- Home

- »

- Communication Services

- »

-

Communication Platform As A Service Market Report, 2030GVR Report cover

![Communication Platform As A Service Market Size, Share & Trends Report]()

Communication Platform As A Service Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Service), By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-023-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Communication Platform As A Service Market Summary

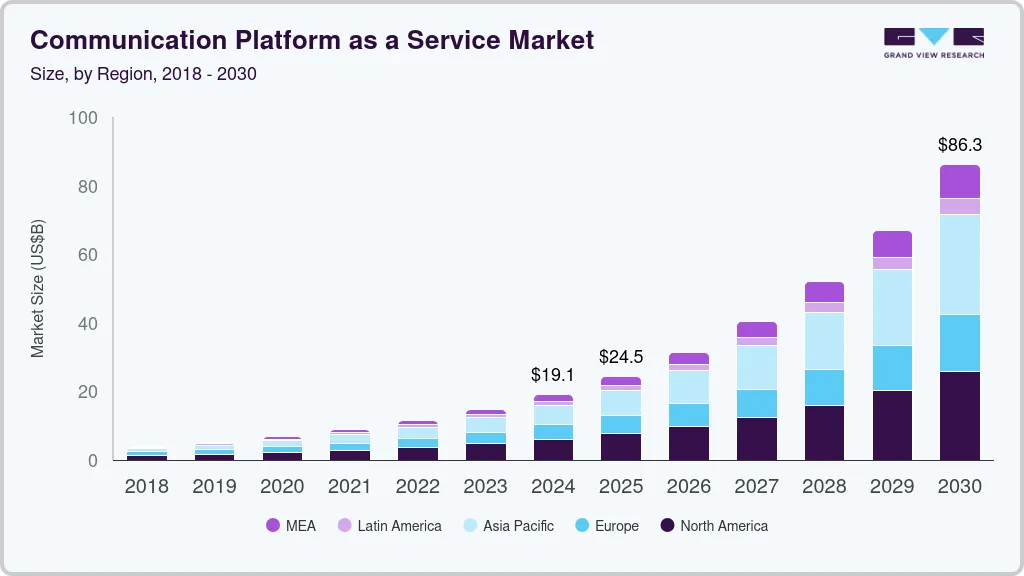

The global communication platform as a service market size was estimated at USD 19,100.8 million in 2024 and is projected to reach USD 86,260.9 million by 2030, growing at a CAGR of 28.7% from 2025 to 2030. The market growth is driven by its ability to seamlessly integrate communication and collaboration capabilities into business applications and processes, aligning with the digital transformation needs of enterprises.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of components, solution accounted for a revenue share of 85.1% in 2024.

- Service is the most lucrative component segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 19,100.8 Million

- 2030 Projected Market Size: USD 86,260.9 Million

- CAGR (2025-2030): 28.7%

- North America: Largest market in 2024

Moreover, enterprises' increasing adoption of omnichannel communication models offers significant growth opportunities. In addition, the shift toward cloud-based solutions is one of the primary growth factors for the communication platform as a service (CPaaS) industry.

Businesses increasingly adopt multiple communication channels, such as voice, video, messaging, social media, and email, to engage with customers seamlessly and consistently. Consumer preferences for real-time, personalized interactions across various platforms spur this trend. CPaaS providers are responding by integrating a wide array of communication options into a single platform, making it easier for businesses to manage customer engagement. By enabling companies to deliver consistent messaging across channels, CPaaS enhances customer experience and boosts retention rates.

Businesses are moving away from on-premise communication systems in favor of cloud-based platforms that offer flexibility, scalability, and cost-efficiency. Cloud CPaaS solutions enable businesses to scale their communication capabilities quickly without significant upfront investments in hardware or infrastructure. In addition, cloud platforms provide enhanced security, reliability, and integration with other enterprise applications, allowing companies to optimize communication workflows and improve productivity. This trend is expected to accelerate as more organizations embrace cloud migration strategies, thereby driving the growth of the communication platform as a service industry.

