CROs accelerates demand for efficient supply chain solutions. Increasing adoption of AI-powered logistics, direct-to-patient trial models, and advanced cold chain infrastructure supports market growth. In addition, favorable government initiatives and rising clinical trials for biologics and gene therapies further strengthen the U.S. market.

Europe Clinical Trial Supplies Market Trends

The clinical trial supplies market in Europe is expected to grow at a significant CAGR during the forecast period, driven by substantial government funding, a well-established regulatory framework, and a high concentration of pharmaceutical and biotech companies. The region benefits from the European Medicines Agency’s (EMA) regulatory harmonization, streamlining cross-border clinical trials. Growing investments in advanced cold chain logistics and decentralized trials enhance supply efficiency. In addition, countries like Germany, the UK, and France are leading in clinical research, supported by innovation hubs, robust healthcare infrastructure, and increasing biologics development.

The Germany clinical trial supplies market held the largest share in Europe in 2024, owing to its strong pharmaceutical industry, advanced research infrastructure, and high clinical trial activity. The country’s well-developed logistics network supports efficient trial supply distribution. Government incentives for R&D and a favorable regulatory environment further enhance market growth.

The clinical trial supplies market in the UK is anticipated to grow at a significant CAGR over the forecast period. The country’s market is primarily attributed to strong government support, a booming biotech sector, and streamlined regulatory processes under the Medicines and Healthcare Products Regulatory Agency (MHRA). Post-Brexit policies are driving investments in domestic supply chain infrastructure to ensure seamless trial execution. In addition, collaborations between academia, pharma companies, and the NHS are fostering innovation in clinical trial supply management.

Asia Pacific Clinical Trial Supplies Market Trends

The clinical trial supplies market in Asia Pacific is expected to grow at a lucrative CAGR during the forecast period. The regional growth is due to cost-effective trial operations, diverse patient recruitment, and improved regulatory frameworks. Countries like China, India, and Australia are attracting global trials with government incentives and growing pharmaceutical R&D. Advancements in cold chain logistics, and digital tracking solutions are strengthening regional supply chains. Rising investments in biologics and personalized medicine further drive demand for specialized clinical trial supplies. As regulatory harmonization improves, Asia-Pacific becomes a key global clinical research hub.

The China clinical trial supplies market is one of the lucrative markets for clinical trial supplies players owing to strong government support, a rapidly expanding pharmaceutical sector, and regulatory reforms by the National Medical Products Administration (NMPA). The country’s large patient pool attracts global trials, while investments in cold chain logistics and AI-driven supply management enhance efficiency. Increasing biologics development further accelerates market expansion.

The clinical trial supplies market in India is expected to grow at the fastest CAGR over the forecast period. The country’s growth is due to its cost-effective operations, large patient pool, and favorable regulatory reforms. Increasing pharmaceutical R&D and government incentives attract global clinical trials. Advancements in cold chain logistics and digital tracking solutions are improving supply chain efficiency and supporting market growth.

The Japan clinical trial supplies market is expected to grow at the fastest CAGR over the forecast period. The growth in the country is driven by strong pharmaceutical innovation, regulatory efficiency under the Pharmaceuticals and Medical Devices Agency (PMDA), and high investment in biologics. The country's advanced healthcare infrastructure and focus on precision medicine increase demand for specialized logistics. Growth in decentralized trials and digital supply chain solutions further enhances market expansion.

Latin America Clinical Trial Supplies Market Trends

The clinical trial supplies market in Latin America is expected to grow at a significant CAGR over the forecast period, due to lower operational costs, a diverse patient population, and increasing pharmaceutical investments. Countries like Brazil and Mexico are streamlining regulatory processes to attract global clinical trials. Expanding cold chain logistics, improving infrastructure, and rising collaborations with international pharma companies enhance the region’s clinical trial supply capabilities.

The Brazil clinical trial supplies market held the largest share in Latin America in 2024. The market growth is owing to government initiatives, a large patient pool, and growing pharmaceutical R&D. Regulatory improvements by ANVISA are streamlining trial approvals and attracting global sponsors. Investments in cold chain logistics and advanced distribution networks are enhancing supply chain efficiency, supporting the country’s role as a regional hub for clinical research.

