- Home

- »

- Clothing, Footwear & Accessories

- »

-

Clogs Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Clogs Market Size, Share & Trends Report]()

Clogs Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Casual Clogs, Occupational Clogs), By Material, By End-use (Men, Women, Kids), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-384-8

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Clogs Market Summary

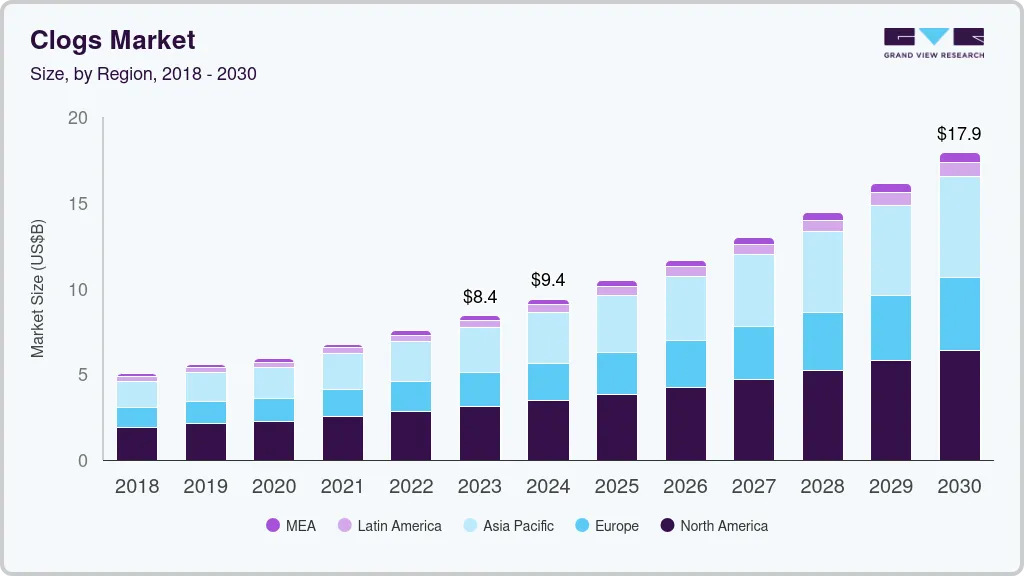

The global clogs market size was estimated at USD 8,405.0 million in 2023 and is projected to reach USD 17,917.6 million by 2030, growing at a CAGR of 11.4% from 2024 to 2030. The major growing factors for the global market include increasing consumer awareness of the health benefits and comfort provided by clogs, particularly in professions requiring long hours of standing, such as healthcare and culinary industries.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, casual clogs accounted for a revenue of USD 8,405.0 million in 2023.

- Casual Clogs is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 8,405.0 Million

- 2030 Projected Market Size: USD 17,917.6 Million

- CAGR (2024-2030): 11.4%

- North America: Largest market in 2023

Fashion trends have also seen a resurgence in the popularity of clogs, driven by celebrity endorsements and a nostalgic revival of retro styles. In addition, the growing emphasis on sustainability and eco-friendly products has spurred demand for clogs made from natural and recycled materials.

The fashion industry has seen a resurgence in the popularity of clogs, influenced by high-profile designers and celebrities who have embraced them as a stylish and practical footwear option. Luxury brands like Gucci and Balenciaga have introduced high-fashion clogs in their collections, while celebrities like Sarah Jessica Parker and Kendall Jenner have been spotted wearing them.

Innovations in material technology have led to the development of clogs that are more comfortable, durable, and aesthetically pleasing. New materials like EVA (Ethylene Vinyl Acetate) and advanced synthetic blends offer enhanced performance. EVA-based clogs, known for their lightweight and shock-absorbent properties, are widely used in both casual and occupational footwear.

Consumers are increasingly looking for unique products that reflect their style. Customization and personalization of footwear, including clogs, present a significant opportunity. Crocs has successfully implemented customization options where consumers can choose colors and add personalized charms (Jibbitz) to their clogs. There is a growing consumer preference for sustainable and eco-friendly products. Brands that focus on sustainability can attract environmentally conscious consumers. Crocs has also committed to using sustainable materials and achieving net-zero emissions by 2030.

Product Insights

The casual segment led the market with the largest revenue share of 68.62% in 2023. The market is mainly driven due to the increasing demand for comfortable and versatile footwear, driven by lifestyle changes and the rise of remote work. The trend towards casual and athleisure wear has made clogs a popular choice for everyday use, combining comfort with style. For example, brands like Crocs have seen a resurgence due to their focus on casual comfort, launching collaborations with celebrities and influencers to attract a younger demographic.

