- Home

- »

- Communication Services

- »

-

Cloud Kitchen Market Size & Share, Industry Report, 2030GVR Report cover

![Cloud Kitchen Market Size, Share & Trends Report]()

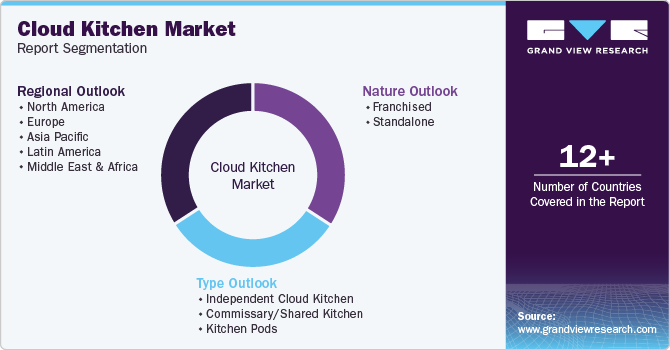

Cloud Kitchen Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Independent Cloud Kitchen, Commissary/Shared, Kitchen Pods), By Nature (Franchised, Standalone), By Region (North America, APAC), And Segment Forecasts

- Report ID: GVR-4-68038-271-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cloud Kitchen Market Summary

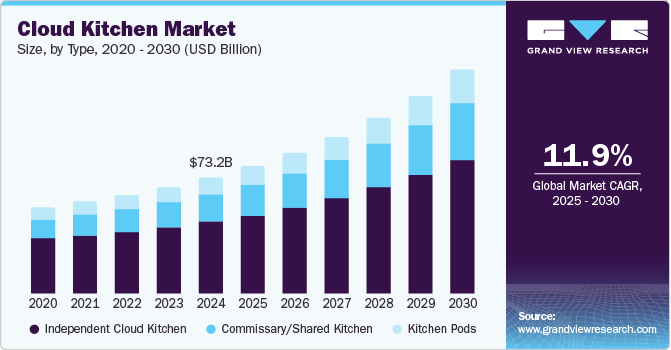

The global cloud kitchen market size was estimated at USD 73.18 billion in 2024 and is projected to reach USD 141.08 billion by 2030, growing at a CAGR of 11.9% from 2025 to 2030, reflecting a significant shift in consumer behavior and food service delivery systems.

Key Market Trends & Insights

- The Asia Pacific cloud kitchen market dominated the global market with a revenue share of 47.8% in 2024.

- The cloud kitchen market in China is experiencing significant growth as consumer preferences shift toward online food delivery.

- By type, the independent cloud kitchen segment dominated the market with a revenue share of 62.1% in 2024.

- By type, the commissary/shared kitchen segment is projected to grow at the highest CAGR during the forecast period.

- By nature, the franchised segment dominated the market with the highest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 73.18 Billion

- 2030 Projected Market Size: USD 141.08 Billion

- CAGR (2025-2030): 11.9%

- Asia Pacific: Largest market in 2024

- Middle East and Africa: Fastest growing market

A key factor contributing to this market state is the rise of food delivery apps, which have made it easier for consumers to order meals from various restaurants without the need to step out of their homes. In addition, the increasing urbanization and busy lifestyles of consumers have led to a growing preference for convenient dining options, which cloud kitchens provide by eliminating the need for physical dining spaces.The ongoing advancements in technology, particularly in logistics and food preparation processes, enhance operational efficiency for cloud kitchens. Furthermore, the growing internet penetration and smartphone usage globally facilitate greater access to food delivery services, allowing more consumers to engage with cloud kitchens. The popularity of ghost kitchens is increasing as they facilitate the preparation of food exclusively for delivery, and they enable lower overhead costs and flexible menu offerings.

Moreover, the evolving consumer preference for healthier and diverse food options is driving the cloud kitchen industry. As consumers become more health-conscious, cloud kitchens that offer nutritious meal choices are likely to attract a larger customer base. For instance, ZOIL was launched in India with the mission of providing heart-healthy food options. The company focuses on zero-oil meals, offering a menu designed for individuals seeking nutritious alternatives to their favorite Indian recipes without compromising on taste.

