- Home

- »

- Homecare & Decor

- »

-

Commercial Cleaning Products Market Size Report, 2030GVR Report cover

![Commercial Cleaning Products Market Size, Share & Trends Report]()

Commercial Cleaning Products Market Size, Share & Trends Analysis Report By Application (Cleaning Tools and Paper Products, Personal Care), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-820-4

- Number of Report Pages: 88

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

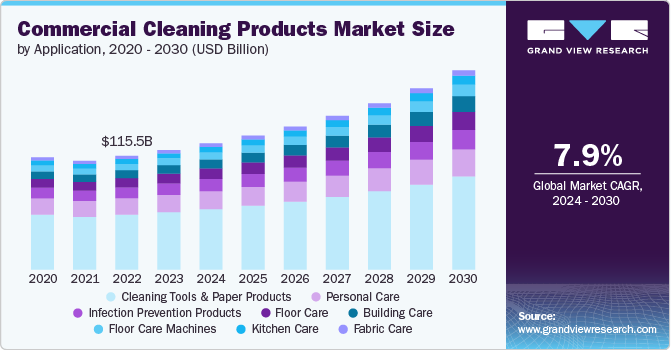

The global commercial cleaning products market size was estimated at USD 121.29 billion in 2023 and is expected to grow at a CAGR of 7.91% from 2024 to 2030. The increasing focus on maintaining clean and hygienic environment in commercial places plays a key role in driving the global demand.

The cleaning and hygiene products market is a diverse and dynamic industry that encompasses a wide range of products designed to maintain cleanliness, hygiene, and sanitation in various settings. These products are used in residential, commercial, and industrial environments and include items like disinfectants, cleaning agents, detergents, paper products, and personal care. A major growth driver is the heightened awareness of hygiene and sanitation, especially after the COVID-19 pandemic. The increased focus on maintaining cleanliness in public and private spaces has led to a surge in demand for disinfectants, sanitizers, and cleaning supplies.

Moreover, higher prominence toward workplace cleanliness and hygiene owing to better productivity and corporate performance has been driving the market growth. A clean work environment helps keep workers happier and healthier, reduces the spread of germs, and limits workers’ absences due to illnesses. Researchers at Harvard and Syracuse Universities report that an improvement in the air quality of a workplace can positively influence the overall performance of the employees.

The rising number of restaurants, hotels, and hospitals across regions has been significantly contributing to the demand for various commercial cleaning products to maintain a clean and hygienic environment. Expansion in the foodservice industry in terms of new restaurant establishments is expected to contribute to market growth.

There has been a significant rise in the demand for safe cleaning products that are free from harsh chemicals. Many cleaning products contain ammonia, which is very off-putting. In commercial places that see many visitors every day, such products can hamper the overall experience of the visitors. In extreme cases, such chemicals can also cause allergies, especially among people with a sensitivity to chemical cleaning products, who may sneeze, cough, or experience watery eyes.

Technological advancements and innovation in product development have also contributed to market growth. Companies are introducing new formulations, eco-friendly products, and automation in cleaning processes. For instance, the rise of robotic cleaning devices and automatic dosing systems for dishwashers and washing machines has added convenience and efficiency to cleaning tasks, appealing to both residential and commercial users. Furthermore, the growing trend toward green cleaning and sustainability has prompted consumers to seek products with natural ingredients, biodegradable packaging, and reduced environmental impact.

Innovation is a leading driver of this industry, with market players launching technologically advanced products. In December 2021, Unilever introduced a new dishwashing liquid made entirely from naturally sourced ingredients. This innovative product has a 99% biodegradable formulation, is manufactured using 100% plant-based ingredients, and is packaged in bottles constructed from 100% recyclable plastics. The company's primary goal is to minimize carbon footprints and decrease reliance on ingredients derived from fossil fuels.

Market Concentration & Characteristics

The commercial cleaning products market is experiencing significant innovation, particularly in sustainability with eco-friendly ingredients and packaging, advanced cleaning technologies like automation and IoT, and enhanced safety formulations to reduce health risks. These advancements aim to improve efficiency, environmental impact, and user safety.

Regulations in the commercial cleaning products market drive innovation towards safer, more environmentally friendly formulations, ensuring compliance with health and environmental standards. These regulations also promote transparency through labeling requirements and encourage the adoption of sustainable practices across the industry.

Substitutes in the commercial cleaning products market include natural and DIY cleaning solutions such as vinegar, baking soda, and essential oils, which appeal to environmentally conscious consumers. In addition, technological alternatives such as UV-C light sanitizers and steam cleaners are gaining popularity for their chemical-free cleaning capabilities.