The occupational segment is projected to grow at the fastest CAGR of 12.0% from 2024 to 2030. The growth factors for occupational clogs include the increasing focus on workplace safety, comfort, and hygiene, particularly in industries such as healthcare, culinary, and manufacturing. Occupational clogs are designed to provide support during long shifts, with features like slip-resistant soles, easy-to-clean materials, and ergonomic design. For instance, brands such as Dansko and Birkenstock have gained popularity among healthcare professionals for their comfortable and durable clogs that reduce foot fatigue.

Material Insights

Based on material, the synthetic segment led the market with the largest revenue share of 38.51% in 2023. The growth factors include advancements in material technology, cost-effectiveness, and versatility in design and color options. Synthetic materials like EVA (Ethylene Vinyl Acetate) and high-quality plastics offer lightweight, durable, and flexible alternatives to traditional materials, making them ideal for various environments and activities. For example, Crocs has capitalized on these benefits by using their proprietary Croslite material, which provides comfort and durability while being easy to clean.

The rubber segment is projected to grow at the fastest CAGR of 11.7% from 2024 to 2030. The major drivers include their inherent properties of waterproofness, slip resistance, and durability, which make them ideal for various demanding environments. Rubber clogs are particularly popular in industries such as gardening, food service, and healthcare, where their easy-to-clean and protective features offer significant advantages. For instance, brands like Bogs, and Tingley have seen increased demand for their rubber clogs due to their robust design and resistance to harsh conditions.

End-use Insights

Based on end use, the men segment led the market with the largest revenue share of 46.1% in 2023. The growth factors for men’s clogs include the rising trend towards casual and comfortable footwear in everyday fashion, driven by a shift towards more relaxed dress codes and the increasing focus on comfort and functionality. The appeal of men’s clogs is enhanced by their versatility, suitable for both indoor and outdoor use, and their ability to complement casual and athleisure outfits. For example, Crocs and Bogs have successfully marketed men’s clogs by emphasizing their comfort, durability, and style, with designs that cater to men’s preferences for practicality and ease.

The women segment is projected to grow at the fastest CAGR of 9.7% from 2024 to 2030 owing to increasing demand for stylish yet comfortable footwear that seamlessly transitions between various settings, such as work, leisure, and casual outings. Women’s clogs are popular for their versatility and design, catering to both fashion-conscious consumers and those seeking practicality. For instance, brands like Birkenstock and Free People have capitalized on this trend by offering fashionable clogs in a range of colors, patterns, and materials that appeal to women seeking both aesthetics and comfort.

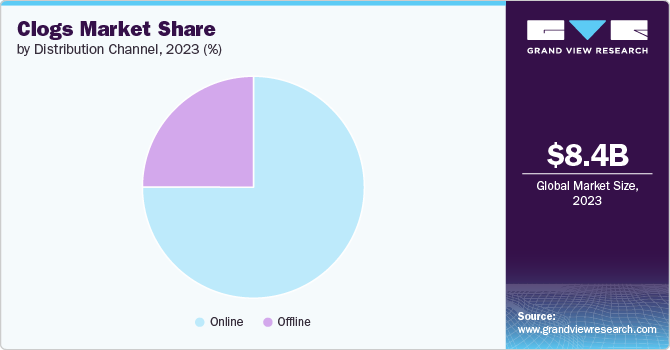

Distribution Channel Insights

Based on distribution channel, the online segment led the market with the largest revenue share of 75.05% in 2023. The market drivers include the tactile experience of trying on footwear, immediate product availability, and personalized customer service. Consumers often prefer the ability to physically inspect and try on clogs for comfort and fit, which drives traffic to brick-and-mortar stores. Retailers like Foot Locker and Nordstrom leverage their physical stores to provide a comprehensive shopping experience, allowing customers to try different styles and receive personalized recommendations from sales associates.

The online segment is anticipated to grow at the fastest CAGR of 12.3% from 2024 to 2030. The market is mainly driven by the convenience of 24/7 shopping, a wide range of product options, and advanced digital marketing strategies. E-commerce platforms offer the advantage of shopping from anywhere without time constraints, appealing to busy consumers who prefer the ease of browsing and purchasing from home. For example, brands like Crocs and Birkenstock have seen significant online growth by utilizing user-friendly websites, detailed product descriptions, and high-quality images to enhance the shopping experience.

Regional Insights

The North America dominated the clogs market with a revenue share of 37.10% in 2023. The market is primarily driven by increasing emphasis on comfort-oriented footwear, the popularity of casual and athleisure fashion trends, and the significant influence of the healthcare and hospitality sectors. The demand for comfortable footwear has surged as consumers prioritize health and wellness, leading to greater adoption of clogs for everyday wear.

