- Home

- »

- Electronic Devices

- »

-

Commercial Printing Market Size, Industry Report, 2030GVR Report cover

![Commercial Printing Market Size, Share & Trends Report]()

Commercial Printing Market (2025 - 2030) Size, Share & Trends Analysis Report By Printing Technology (Digital Printing, Lithography Printing), By Application (Packaging, Advertising), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-001-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Commercial Printing Market Summary

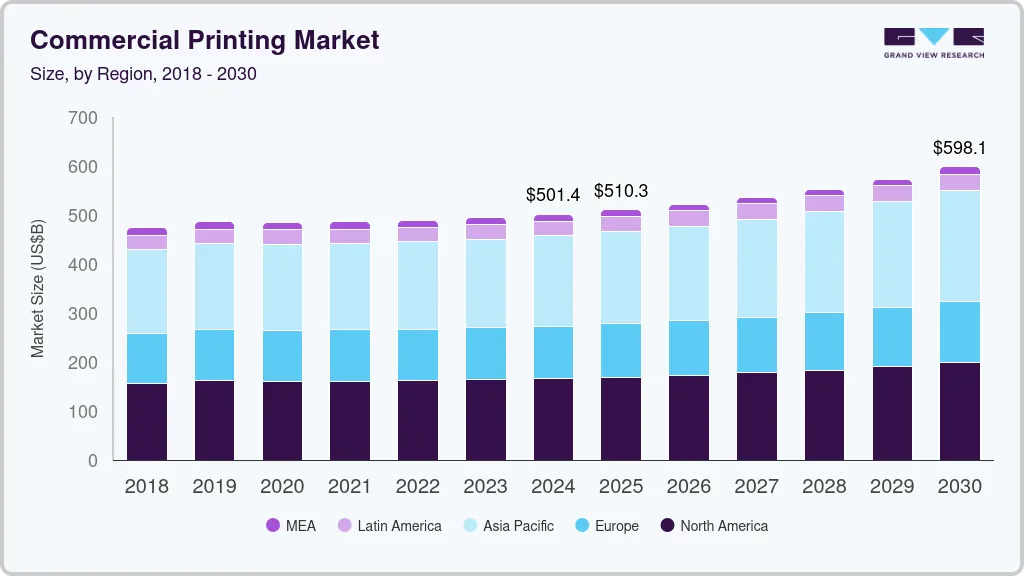

The global commercial printing market size was estimated at USD 501.36 billion in 2024 and is projected to reach USD 598.06 billion by 2030, growing at a CAGR of 3.2% from 2025 to 2030. The increasing need of businesses and enterprises for advertising materials such as brochures and pamphlets drives the demand for commercial printing services.

Key Market Trends & Insights

- Asia Pacific accounted for the largest revenue share of over 36.7% in 2024.

- The U.S. commercial printing market is expected to grow significantly from 2025 to 2030.

- By printing technology, the lithography printing segment held the largest market share of 44.1% in 2024.

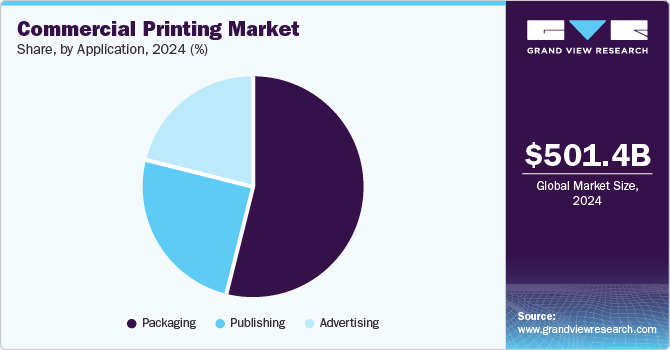

- By application, the packaging segment dominated the market in 2024 and accounted for a share of 54.2% of the global revenue.

Market Size & Forecast

- 2024 Market Size: USD 501.36 Billion

- 2030 Projected Market Size: USD 598.06 Billion

- CAGR (2025-2030): 3.2%

- Asia Pacific: Largest market in 2024

Advertising is one of the excellent marketing tools. Increasing technological proliferation, such as faster presses and new color & toner technology, allows better production capabilities and superior quality. In addition, the technical development of printing techniques proves to be cost-effective and efficient for bulk printing. Cost-effectiveness can prevent the restraining impacts of digital media on printing services to a certain extent.

