- Home

- »

- Electronic & Electrical

- »

-

Coffee Machine Market Size & Share Analysis Report, 2030GVR Report cover

![Coffee Machine Market Size, Share & Trend Report]()

Coffee Machine Market (2023 - 2030) Size, Share & Trend Analysis Report By Product Type (Drip/Filter, Pod/Capsule, Espresso, Bean-to-Cup), By Application (Commercial, Residential), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-377-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Coffee Machine Market Summary

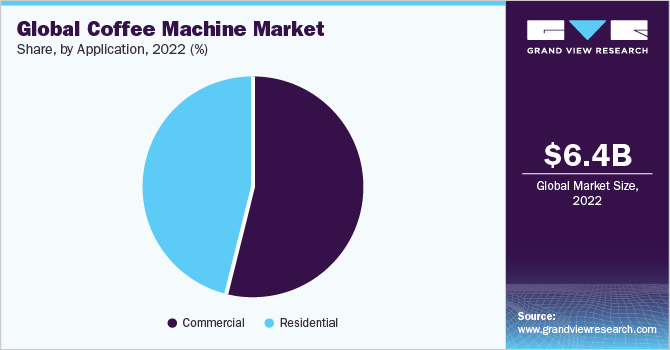

The global coffee machine market size was estimated at USD 6.41 billion in 2022 and is anticipated to reach USD 9.26 billion by 2030, growing at a CAGR of 4.7% from 2023 to 2030. Increased consumption of coffee in Asian countries is one of the key factors driving the growth.

Key Market Trends & Insights

- Europe accounted for the largest revenue share of 32.6% in 2022.

- Asia Pacific is anticipated to grow at the fastest CAGR of 5.6% over the forecast period.

- By product type, demand for pod/capsule machines is projected to grow at the fastest CAGR of 5.3% over the forecast period.

- By application, residential use of coffee machines is projected to grow at the fastest CAGR of 4.9% from 2023 to 2030.

Market Size & Forecast

- 2022 Market Size: USD 6.41 Billion

- 2030 Projected Market Size: USD 9.26 Billion

- CAGR (2023-2030): 4.7%

- Europe: Largest market in 2022

- Asia Pacific: Fastest growing market

In addition, the launch of new products, such as green and organic coffee, is anticipated to result in major consumption, thus contributing to market growth. Growing consumer awareness related to the health benefits of coffee, such as protection against liver cancer, type 2 diabetes, and heart failure, is likely to result in higher coffee consumption, and subsequently contribute to growth in demand for coffee machines.

The rapid rise in the amount of coffee intake is the major factor driving the industry’s growth. This is owing to an increase in demand for specialty beverages, including coffee, in recent decades due to a rising number of affluent consumers and an expanding palate for gourmet variants. According to the National Coffee Association (NCA), in the U.S., over 62.0% of the total population consumes coffee every day. Consumers prefer coffee machines over hand-made coffee due to high demand and the desire for gourmet coffee variants. This trend has resulted in a significant increase in coffee machine sales. According to an NCA report, out of the total coffee consumed in the U.S., nearly 60.0% is gourmet.

The COVID-19 pandemic negatively impacted the industry. Due to the COVID-19 pandemic governments imposed strict lockdowns, also resulting in temporary closure of production facilities. Sales crumpled to the lowest levels during the pandemic, as global demand fell amid the lockdown. The lockdown in China forced coffee machine manufacturers based in the U.S. and Europe to halt production as they export several input supplies temporarily. Relaxation of government restrictions, expansion of commercial infrastructure, and back-to-office culture all contributed to the industry's revival in 2021-22.

Coffee machines reduce the time and effort required to prepare coffee in coffeehouses and office cafeterias. The advent of coffee capsules that offer enhanced tasting coffee and the introduction of smart coffee machines integrated with Bluetooth, Wi-Fi, voice assistance, etc., which can be accessed, operated, and controlled through smartphones from anywhere inside the house, are the most recent advancements in the market. The rising demand for such smart coffee machines by consumers due to their high convenience is expected to significantly aid in the expansion of the global coffee machine industry during the forecast period.

Convenience stores are popular coffee-buying locations among coffee enthusiasts. These convenience stores’ viability is determined by their quick service and automated machines that serve high-quality coffee. While coffee shops cater to a specific demographic of coffee enthusiasts, other foodservice and retail channels cater to a broader range of customers with varying levels of expertise. Market participants are expected to benefit greatly from penetration in these avenues. However, health problems such as anxiety and restlessness due to excessive intake of caffeine act as restraints for industry growth.

Market Dynamics

In the U.S., the consumption of coffee has been rising over the past few years. According to the data released by the International Coffee Organization in 2021, coffee consumption in the U.S. has grown by 1.2% in the past five years, driving the demand for coffee machines in the country. Changing consumer lifestyles and the growing coffee culture drive the demand for coffee machines. The shift in consumer preferences toward specialty coffee, such as artisanal and gourmet blends, drives the demand for various types of coffee machines, including espresso machines and drip coffee makers. Consumers are also discovering various types and flavors of coffee, further driving product demand.

Coffee machines have changed dramatically as a result of technological innovations. Coffee machine manufacturers are now including innovative features like smartphone connectivity, touchscreen interface, and voice control. These developments improve the user experience and make coffee brewing more flexible and convenient. In addition, consumers looking for quick and hassle-free brewing methods prefer modern brewing technologies like pod-based brewers and capsule coffee machines.

The coffee machine market has grown significantly owing to the prevalence of e-commerce platforms. Online shoppers can now easily find a large selection of coffee makers, accessories, and related products. Sales of coffee machines through online channels have increased as a result of the ease of online purchasing, competitive pricing, and the availability of user ratings and suggestions.