U.S. Clogs Market Trends

The clogs market in the U.S. is projected to grow at the fastest CAGR of 11.0% from 2024 to 2030. The growth drivers include the rising demand for versatile and comfortable footwear driven by changing lifestyle trends, the strong presence of influential brands, and the growth of e-commerce. With an increasing number of consumers working from home and seeking casual yet supportive footwear, clogs have become a popular choice. Brands like Crocs and Dansko have capitalized on this trend, offering a variety of styles that cater to both fashion and functionality.

Europe Clogs Market Trends

The clogs market in Europe is projected to grow at a significant CAGR of 11.6% from 2024 to 2030. The market is driven by to strong tradition of craftsmanship, a rising focus on sustainability, and the influence of fashion trends emphasizing comfort and practicality. European consumers appreciate the heritage and quality associated with traditional clog-making regions like Sweden and the Netherlands, where brands such as Swedish Hasbeens, and Sanita capitalize on this legacy.

Asia Pacific Clogs Market Trends

The clogs market in the Asia Pacific is projected to grow at the fastest CAGR of 12.1% from 2024 to 2030. The market drivers include the region’s rapidly growing middle class, increasing urbanization, and rising health and wellness awareness. As disposable incomes rise, consumers in countries like China, India, and Japan are seeking comfortable and fashionable footwear options, driving demand for clogs. Brands like Crocs have successfully tapped into this market by offering a range of styles and collaborating with local influencers to boost their appeal.

Key Clogs Company Insights

The competitive landscape of the global market is characterized by the presence of well-established brands, niche market players, and emerging companies, each vying for market share through innovation, brand loyalty, and strategic collaborations. Large companies invest heavily in marketing, often collaborating with celebrities and influencers to enhance brand appeal.

Key Clogs Companies:

The following are the leading companies in the clogs market. These companies collectively hold the largest market share and dictate industry trends.

- Crocs Inc.

- Dansko, LLC

- Birkenstock USA, LP

- Sanita

- Deckers Outdoor Corporation (UGG)

- Haflinger

- Alegria Shoes

- Lotta From Stockholm

- Calou AB

- Tessa Clogs

Recent Developments

-

In June 2024, In April 2024, Crocs and Pringles announced a collaboration, launching a limited-edition collection of clogs. This partnership features clogs inspired by Pringles' branding, including designs with Pringles' colors and logo. The collaboration leverages Crocs' expertise in casual footwear and Pringles' strong brand recognition in the snack industry

-

In April 2023, Crocs unveiled new customization capabilities, significantly enhancing their personalization options for customers. This initiative allows consumers to design their unique pairs of Crocs with a variety of colors, patterns, and Jibbitz charms, enabling a truly personalized footwear experience

Clogs Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.37 billion

Revenue forecast in 2030

USD 17.92 billion

Growth rate

CAGR of 11.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; South Korea; Australia; Brazil; South Africa

Key companies profiled

Crocs Inc.; Dansko, LLC; Birkenstock USA; LP; Sanita; Deckers Outdoor Corporation (UGG); Haflinger; Alegria Shoes; Lotta From Stockholm; Calou AB; Tessa Clogs

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clogs Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clogs market report based on product, material, end use, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Casual Clogs

-

Occupational Clogs

-

Medical Clogs

-

Chef Clogs

-

Gardening Clogs

-

Others

-

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Leather

-

Rubber

-

Synthetic Material

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Kids

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Others

-

-

Online

-

E-commerce Websites

-

Company Websites

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global clogs market size was estimated at USD 8.40 billion in 2023 and is expected to reach USD 9.37 billion in 2024.

b. The global clogs market is expected to grow at a compounded growth rate of 11.4% from 2024 to 2030 to reach USD 17.52 billion by 2030.

b. Casual clogs accounted for a market share of 68.6% of the global revenues in 2023. The market is mainly driven due to the increasing demand for comfortable and versatile footwear, driven by lifestyle changes and the rise of remote work.

b. Some key players operating in the clogs market include Crocs Inc., Dansko, LLC, Birkenstock USA, LP, Sanita, Deckers Outdoor Corporation (UGG), Haflinger, Alegria Shoes, Lotta From Stockholm, Calou AB, Tessa Clogs

b. Key factors that are driving the clogs market growth include increasing consumer awareness of the health benefits and comfort provided by clogs, particularly in professions requiring long hours of standing, such as healthcare and culinary industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.