- Home

- »

- Animal Health

- »

-

Companion Animal Diagnostics Market Size Report, 2033GVR Report cover

![Companion Animal Diagnostics Market Size, Share & Trends Report]()

Companion Animal Diagnostics Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Consumables, Reagents & Kits, Equipment & Instruments), By Animal (Dogs, Cats, Horses), By Testing Category, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-750-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Companion Animal Diagnostics Market Summary

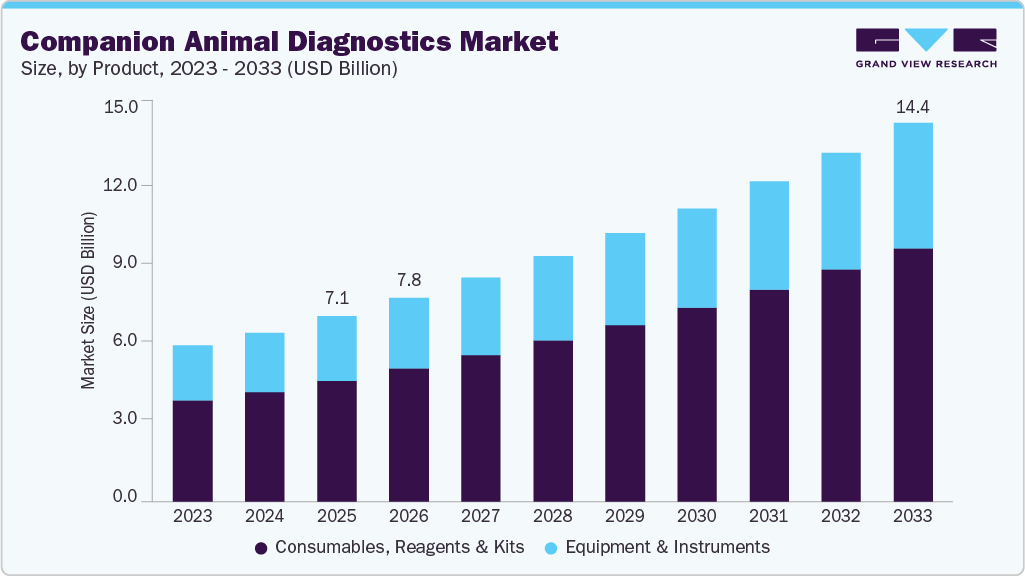

The global companion animal diagnostics market size was estimated at USD 7.06 billion in 2025 and is projected to reach USD 14.41 billion by 2033, growing at a CAGR of 9.27% from 2026 to 2033. The market is experiencing growth driven by rising pet ownership, increasing spending on advanced veterinary care, and growing awareness of early disease detection.