Middle East & Africa (MEA) Clinical Trial Supplies Market Trends

The clinical trial supplies market in MEA is expected to grow at a lucrative CAGR of 8.1% during the forecast period, due to increasing healthcare investments, regulatory advancements, and rising pharmaceutical collaborations. Countries like the UAE and South Africa are improving trial infrastructure, attracting global research. Expanding cold chain logistics and government support for biotech innovation enhance regional supply chain capabilities, driving market growth.

The South Africa clinical trial supplies market held the largest share in the Middle East & Africa in 2024. Investments in pharmaceutical R&D and cold chain logistics are enhancing supply chain efficiency. The country’s participation in global clinical trials, especially in infectious diseases and vaccines, further drives market expansion.

Key Clinical Trial Supplies Company Insights

The major players operating across the clinical trial supplies industry are focused on the adoption of in-organic strategic initiatives such as mergers, service launches, expansion, acquisitions, and partnerships to enhance competitive edge in the market. For instance, in March 2023, Calyx, an eClinical regulatory services and solutions provider, announced the availability through a simulation of Calyx supply, a clinical trial supply forecasting service available through the company's in-house expert statistical design and trial supplies consultants.

Key Clinical Trial Supplies Companies:

The following are the leading companies in the clinical trial supplies market. These companies collectively hold the largest market share and dictate industry trends.

- Almac Group

- Biocair

- Catalent Inc.

- KLIFO

- Movianto

- PCI Pharma Services

- Sharp Services, LLC

- Thermo Fischer Scientific Inc.

- UPS Healthcare

- PAREXEL International Corporation

Recent Developments

-

In July 2023, Almac Group opened a custom-built GMP warehouse and dispatch hub in the UK. The facility aimed to support all the manufacturing and laboratory activities of API from drug development to commercialization. Such expansion strengthened broadened company’s offerings in the market.

-

In February 2023, Catalent completed a USD 2.2 million expansion of its clinical supply facility in Singapore. This expansion has enlarged the site's footprint to 31,000 square feet, providing room for installing 35 new freezers dedicated to ultra-low temperature (ULT) storage, thereby strengthening the company’s operational capabilities in the supply chain management.

-

In January 2023, ASLAN Pharmaceuticals partnered with Thermo Fisher Scientific to manufacture a high-concentration formulation of Eblasakimab for forthcoming studies. Through this partnership, Thermo Fisher Scientific contributes its expertise in biologic manufacturing and scale-up capacity to manage a clinical supply of Eblasakimab for the anticipated Phase 3 studies.

Clinical Trial Supplies Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.90 billion

Revenue forecast in 2030

USD 4.10 billion

Growth rate

CAGR of 7.19% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

March 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Clinical phase, product & service, end use, therapeutic use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; India; China; Japan; Australia; Singapore; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Almac Group; Biocair; Catalent Inc.; KLIFO; Movianto; PCI Pharma Services; Sharp Services, LLC; Thermo Fischer Scientific Inc.; UPS Healthcare; PAREXEL International Corporation

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Trial Supplies Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clinical trial supplies market report based on clinical phase, product & services, therapeutic use, end use, and region:

-

Clinical Phase Outlook (Revenue, USD Billion, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Other

-

-

Product & Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Manufacturing

-

Storage & Distribution

-

Cold Chain Distribution

-

Non-Cold Chain Distribution

-

-

Supply Chain Management

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical

-

Biologics

-

Medical device

-

Others

-

-

Therapeutic Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oncology

-

CNS Diseases

-

Cardiovascular Diseases

-

Infectious Disease

-

Metabolic Disorders

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018- 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical trial supplies market size was estimated at USD 2.73 billion in 2024 and is expected to reach USD 2.90 billion in 2025.

b. The global clinical trial supplies market is expected to grow at a compound annual growth rate of 7.19% from 2025 to 2030 to reach USD 4.10 billion by 2030.

b. North America dominated the clinical trial supplies market with a share of 43.83% in 2024. This is attributable to the high share of clinical trials conducted in this region and a greater number of clinical trials supply players with the most advanced technology.

b. Some key players operating in the clinical trial supplies market include KLIFO A/S, PAREXEL International Corporation, Almac Group Ltd, Movianto GmbH, Biocair International Ltd., PCI Pharma Services, and Thermo Fischer Scientific.

b. Key factors that are driving the clinical trial supplies market growth include globalization and a rise in the number of clinical trials, increasing complexities, and a rising number of biologics and biosimilar drugs in trials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.