- Home

- »

- Healthcare IT

- »

-

Clinical Trials Matching Software Market Size Report, 2030GVR Report cover

![Clinical Trials Matching Software Market Size, Share & Trends Report]()

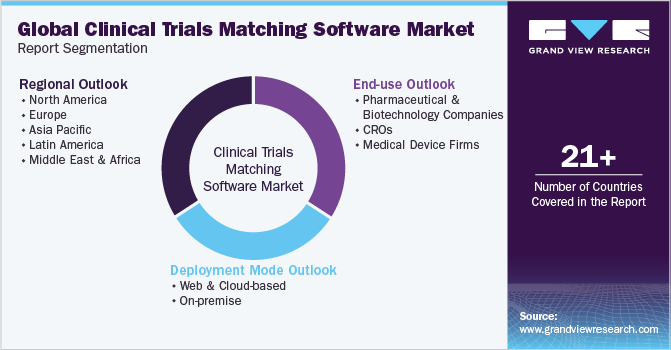

Clinical Trials Matching Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Deployment Mode (Web & Cloud-based, On-premise), By End Use (Pharmaceutical & Biotechnology Companies, Medical Device Companies), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-921-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Clinical Trials Matching Software Market Summary

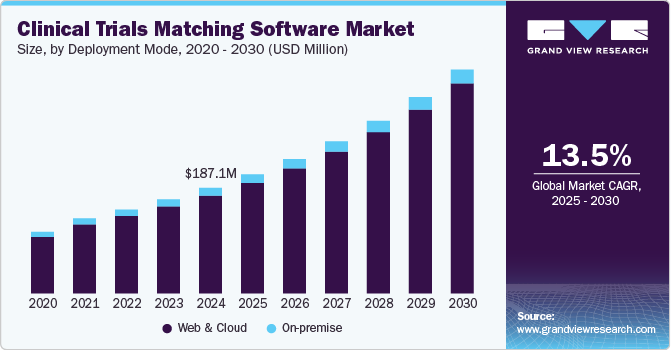

The global clinical trials matching software market size was estimated at USD 187.1 million in 2024 and is projected to reach USD 396.1 million by 2030, growing at a CAGR of 13.5% from 2025 to 2030. The market growth can be attributed to the increasing complexity of clinical trials, the rising adoption of AI and machine learning in patient recruitment, and the growing need to enhance trial efficiency.

Key Market Trends & Insights

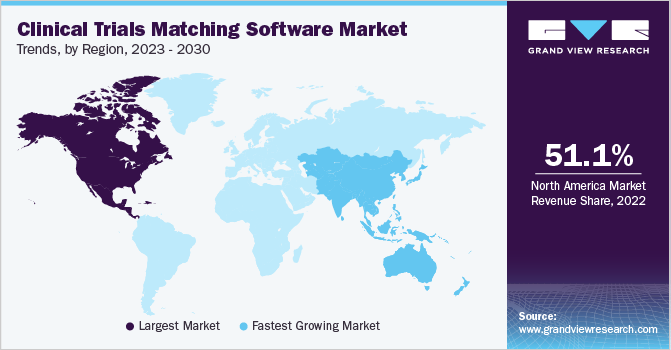

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, web & cloud accounted for a revenue of USD 195.7 million in 2024.

- Web & Cloud is the most lucrative deployment mode segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 187.1 million

- 2030 Projected Market Size: USD 396.1 million

- CAGR (2025-2030): 13.5%

- North America: Largest market in 2024

According to myTomorrows, February 2025 insights, the increasing number of disease subtypes has led to a surge in clinical trials with complex eligibility criteria. With over 500,000 registered trials globally and 8,000+ drugs in development, navigating this landscape is challenging for physicians. Limited trial visibility further hampers sponsors and sites, making patient recruitment, and retention difficult. Pharmaceutical and biotechnology companies are leveraging advanced matching solutions to accelerate participant enrollment, reduce costs, and improve trial success rates.

