- Home

- »

- Next Generation Technologies

- »

-

Colombia Travel Retail Market Size, Share, Industry Report, 2019-2025GVR Report cover

![Colombia Travel Retail Market Size, Share & Trends Report]()

Colombia Travel Retail Market Size, Share & Trends Analysis Report By Product (Perfume & Cosmetics, Confectionery, Wine & Spirit, Fashion, Electronics, Tobacco), By Channel, and Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-845-9

- Number of Report Pages: 55

- Format: PDF, Horizon Databook

- Historical Range: 2015 - 2017

- Forecast Period: 2019 - 2025

- Industry: Technology

Report Overview

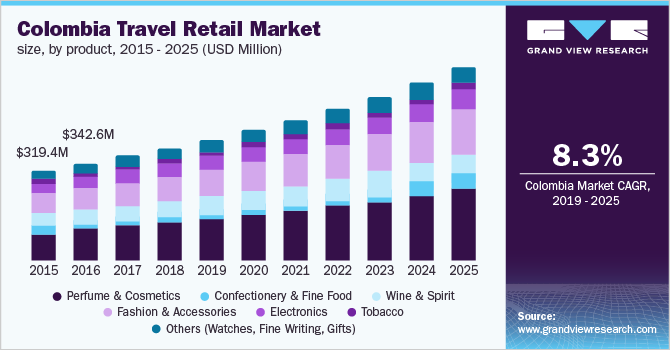

The Colombia travel retail market size to be valued at USD 686.0 million by 2025 and is expected to grow at a compound annual growth rate (CAGR) of 8.3% during the forecast period. The market is anticipated to be driven by the rising number of international travelers and the growth of the travel and tourism industry. Colombia is Latin America’s third-largest air travel market after Brazil and Mexico. According to the World Travel & Tourism Council (WTTC), the Colombian capital of Bogota alone accounts for 29% of Colombia’s tourism activity. The anticipated surge in international passenger traffic in the next few years is expected to have an impact on travel retail.

Caño Cristales, a remote river canyon, was closed to tourists for several years because of guerrilla activity. The Colombian government has taken several efforts to regulate the tourism industry including the demobilization of the largest guerrilla group in Caño Cristales, thereby driving the market. The untapped travel retail channels, such as downtown and hotel shops, railway stations, and cruise lines, are expected to witness significant growth in line with the rising disposable income and the increasing number of tourists. The penetration levels of travel retail at airports are also expected to grow significantly over the next decade, which can be attributed to the significant investment opportunities that are created as a result of foreign direct investments.

A rising number of air passengers owing to an enhanced standard of living and low airfares is expected to contribute to the growth of travel retail. Political stability and improved security situation drive the tourism industry. Additionally, owing to the changing nature of the air travel industry, such as the growing number of millennial travelers, retailers are increasingly focusing on offering digitally-driven platforms to drive consumer buying power. Moreover, a growing number of efforts taken by various airports to improve the revenue from other non-aeronautical resources has accelerated the advancement of the retail sector.

The continued development of the travel and tourism industry has improved the growth prospects of the retail sector. The growth of Colombia's travel and tourism industry is subsequently driving the demand for perfumes, cosmetics, confectioneries, fine food, wine and spirit products, apparel, electronics, tobacco products, and other products, such as watches and gifts. An improving economy and the rising levels of the disposable income of Colombian middle-income households are expected to act as a catalyst for travel retail. The changing international perception about the Colombian business environment following the execution of the newly signed free trade agreements is also expected to drive the market growth.

Colombia Travel Retail Market Trends

The Colombian travel retail market is predicted to rise over the forecast period as a result of rising levels of disposable income and increasing middle-class consumers in Colombia coupled with a stable economy. In addition, the industry growth is driven by a rise in the number of foreign passengers owing to the rising living standards and a changing lifestyle.

Medium and small-sized businesses, which are the backbone of any economy, are profited from travel retail. They use travel retail as a reliable platform for exhibiting their items to foreign tourists for a low cost of advertising. It offers an incredible opportunity for retailers to market their products, enhance client loyalty, and acquire new customers from other countries. These factors are expected to propel the market growth over the forecast period.

However, it is anticipated that the development of the travel retail sector will be hampered in the near future by strict government regulations, the chaotic local marketplaces, and the low interest of consumers in shopping at airports. Although the stores and outlets at the airport are trying to increase the product sales, but are limited due to the high price of the products and lack of promotional campaigns. In addition, the political instability in the country is expected to hamper the market growth.

The government of Colombia has increased its investment and foreign direct investment in the travel and tourism industry to support its development. In addition, the government has devised favorable policies for the same. These are expected to generate lucrative opportunities for market growth over the forecast period.

Product Insights

Based on product, the market has been segmented into perfume and cosmetics, wine and spirit, confectionery and fine food, fashion and accessories, tobacco, electronics, and others. Perfume and cosmetics generated the highest revenue in 2018, accounting for 30.6% of the market share. According to studies, people across all age groups usually spend around USD 30 on perfumes and cosmetics on a single purchase. Additionally, an increased preference for perfumes and cosmetics by millennials and middle-aged consumers is projected to drive the segment over the forecast period.

The fashion and accessories segment accounted for the second-largest market share of 22.8% in 2018. Strong government support for organizations with international certificates such as ISO 14000, BASC, and ISO 9000 and favorable commercial trade agreements drive the country’s fashion industry position in the South American region. The local fashion and accessory manufacturers have a competitive advantage over international fashion and accessory manufacturers owing to the unique design and product quality, thereby driving the retail sector in the country.