The booming demand for packaging and labeling from the e-commerce industry contributes significantly to market growth. E-commerce vendors such as Amazon, eBay, and Target are adopting innovative packaging solutions such as additive manufacturing and AI-powered design tools to enhance their packaging. Market players from the logistics, warehousing, and retail sectors are investing in hybrid print technologies. Hybrid technology helps combine the benefits offered by analog and digital technologies. This is accomplished by combining the dependability and effectiveness of flexographic printing with the artistic potential of digital technology.

Despite the increasing adoption of digital media for the publication of books and advertising, commercial printing still holds relevance since the experience that printed materials and publications offer is unique. It cannot be duplicated in an online medium. Avid book readers and magazine buyers prefer the printed form over online reading, as physical books add to the experience. Printed books also offer benefits to users, such as better readability. The sale of print books in the United States increased by nearly USD 68 million in 2021. The growing popularity of print-on-demand (POD) among consumers also expands the market. POD is an order delivery method in which goods are printed as soon as an order is placed. POD allows users to get customized designs for a wide range of products. Increasing consumer’s preference for customization & personalization also contributes to the target market growth.

The rising cost of input materials such as ink, paper, and pigments, among others, is one of the restraining factors of market growth over the forecast period. In addition, consumers' increasing adoption of digital media is further anticipated to hinder the market. However, adopting green commercial printers among vendors is expected to create lucrative opportunities for the market. Green technology uses eco-friendly papers, soy inks, and coatings, which are expected to broaden the demand for green commercial printers, opening new market growth opportunities.

COVID-19 Impact Analysis

The COVID-19 pandemic limited the target market's growth during the outbreak's peak. Due to the COVID-19 epidemic, the demand for commercial printing services was significantly reduced, negatively impacting the market. Also, the printing operations were affected across the globe owing to the closing down of the facilities and support operations. Most firms across the globe adopted remote working, which led to a complete transition to paperless processes. Also, consumers significantly shifted to digital media due to safety concerns. These factors reduced the need for commercial printing, considerably impacting the market.

Furthermore, due to the cancellation of numerous events, there was a decreased demand for printed promotional materials. Also, the advertising strategy was shifted to the digital medium, and demand for printed advertising products was reduced during the pandemic. However, the pandemic resulted in increased demand for packaging owing to the booming demand for packaged products. The pandemic resulted in the rise of online food delivery services, thereby contributing to the increased demand for packaging products. This negatively impacted consumer spending, and consumer demand started picking up at a slow pace after the lifting of the restrictions. The market is limping back to normalcy as players strive to accommodate the business with the market realities.

Printing Technology Insights

The digital printing segment is expected to grow at the fastest CAGR of 4.4% during the forecast period. The segment growth is attributed to the rapid adoption of inkjet and laser printing solutions across the paper and packaging printing sector due to the cost-efficient and flexible nature of the technology. Furthermore, the segment is anticipated to be driven by adopting artificial intelligence (AI) and Internet of Things (IoT) based technologies. Digital printing also reduces costs for color prints and has a better return on investments; hence, it is adopted widely for printing applications.

The lithography printing segment held the largest market share of 44.1% in 2024. The segment's dominant nature is owing to the growing demand for printing from packaging applications. Lithography technology offers various advantages, such as consistent and high image quality, leading to higher adoption. Lithographic printing is ideal for high-volume batches of static mailings, such as directories and product advertisements. Flexographic technology is also one of the most used technologies. However, the post-printing processes required for it limit its adoption.

Application Insights

The packaging segment dominated the market in 2024 and accounted for a share of 54.2% of the global revenue. The packaging segment includes printing on labels, tags, and flexible packaging. Commercial printers have been noted to be incorporating digital technology to improve packaging print quality. In addition, Quick Response (QR) codes are now a standard print on product packaging that may be scanned with a smartphone to display additional data, like product details and promotional content, to name a few. The regulatory requirement of packaging printing on products such as pharmaceuticals, cigarettes, and alcoholic beverages is one of the driving factors for the segment's growth.