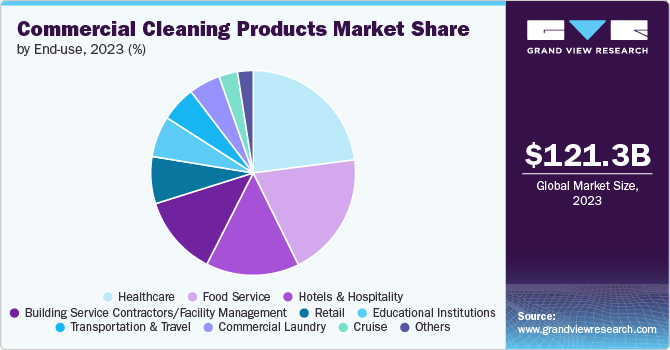

End-user concentration in the commercial cleaning products market is diverse, encompassing sectors such as healthcare, hospitality, food service, and office buildings. This broad range of end-users drives demand for specialized cleaning solutions tailored to the unique requirements of each industry, such as disinfectants for hospitals and degreasers for kitchens.

Application Insights

Cleaning tools and paper products accounted for a revenue share of around 48.23% in 2023. The market for cleaning tools and paper products is driven by several key factors. Innovation in product design, such as ergonomic handles and microfiber materials, enhances cleaning efficiency and user comfort. Environmental sustainability is also a major driver, with increasing demand for recycled and biodegradable paper products. In addition, the rise in hygiene awareness, particularly post-COVID-19, has led to a surge in demand for high-quality cleaning tools and disposable paper products such as paper towels and sanitary wipes. Technological advancements, such as automated dispensers and IoT-enabled cleaning tools, further drive the market by improving cleanliness and reducing waste.

The building care segment is projected to grow at a CAGR of 9.62% over the forecast period of 2024-2030. Enhanced health and safety regulations require regular and thorough cleaning, leading to increased demand for professional cleaning services and high-quality products. The rise in environmental consciousness has spurred the adoption of green cleaning practices and products. In addition, the growing emphasis on maintaining aesthetic appeal and operational efficiency in commercial and residential buildings contributes to the demand for comprehensive building care solutions.

End-use Insights

The usage of commercial cleaning products in the healthcare industry accounted for a revenue share of around 22.96% in 2023. Regulatory requirements for maintaining high hygiene standards in healthcare facilities drive the need for effective and reliable cleaning products. In addition, the rising incidence of healthcare-associated infections (HAIs) has led to a greater emphasis on preventative measures, including the use of advanced disinfectants and sterilization products. The growth in the healthcare sector, with more facilities and patients, further boosts demand. Innovations in cleaning technologies and products that ensure safety and efficacy also contribute to the increased demand.

The building service contractors/facility management segment is estimated is projected to grow at a CAGR of 9.47% over the forecast period of 2024-2030. Strategic partnerships with cleaning service providers or facility management companies is a lucrative opportunity in this market as they can help manufacturers expand their market reach and enhance brand visibility. Manufacturers can extend partnerships with regional/domestic janitorial service providers and share enhanced training protocols to commercial sectors, including general buildings, healthcare facilities, and hospitality establishments, to ensure continued sales of their products. For instance, in July 2020, Merry Maids, a ServiceMaster company (offering professional cleaning services), collaborated with 3M Company, one of the leaders in cleaning and hygiene products, to enhance cleaning services and provide science-based solutions for commercial environments.

Regional Insights

The commercial cleaning products market in North America held 30.21% of the global revenue in 2023. Rapid growth witnessed in the commercial sector, particularly in terms of mushrooming restaurants and cafes across the region, is driving the demand for commercial cleaning products. North America, being one of the most prominent locations in the world for businesses, attracts millions of investors. It is estimated that in the next five to ten years, more companies will be establishing their business centers in the U.S. In line with this growth of the commercial sector in the region, there will be an increase in the demand for cleaning supplies.

U.S. Commercial Cleaning Products Market Trends

The commercial cleaning products market in the U.S. is expected to grow at a CGAR of 7.10% from 2024 to 2030. Heightened awareness of hygiene and cleanliness post-pandemic has driven increased demand across various sectors, including healthcare, hospitality, and corporate offices. Stringent regulatory standards and health guidelines necessitate effective cleaning solutions, boosting market growth. The shift towards sustainable practices has led to a preference for eco-friendly cleaning products and technologies.

Asia Pacific Commercial Cleaning Products Market Trends

The Asia Pacific commercial cleaning products market is projected to grow at a CAGR of 9.37% from 2024 to 2030. Various large organizations are investing heavily in such lucrative regions and setting up new offices and plants in emerging markets such as China, India, and Singapore. Prominent banks such as HSBC and Barclays have already started hiring in Asia in large numbers and are reducing the manpower size in the U.S. GE has also shifted the headquarters of its x-ray business from the U.S. to Beijing. This increasing presence of commercial buildings, offices, and businesses in Asia is likely to attract the sales of commercial cleaning products.

