- Home

- »

- Conventional Energy

- »

-

Coal To Liquid Market Size & Share, Industry Report, 2030GVR Report cover

![Coal To Liquid Market Size, Share & Trends Report]()

Coal To Liquid Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Direct, Indirect), By Product (Diesel, Gasoline), By Application (Transportation, Cooking), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-004-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Coal To Liquid Market Summary

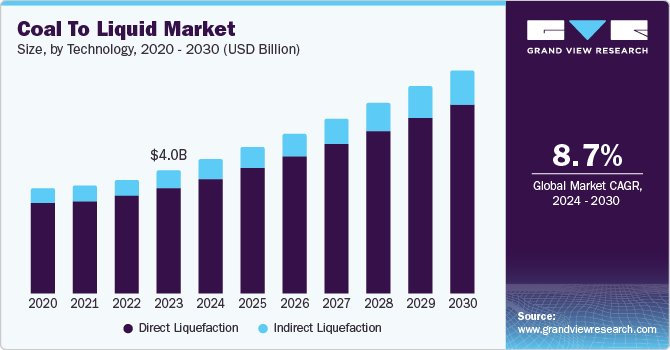

The global coal to liquid market size was valued at USD 4.05 billion in 2023 and is projected to reach USD 7.27 billion by 2030, growing at a CAGR of 8.7% from 2024 to 2030. Increasing demand for coal to liquid (CTL) to produce fuels such as diesel, gasoline, and other fuels has led to market growth.

Key Market Trends & Insights

- Asia Pacific dominated the coal to liquid market with a market share of 64.4% in 2023.

- Based on technology, the direct liquefaction segment dominated the market in 2023 with a share of 85.5%.

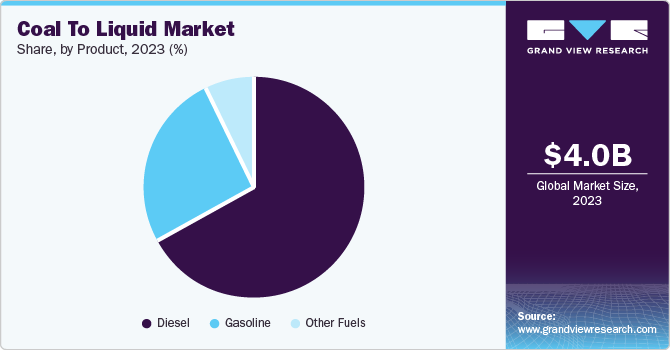

- Based on product, the diesel segment dominated the market in 2023 with a share of 66.6%.

- Based on application, the transportation fuel segment dominated the market in 2023 with a share of 89.4%.

Market Size & Forecast

- 2023 Market Size: USD 4.05 Billion

- 2030 Projected Market Size: USD 7.27 Billion

- CAGR (2024-2030): 8.7%

- Asia Pacific: Largest market in 2023

The abundant coal reserves in numerous areas provide a dependable and easily accessible supply of raw materials to produce liquid fuels. CTL technology transforms coal into liquid fuels such as diesel and jet fuel, decreasing reliance on traditional petroleum resources. Hence, these factors have resulted in the growth of the coal-to-liquid (CTL) market.

CTL provides energy security advantages through fuel source diversification and decreased dependence on imported oil. In addition, enhancements in CTL technology have increased effectiveness and decreased environmental effects, making it a more feasible choice for fulfilling energy needs and reducing carbon emissions. According to the Center for Climate and Energy Solutions, CO2 accounts for about 76.0 % of total greenhouse gas emissions. CTL's appeal as an alternative energy source is boosted by geopolitical factors and changing oil prices, prompting increased investment and growth in the industry. To improve energy autonomy and reduce greenhouse gas emissions, the global CTL market is expected to experience major development and expansion.

Furthermore, increased demand for electricity has led to the growth of this market as thermal power plants use fuels to heat steam that rotates the turbines to generate electricity. Although there is an increased adoption of renewable energy sources, coal remains one of the major sources of energy generation. For instance, In India, 75% of total power generation in 2020 was achieved with the help of thermal power plants that used coal as a fuel. Therefore, these factors are responsible for the growth of the market.

Technology Insights

The direct liquefaction segment dominated the market in 2023 with a share of 85.5%. Direct liquefaction offers properties such as low emissions and low water consumption. Technological advancements have led to improved efficiency and yielding capacity of direct liquefaction processes. The production cost of direct liquefaction is low, as it does not rely on a synthesis gas production step. Furthermore, government support to develop direct liquefaction technology has also resulted in the market growth of this segment.

The indirect liquefaction segment is expected to grow at a CAGR of 9.3% during the forecast period. The market growth is due to already established processes and equipment, which constantly produces top-quality liquid fuels. Indirect liquefaction can produce various fuels, such as gasoline, jet fuel, petrochemicals, and diesel. Hence, the rising demand for liquid fuels increases the demand for the indirect liquefaction.

Product Insights

The diesel segment dominated the market in 2023 with a share of 66.6%. Rising demand for diesel has resulted in the market growth of this segment, as diesel is utilized for heavy vehicles such as trucks, buses, and equipment. Growth in the manufacturing industry also aids market growth as diesel is used as a fuel for various industrial machinery and generators. Companies use diesel as a fuel due to its affordability, availability, and compatibility with different machinery. Furthermore, technological improvements in indirect liquefaction have led to improved production rates of diesel fuel. Therefore, these factors are responsible for the market growth of this segment.