Key Market Trends & Insights

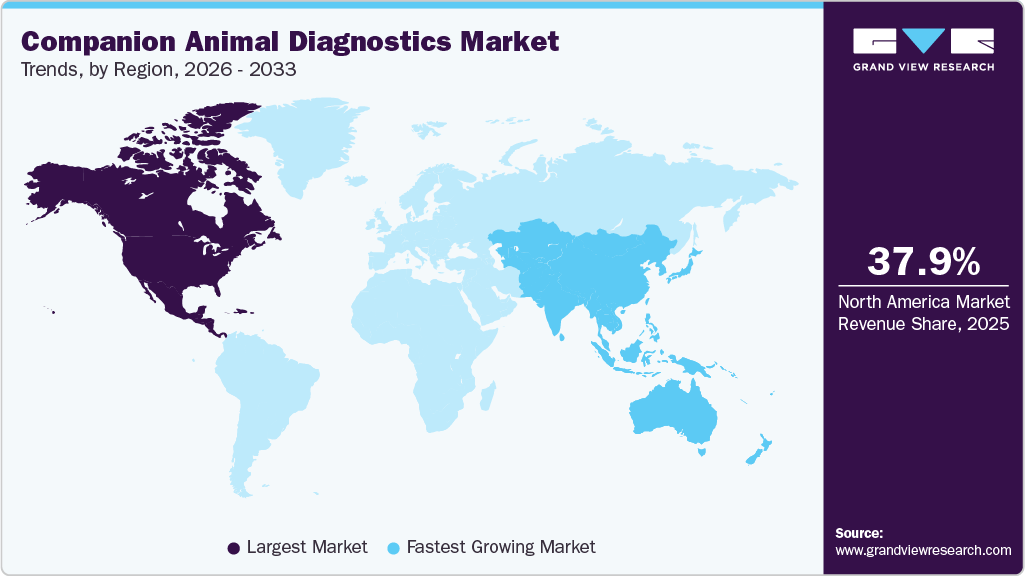

- North America companion animal diagnostics market held the largest revenue share of 37.91% in 2025.

- The U.S. companion animal diagnostics market is dominated with the largest revenue share in 2025.

- By product, the consumables, reagents & kits segment held the largest share of 64.96% in the market in 2025

- By animal type, the dog segment is the largest in the market in 2025.

- Based on the testing category, the clinical chemistry segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 7.06 Billion

- 2033 Projected Market Size: USD 14.41 Billion

- CAGR (2026-2033): 9.27%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Technological advancements such as point-of-care testing, molecular diagnostics, and AI-based imaging are further accelerating adoption across veterinary clinics worldwide. Moreover, in September 2024, Zoetis introduced the Vetscan OptiCell, an innovative, AI-powered, cartridge-based hematology analyzer designed to provide laboratory-grade complete blood count (CBC) results directly at the point of care. This next-generation diagnostic tool enhances clinical accuracy, streamline workflow efficiency, and features a compact, user-friendly design tailored for veterinary practices. The device is set to make its public debut at the London Vet Show in November 2024.

This cutting-edge innovation is poised to significantly drive growth in the companion animal diagnostics market. By enabling rapid, reliable, and on-site blood analysis, Vetscan OptiCell empowers veterinarians to make faster and more informed treatment decisions. The integration of AI not only boosts diagnostic precision but also reduces the need for outsourced lab services, thereby lowering turnaround time and operational costs. As veterinary clinics and hospitals increasingly seek advanced, easy-to-use diagnostic tools that deliver immediate results, demand for such point-of-care solutions is expected to rise, contributing to broader market expansion. Additionally, the launch strengthens Zoetis' leadership position in veterinary diagnostics, encouraging further innovation and investment in the sector.

Table 1 Pricing analysis, diagnostics (USD)

Product

Company

Product Information

ASP (USD)

VetScan HM5

Zoetis

Veterinary Hematology Analyzer

6,800 per unit

VETSCAN VS2 Chemistry Analyzer

Zoetis

Veterinary chemistry analyzer

2,200 to 6,800 per unit

IDEXX Catalyst One

IDEXX Laboratories

Veterinary chemistry analyzer

14,995 per unit

LaserCyte Dx

IDEXX Laboratories

Veterinary Hematology Analyzer

4,500 per unit

Test Kits

-

Consumables, Reagents & Kits

1.20 to 7.80

Source: Secondary Research, Grand View Research

Table 2 Pricing analysis by AWA, tests, (USD)

Test Type

ASP (USD)

Cat FeLV/FIV Combo Test

40

Dog Heartworm Test

40

Dog Heartworm Test

50

Source: Secondary Research, Grand View Research

The increasing prevalence of zoonotic diseases those transmissible from animals to humans is significantly driving growth in the companion animal diagnostics market. As public health risks rise, there is growing demand for early detection and accurate diagnosis of these diseases in animals to prevent potential outbreaks and ensure both animal and human safety. This has led to greater adoption of advanced diagnostic tools, such as molecular tests and point-of-care analyzers, across veterinary clinics, farms, and diagnostic laboratories. Additionally, heightened awareness of the One Health approach, which recognizes the link between human, animal, and environmental health, is prompting increased investments in veterinary disease surveillance and preventive care. Together, these factors are propelling the expansion of the veterinary diagnostics industry.