Furthermore, investment in the cloud kitchen sector is anticipated to surge as entrepreneurs and established restaurant brands recognize the potential for profitability in this model. The growing interest of venture fcapitalists in innovative food service solutions is expected to drive the funding for developing advanced cloud kitchen technologies and expanding their reach. For instance, investors such as Coatue and Lightbox are divesting their shares in Rebel Foods at a valuation ranging from USD 700 million to USD 800 million. Meanwhile, the company is securing primary capital, which places its valuation at approximately USD 1.3 billion, resulting in a blended valuation of around USD 1 billion.

Type Insights

The independent cloud kitchen segment dominated the market with a revenue share of 62.1% in 2024. This growth can be attributed to the flexibility and independence that these operators possess, allowing them to innovate and adapt their menus quickly to meet changing consumer preferences. In addition, without the overhead costs associated with traditional restaurants, independent cloud kitchens can offer competitive pricing, attracting a wider customer base. Their ability to leverage technology for efficient order processing and delivery further enhances their appeal in a rapidly evolving food service landscape.

The commissary/shared kitchen segment is projected to grow at the highest CAGR during the forecast period. This trend is driven by the increasing number of startups and small food businesses that rely on shared facilities to minimize initial investment costs. By utilizing commissary kitchens, these businesses can access professional-grade equipment and resources while benefiting from a collaborative environment that fosters innovation and networking opportunities. As more entrepreneurs enter the cloud kitchen industry, the demand for these shared spaces is expected to rise significantly.

Nature Insights

The franchised segment dominated the market with the highest share in 2024 due to its established brand recognition and operational support systems. Franchised cloud kitchens benefit from proven business models that reduce risks for new operators entering the cloud kitchen industry. The backing of a recognized brand attracts customers and provides franchisees with marketing support and operational guidelines that streamline their processes. For instance, Rebel Foods, which operates a network of cloud kitchens, is making a notable shift toward the offline market. The company is expanding its brand, Oven Story Pizza, by adopting a franchise model. This approach is designed to enhance its market share within the rapidly growing pizza segment and to better compete with international pizza chains in the country.

The standalone segment is expected to grow at a significant CAGR over the forecast period. Standalone cloud kitchens offer unique advantages by focusing solely on delivery without the distractions of dine-in services. This model allows specialization in specific cuisines or menu items, catering directly to consumer tastes. Moreover, as urbanization continues and consumers seek convenient dining options, standalone cloud kitchens are well-positioned to meet this demand by providing quick and efficient food delivery services tailored to local preferences.

Regional Insights

The North America cloud kitchen market is witnessing significant growth, driven by changing consumer preferences and the increasing demand for food delivery services. The rise of technology and mobile applications has made it easier for consumers to access a variety of cuisines from the comfort of their homes. This trend is further supported by the growing number of startups and established restaurants venturing into the cloud kitchen model, which allows them to operate without the overhead costs associated with traditional dining establishments.

U.S. Cloud Kitchen Market Trends

The U.S. cloud kitchen market is particularly thriving, and major cities such as New York and Los Angeles are at the forefront, where the demand for convenient food options is high. Many entrepreneurs are capitalizing on this trend by launching ghost kitchens that cater to specific dietary preferences, such as vegan or gluten-free options. In addition, partnerships with delivery platforms such as Uber Eats and DoorDash have enabled these kitchens to reach a broader audience quickly.

Asia Pacific Cloud Kitchen Market Trends

The Asia Pacific cloud kitchen market dominated the global market with a revenue share of 47.8% in 2024, owing to its large population and rapidly evolving food industry. Countries such as China and India are experiencing a surge in demand for food delivery services, driven by urbanization and busy lifestyles. The region's diverse culinary landscape allows cloud kitchens to offer a wide variety of cuisines, appealing to different consumer tastes.

The cloud kitchen market in China is experiencing significant growth as consumer preferences shift toward online food delivery. Major cities such as Beijing and Shanghai are seeing a surge in cloud kitchens catering to local tastes while offering international cuisines. The popularity of food delivery apps has made it easier for consumers to access meals from their favorite restaurants without leaving home.