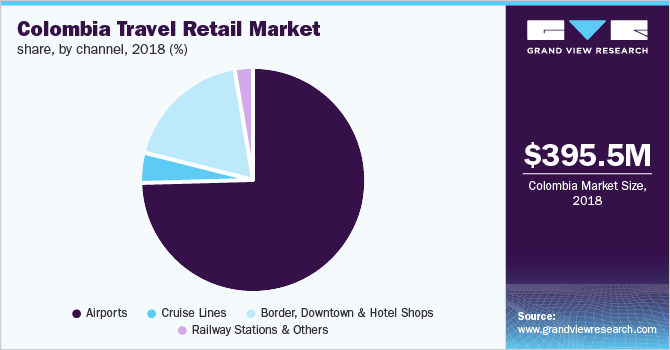

Channel Insights

Based on channel, the market has been classified into airports, cruise lines, border, downtown, and hotel shops, and railway stations, and others. The airport segment accounted for the largest market share in 2018. The increasing number of airline passengers across the globe is driving the market growth for this segment. Moreover, duty-free product sales in Colombia airports have increased over the last few years. In Colombia, the airline industry is undergoing a complete transformation with an increase in airline routes and the arrival of low-cost airlines.

The border, downtown, and hotel shops segment held the second-largest market share in 2018 and is expected to witness considerable growth over the forecast period. The rise in local travel and tourism has increased the demand for electronics, fashion, and accessories, and fine food items stores at the border, downtown, and hotels, thereby driving the retail sector. Retailers have a potential opportunity to gain higher profits and experience better operational performance owing to lower rents for shops at border and downtown areas in comparison to airports.

Key Companies & Market Share Insights

The industry has undergone unprecedented structural changes and consolidation in recent years in the form of partnerships, mergers, acquisitions, and the foray of new overseas competitors. There is moderate competition in the market owing to the limited number of players active in the market. However, companies are focusing on partnerships and expansions to enter the Colombian market. Moreover, the government plans to expand the airport passenger capacity over the next few years which is expected to offer potential growth opportunities for retail operators in the travel and tourism industry.

Prominent players in operating in the market include Duty-Free Americas, Inc. (DFA); Dufry and 3Sixty Duty-Free; Motta International; Areas; and Duty-Free Partners. A majority of these companies adopt both organic and inorganic growth strategies to increase their market share. For instance, in November 2019, Duty-Free Americas, Inc., in partnership with Diageo Global Travel and Middle East (GTME), opened a Diageo store at El Dorado International airport (Colombia). The store was the first Diageo retail shop in the Latin American region.

Recent Developments

-

In June 2022, Dufry announced the extension of its current contract to run the two duty-free shops at Kuwait International Airport in Terminal 1 for an additional four years. These will supplement the current offerings, which include international firms in all the major travel retail categories, such as cosmetics, food, candy, cigarettes, and luxury items.

-

In July 2021, Virgin Atlantic, a major Britain's international airline and a pioneer in the field of passenger experience, and 3Sixty Duty Free, a leading provider in omnichannel travel retail solutions, announced expanded cooperation. This collaboration will improve the passenger experience and the entire economic possibilities for travel retail. Also, the partnership is expected to introduce the industry to the next-generation omnichannel travel retail solution powered by Omnevo.

-

In February 2020, Areas, a global leader in food, beverage, and travel retail acquired 80% of the airport's gastronomic offer during the restaurant tendering procedure conducted for the Los Cabos aerodrome.

Colombia Travel Retail Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 457.8 million

Revenue forecast in 2025

USD 686.0 million

Growth Rate

CAGR of 8.3% from 2019 to 2025

Base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, channel

Key companies profiled

Duty Free Americas, Inc. (DFA); Dufry and 3Sixty Duty Free; Motta International; Areas; Duty Free Partners

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country; regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Colombia Travel Retail Market SegmentationThis report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2015 to 2025. For this study, Grand View Research has segmented the Colombia travel retail market report based on product and channel:

-

Product Outlook (Revenue, USD Million, 2015 - 2025)

-

Perfume & Cosmetics

-

Confectionery & Fine Food

-

Wine & Spirit

-

Fashion & Accessories

-

Electronics

-

Tobacco

-

Others

-

-

Channel Outlook (Revenue, USD Million, 2015 - 2025)

-

Airports

-

Cruise Lines

-

Border, Downtown & Hotel Shops

-

Railway Stations & Others

-

Frequently Asked Questions About This Report

b. The global colombia travel retail market size was estimated at USD 425.3 million in 2019 and is expected to reach USD 457.8 million in 2020.

b. The global colombia travel retail market is expected to grow at a compound annual growth rate of 8.3% from 2019 to 2025 to reach USD 686.0 million by 2025.

b. Airports channel segment dominated the colombia travel retail market with a share of 75.0% in 2019. The increasing number of airline passengers across the globe is driving the market growth for this segment.

b. Some key players operating in the colombia travel retail market include Duty Free Americas, Inc. (DFA); Dufry and 3Sixty Duty Free; Motta International; Areas; and Duty Free Partners.

b. Key factors that are driving the market growth include the rising number of international travelers, and the growth of the travel and tourism industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."