As clinical trials become more intricate due to the incorporation of advanced methodologies and diverse patient populations, there is a heightened need for efficient patient recruitment strategies. According to statistics published by Antidote Technologies, Inc., in January 2024, approximately 80% of clinical trials fail to meet their enrollment timelines. This complexity necessitates sophisticated matching software that can quickly analyze vast datasets to identify suitable candidates. The ability to streamline this process not only enhances operational efficiency but also reduces costs associated with prolonged trial durations.

Technological innovations such as artificial intelligence (AI), machine learning (ML), and big data analytics are revolutionizing clinical trial management. These technologies enable more accurate patient matching by processing large volumes of data from electronic health records (EHRs) and other sources. Integrating these technologies into clinical trial matching software enhances efficiency and improves the overall quality of data collected during trials, leading to more reliable results. For instance, in February 2025, myTomorrows, a global health technology company, launched its next-generation AI platform to enhance clinical trial recruitment. The platform streamlines how physicians search, pre-screen, and refer patients, enabling trial sponsors to accelerate enrollment, improve diversity, and optimize operations. At its core, the AI-powered pre-screening tool automates eligibility checks with 98% accuracy, surpassing industry standards and outperforming medical professionals in precision.

"Physicians are committed to providing the best care for their patients, yet many lack the necessary time to navigate the often confusing and complicated process of identifying suitable clinical trials. This gap results in increased workloads for both physicians and site staff, a reduced likelihood of successful screening and enrollment, and missed opportunities for patients. Our next-generation AI platform will lower barriers for physicians by streamlining the clinical trial search, pre-screening, and referral process - all in one secure place. Built as a strong foundation for future agentic AI applications, we're taking a bold step in leading the future of clinical trial access."

-Michel van Harten, MD, CEO of my Tomorrows

Regulatory bodies worldwide emphasize the need for expedited drug development processes to bring new therapies to market more quickly. Initiatives such as the FDA’s Breakthrough Therapy Designation aim to accelerate the review process for promising drugs. Hence, sponsors are pressured to optimize their trial designs and recruitment strategies. This environment demands adequate clinical trial-matching solutions to help organizations comply with regulatory expectations while ensuring timely patient enrollment.

Case Study & Insights

Case Study: Evaluation of an artificial intelligence-based clinical trial matching system in Chinese patients with hepatocellular carcinoma

-

The study assessed an AI-driven clinical trial matching system (CTMS) capable of automatically extracting medical information from electronic health records and aligning it with appropriate clinical trials.

-

The study reported that the CTMS proved highly efficient in excluding ineligible patients for clinical trials. It was noted to perform effectively, significantly reducing the time required for this process by 98.7%.

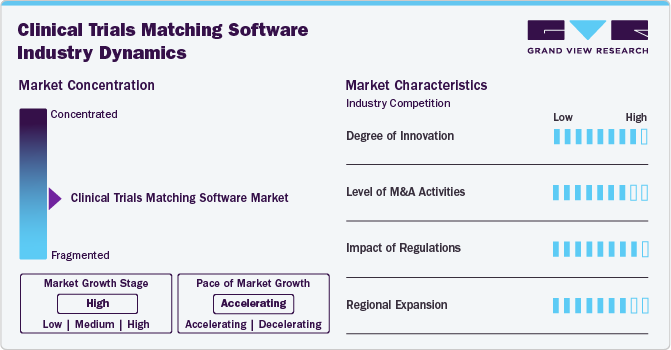

Market Concentration & Characteristics

The industry growth is high and accelerating. This industry is characterized by the increasing complexity of clinical trials, the growing demand for personalized medicine, advancements in technology, and regulatory pressures for faster drug development.

The market is highly innovative, with continuous advancements in AI, machine learning, and data analytics. For instance, in June 2024, Lokavant launched Spectrum, the first AI-powered clinical trial feasibility software that helps optimize trial timelines and costs in real-time. It enables study teams to predict, adjust, and perform iterative feasibility analysis for better decision-making throughout the trial process.