Artificial intelligence (AI) and automation are transforming the CPaaS landscape by enabling more intelligent and efficient communication systems. AI-powered chatbots, virtual assistants, and automated workflows are being increasingly integrated into CPaaS platforms to enhance customer service, reduce response times, and improve overall engagement. Machine learning algorithms help companies better understand customer behavior, predict needs, and deliver highly personalized experiences. Automating routine tasks, such as appointment scheduling, order processing, and customer support, frees human agents to focus on more complex issues while improving operational efficiency. This trend drives the demand for CPaaS solutions that offer AI-driven features, thereby driving the growth of the communication platform as a service industry.

Despite the significant growth of the global communication platform as a service industry, several restraining factors could hamper its growth. One of the major challenges in the market is the complexity of integration with existing enterprise systems. Many businesses operate with legacy systems, which can be difficult to integrate with modern CPaaS platforms, leading to increased implementation costs and longer adoption times. In addition, concerns around data security and privacy could be a barrier, especially with the increasing volume of sensitive customer information being transmitted across communication channels.

Component Insights

The solution segment accounted for the largest share of 85.1% in 2024. The segment is further bifurcated into the API platform and ADK platform. Key solutions include voice API, video API, messaging API, and other API solutions, which are integrated into business applications to improve customer interactions, internal communication, and workflow automation. The segment's growth can be attributed to the improved programmable video capabilities, enabling better humanized digital interactions. Moreover, built-in-app videos with APIs for integrated workflow are expected to improve the overall value proposition of CPaaS businesses.

The services segment is expected to grow at the highest CAGR during the forecast period. The segment is further bifurcated into managed services and professional services. The growing integration of artificial intelligence (AI) and machine learning (ML) for agent augmentation, speech recognition, automation, emotion analysis, and call analytics drives demand for professional and managed services in the market. For instance, banks and other financial institutions use conversational AI platforms in combination with APIs to automate customer service interactions and to improve customer experience.

Enterprise Size Insights

The large enterprises segment held the largest market in 2024. Large enterprises from different industries use CPaaS for different enterprise communication channels. The most common industries using communication platform as a service (CPaaS) solutions are accounting, finance, education, healthcare, insurance, retail, travel and hospitality, and transportation and logistics.Large enterprises increasingly focus on advanced analytics and AI-driven insights, which can be effectively integrated into CPaaS platforms for improved decision-making.

The Small and Medium Enterprises (SMEs) segment is expected to register the highest CAGR during the forecast period. SMEs leverage CPaaS solutions for various use cases such as marketing and sales, customer engagement, customer experience, query handling, payments, etc. SMEs typically have more limited resources than large enterprises, making CPaaS an attractive option due to its low upfront costs and pay-as-you-go pricing models. CPaaS enables SMEs to deploy sophisticated communication tools, such as messaging, voice, and video services, without significant infrastructure investment.

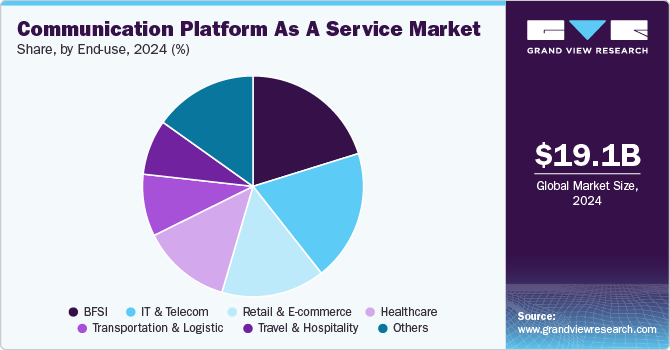

End Use Insights

The BFSI segment dominated the market in 2024.With the increasing demand for real-time communication, security, and personalized customer service, CPaaS offers BFSI institutions a powerful tool to enhance their customer engagement and streamline internal operations. CPaaS solutions enable secure, multi-channel communication such as voice, messaging, and video, which are critical for customer support, transaction updates, fraud alerts, and financial advisory services. In addition, integrating CPaaS with existing banking and financial applications allows for seamless automation of processes such as loan approvals, insurance claims, and account management, reducing operational costs and improving efficiency.