Market Concentration & Characteristics

The companion animal diagnostics market is defined by several influential characteristics that shape its growth trajectory and structural dynamics. The integration of diagnostics with information technology such as cloud-based data sharing platforms enhances workflow efficiency and facilitates better treatment planning. The ongoing development of faster, more precise assays, including PCR-based molecular tests and advanced immunoassays, reflects the industry's commitment to improving diagnostic capabilities. These innovations collectively contribute to a highly dynamic and competitive market landscape.

The market shows a high degree of innovation driven by rapid advances in molecular diagnostics, AI-enabled imaging, and point-of-care (POC) testing. Real-time PCR panels and next-generation sequencing are increasingly used for early and precise disease detection in pets. AI-powered radiology and ultrasound tools improve diagnostic accuracy and workflow efficiency in veterinary clinics. Additionally, portable POC analyzers enable rapid in-clinic testing for conditions such as parasitic infections, diabetes, and kidney disease.

The market is experiencing a high level of M&A activity as leading companies pursue geographic expansion, technology acquisition, and service integration. Major players such as Zoetis and Mars, through its diagnostics arm Antech, continue to consolidate laboratory networks and specialty testing capabilities. Recent acquisitions, including Zoetis’ purchase of Veterinary Pathology Group in November 2025 in the UK and Vimian’s acquisition of AllAccem in July 2025, highlight strong investor confidence in diagnostics-driven growth. This sustained consolidation trend reflects the market’s shift toward scalable, integrated, and data-driven veterinary diagnostic platforms.

Regulation has a significant impact on the market by shaping product approval timelines, quality standards, and market entry barriers. In the U.S., the FDA’s Center for Veterinary Medicine (CVM) regulates veterinary diagnostic devices, requiring validation of safety, accuracy, and manufacturing quality. In Europe, the In Vitro Diagnostic Regulation (IVDR) tightened clinical evidence and post-market surveillance requirements, increasing compliance costs for diagnostic manufacturers. For example, molecular diagnostic test developers must now generate stronger performance data before commercialization, slowing launches but improving overall test reliability and clinical trust.

Product substitutes include clinical examination-based diagnosis, empirical treatment without laboratory confirmation, and outsourcing tests to reference laboratories instead of using point-of-care systems. For example, veterinarians may treat suspected infections based on symptoms without immediate blood or imaging diagnostics to reduce costs. In-house analyzers can also be substituted by third-party labs such as IDEXX Reference Laboratories or Antech Diagnostics. While substitutes offer cost or convenience advantages, they often delay definitive diagnosis and limit real-time clinical decision-making.

Regional expansion is accelerating as global players target high-growth regions such as Asia-Pacific, Latin America, and Eastern Europe. Companies like IDEXX, Zoetis, and Mars Diagnostics are expanding laboratory networks and point-of-care instrument placements beyond North America and Western Europe. For example, IDEXX has increased reference lab capacity in China and Southeast Asia to support rising pet ownership and veterinary spending. This geographic diversification helps manufacturers capture untapped demand and reduce reliance on mature domestic markets.

Product Insights

On the basis of products, the consumables, reagents & kits segment accounted for the highest market share in 2025, due to their critical role in enabling efficient, accurate, and cost-effective testing. Unlike expensive diagnostic instruments that require significant upfront investment and maintenance, consumables and kits offer a more accessible solution for veterinary clinics of all sizes. These products include items such as test strips, reagents, slides, and ready-to-use kits that simplify complex diagnostic processes, allowing veterinarians to quickly detect common diseases and monitor animal health. For example, rapid antigen test kits for canine parvovirus or feline leukemia virus provide results within minutes, facilitating timely treatment decisions and improving animal outcomes without the need for specialized equipment or extensive training.

Moreover, consumables and reagents offer greater flexibility and convenience compared to standalone diagnostic instruments. They can be easily stocked, transported, and used in various clinical settings, including mobile or remote veterinary services, which is increasingly important as pet owners seek more accessible healthcare for their companion animals. Additionally, these products can be tailored for specific diagnostic needs, ensuring higher sensitivity and specificity for particular diseases or conditions common in cats, dogs, and other pets. This adaptability, combined with their cost-effectiveness and ease of use, makes consumables, reagents, and kits the preferred choice for many veterinarians, thereby driving their dominance in the market over larger, more complex instruments.