Europe Commercial Cleaning Products Market Trends

Europe commercial cleaning products market accounted for a revenue share of around 32.38% in the year 2023. The European Union (EU) has been at the forefront of promoting sustainability and reducing environmental impact across industries. Green cleaning initiatives, which emphasize the use of eco-friendly cleaning products and practices, are gaining traction. Businesses and institutions are increasingly opting for cleaning products that are biodegradable, non-toxic, and produced using sustainable manufacturing practices. This shift towards sustainability is driven by consumer preferences, corporate social responsibility (CSR) goals, and regulatory incentives promoting green procurement practices.

Key Commercial Cleaning Products Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. Leveraging extensive global distribution networks, these major players effectively reach diverse customer bases and tap into emerging markets.

Key Commercial Cleaning Products Companies:

The following are the leading companies in the commercial cleaning products market. These companies collectively hold the largest market share and dictate industry trends.

- Diversey, Inc.

- Ecolab Inc.

- 3M

- The Clorox Company

- SC Johnson

- Medline Industries, Inc.

- The Procter & Gamble Company

- Unilever Plc

- Betco

- Lonza Group AG

Recent Development:

-

In June 2024, Solenis, a prominent global manufacturer of specialty chemicals catering to water-intensive sectors, completed the acquisition of Orkla's entire stake in Lilleborg. Lilleborg, based in Oslo, Norway, specializes in providing professional cleaning solutions and holds a significant position in Norway's commercial market..

-

In June 2024, Solenis, a prominent global manufacturer of specialty chemicals, completed its acquisition of Aqua ChemPacs, LLC. Based in Huntingdon Valley, Pennsylvania, Aqua ChemPacs specializes in producing pre-portioned, concentrated liquid chemical packs housed in eco-friendly packaging with a low carbon footprint. These innovative ChemPacs dissolve readily in water, enabling customers in diverse sectors such as restaurants, retail, healthcare, education, and event venues worldwide to create a range of effective cleaning and disinfection solutions on-site.

-

In September 2023, Bunzl Canada unveiled its latest environmentally-friendly cleaning product line branded as REGARD™. The new line focuses on reducing environmental impact throughout the procurement and delivery processes, utilizing intelligent and innovative packaging solutions.

-

In February 2022, Essity, a prominent company in hygiene and health sectors, has acquired Legacy Converting, Inc., a US-based company specializing in professional wiping and cleaning products. Legacy Converting offers a range of products including sanitizing and disinfecting wet-wipes, chemical-ready wipes, and dry wipes. The acquisition, valued at USD 40 million with a potential additional earnout of USD 10 million, was completed on a cash and debt-free basis. Essity, known for its leading Tork brand, is the world's largest provider of products and services in the professional hygiene market.

Commercial Cleaning Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 128.16 billion

Revenue forecast in 2030

USD 202.32 billion

Growth rate

CAGR of 7.91% from 2024 to 2030

Actuals data

2018 - 2023

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa; Central America; Caribbean Islands

Country scope

U.S.; Canada; Germany; UK; France; Russia; Italy; Spain; Netherlands; Switzerland; Poland; Sweden; Belgium; Ireland; Austria; Denmark; Romania; Czech Republic ; Finland; Portugal; Greece; Hungary; Slovakia Australia; New Zealand; India; Japan; Thailand; Philippines; Indonesia; Singapore; Malaysia; China; Taiwan; Hong Kong; South Korea; Argentina; Brazil; Mexico; Chile; Colombia; Peru; Turkey; Israel; UAE; Saudi Arabia; Egypt; Morocco; Kenya; Nigeria; South Africa

Key companies profiled

Diversey, Inc.; Ecolab Inc.; 3M; The Clorox Company; SC Johnson; Medline Industries; Inc.; The Procter & Gamble Company; Unilever Plc; Betco; Lonza Group AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Commercial Cleaning Products Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global commercial cleaning products market report on the basis of application, end-use, and region:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cleaning Tools and Paper Products

