- Home

- »

- Advanced Interior Materials

- »

-

Cold Spray Technology Market Size, Industry Report, 2030GVR Report cover

![Cold Spray Technology Market Size, Share & Trends Report]()

Cold Spray Technology Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Aluminium, Titanium), By Service (Cold Spray Additive Manufacturing, Cold Spray Coatings), By End Use (Aerospace, Electrical & Electronics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-035-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cold Spray Technology Market Summary

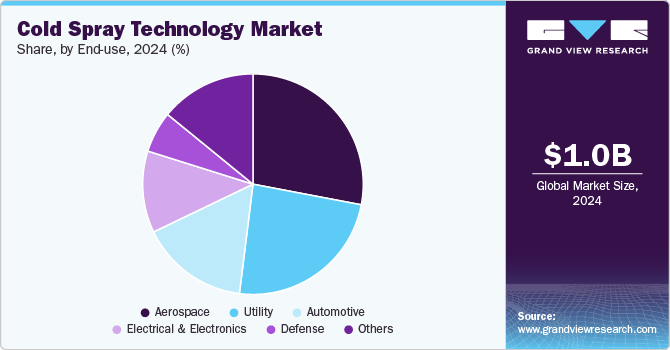

The global cold spray technology market size was estimated at USD 1,047.6 million in 2024 and is projected to reach USD 1,559.7 million by 2030, growing at a CAGR of 7.0% from 2025 to 2030. Rising demand from the aerospace industry as a repair technique for lightweight aerospace alloys is expected to drive the market over the forecast period.

Key Market Trends & Insights

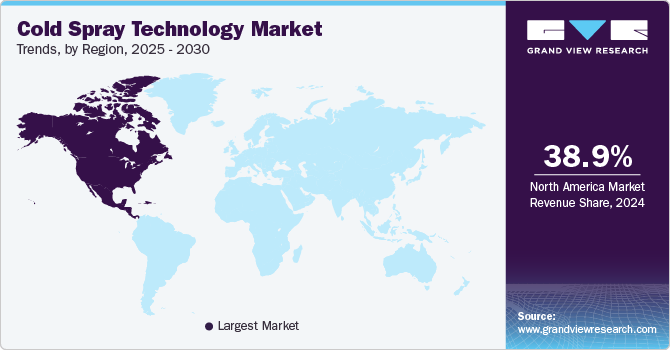

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, South Africa is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, aluminum accounted for a revenue of USD 319.4 million in 2024.

- Titanium is the most lucrative material segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1,047.6 Million

- 2030 Projected Market Size: USD 1,559.7 Million

- CAGR (2025-2030): 7.0%

- North America: Largest market in 2024

In the aerospace industry, cold spray technology is used for developing various components including structured elements, satellites, gearboxes, landing gear nozzles, engine parts, and other nonstructural elements. Thus, the growth of the aerospace industry is projected to have a positive impact on the adoption of cold spray technology in the country over the forecast period. Furthermore, the growing electrical & electronics industry in Asia Pacific will boost the demand for cold spray technology in the market over the forecast period.

The development and the adoption of cold spray technology in the country have been encouraged by the U.S. Department of Defense and the U.S. Army Research Laboratory (ARL) for the last two decades. The U.S. Department of Defense has also offered significant research funding for the use of cold spray technology for repairing damaged parts of warships, fighter planes, defense vehicles, military tanks, etc. For instance, in April 2024, the Letterkenny Army Depot (LEAD) located in Pennsylvania adopted cold spray technology as a part of its modernization plan. This technology is expected to be used by this facility to carry out non-structural upkeeps, which include repairing corroded surfaces, as well as surfaces with other types of faults, due to its low operating temperature.

Drivers, Opportunities & Restraints

The increasing demand for advanced manufacturing processes and materials innovation drives the adoption of cold spray technology. Industries such as aerospace, automotive, and electronics are seeking efficient methods for repairing components and enhancing surface properties without the thermal stress that traditional processes may impose. As the need for lightweight, durable, and corrosion-resistant materials grows, cold spray's ability to deposit coatings at low temperatures becomes an attractive solution for improving performance and extending the lifespan of critical parts.

One of the primary restraints for the widespread implementation of cold spray technology is the relatively high cost of equipment and materials associated with the process. While cold spray offers significant advantages in terms of material performance and efficiency, the initial investment and operational costs can be barriers for smaller manufacturers or those with budget constraints. Additionally, the technology requires specialized training and expertise, which may limit its adoption in industries where skilled personnel are scarce.