The advertising segment is anticipated to grow at a promising CAGR of about 2.4% during the forecast period. Print advertisements provide coverage of events, in-depth analysis, and mass-circulation of tangible promotions and news, thus resulting in higher conversion rates and building credibility. Gravure and digital print processes, such as newspapers, newsletters, posters, flyers, and brochures, are generally utilized for short runs. Publishing comprises books, newspapers, magazines, and others. The rising prevalence of newspaper and newsletter subscribers is one of the key factors driving the publishing application market.

Regional Insights

The North America commercial printing market held the second-largest share in 2024, accounting for over 33.2% of the global revenue. The regional growth is attributable to the high demand for commercial printing for marketing, packaging, labeling, and advertising. Furthermore, key regional players, such as Quad/Graphics Inc., Acme Printing, Cenevo, and RR Donnelley, are anticipated to further propel market growth.

The U.S. commercial printing market is expected to grow significantly from 2025 to 2030. The adoption of digital printing technologies is transforming the U.S. commercial printing landscape. Digital printing offers enhanced flexibility, customization, and cost-effectiveness compared to traditional methods, catering to the evolving needs of businesses and consumers. Moreover, integration with digital workflows has increased online printing services, where customers can order custom prints directly through web interfaces. This on-demand service supports businesses and individual consumers seeking convenience and quick turnarounds.

Asia Pacific Commercial Printing Market Trends

The commercial printing market in Asia Pacific is expected to grow at the highest CAGR of 3.7% over the forecast period, and it was also the dominant region in the global market in 2024. The regional growth is attributed primarily to advancements in the print industry, such as digital technologies, particularly in China and India. With such improvements, high-tech commercial printers have replaced traditional printers due to their high-speed capabilities. Moreover, the region’s e-commerce boom and organization of the retail sector offer enormous potential for packaging growth in the packaging application, supporting the target market.

The commercial printing market in India is expected to grow at a significant CAGR from 2025 to 2030. The rapid rise of e-commerce platforms in India has amplified the demand for printed packaging materials. Online retailers require customized packaging to enhance brand identity and ensure safe product delivery, contributing to the surge in commercial printing services. In addition, the trend towards personalized packaging to create memorable unboxing experiences has increased in India, where consumer engagement has become crucial.

Europe Commercial Printing Market Trends

The commercial printing market in Europe is expected to grow at a significant CAGR from 2025 to 2030. Despite the rise of digital media, print advertising remains a vital component of marketing strategies for many European businesses. The demand for high-quality brochures, catalogs, and direct mail continues to support the commercial printing sector. Furthermore, as Europe's economy recovers, retail, manufacturing, and pharmaceutical industries are increasing their demand for printed materials, including packaging, labels, and promotional items. This resurgence is contributing to market growth.

The UK commercial printing market is expected to grow significantly from 2025 to 2030. This growth is anticipated to be driven by the increasing demand for packaging materials and advancements in digital printing technologies. However, the market faces challenges due to the rising popularity of digital media, which has led to a decline in traditional print media consumption. Despite these challenges, the commercial printing industry continues to adapt by embracing digital solutions and focusing on specialized printing services to meet evolving market needs.

Key Commercial Printing Company Insights

The commercial printing industry is highly fragmented and is expected to see heightened competition due to the presence of numerous players. Leading companies are investing heavily in research and development to incorporate advanced technologies into commercial printers, particularly those utilized by publishers, advertisers, and marketing companies, further intensifying competition.

Some key companies operating in the Print-on-demand market include Dai Nippon Printing Co., Ltd., Transcontinental Inc., and Quad.com.

-

Dai Nippon Printing Co., Ltd. is a Japanese printing company specializing in a wide range of printing-related products and services. The company’s operations and activities are categorized into four reportable business segments: information communication, electronics, beverages, lifestyle & industrial supplies. The lifestyle & industrial supplies segment includes the packaging, living spaces, and industrial high-performance material businesses

-

Transcontinental Inc. is a versatile provider of flexible packaging services. The company's offerings include packaging solutions, commercial printing, and specialized media services. Its services include packaging for flexible materials such as plastic and paper, including roll stock, bags, pouches, and shrink films. The company is also involved in flyer printing, in-store marketing products, and media services. Moreover, it provides advanced coating services for various substrates, educational publications, and flyer distribution in print and digital formats. The company operates printing plants, media studios, and flexible packaging facilities.