Merger and acquisition activities in this market are moderately high as companies seek to strengthen their technological capabilities and expand market reach. For instance, in January 2024, PharmAlliance acquired Monitorforhire, a clinical research monitoring service. This acquisition provides access to a web-based platform that connects sponsors with trial monitors, supporting PharmAlliance's expansion of its consulting business.

The impact of regulations on the market is assessed as high. Regulatory bodies such as the U.S. FDA and EMA have established guidelines for conducting and reporting clinical trials. Compliance with these regulations is critical for software providers, as it ensures that their solutions meet industry standards for data security and patient privacy. The increasing emphasis on regulatory compliance drives investment in advanced software solutions that facilitate adherence to these requirements.

The market's regional expansion is considered high and emerging regional markets such as Asia-Pacific and Latin America are adopting digital health technologies, leading to the rise in healthcare demands and government initiatives supporting innovation and growth. The digitization of research processes is opening doors for new players in these regions, creating opportunities for growth as they seek efficient patient recruitment strategies and enhanced trial management capabilities.

Deployment Mode Insights

Web & Cloud-based segment held the largest revenue share of 92.65% in 2024 and is the fastest-growing segment of the forecast period owing to the cloud computing model, which is easy to maintain with no upkeep expenditures. These platforms allow real-time data sharing, collaboration, and seamless integration across multiple stakeholders, including researchers, hospitals, and patients. Drivers include the increasing adoption of cloud technologies, the demand for faster clinical trial recruitment, and the need for remote accessibility.

On-premises segment is expected to grow significantly over the forecast period. This segment is driven by concerns over data privacy, regulatory requirements, and the preference of larger organizations that need custom configurations and robust security measures. In addition, some companies with sensitive patient information or those in highly regulated industries prefer on-premises deployment. Pharmaceutical companies managing complex clinical trials may choose on-premises systems to ensure strict adherence to industry standards and safeguard patient data.

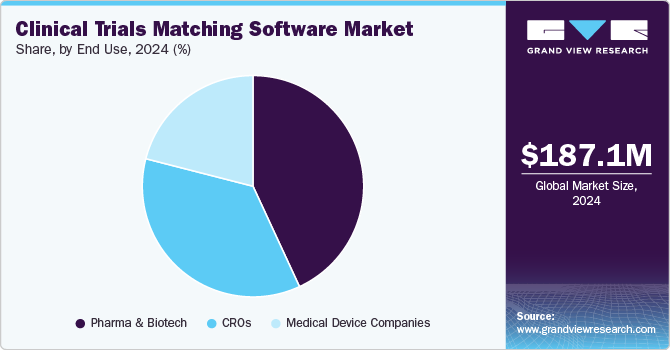

End Use Insights

Pharmaceutical and biotechnology companies held the largest revenue share in 2024 due to their substantial involvement in clinical research and drug development. These companies rely on clinical trial matching software to streamline patient recruitment, reduce trial costs, and ensure regulatory compliance. Drivers include the increasing complexity of clinical trials, the need for faster time-to-market for new drugs, and the demand for personalized medicine. Pharmaceutical companies leverage AI-driven platforms to efficiently match patients with appropriate trials, accelerating their clinical development pipeline while enhancing trial accuracy and success rate.

Contract Research Organizations (CRO) segment is expected to register the fastest CAGR over the forecast period. CROs provide end-to-end drug development services, including commercialization, pharmacovigilance, and post-approval support, catering to manufacturing organizations with limited R&D budgets. The increasing trend of outsourcing clinical trials and the rising complexity of drug development are key factors driving market growth. This has also encouraged new entrants in the market. For example, in November 2023, AstraZeneca launched Evinova, a company dedicated to offering CROs and major pharmaceutical firms access to its proven digital solutions for conducting clinical trials. This development is expected to further accelerate market expansion.