Animal Insights

On the basis of animal, dogs held the highest market share in 2025. The growing dog population, expenditure on pets, pet humanization, medicalization rate, and uptake of pet insurance are some of the key drivers of the segment. For instance, according to the National Pet Owners Survey 2023-2024 conducted by the American Pet Products Association, 86.9 million households (around 66%) in the U.S. owned dogs. For decades, dogs have gained greater importance and popularity in North America, where owners frequently treat them as devoted family members. To a degree, where one-third of the U.S. population loves their dogs more than their partners.

Cats segment is expected to register the fastest growth rate from 2026 to 2030 due to the rapid rise in global cat ownership, particularly in urban households and single-person homes. Cats have a higher incidence of chronic conditions such as chronic kidney disease (CKD), hyperthyroidism, diabetes, and urinary tract disorders, which require frequent diagnostic testing. Increasing awareness of feline-specific preventive care and routine wellness screening is also driving test volumes. Advancements in feline-specific molecular and immunodiagnostic tests for diseases such as feline leukemia virus (FeLV) and FIV further support market growth. Additionally, improved veterinary access and pet insurance coverage for cats are accelerating diagnostic adoption across both clinics and home-care settings.

Testing Category Insights

On the basis of testing category, the clinical chemistry segment dominated the market with a share of 22.95% in 2025, due to its critical role in evaluating the health status of animals through the analysis of blood and other bodily fluids. It enables the detection of metabolic disorders, organ function abnormalities, and various diseases, making it indispensable in routine and preventive veterinary care. For example, liver and kidney function tests using clinical chemistry analyzers help veterinarians diagnose conditions early and monitor treatment effectiveness in pets. The growing demand for rapid, accurate diagnostics in both companion and farm animals further reinforces the dominance of clinical chemistry in the market.

The molecular diagnostics segment is anticipated to grow at the fastest CAGR of 11.47% over the coming years. This is due to its superior accuracy, early disease detection capability, and ability to identify pathogens at the genetic level. Rising prevalence of infectious diseases such as canine parvovirus, feline leukemia virus (FeLV), and respiratory infections is driving demand for PCR- and NAAT-based tests. Veterinary clinics and reference labs increasingly prefer molecular methods for faster turnaround times and higher sensitivity compared to conventional tests. Advancements in real-time PCR, multiplex panels, and portable molecular platforms are also expanding in-clinic and point-of-care adoption. Additionally, growing awareness among pet owners and veterinarians about precision diagnostics is accelerating the uptake of molecular testing globally.