Product Type Insights

Demand for pod/capsule machines is projected to grow at the fastest CAGR of 5.3% over the forecast period. Operational convenience offered by automatic coffee machines, coupled with consistent brewing, has driven the middle-class population towards pod coffee machines. Consumer preference for coffee pods has been tarnished due to the high environmental footprint of used coffee pods. Adoption of sustainable coffee pods by manufacturers is likely to boost segment growth in the coming years.

Drip filter machines are projected to grow at a CAGR of 4.6% over the forecast period. Components of drip filter machines, such as the filter and cone, are reusable. This has played an important role in increasing its demand. In addition, manufacturers are introducing drip machines with advanced technological features, which is also likely to propel segment growth. For instance, the advent of smart drip coffee machines. These can be accessed through smartphones or devices, and are being widely used globally as of 2022.

Application Insights

Residential use of coffee machines is projected to grow at the fastest CAGR of 4.9% from 2023 to 2030. Demand for specialty coffee induced with different flavors is driving this segment. In addition, countries, such as the U.S., witness a high demand for household coffee machines owing to higher per capita coffee consumption. Moreover, technological advancements in coffee machines also act as a key driver for segment growth.

Commercial demand is projected to grow at a CAGR of 4.5% over the forecast period. An increasing number of cafes and restaurants across the globe is boosting product demand in this category. The rapidly growing corporate sector is also slated to fuel product demand further. The demand for coffee machines is expected to grow substantially because of increasing investments in commercial spaces such as airports, hospitals, and hotels, among others.

Regional Insights

Europe accounted for the largest revenue share of 32.6% in 2022. High consumption of coffee in the region is among the key factors driving market growth. The presence of a number of commercial complexes and offices results in increased product sales. Large imports of green coffee beans in the region and rising demand for espresso blend drinks are likely to drive the demand for the coffee machines in the region. Moreover, the European espresso machine market is the largest in the world, with about 185,000 units sold every year.

Asia Pacific is anticipated to grow at the fastest CAGR of 5.6% over the forecast period. According to the International Coffee Organization (ICO), in 2019, coffee consumption volume in Asia Pacific was estimated to be 37.51 million bags and increased by 2.9% over the previous year. The increasing popularity of international cafe brands and an increasing number of restaurants, hotels, homes, and companies are expected to fuel demand for coffee machines in the region over the forecast period.

Key Companies & Market Share Insights

Major players are investing in R&D to introduce machines featuring the latest technologies. Considering the distinct needs of F&B chains and specialty coffee shops, manufacturers in the coffee machines industry are introducing multiple models of coffee machines. For instance:

-

In February 2022, Nestle Nespresso S.A. and OpenSC collaborated and announced the launch of a new technology that would increase transparency in the supply chain of the KAHAWA ya CONGO coffee.

-

In July 2021, Keurig launched the company’s new connect technology platform named BrewID. This technology provides a feature that will give customers a properly tailored, full-flavored coffee. In this respect, the technology understands the specific roast and brand of the K-Cup pod to customize brew settings as per the creator’s recommendations.

-

In May 2021, De’ Longhi S.p.A. acquired Eversys, a notable name in the professional espresso coffee machine space, based in Switzerland.

-

In October 2020, Nestlé's coffee brand, Nespresso, launched new touchless functionalities. Nespresso launched three new options for its Nespresso Momento machines to enable employees to maintain social interactions around a cup of coffee more safely.

-

In January 2020, Starbucks Corporation introduced AI-enabled coffee machines across several of their stores in the U.S. and the UK. This machine consists of AI-enabled sensors that help provide an efficient coffee brewing experience to the users.

Some of the key players operating in market include:

-

Keurig Green Mountain, Inc.

-

Panasonic Malaysia

-

Nestlé Nespresso S.A.

-

De’Longhi Appliances S.r.l.

-

Electrolux

-

Morphy Richards India

-

Koninklijke Philips N.V.

-

Hamilton Beach Brands, Inc.

-

Schaerer

-

Robert Bosch GmbH

Coffee Machine Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.64 billion

Revenue forecast in 2030

USD 9.26 billion

Growth rate

CAGR of 4.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Italy; China; Japan; India; South Korea; Australia; Brazil; South Africa

Key companies profiled

Keurig Green Mountain, Inc., Panasonic Malaysia, Nestlé Nespresso S.A., De’Longhi Appliances S.r.l., Electrolux, Morphy Richards India, Koninklijke Philips N.V., Hamilton Beach Brands, Inc., Schaerer, Robert Bosch GmbH.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coffee Machine Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global coffee machine market report on the basis of product type, application, and region.

-

Product Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Drip/Filter

-

Pod/Capsule

-

Espresso

-

Bean-to-Cup

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global coffee machine market size was estimated at USD 6.41 billion in 2022 and is expected to reach USD 6.64 billion in 2023.

b. The global coffee machine market is expected to grow at a compound annual growth rate of 4.7% from 2023 to 2030 to reach USD 9.26 billion by 2030.

b. Drip filter dominated the global coffee machine market with a share of 54.1% in 2022. This is attributable to the increasing introduction of these products integrated with advanced features that have boosted its application in the quick-service restaurants and high-quality coffee providers.

b. Some key players in the global coffee machine market include Keurig Green Mountain, Inc.; Panasonic Malaysia; Nestlé Nespresso S.A.; De’Longhi Appliances S.r.l.; Electrolux; Morphy Richards India; Koninklijke Philips N.V.; Hamilton Beach Brands, Inc.; Schaerer; and Robert Bosch GmbH.

b. Key factors that are driving the market growth include increasing coffee consumption in Asian countries, increasing awareness about the health benefits of coffee, and the introduction of new products, such as green and organic coffee.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.