Middle East and Africa Cloud Kitchen Market Trends

The Middle East and Africa (MEA) is expected to grow at the fastest CAGR over the forecast period owing due to fast-growing demand for food delivery services in the region. This region is witnessing an increase in urbanization and changes in consumer lifestyle, leading to a greater reliance on convenient dining options. The diverse culinary traditions across countries in the MEA region provide ample opportunities for cloud kitchens to innovate and cater to various tastes. Furthermore, investments in technology and infrastructure are enhancing delivery logistics, making it easier for cloud kitchens to operate efficiently.

In the UAE cloud kitchen market, particularly Dubai, the cloud kitchen industry is flourishing. The city’s cosmopolitan nature attracts a mix of expatriates who seek diverse dining options delivered to their homes or offices. Many cloud kitchens in Dubai focus on specific cuisines or dietary trends, such as healthy meal preparations or gourmet offerings. The strong presence of food delivery platforms also supports these businesses by providing them with a ready customer base that prefers convenience. As consumer preferences continue to evolve, Dubai's cloud kitchen sector is expected to grow significantly, reflecting broader trends across the MEA region.

Key Cloud Kitchen Company Insights

The cloud kitchen market is characterized by several key players who significantly influence its dynamics. Some major companies that lead the cloud kitchen industry are DoorDash, which partners with various restaurants to streamline cloud kitchen operations and has an extensive delivery network; City Storage Systems LLC, which focuses on providing the necessary infrastructure and technology for ghost kitchens, enabling brands to operate without traditional dining spaces; and Kitopi, which specializes in managing multiple restaurant brands efficiently through advanced technology and operational expertise.

-

DoorDash is primarily known for its extensive food delivery network. The company has expanded its services to include cloud kitchens, partnering with various restaurants to optimize their operations and enhance delivery efficiency. By leveraging technology and data analytics, DoorDash aims to streamline the food ordering process, making it easier for consumers to access a wide range of cuisines from the comfort of their homes.

-

City Storage Systems LLC specializes in providing infrastructure and technology solutions tailored for ghost kitchens. The company focuses on creating efficient kitchen spaces that allow restaurant brands to operate without traditional dining facilities. By offering shared kitchen environments equipped with advanced technology, City Storage Systems enables businesses to reduce overhead costs while enhancing their delivery capabilities. This innovative approach supports the growing demand for food delivery services in urban areas, positioning City Storage Systems LLC. as a key player in the cloud kitchen industry.

Key Cloud Kitchen Companies:

The following are the leading companies in the cloud kitchen market. These companies collectively hold the largest market share and dictate industry trends.

- DoorDash

- Farm To Fork Sdn Bhd (Pop Meals)

- Kitopi

- Rebel Foods

- Zuul Kitchens, Inc (Kitchen United)

- Starbucks Coffee Company

- Ghost Kitchen Orlando

- City Storage Systems LLC.

- Swiggy Limited

- Zomato Ltd.

Recent Development

-

In June 2024, London-based private equity firm Finnest announced the acquisition of a majority stake in the cloud kitchen startup Kitchens@, with an investment of approximately USD 160 million. With this investment, Finnest holds the largest stake of 53.75% in Kitchens@. This capital would support the startup’s business operations, meet working capital requirements, and expand its footprint.

-

In January 2022, Curefoods, recognized as rapidly growing cloud kitchen company in India’s with brands such as CakeZone, EatFit, and Aligarh House, announced its merger with Maverix, a player in the food tech space. This merger positioned Curefoods as India's second-largest cloud kitchen operator in terms of footprint, significantly enhancing its manufacturing capabilities in the fresh food sector.

Cloud Kitchen Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 80.35 billion

Revenue forecast in 2030

USD 141.08 billion

Growth rate

CAGR of 11.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, nature, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

DoorDash; Farm To Fork Sdn Bhd (Pop Meals); Kitopi; Rebel Foods; Zuul Kitchens, Inc; Starbucks Coffee Company; Ghost Kitchen Orlando; City Storage Systems LLC.; Swiggy Limited, Zomato Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud Kitchen Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cloud kitchen market report based on type, nature, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Independent Cloud Kitchen

-

Commissary/Shared Kitchen

-

Kitchen Pods

-

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Franchised

-

Standalone

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.