- Home

- »

- Automotive & Transportation

- »

-

Commercial Aircraft Landing Gear Market Size Report, 2030GVR Report cover

![Commercial Aircraft Landing Gear Market Size, Share & Trends Report]()

Commercial Aircraft Landing Gear Market Size, Share & Trends Analysis Report By Gear Position (Main Landing, Nose Landing), By Component, By Aircraft Type, By Arrangement Type (Tricycle, Tandem, Tailwheel), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-041-5

- Number of Report Pages: 184

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market size & Trends

The global commercial aircraft landing gear market size was valued at USD 2,357.5 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.5% from 2023 to 2030.The expansion in the fleet size of major airlines and the surging growth in the commercial aviation sector is expected to drive demand for new airliners and, consequently, for landing gear.

The civil aviation sector is poised to grow significantly due to the increased gear position of next-generation aircraft. Improvements in global economic conditions have led to an increase in air passenger traffic worldwide. There has been a steep increase in commercial airplanes to cater to the increasing demand for air travel. This growth in commercial aircraft is expected to drive demand for commercial aircraft landing gear systems.

Airplane manufacturers now use lightweight materials, electronic technologies, and innovative solutions to optimize overall aircraft performance during touchdowns and reduce aircraft downtime. These new systems require a lower degree of maintenance than their traditional counterparts. The increasing need for more fuel-efficient and eco-friendly airliners to replace the older ones is expected to drive the industry over the next eight years.

The global commercial aircraft landing gear industry is expanding rapidly. Technologically advanced control systems are increasingly replacing manually-controlled hydraulic and mechanical systems. Moreover, the competition among the industry incumbents across the value chain is increasing considerably.

The changing global economy transforms the global industry. However, challenges, such as increasing energy costs, expensive raw materials, and U.S. dollar inflation, are expected to challenge the industry's growth in the future. To overcome these obstacles, various players across the value chain, from OEMs to component & raw material suppliers, have started developing new business processes to benefit from the rapid globalization of the industry.

The commercial aviation industry has been perilously placed since 2008 when oil prices skyrocketed to almost USD 150 a barrel. It consequently resulted in a decline in passenger numbers and a fall in aircraft production. Recent times have witnessed a rise in the number of passengers in commercial aviation as oil prices have stabilized. The growing power bestowed on the middle-class population in developing economies and the mounting global economy have emerged as the dominant driving factors for the growth of commercial aviation, thereby fueling the demand for landing gear.

Around 3 billion people in the Asia-Pacific region are anticipated to enter the middle class by 2030. The Asia-Pacific region is anticipated to witness sturdy growth in the commercial aviation sector because the world's major air traffic would be located there. A major chunk of this population would be across the Asia-Pacific region as budget carriers would service the novel cost-sensitive middle class. The major returns on investment are expected from pilot training schools, providing Asian budget carriers with qualified commercial pilots. The expansion in the fleet size of major airlines and the surging demand for commercial aviation is expected to drive the demand for new aircraft and, ultimately, for landing gear.

Gear Position Insights

The gear position segment is categorized into main and nose landing gear. The main landing gear held the largest market share of 65.6% in 2022. Main landing gears are estimated to dominate the market over the next eight years as they constitute one of the primary requirements for aircraft. The main landing gear bears most of the aircraft's weight during landing and takeoff. It is responsible for absorbing the impact forces and providing stability to the aircraft. The main gear typically consists of larger and more robust components than the nose gear, allowing it to handle higher loads and withstand the stress associated with landing. This load-bearing component is crucial for ensuring the safe operation of commercial aircraft, making the main landing gear a critical component.

The nose landing gear segment is projected to register the fastest CAGR of 9.1% over the forecast period. Advances in aircraft technology have led to the development of more efficient and capable aircraft models. These advancements often include improvements in landing gear systems, including the nose landing gear. Upgraded nose landing gears offer enhanced reliability, durability, and performance, which can improve overall aircraft safety and efficiency.

Landing gear manufacturers are substantially increasing investments in new touchdown sets for exchange purposes. Airline operators are now becoming more reluctant to purchase spares of these systems, mainly due to high costs. Most airlines prefer to rely on pool items and short-term leases. The increasing demand for MRO has made it difficult for OEMs to support their products due to low capacity and is thus expected to drive revenues for line-fit system providers.