The gasoline segment is expected to grow at a CAGR of 9.2% during the forecast period. The market growth is due to increased demand for passenger vehicles, as gasoline is the primary fuel for light-duty vehicles. Rapid urbanization and increased disposable income have led to increased demand for vehicles. Furthermore, technological advancements in CTL processes have led to improved production of gasoline. Hence, these factors aid in the market growth of this segment.

Application Insights

The transportation fuel segment dominated the market in 2023 with a share of 89.4%. Rising demand for commercial and passenger vehicles due to rapid urbanization has led to the market growth of this segment. Economic growth in developing countries has led to an increase in industrial activities, which has also led to increased demand for transportation fuel. Furthermore, government initiatives to promote CTL development have also resulted in the market growth of this segment.

The cooking fuel segment is projected to grow at a CAGR of 4.5% during the forecast period. The market growth was due to the rising usage of CTL-based cooking fuels, which are safer to handle and comparatively more environment-friendly than wood, charcoal, and other fuels. Furthermore, major companies are focusing on launching efficient CTL-based fuels to improve market expansion. Hence, these factors aid in the market growth of this segment.

Regional Insights

North American coal-to-liquid market was identified as a lucrative region in this industry, as it had a market share of 18.0% in 2023. The market growth results from the rising demand for fuel due to an increase in the number of vehicles and manufacturing plants. Increased awareness regarding alternate fuels has reduced oil and gas dependency. Furthermore, favorable government policies aid in the production of energy domestically. These factors contribute to the market growth of this segment.

U.S. Coal To Liquid Market Trends

The U.S. coal to liquid market is expected to grow rapidly due to major coal reserves and major companies focusing on the development of CTL technology. Favorable government policies and funds promote research and development in this field. Furthermore, the country's reduced dependency on fossil fuels has aided in its increased demand for CTL fuels.

Asia Pacific Coal To Liquid Market Trends

Asia Pacific dominated the coal to liquid market with a market share of 64.4% in 2023. The market growth is due to abundant coal reserves, making Asia Pacific an ideal location for implementing CTL technology. Moreover, the increasing energy needs in the area due to the rising population, energy safety concerns, and the unpredictability of oil costs encourage investments in alternative fuel technologies such as CTL. Furthermore, government initiatives to promote CTL technology in countries such as China, India, and Japan have also led to market growth in this region

China held a substantial market share of 73.4% in the Asia Pacific coal to liquid (CTL) market. The presence of major manufacturing sectors and coal reserves has aided in the market's growth. Manufacturing companies require fuel to conduct their activities. Population growth and urbanization have also increased the demand for CTL-based fuels. Furthermore, major companies are focusing on advancements in CTL technology. Hence, these factors are responsible for the growth of the CTL market in this country.

Europe Coal To Liquid Market Trends

Europe had a market share of 13.3% in 2023, owing to an increased shift towards CTL-based fuels as many European countries focus on reducing their reliance on fossil fuels. Government initiatives and funding to increase the adoption of CTL-based fuel have led to many companies reducing the usage of traditional fossil fuels. Furthermore, rising electricity demands have led to increased usage of CTL fuels in thermal power plants. Hence, these factors are responsible for the market growth of this segment.

The Germany coal-to-liquid (CTL) market is expected to grow rapidly due to the increased implementation of CTL-based fuel in the country's manufacturing sector. Government initiatives regarding the development and usage of CTL fuel technology have reduced dependency on fossil fuels. Furthermore, rising demand for electricity due to rapid urbanization and growth in the manufacturing sector has led to increased usage of CTL-based fuel in the country.

Key Coal To Liquid Company Insights

Some of the major companies in the coal to liquid (CTL) market are Envidity Energy Inc., INNER MONGOLIA YITAI COAL CO., LTD., Altona Rare Earths Plc, and more. Companies are focusing on improving the production efficiency of coal to liquid process and procurement of raw materials in order to mitigate the constant demand of energy resources.

-

Envidity Energy Inc is a company that deals with production of diesel, motor gasoline, jet fuel and more. The company products fuels with the help of coal to liquid processing using Fisher-Tropsch (FT) technology.

-

Altona Rare Earths Plc is a mining company that specializes in development of rare earth elements projects. The company deals with finding and development of metals and minerals such as lithium, copper, nickel, neodymium, and more.

Key Coal to Liquid (CTL) Companies:

The following are the leading companies in the coal to liquid (CTL) market. These companies collectively hold the largest market share and dictate industry trends.

- Envidity Energy Inc.

- INNER MONGOLIA YITAI COAL CO., LTD.

- Altona Rare Earths Plc

- Bakrie Global Ventura

- Celanese Corporation

- CHINA SHENHUA

- Monash Energy

- Sasol Limited

- Linc Energy Systems

- Bumi plc

Recent Developments

- In September 2023, Sasol Limited announced the completion of the study for a new destoning unit to improve coal quality. The company was focused on improving coal quality through various initiatives, such as miner operating training to improve quality awareness and contamination measurement. The company also planned to install various components, such as an inclinometer and technology testing.

Coal To Liquid Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.14 billion

Revenue forecast in 2030

USD 7.27 billion

Growth Rate

CAGR of 8.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, Product, Application, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, China, India, Japan, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE.

Key companies profiled

Envidity Energy Inc.; INNER MONGOLIA YITAI COAL CO., LTD.; Altona Rare Earths Plc; Bakrie Global Ventura; Celanese Corporation; CHINA SHENHUA; Monash Energy; Sasol Limited; Linc Energy Systems., Bumi plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coal To Liquid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global coal to liquid (CTL) market report based on technology, product, application, and region.

-

Technology Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Liquefaction

-

Indirect Liquefaction

-

-

Product Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Diesel

-

Gasoline

-

Other Fuels

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Transportation Fuel

-

Cooking Fuel

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.