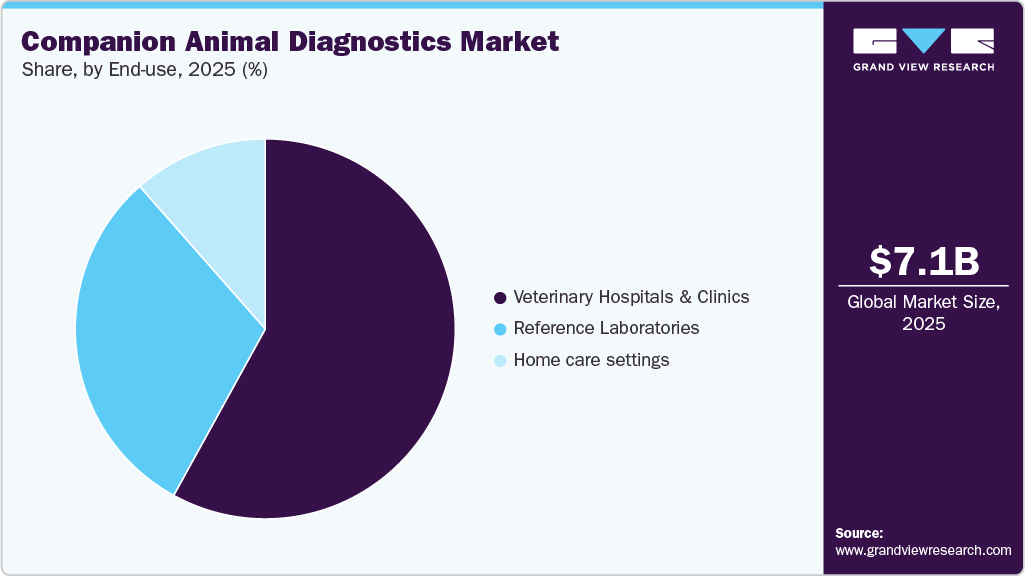

End Use Insights

On the basis of end use, veterinary hospitals and clinics segment held the highest share of the market in 2025. This segment traditionally holds the highest market share because they are the primary users and decision-makers driving demand for diagnostic tools and services. Their expertise in diagnosing and treating a wide range of health conditions in pets such as dogs, cats, and other companion animals makes them essential stakeholders in adopting advanced diagnostic technologies. For example, veterinarians routinely rely on blood chemistry analyzers, rapid test kits, and imaging devices to accurately diagnose illnesses like kidney disease or infections in pets, guiding timely treatment plans. Their growing emphasis on preventive care and early disease detection continues to boost the use of diagnostic products, reinforcing their pivotal role in shaping market growth.

Home care settings segment is estimated to grow at the fastest CAGR in the coming years. This is due to rising pet humanization and increasing demand for convenient, stress-free testing solutions. Growing adoption of at-home rapid test kits for glucose monitoring, kidney function, and parasitic infections enables early disease detection without frequent clinic visits. Advancements in portable diagnostic devices and wearable health trackers further support continuous monitoring at home. The expansion of tele-veterinary services also complements home diagnostics by enabling remote consultations based on self-test results. Additionally, higher pet healthcare spending and strong e-commerce penetration are accelerating the adoption of home-based diagnostic products.

Regional Insights

North America dominated the global companion animal diagnostics market in 2025, holding the largest revenue share of 37.91%.The market growth is attributed to rising pet ownership, increasing pet healthcare spending, and a shift toward preventive and precision medicine. Advances in molecular diagnostics, liquid biopsy, microbiome testing, and point-of-care platforms are accelerating market growth, with strong adoption in veterinary clinics and at-home testing models. For example, in February 2025, Affordable Pet Labs launched Oncotect, a non-invasive urine test for early detection of specific canine cancers, along with an upgraded Total Health Blood Test that now includes comprehensive allergy screening, supported by in-home sample collection across 32 U.S. locations. These innovations significantly expand access to proactive, at-home veterinary diagnostics, accelerating early disease detection.

U.S. Companion Animal Diagnostics Market Trends

The companion animal diagnostics market in the U.S. accounted for the highest market share in the North America market. The market is growing rapidly due to the rise in technological advancements to enhance early disease detection and personalized treatment options for pets, along with the presence of key market players. For example, in May 2025, Zoetis Inc., a global leader in animal health, unveiled its newest and largest diagnostics reference laboratory at the UPS Healthcare Labport facility located at Louisville Muhammad Ali International Airport. The ribbon-cutting ceremony was attended by Kentucky Governor Andy Beshear and other state officials. This strategic expansion marks a major milestone in Zoetis’ continued commitment to innovation in diagnostics, designed to enhance animal care by providing veterinarians and pet owners throughout the U.S. with faster, more accurate, and more accessible testing services.

The Canada companion animal diagnostics market is expected to grow at a significant CAGR during the forecast period. The market is driven by rising pet ownership, increased spending on preventive veterinary care, and strong adoption of advanced diagnostic technologies across clinics and reference laboratories. Demand is growing for molecular diagnostics, cancer screening, allergy testing, and point-of-care analyzers that deliver faster clinical decisions and improved outcomes. For example, IDEXX Laboratories Canada plays a major role in reference testing and in-clinic diagnostics, while newer innovations such as non-invasive cancer screening, microbiome testing, and rapid endocrine assays are gaining traction. CFIA-approved laboratory infrastructure further strengthens diagnostic standards and laboratory capacity nationwide. Together, these factors are shifting the Canadian market toward earlier detection, precision diagnostics, and decentralized, in-clinic testing models for companion animals.