-

Paper Products

-

Toilet Paper

-

Tissue Paper/Hygiene Paper

-

Kitchen Towels

-

Wipes

-

Others

-

-

Mops

-

Buckets and Pails

-

Manual Sweeper and Wiper

-

Machine Pads

-

Broom and Dustpans

-

Cloths & Sponges

-

Toilet Brushes and Holders

-

Trolleys and Carts

-

Others

-

-

Personal Care

-

Hand Wash/Soap

-

Hand Sanitizer

-

Body Wash/Soap

-

Shampoo and Conditioner

-

Hand Creams

-

Barrier Creams and Moisturizers

-

Body Lotion/Creams

-

Others

-

-

Infection Prevention Products

-

Wipes

-

Disinfectants and Antiseptics

-

Sporicides

-

UV Disinfection Products

-

Others

-

-

Floor Care

-

Floor Cleaners and Maintainers

-

Stone Cleaners

-

Vinyl & Linoleum Cleaners

-

Concrete Cleaners

-

Wood Cleaners

-

-

Floor Disinfectant

-

Carpet Cleaner Solution

-

Floor Polish/Wax

-

Others

-

-

Building Care

-

Above Floor Cleaners

-

Toilet Bowl Cleaners

-

Surface Cleaners

-

Glass Cleaners

-

Disinfectant Cleaners

-

Air Care/Air Fresheners

-

Specialty Surface Cleaners

-

Drain and Sink Cleaners

-

Power Cleaners

-

Others

-

-

Floor Care Machines

-

Walk-Behind Floor Scrubbers and Driers

-

Vacuum Cleaners

-

Dry Vacuum Cleaners

-

Wet Vacuum Cleaners

-

Combined/Multi-functional (Dry & Wet)

-

Robot/Robotic Vacuum Cleaners

-

-

Walk-Behind Floor Sweepers

-

Steam Cleaners

-

Carpet Machines

-

Others

-

-

Kitchen Care

-

Dish Soap & Liquid (Manual)

-

Dishwasher Detergents and Boosters (Including auto-dosing dishwasher detergent)

-

Surface/Glass Cleaners

-

Degreasers

-

Sink & Drain Cleaners

-

Food Wash Solutions

-

Oven Cleaners

-

Descalers

-

Grill and Fryer Cleaners

-

Surface Disinfectants and Antibacterial Wipes

-

Others

-

-

Fabric Care

-

Laundry Detergent

-

Fabric Softener

-

Stain Remover

-

Neutralizers/Fabric Freshener/Odor Eliminator

-

Boosters

-

Bleach/Color-Safe Bleach

-

Auto-dosing Detergent

-

Others

-

-

-

End-use Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Healthcare

-

Hospitals

-

Medical Office Buildings (MOBs)

-

Senior Living and Retirement Communities

-

Medical Centers (Life Science, Biotech, Research Centers)

-

Specialty Care Centers

-

-

Food Service

-

Full-Service Restaurants

-

Quick Service Restaurants

-

Fast Casual Dining

-

Contract Catering

-

Inflight Catering

-

Others

-

-

Hotels & Hospitality

-

Hotels & Resorts

-

Leisure and Entertainment Parks

-

Others

-

-

Building Service Contractors/Facility Management

-

Commercial Buildings/Office Spaces

-

Government Offices

-

Institutions

-

Others (Warehouses and Distribution Centers, Industrial Facilities)

-

-

Retail

-

Educational Institutions

-

Transportation and Travel

-

Commercial Laundry

-

Cruise

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Poland

-

Sweden

-

Belgium

-

Ireland

-

Austria

-

Denmark

-

Romania

-

Czech Republic

-

Finland

-

Portugal

-

Greece

-

Hungary

-

Slovakia

-

-

Asia Pacific

-

Australia

-

New Zealand

-

India

-

Japan

-

Thailand

-

Philippines

-

Indonesia

-

Singapore

-

Malaysia

-

China

-

Taiwan

-

Hong Kong

-

South Korea

-

-

Latin America

-

Argentina

-

Brazil

-

Mexico

-

Chile

-

Colombia

-

Peru

-

-

Middle East & Africa (MEA)

-

Turkey

-

Israel

-

UAE

-

Saudi Arabia

-

Egypt

-

Morocco

-

Kenya

-

Nigeria

-

South Africa

-

Central America

-

Caribbean Islands

-

-

Frequently Asked Questions About This Report

b. The commercial cleaning products market was estimated at USD 121.29 billion in 2023 and is expected to reach USD 128.16 billion in 2024.

b. The commercial cleaning products market is expected to grow at a compound annual growth rate of 7.91% from 2024 to 2030 to reach USD 202.32 billion by 2030.

b. Europe dominated the commercial cleaning products market with a share of over 32.38% in 2023. The growth of the regional market is mainly driven by increasing demand from the healthcare industry and rising demand from the food industry.

b. Some of the key players operating in the commercial cleaning products market include Diversey, Inc., Ecolab Inc., 3M, The Clorox Company, SC Johnson, Medline Industries, Inc., The Procter & Gamble Company, Unilever Plc, Betco, and Lonza Group AG.

b. Key factors that are driving the commercial cleaning products market growth include the increasing focus on maintaining a clean and hygienic environment in commercial places, and the growth of the commercial and institutional sectors, including healthcare, education, and hospitality has fueled the need for cleaning products to meet strict hygiene standards.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."