The healthcare segment is anticipated to grow rapidly during the forecast period. This can be attributed to the growing adoption of CPaaS by the healthcare industry for different use cases such as remote diagnostic, scheduling, virtual patient-doctor visits, and appointment reminders, among others. Increasing digital transformation to improve patient care, streamline operations, and ensure compliance with regulatory standards can also be attributed to the segment’s growth. With the healthcare industry shifting toward digital solutions, CPaaS plays a crucial role in optimizing communication, improving operational efficiency, and enhancing overall patient care.

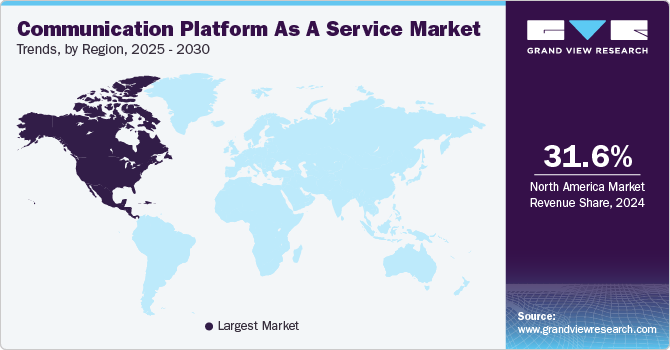

Regional Insights

The North America communication platform as a service industry dominated the global market and accounted for 31.6% of overall share in 2024. Factors such as high research & development (R&D) expenditures, established telecom service market, and the presence of numerous CPaaS companies are driving market growth in the region. Moreover, the region has a developed technological infrastructure, aiding market growth.

U.S. Communication Platform as a Service Market Trends

The communication platform as a service market in the U.S. held a dominant position in 2024. The country’s advanced technological landscape, high levels of investment in digital transformation, and a large number of enterprises seeking scalable, flexible communication solutions make it an ideal environment for CPaaS growth. The country has witnessed strong demand across various industries, such as banking, retail, healthcare, and IT, as businesses leverage CPaaS solutions to integrate voice, video, and messaging capabilities into their applications.

Europe Communication Platform as a Service Market Trends

The communication platform as a service market in Europe is expected to register a moderate CAGR from 2025 to 2030. European businesses increasingly adopt CPaaS solutions to enhance customer communication, improve operational efficiency, and ensure compliance with evolving data protection regulations such as the GDPR. In addition, the region also has a robust IT infrastructure and a high adoption rate of cloud-based services, both of which contribute to the demand for CPaaS.

The UK communication platform as a service market is expected to grow moderately during the forecast period. The country’s strong focus on innovation, digital transformation, and the widespread adoption of cloud technologies makes it an ideal market for CPaaS growth.

The communication platform as a service market Germany held a substantial market share in 2024. The country's strong economy, advanced technological infrastructure, and focus on digitalization across various industries can be attributed to the market's growth. In addition, the growing demand for omnichannel communication and the need for secure, compliant communication tools, especially in the banking and healthcare sectors, are fueling CPaaS adoption.

Asia Pacific Communication Platform as a Service Market Trends

The communication platform as a service market in Asia Pacific is anticipated to grow at a significant CAGR during the forecast period. Market growth across the region can be attributed to the growth of end-use industries such as retail and e-commerce, IT and telecom, BFSI, healthcare, transportation and logistics, and education, among others.

Japan communication platform as a service market is expected to grow moderately during the forecast period. The country’s focus on technological innovation, high levels of digital adoption, and a strong IT infrastructure contribute to the rapid growth of the CPaaS market.

The communication platform as a service market in China held a substantial market share in 2024.The country’s massive digital transformation efforts and the widespread use of mobile communication technologies are some of the major factors behind the market's growth.With the rise of e-commerce, fintech, and cloud-based services, businesses in China are increasingly adopting CPaaS solutions to enhance customer engagement, streamline communication, and integrate AI-driven automation.

Key Communication Platform As A Service Company Insights:

Some of the key companies in the communication platform as a service industry include Avaya Inc., Bandwidth Inc., Infobip Ltd., MessageBird, and others. Organizations are focusing on integrating advanced technologies into their offerings to maintain competitive advantages. Therefore, key players are taking several strategic initiatives, such as new product launches, mergers and acquisitions, and partnerships.