Aircraft Type Insights

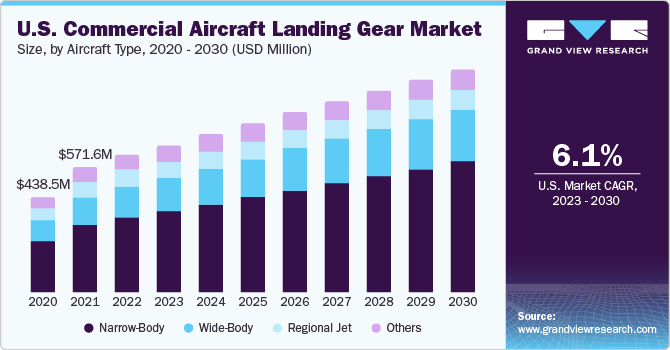

The aircraft type segment is divided into narrow-body, wide-body, regional jet, and others. The narrow-body segment dominated the market with the highest revenue share of 59.7% in 2022. Narrow-body is expected to emerge as the leading segment over the forecast period. Rising passenger traffic in Low-Cost Carriers (LCCs) and a growing number of high-density flights between major airports are expected to drive the demand for such aircraft.

Airlines across developed economies, such as the U.S. and Germany, face growing competition from LCCs, as these carriers are transforming older, fuel-inefficient airplanes with new economic single-aisle models. Moreover, increased demand for replacing aging airliners, especially in emerging markets, is expected to further drive the need for commercial airplanes over the forecast period.

The wide-body segment is expected to witness significant growth of CAGR 8.0% over the forecast period. Wide-body aircraft are designed to be more fuel-efficient, allowing airlines to operate long-haul flights with lower fuel consumption per passenger. They often incorporate advanced technologies, such as improved aerodynamics, lighter materials, and more efficient engines. By reducing fuel consumption and emissions, wide-body aircraft help airlines meet environmental regulations and reduce operating costs. The demand for these fuel-efficient wide-body aircraft leads to the expansion of the commercial aircraft landing gear market as manufacturers develop landing gear systems that can handle the unique requirements of these larger and more efficient aircraft.

Arrangement Type Insights

The tricycle segment dominated the market with the highest revenue share of 66.4% in 2022. The tricycle is the most widely used arrangement type globally, providing better visibility from the flight deck during ground maneuvering. Such an arrangement provides a safe distance between the other aircraft's components, such as fuselage and wings, when the airplane is on the ground.

The tandem segment is expected to witness significant growth of CAGR 8.8% over the forecast period. The tandem segment is poised to witness the highest growth over the forecast period as it allows for flexible wings with gears under the fuselage. The tail and main gears are aligned on the airplane's longitudinal axis in such an arrangement. Few airliners, including sailplanes, are designed with tandem gears. The tailwheels segment accounted for a considerable market share in 2022, and these landing gears are mostly used in traditional or small airplanes.

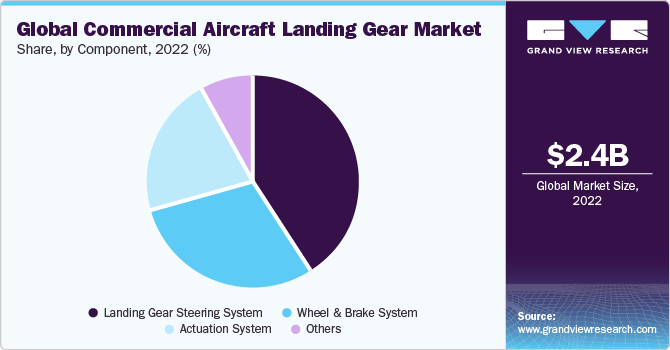

Component Insights

The landing gear steering system segment dominated the market, with the highest revenue share of 41.3% in 2022. The dominance in the landing gear market is determined by load-bearing components, structural design, complexity, and overall performance rather than the steering system alone. The main landing gear, with its weight distribution, load-bearing component, and structural design, remains the primary factor in the market.