Cimpress and ACME Printing are some of the emerging Print-on-demand vendors.

-

Cimpress plc provides customized print products and services on a large scale. The company gathers diverse, individually tailored orders from various sources, including large, medium, small, and micro businesses, printers, resellers, graphic designers, and traditional suppliers who delegate these products. The company's operations are structured into five segments: PrintBrothers and Vista.

-

ACME Printing is a prominent market player recognized for its comprehensive range of printing solutions. With a steadfast commitment to quality and innovation, ACME Printing offers diverse services, including offset and digital printing, graphic design, and promotional materials.

Key Commercial Printing Companies:

The following are the leading companies in the commercial printing market. These companies collectively hold the largest market share and dictate industry trends.

- Quad.com

- Cenveo Worldwide Limited

- Acme Printing

- R.R. Donnelley & Sons Company

- Transcontinental Inc.

- LSC Communications LLC.

- Gorham Printing, Inc.

- Dai Nippon Printing Co., Ltd.

- Mixam UK Limited

- Cimpress

- Quebecor

- Duncan Print Group

Recent Developments

-

In September 2024, Artisan Colour, a commercial printing company, acquired MarComm, a digital marketing agency. This strategic move positions them as the first fully integrated print and digital marketing solution. By combining their expertise, they aim to achieve a new standard of marketing effectiveness by leveraging both print and digital channels for maximum impact and return on investment.

-

In May 2024, Canon and Heidelberg collaborated to integrate inkjet printing solutions into the commercial printing industry. Heidelberg will integrate Canon's B2 and B3 sheetfed inkjet presses into their Prinect workflow. This partnership aims to provide printers with a hybrid offset/digital solution, catering to the growing demand for shorter runs and diverse print jobs. Heidelberg will also provide service and ink supplies for these inkjet presses.

-

In August 2023, Starline Printing, a commercial printing company based in New Mexico, announced its merger with Colorado's CPCneutek. This strategic move aims to enhance operational efficiency and cost-effectiveness within the dynamic printing industry. The merged entity, retaining the Starline Printing name, will leverage the combined strengths of both companies, including Starline's strong client relationships and CPCneutek's expertise in specialized printing solutions.

Commercial Printing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 510.33 billion

Revenue forecast in 2030

USD 598.06 billion

Growth rate

CAGR of 3.2% from 2025 to 2030

Actual year

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Printing technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; UAE; KSA; Saudi Arabia

Key companies profiled

Quad.com; Cenveo Worldwide Limited; Acme Printing; R.R. Donnelley & Sons Company; Transcontinental Inc.; LSC Communications LLC.; Gorham Printing, Inc.; Dai Nippon Printing Co., Ltd.; Mixam UK Limited; Cimpress, Quebecor; Duncan Print Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Commercial Printing Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global commercial printingmarket report based on printing technology, application, and region:

-

Printing Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Digital Printing

-

Lithography Printing

-

Flexographic

-

Screen Printing

-

Gravure Printing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Packaging

-

Advertising

-

Publishing

-

Books

-

Newspaper

-

Magazines

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global commercial printing market size was estimated at USD 501.36 billion in 2024 and is expected to reach USD 510.33 billion in 2025.

b. The global commercial printing market is expected to witness a compound annual growth rate of 3.2% from 2025 to 2030 to reach USD 598.06 billion by 2030.

b. Asia Pacific is expected to grow at the highest CAGR of 3.7% over the forecast period. The growth can be attributed to the growing demand for ptinting from packaging and advertising applications in countries such as India, China, and Japan.

b. Some key players operating in the commercial printing market include ACME Printing, Dai Nippon Printing Co. Ltd., R.R. Donnelley & Sons Co., Quad/Graphics Incorporated, Quebecor World Inc., Transcontinental Inc., Cimpress plc, and Ceneveo.

b. Key factor driving the growth of the commercial printing market include technological proliferation especially digital printing, along with the increasing demand and need for advertising across several business sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.