-

Avaya Inc. offers CPaaS solutions through its Avaya Communication APIs, enabling organizations to integrate advanced AI capabilities and automation into their existing workflows without replacing current technology. Businesses can select from multiple deployment options with the company, including a "build your own solution" service.

-

Known for its wide range of UCaaS, CCaaS, and cloud tools, Bandwidth Inc. also empowers companies as a prominent CPaaS provider with a range of communication APIs for CPaaS functionality. There are dedicated voice APIs with global coverage, high-level reliability, and messaging APIs for web and mobile-focused businesses. The company also has a dedicated authentication API for communication security.

Key Communication Platform As A Service Companies:

The following are the leading companies in the communication platform as a service market. These companies collectively hold the largest market share and dictate industry trends.

- TWILIO INC.

- Avaya Inc.

- Vonage America, LLC

- MessageBird

- Infobip Ltd.

- Plivo Inc.

- Telnyx LLC

- TEXTUS

- Voximplant

- Bandwidth Inc.

Recent Developments

-

In June 2024, TrueBusiness, a prominent provider of integrated communications and digital solutions for enterprises and SMEs, partnered with Infobip, a global cloud communications platform, to introduce " True Communications Platform as a Service or True CPaaS." The platform unifies omni-channel communication into a single interface, simplifying the management of various channels and customer journey engagement. Powered by AI, it enables businesses to provide personalized, conversational experiences by leveraging customer insights, along with automated, always-on communication across marketing, sales, and customer support.

-

In October 2022, BICS, a global communications enabler, launched its Communications Platform as a Service (CPaaS) offering. This offering provides enterprises with a customizable toolkit to seamlessly integrate communication services such as voice, SMS, and WhatsApp messages into their services and workflows through APIs.

Communication Platform as a Service Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.48 billion

Revenue forecast in 2030

USD 86.26 billion

Growth rate

CAGR of 28.7% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Netherlands; China; Japan; India; South Korea; Australia; Brazil; Argentina; KSA; UAE; South Africa

Key companies profiled

TWILIO INC.; Avaya Inc.; Vonage America, LLC; MessageBird; Infobip Ltd.; Plivo Inc.; Telnyx LLC; TEXTUS; Voximplant; Bandwidth Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

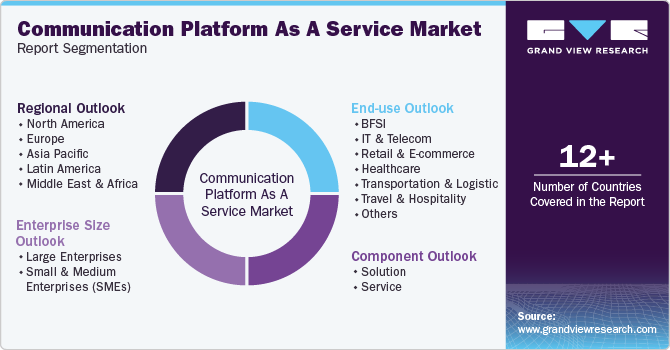

Global Communication Platform as a Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global communication platform as a service market report based on component, enterprise size, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

API Platform

-

Messaging API

-

Voice API

-

Video API

-

Others

-

-

SDK Platform

-

-

Service

-

Managed Services

-

Professional Services

-

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

IT & Telecom

-

Retail & E-commerce

-

Healthcare

-

Transportation & Logistic

-

Travel & Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global communication platform as a service market size was estimated at USD 19.10 billion in 2024 and is expected to reach USD 24.48 billion in 2025.

b. The global communication platform as a service market is expected to grow at a compound annual growth rate of 28.7% from 2025 to 2030 to reach USD 86.26 billion by 2030.

b. North America dominated the communication platform as a service market with a share of 31.6% in 2024. This can be attributable to the presence of numerous communication platform as a service market players in the region.

b. Some key players operating in the communication platform as a service market include TWILIO INC., Avaya Inc., Vonage America, LLC, MessageBird, Infobip ltd., Plivo Inc., Telnyx LLC, TEXTUS, Voximplant, and Bandwidth Inc.

b. Key factors driving the market growth include the ability of communication platform as a service (CPaaS) to embed communication and collaboration into business applications & processes and enterprise digital transformation requirements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.