On the other hand, the actuation system segment is expected to grow at a significant CAGR of 8.8% over the forecast period. Actuation systems play a crucial role in the performance and safety of commercial aircraft landing gear. These systems are responsible for deploying and retracting the landing gear and providing stability and control during landing and takeoff. Advanced actuation systems offer improved reliability, precision, and responsiveness, which are highly valued in the aviation industry. The focus on safety and performance makes actuation systems a key component in commercial aircraft landing gear, leading to their dominance in the market.

Moreover, electronic control systems are increasingly replacing hydro-mechanical systems owing to their inherent advantages, such as high accuracy and the capability to change various design parameters, including steering ratio and steering rate. There has been a similar trend in the braking systems segment, wherein electronic systems replace conventional mechanical braking systems.

Although a majority of airliners have steerable nose gear, some airplanes do not possess the ability to steer the nose gear. In such cases, the steering operation is accomplished with the help of differential braking during taxi. Heavy airliners are typically equipped with hydraulic power to steer the nose gear. The touchdown systems are precisely designed to reduce the ground loads transmitted to the airframe. Some airplanes employ semi-active and active shock absorber systems to improve landing gear performance.

Regional Insights

North America dominated the market with the largest revenue share of 31.8% in 2022. North America boasts a significant number of airlines and aircraft fleet operators. Major carriers, including American Airlines, United Airlines, Delta Air Lines, and Southwest Airlines, are headquartered in the region. These airlines operate extensive domestic and international networks, requiring many aircraft and corresponding landing gear systems. The demand generated by North American fleet operators drives the market for commercial aircraft landing gear, providing a favorable environment for North American manufacturers to thrive.

The Asia Pacific is expected to grow at the fastest CAGR of 9.2% during the forecast period. Asia Pacific is presumed to emerge as the dominant region over the forecast period due to the growing demand for commercial aircraft across developing countries, such as Japan and India. The demand for commercial aviation is increasing due to the growing income levels of middle-class society, making flying more affordable. The region is expected to achieve unprecedented long-term growth in commercial aviation. This growth is anticipated to generate substantial economic impacts from commercial aerospace and facilitate general growth in developing economies from the catalytic effect of increased global connectivity.

Moreover, Asia Pacific is achieving unprecedented long-term growth in commercial aviation, which in turn is generating high economic impacts from aviation and facilitating general growth in developing economies from the catalytic impact of increased global connectivity. For instance, in November 2022, China Aviation Supplies (CASC) officially concluded a significant bulk purchasing agreement with Airbus involving the acquisition of 140 Airbus jets. The total value of this deal was estimated at USD 17 billion and included CASC's existing orders.

Key Companies & Market Share Insights

The global market for commercial aircraft landing gear is dynamic. Companies in the marketplace are transforming their gear positions and solutions to provide cost-effective systems to aircraft manufacturers. The key manufacturers are increasingly forming long-term agreements with suppliers to effectively manage their profit margins and inventory flow.

Other strategies companies undertake include developing new gear positions and service lines. For instance, in September 2022, Caterpillar announced the launch of a Cat G3512 natural gas generator. The generator is designed to perform maximum operations on a low-pressure energy supply. This newly launched generator suits data centers, schools, retail complexes, universities, government offices, and research facilities.

Key Commercial Aircraft Landing Gear Companies:

- AAR

- Advantage Aviation Technologies

- CIRCOR AEROSPACE PRODUCTS GROUP

- Eaton

- Héroux-Devtek

- Honeywell International Inc.

- Magellan Aerospace Corporation

- Liebherr

- MAG Inc.

- Sumitomo Precision Products Co., Ltd. (SPP)

- Safran Landing Systems

- UTC Aerospace Systems (United Technologies Corporation (UTC))

- Triumph Group

- Whippany Actuation Systems

Recent Developments

-

In March 2023, Emirates, the prominent Dubai-based airline and the leading operator of Airbus A380 long-range aircraft globally, has recently entered into two significant contracts with Lufthansa Technik AG for comprehensive Maintenance, Repair, and Overhaul (MRO) services. The agreements entail Lufthansa Technik providing Emirates with highly adaptable additional components for A380 base maintenance tasks, including C-checks and overhauls for the main landing gears of the airline's double-deck flagship aircraft.