There is a significant opportunity for the development of hybrid manufacturing techniques that integrate cold spray with other additive or subtractive processes. By combining cold spray with established methods, manufacturers can enhance their capabilities in creating complex geometries and achieving superior material properties. Furthermore, the growing focus on sustainability and resource efficiency presents an opportunity for cold spray technology to reduce waste and enhance recycling efforts in various industries, aligning with global trends towards greener manufacturing practices.

Material Insights

The aluminum segment led the market and accounted for 28.7% of the global revenue share in 2024. Aluminum and its alloys are extensively used due to their low density, great ductility, good resistance to corrosion, and excellent thermal and electrical conductivity. The cold-sprayed aluminum and its alloy coatings can be utilized to repair industrial par for significant cost savings. Although aluminum and its alloys have a low melting point and relatively low strength, they are theoretically simple materials to spray due to their good plasticity, high deformability, and low critical velocity. Additionally, the aluminum powder's surface is rapidly oxidized, and it is still difficult to make high-density deposits while mitigating the effects of the oxide layer.

Titanium is utilized extensively in petroleum, aviation, chemical, medical, sports equipment, construction, aerospace, automotive, and other fields owing to its high strength, good biocompatibility, superior corrosion resistance, and low density. The critical velocities necessary for the deposition of titanium in the cold spray are high. Higher parameters and a high-pressure cold spray system are needed to produce dense titanium alloy coatings. Cold spraying can generate oxygen-sensitive compounds like titanium without causing considerable chemical deterioration of the powder.

Service Insights

The cold spray coatings segment led the market and accounted for 89.5% of the global revenue share in 2024. Cold spray coatings prevent tensile residual stresses, oxidation, and undesirable chemical reactions. Furthermore, the latest technique for depositing coatings and carrying out additive manufacturing of structures is cold spraying. Different metallic or metallic-ceramic materials can be used in this low-temperature procedure to create coatings with a quality that is not possible to achieve using any other method.

Cold spray additive manufacturing (CSAM) is a high-potential, newly developed technology used for the development of engineering components that offer improved performance across a variety of surfaces, sub surfaces, and interfaces. Future developments in cold spray additive manufacturing (CSAM) technology may result in its potential use in innovative product designing approaches adopted by the automotive industry. The majority of the recent developments in cold spray additive manufacturing (CSAM) technology have been focused on electric motors used in the automotive industry to reduce carbon dioxide emissions from automobiles wherein these motors are to be used.

End Use Insights

The aerospace segment led the market and accounted for 26.4% of the global revenue share in 2024. The cold spray technology market is anticipated to be driven by an expanding application scope due to benefits including reduced harmful gas emissions, wear and corrosion protection, electrical resistance, and thickness capacity. A favorable effect on the cold spray technology market is anticipated from the expansion of the aerospace industry, notably civil aviation, in Asia Pacific including India and China due to the rising consumer disposable income.

Cold-spraying technology has gained more attention globally as a result of advancements in fundamental practical applications in different industries, which is expected to fuel market expansion over the forecast period. Due to its expanding use in a variety of components such as electrical contacts, refrigeration units, circuit boards, electric motors & generators, transformers, semiconductors & displays, and bus bars, which require high electrical resistance, corrosion resistance, and oxidation resistance to operate in harsh environments, cold spray coating is experiencing increased demand in electrical & electronics end-use sector.

Regional Insights

The cold spray technology market in North America accounted for a revenue share of 38.9% in 2024. The region is witnessing significant growth owing to the industrial dynamics and commodity abundance in its countries. North America comprises countries such as the U.S., Mexico, and Canada, which have significant and complex economies. The region represents the largest market for cold spray technology in the world owing to the presence of various aerospace and automotive companies.

U.S. Cold Spray Technology Market Trends

The U.S. cold spray technology market held a significant share in 2024. The rising demand for products manufactured using cold spray technology from the transportation and automotive industries in the U.S. is expected to drive the market’s growth in the country over the forecast period. Moreover, cold spray technology is mainly used in the electronics industry for coating of electronics components wherein corrosion protection is of utmost importance.

The cold spray technology market in Canada is expected to grow at a CAGR of 5.6% over the forecast period. Rising investments in research activities for developing self-driving or autonomous cars and increasing adoption of the Internet of Things (IoT) by the masses in Canada have augmented the demand for electronic housing, sensors, actuators, semiconductors, and microcontrollers in the country. This, in turn, has led to the surged adoption of cold spray coatings in Canada that are used in the aforementioned products.

Mexico cold spray technology market is expected to grow at a CAGR of 5.1% over the forecast period. The support of the Government of Mexico for partial privatization of the oil & gas industry in the country is expected to provide new opportunities for foreign midstream providers in the oil & gas industry in Mexico. It is also anticipated to offer lucrative growth opportunities to the oil & industry and increase the upstream, midstream, and downstream activities in the country, thereby fueling the demand for cold spray technology for coating sleeves, extruders, hydraulic plungers, rotors, mechanical seals, lip seals, compressor rods, pump shafts, bearings & bearing bushes, etc.