Regional Insights

North America clinical trials matching software marketdominated the global market with a revenue share of 49.83% in 2024. Advanced technological innovations and the increasing complexity of clinical trials drive the trials. Artificial intelligence (AI) and machine learning are increasingly integrated to enhance patient recruitment and optimize trial timelines. North America's strong healthcare infrastructure and regulatory environment, with standards set by the FDA and Health Canada, encourage digital solutions to improve trial efficiency and compliance. The growing trend of patient-centric trials and the rise of telemedicine further boost the adoption of clinical trial matching software, as these tools align with the region's focus on personalized medicine.

U.S. Clinical Trials Matching Software Market Trends

The U.S. clinical trial matching software market is growing due to the continued push for faster and more efficient clinical trial processes. The FDA has been encouraging innovation in clinical trial design and recruitment, influencing the development of digital solutions for trial matching. The increasing use of real-world data (RWD) and artificial intelligence in trial recruitment is a significant trend, with platforms improving the speed and accuracy of matching patients to trials. The U.S. government’s investment in digital health technologies and regulations, such as the 21st Century Cures Act, encouraged growth in the clinical trials matching software market.

Asia Pacific Clinical Trials Matching Software Market Trends

The clinical trials matching software market in Asia Pacific is fueled by the increasing number of clinical trials conducted in the region and the adoption of advanced technologies such as artificial intelligence and cloud-based solutions. Expanding healthcare infrastructure and government initiatives to support clinical research are facilitating the adoption of these technologies. Japan's and South Korea's regulatory frameworks have become more aligned with global standards, promoting international collaborations and boosting the demand for trial-matching software.

The clinical trials matching software market in China is expanding due to a growing demand for efficient clinical trial management and China's increasing role in global drug development. Regulatory reforms, such as the China National Medical Products Administration (NMPA) aligning closely with ICH-GCP standards, are helping create a more conducive environment for clinical trials. In addition, innovations in digital health technologies, such as using big data analytics and AI in patient recruitment, are transforming clinical trial processes. China's large population and diverse patient pool offer significant opportunities for trial matching software to streamline recruitment efforts.

India clinical trials matching software market is witnessing substantial growth driven by the country's expanding pharmaceutical and biotechnology sectors. The rise in clinical trials outsourcing to India, combined with a tech-savvy healthcare ecosystem, is spurring demand for advanced trial matching software. The government's initiatives, such as the Drugs and Cosmetics (Amendment) Act 2020, aim to make clinical trials efficient, align with global standards, and improve the regulatory environment.

Europe Clinical Trials Matching Software Market Trends

The clinical trials matching software market in Europe is seeing strong innovation, particularly in integrating AI and machine learning technologies to optimize patient recruitment. The regulatory landscape, shaped by the European Medicines Agency (EMA) and GDPR, influences software development, ensuring data privacy and compliance. For instance, the UK’s National Health Service (NHS) is adopting digital tools to streamline clinical trial participation, reflecting a shift toward more personalized medicine and patient-centric trials. This trend is supported by significant government investment in healthcare IT infrastructure, which is expected to enhance adoption rates in the coming years.

Latin America Clinical Trials Matching Software Market Trends

The clinical trial matching software market in Latin America is driven by the increasing demand for efficient trial processes and greater access to clinical research. Regional expansion is fueled by partnerships between local institutions and global pharmaceutical companies aiming to conduct clinical trials more effectively. The region’s regulatory environment, including adherence to ICH-GCP standards, is evolving, with governments focusing on improving clinical trial infrastructure to attract more international studies and drive the adoption of trial-matching technologies.

Middle East & Africa Clinical Trials Matching Software Market Trends

The clinical trials matching software market in the Middle East and Africa is witnessing rapid expansion in usage, spurred by growing investment in healthcare infrastructure and an increasing number of clinical trials in the region. Innovation in this market is focused on overcoming logistical challenges, such as remote patient recruitment and monitoring in underserved areas. In addition, the expansion of healthcare technology ecosystems, including the rise of telemedicine, is expected to drive the adoption of trial-matching software solutions across MEA.