-

In January 2023, ASL Aviation Holdings and AMETEK MRO AEM collaborated to provide landing gear services for ASL's esteemed European B737 Next Generation and Classic aircraft fleet. This strategic partnership underscores ASL's unwavering dedication to forming strong alliances with premier suppliers like AEM. By entering into this agreement, ASL gains the advantage of optimizing the overhaul processes for landing gears across its extensive European B737 fleet while entrusting the task to a reputable and reliable supplier with whom they have full confidence to deliver exceptional service.

-

In January 2023, UAVOS Inc. achieved remarkable milestones in its Medium Altitude Long Endurance (MALE) unmanned aircraft program by successfully conducting tests on its main landing gear leaf spring. This cutting-edge leaf-spring system is fabricated using high-temperature molding techniques and aircraft prepreg carbon material, resulting in a remarkable 50% increase in strength compared to conventional steel while maintaining a thinner and lighter profile.

-

In November 2022, Deutsche Aircraft and HEGGEMANN AG jointly announced the achievement of the gear positioning readiness stage for the new landing gear, designed to be compatible with the entire Dornier 328 (D328) aircraft family. This landing gear is designed to be retrofittable to turboprop and jet variants of the existing in-service fleet and the new D328ecoTM aircraft.

-

In July 2022, Airbus confirmed the signing of multiple aircraft orders with Air China, China Eastern, China Southern, and Shenzhen Airlines, amounting to 292 A320 family aircraft. This development showcased remarkable recovery momentum for the Chinese aviation market. The number of aircraft ordered is expected to generate a substantial demand for landing gear installed on these planes. Consequently, the market for landing gears is poised for exponential growth opportunities during the forecast period.

Commercial Aircraft Landing Gear Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.55 billion

Revenue forecast 2030

USD 4.24 billion

Growth rate

CAGR of 7.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Gear position, component, aircraft type, arrangement type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Japan; China; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

AAR; Advantage Aviation Technologies; CIRCOR AEROSPACE PRODUCTS GROUP; Eaton; Héroux-Devtek; Honeywell International Inc.; Magellan Aerospace Corporation; Liebherr; MAG Inc.; Sumitomo Precision Products Co., Ltd. (SPP); Safran Landing Systems; UTC Aerospace Systems (United Technologies Corporation (UTC)); Triumph Group; Whippany Actuation Systems

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Commercial Aircraft Landing Gear Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global commercial aircraft landing gear market report based on gear position, component, aircraft type, arrangement type, and region:

-

Gear Position Outlook (Revenue in USD Million, 2017 - 2030)

-

Main Landing Gear

-

Nose Landing Gear

-

-

Component Outlook (Revenue in USD Million, 2017 - 2030)

-

Landing Gear Steering System

-

Wheel & Brake System

-

Actuation System

-

Others

-

-

Aircraft Type Outlook (Revenue in USD Million, 2017 - 2030)

-

Narrow-Body

-

Wide-Body

-

Regional Jet

-

Others

-

-

Arrangement Outlook (Revenue in USD Million, 2017 - 2030)

-

Tricycle

-

Tandem

-

Tailwheel

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global commercial aircraft landing gear market size was estimated at USD 2,357.5 million in 2022 and is expected to reach USD 2.55 billion in 2023.

b. The global commercial aircraft landing gear market is expected to grow at a compound annual growth rate of 7.5% from 2023 to 2030 to reach USD 4.24 billion by 2030.

b. Asia Pacific region is anticipated to register growth at a fastest CAGR owing to the growing demand of commercial aviation as a result of rising income levels of the middle-class society across the countries in the region.

b. Some key players operating in the commercial aircraft landing gear market include Eaton Corporation plc, Héroux-Devtek Inc, Mecaer Aviation Group (MAG), Safran Landing Systems, UTC Aerospace Systems, and Honeywell International, Inc.

b. Key factors that are driving the market growth include the expansion in the fleet size of major airlines and the surging growth in the commercial aviation sector.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."