Europe Cold Spray Technology Market Trends

The cold spray technology market in Europe represents the second-largest market for cold spray technology globally owing to the presence of modern infrastructure and facilities, increased research & development activities, and the availability of a highly qualified workforce. The recent development of cold spray applications for repair and additive manufacturing of various components in different fields including biomedical, aerospace, electronics, energy, and semiconductor is projected to drive the market over the forecast period.

Germany cold spray technology market held a 23.5% share in the European market. Automotive, aerospace, and machinery are the top industries in Germany, with automotive being the largest. The growth of industrial and automotive industries is expected to fuel the demand for cold spray technology in the country.

The cold spray technology market in the UK held a 13.0% share in the European market. The UK market is primarily driven by the growing product demand from the aerospace sector, especially for component repairing applications. Rising military spending and boosting research & development activities through joint industry and government investment in the future flight challenge program are expected to positively impact the market growth over the forecast period.

Asia Pacific Cold Spray Technology Market Trends

Asia Pacific cold spray technology market dominated with 22.3% share in 2024. Asia Pacific is the fastest-growing region in the world, contributing to over two-thirds of the global economic growth. The region is one of the most lucrative destinations for automotive, medical, aerospace, and electronic companies. The flourishing automotive industry in Asia Pacific is projected to contribute to the adoption of cold spray technology in the region over the forecast period.

China cold spray technology market held a 23.0% share in the Asia Pacific market. According to the International Trade Administration, China is the world’s largest automobile market with local production to surpass 35 million automobiles by 2025. Growing new developments of NEVs, a stringent limit on fuel consumption, and technological developments are projected to fuel the demand for automobiles. These factors are expected to lead to growth in the production output of the automobile industry, which, in turn, is expected to drive the demand for cold spray technology in the automobile sector.

The cold spray technology market in India held a 13.2% share in the Asia Pacific market. The demand for cold spray technology in the country is driven by the robust growth of the aerospace, utility, and automotive sectors. In India, the usage of cold spray technology in the utility sector has been growing due to its potential benefits.

Central & South America Cold Spray Technology Market Trends

The Central & South American cold spray technology market is expected to witness significant growth owed to increasing industrial investments in the automotive sector. Major manufacturers, such as Volkswagen, and General Motors, announced the expansion of their existing manufacturing facilities in the region to cater to the increasing demand.

Oil & gas, aerospace, automotive, and power generation, are among the top industries in the country. The Brazilian government is promoting the widespread usage of solar energy to diversify its power mix. Hence, substantial growth in the utility sector in the country is projected to have a positive impact on the cold spray technology market over the forecast period.

Middle East & Africa Cold Spray Technology Market Trends

The cold spray technology market in the Middle East & Africa is expected to grow at a significant CAGR over the forecast period. The Gulf Cooperation Council has over 700 healthcare projects worth USD 60.9 billion in the pipeline. Medical tourism is an integral part of the economic diversification plans of these countries, with Abu Dhabi and Dubai being at the forefront of attracting medical tourists. In addition, existing hospitals in these GCC countries are planning to expand their medical capabilities, and physician practices, which has created an increased demand for medical products.

Saudi Arabia cold spray technology market has the second-largest oil reserve in the world. The country possesses around 17% of the proven petroleum reserves of the world. The oil & gas sector accounts for around 50% of the country’s GDP, and approximately 70% of the export earnings. The country is home to the largest offshore and onshore oil fields in the world. The Saudi Arabian Oil Company (Saudi Aramco) continues to identify new fields, expand existing fields, and enhance production. The growth of oil & gas industry in the country is expected to provide lucrative growth opportunities for cold spray technology over the forecast period.

Key Cold Spray Technology Company Insights

Some key players operating in the industry include ASB Industries, Bodycote Plc, and Centerline (Windsor) Limited.

-

Hannecard ASB provides industrial coating services and coating equipment. It has machinists and thermal sprayers, and extensive grinding and machining capabilities. The cold spray solutions can be used for extreme wear, high-temperature barriers, and all-encompassing part repairs.

-

Bodycote specializes in the provision of solutions for the production of precision components. Aerospace applications have been a focus of Bodycote. The product portfolio of the company includes over 100 thermally sprayed aerospace applications.

Titomic Limited and Flame Spray Technologies are some emerging market participants in the market.

-

CenterLine offers customized automated welding line and assembly lines along with standard brand products for fastener welding, resistance welding, metal forming, metal joining, and metal coating applications. It also manufactures and designs bent adapters according to North American and European standards.