Key Clinical Trials Matching Software Company Insights

Key companies offer cloud-based platforms with advanced algorithms and artificial intelligence to streamline the recruitment process, improve efficiency, and enhance patient outcomes. The market is characterized by competition, with major players holding a substantial share, contributing to the increasing adoption of these solutions by hospitals, research institutions, and pharmaceutical companies. The market's growth is driven by the rising demand for personalized medicine and the growing complexity of clinical trial designs.

Key Clinical Trials Matching Software Companies:

The following are the leading companies in the clinical trials matching software market. These companies collectively hold the largest market share and dictate industry trends.

- IBM

- Antidote Technologies, Inc.

- Ofni Systems

- Clario

- Advarra

- ArisGlobal

- BSI Business Systems Integration AG

- Teckro Limited

- Evidation Health, Inc.

- HealthMatch

- Microsoft

- Deep6.ai

- Inspirata, Inc.

- Mendel Health Inc.

- MatchTrial

- Curewiki

- Inteliquet (IQVIA)

- Tempus Labs

Recent Developments

-

In September 2024, Massive Bio unveiled its Patient Connect portal, a new initiative designed to personalize access to cancer clinical trials. The platform utilizes AI-driven technology to match patients with suitable trials based on their specific medical and genetic profiles.

-

In September 2024, Carta Healthcare acquired Realyze Intelligence to strengthen its AI-driven clinical trial matching capabilities. The acquisition aims to integrate advanced data analytics and machine learning technologies of the company with Carta's platform, enhancing the ability to match patients with relevant clinical trials more efficiently.

-

In September 2023, the Israeli group Belong.Life launched Tara, a conversational AI platform designed to streamline cancer clinical trial matching. Tara uses advanced AI to engage with patients, gather relevant health data, and provide personalized trial recommendations based on individual profiles.

Clinical Trials Matching Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 210.74 million

Revenue forecast in 2030

USD 396.13 million

Growth rate

CAGR of 13.45% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Report updated

April 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment mode, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; Spain; France; Italy; Sweden; Denmark; Norway; Asia Pacific; Japan; China; India; Australia; South Korea; Thailand; Latin America; Brazil; Argentina; Middle East & Africa; South Africa; Saudi Arabia; UAE

Key companies profiled

IBM; Antidote Technologies Inc.; Ofni Systems; Clario; Advarra; ArisGlobal; BSI Business Systems Integration AG; Teckro Limited; Evidation Health, Inc.; HealthMatch; Microsoft; Deep6.ai; Inspirata Inc.; Mendel Health Inc.; MatchTrial; Curewiki; Inteliquet (IQVIA);Tempus Labs

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Trials Matching Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clinical trials matching software market report based on deployment mode, end use, and region.

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Web & Cloud-based

-

On-premise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

CROs

-

Medical Device Companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical trials matching software market size was estimated at USD 187.09 million in 2024 and is expected to reach USD 210.74 million in 2025.

b. The global clinical trials matching software market is expected to grow at a compound annual growth rate of 13.45% from 2025 to 2030 to reach USD 396.13 million by 2030.

b. North America dominated the clinical trials matching software market with a share of over 49.83% in 2024. This is attributed to the advanced technological innovations and the increasing complexity of clinical trials drive market demand. In addition, the presence of a strong healthcare infrastructure and regulatory environment, with standards set by the FDA and Health Canada, encourages the adoption of digital solutions to improve trial efficiency and compliance.

b. Some key players operating in the clinical trials matching software market include IBM, Antidote Technologies, Inc., Ofni Systems, Clario, Advarra, ArisGlobal, BSI Business Systems Integration AG, Teckro Limited, Evidation Health, Inc., HealthMatch, Microsoft, Deep6.ai, Inspirata, Inc., Mendel Health Inc., MatchTrial, Curewiki, Inteliquet (IQVIA), Tempus Labs, among others.

b. Key factors driving the growth of the clinical trials matching software market include the rising need for developing advanced treatment solutions due to the increasing incidence of chronic diseases, the growing complexity of clinical trials, the adoption of AI and machine learning in patient recruitment, and the need to enhance trial efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.