-

Titomic specializes in automated metal manufacturing. Its fully customizable cold spray systems can make fast repairs and carry out metal coatings without heat. These systems also can integrate advanced powder feeders for easy and rapid application of thinner coatings across a range of verticals such as aerospace to defense, energy, electronics, and automotive.

Key Cold Spray Technology Companies:

The following are the leading companies in the cold spray technology market. These companies collectively hold the largest market share and dictate industry trends.

- ASB Industries (Hannecard Roller Coatings, Inc)

- Bodycote plc

- Flame Spray Technologies BV

- Plasma Giken Co., Ltd.

- VRC Metal Systems

- CenterLine (Windsor) Limited

- WWG Engineering Pte. Ltd.

- Praxair S.T. Technology, Inc.

- Impact Innovations GmbH

- Concurrent Technologies Corporation

- Effusiontech Pty Ltd (SPEE3D)

- Titomic Limited

Recent Developments

-

In July 2024, VRC Metal Systems introduced the Dragonfly Cold Spray System, an additive manufacturing solution tailored for in-field repairs in sectors such as maritime, aeronautical maintenance, repair and overhaul, and energy. Designed to be functionally similar to VRC's stationary systems like the Raptor and Gen IV, the Dragonfly features four primary modular components: the electrical assembly, gas train, powder feeder, and heating unit, with the heaviest module weighing 42.6 kg.

-

In November 2022, Titomic announced the launch of its D623 medium-pressure Cold Spray Additive Manufacturing (CSAM) machine. With the capabilities such as the restoration of highwear parts and wear-resistant coatings, among other updates, the newly launched machine can deposit harder metals than its D523 low-pressure system.

Cold Spray Technology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.11 billion

Revenue forecast in 2030

USD 1.56 billion

Growth rate

CAGR of 7.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Material, service, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

ASB Industries (Hannecard Roller Coatings, Inc); Bodycote plc

Flame Spray Technologies BV; Plasma Giken Co., Ltd.; VRC Metal Systems; CenterLine (Windsor) Limited; WWG Engineering Pte. Ltd.; Praxair S.T. Technology, Inc.; Impact Innovations GmbH;

Concurrent Technologies Corporation; Effusiontech Pty Ltd (SPEE3D); Titomic Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cold Spray Technology Market Report Segmentation

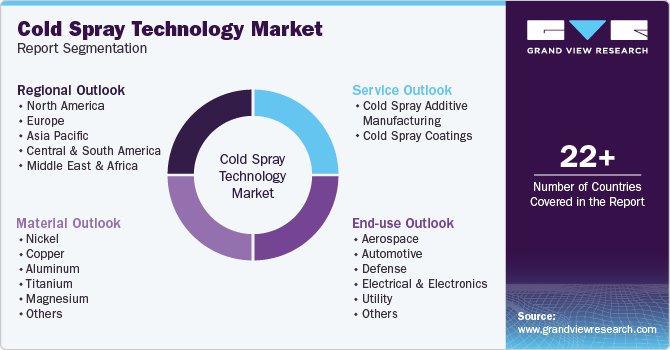

This report forecasts revenue growth at global, regional & country levels, and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cold spray technology market based on the material, service, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Nickel

-

Copper

-

Aluminum

-

Titanium

-

Magnesium

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Cold Spray Additive Manufacturing

-

Cold Spray Coatings

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace

-

Automotive

-

Defense

-

Electrical & Electronics

-

Utility

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cold spray technology market size was estimated at USD 1.05 billion in 2024 and is expected to reach USD 1.11 billion in 2025.

b. The global cold spray technology market is expected to grow at a compound annual growth rate of 7.0% from 2025 to 2030 to reach USD 1.56 billion by 2030.

b. The aerospace end-use segment led the market and accounted for 26.4% of the global revenue share in 2024. The cold spray technology market is anticipated to be driven by an expanding application scope due to benefits including reduced harmful gas emissions, wear and corrosion protection, electrical resistance, and thickness capacity.

b. Some of the key players operating in the cold spray technology market include ASB Industries (Hannecard Roller Coatings, Inc); Bodycote plc, Flame Spray Technologies BV; Plasma Giken Co., Ltd.; VRC Metal Systems; CenterLine (Windsor) Limited; WWG Engineering Pte. Ltd.; Praxair S.T. Technology, Inc.; Impact Innovations GmbH; Concurrent Technologies Corporation; Effusiontech Pty Ltd (SPEE3D); Titomic Limited.

b. Rising demand from aerospace industry as a repair technique for lightweight aerospace alloys is expected to drive the market over the forecast period. Furthermore, growing electrical & electronics industry in Asia Pacific will boost the demand for cold spray technology market over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.