Europe Companion Animal Diagnostics Market Trends:

The Europe companion animal diagnostics market is driven by high rate of pet ownership, with growing awareness among pet owners about the importance of preventive healthcare and early disease detection. This increased demand for advanced diagnostic services pushes veterinary clinics and hospitals to adopt innovative testing technologies. Additionally, Europe’s stringent animal health regulations and emphasis on animal welfare encourage the use of precise diagnostic tools to ensure proper disease management and control. For example, countries like Germany, France, and the UK have well-established veterinary infrastructures and government initiatives supporting animal health, which further stimulate market expansion.

The UK companion animal diagnostics market is experiencing steady growth, driven by rising pet ownership, increasing demand for preventive care, and rapid adoption of advanced diagnostic technologies such as molecular testing, digital imaging, and reference laboratory services. Veterinary clinics are increasingly integrating in-house analyzers and external lab partnerships to improve speed and accuracy of diagnosis for conditions such as cancer, endocrine disorders, and infectious diseases. For instance, in November 2025, Zoetis acquired the Veterinary Pathology Group (VPG), a major diagnostic laboratory network across the UK and Ireland, to expand its diagnostics portfolio and enhance access to faster, high-quality testing for veterinarians. This acquisition accelerates market consolidation, boosts reference laboratory capacity, strengthens competition with established players, and is expected to improve turnaround times, diagnostic accuracy, and access to advanced pathology services for companion animal practices across the UK.

The France companion animal diagnostics market is expected to grow significantly over the forecast period due to the increasing uptake of pet insurance. The demand for insurance coverage is increasing in France as more homes are getting dogs. Furthermore, the need for pet insurance is underscored by the ongoing increase in veterinary costs, which is attributed to advancements in treatment and rising expenses for veterinary services, including diagnostics. This insurance protects pet owners from unexpected medical bills, encouraging them to prioritize their pets' health by purchasing insurance coverage. Pet insurance policies in France range from USD 8.61 to USD 10.79 per month.

Asia Pacific Companion Animal Diagnostics Market Trends

Asia Pacific is expected to grow at a significant CAGR over the forecast period. This expansion is attributed to an increase in investment in research and development by leading global companies, which fuels innovation and the introduction of advanced diagnostic solutions tailored for the region. These efforts are complemented by ongoing initiatives to commercialize pet disease diagnostic services at more affordable price points, making these technologies increasingly accessible to a broader customer base. Furthermore, the region faces a pressing need to manage frequent disease outbreaks, and the rising incidence of zoonotic diseases, illnesses transmitted between animals and humans, which heightens the demand for effective diagnostic tools. This combination of heightened health concerns and strategic investments is expected to significantly accelerate the expansion of the veterinary diagnostics market throughout the Asia Pacific in the coming years.

The Japan companion animal diagnostics market is witnessing strong growth, driven by rising pet humanization, an aging pet population, and increasing demand for preventive and early disease detection. Key trends include the rapid adoption of reference laboratory testing, expansion of molecular and liquid biopsy-based cancer screening, and wider use of point-of-care analyzers in veterinary clinics. For instance, in March 2024, Volition partnered with Fujifilm Vet Systems to launch the Nu.Q Vet Cancer Test for dogs across Japan through Fujifilm’s nationwide network of reference laboratories. The affordable blood-based test supports early cancer detection and can be easily integrated into routine wellness screening for dogs. This launch significantly strengthens Japan’s companion animal diagnostics market by expanding access to early-stage cancer screening at a national scale and reinforcing the shift toward proactive, wellness-driven veterinary care.

The India market for companion animal diagnostics is experiencing notable growth, driven by several key factors. One of the primary contributors is the increasing adoption of advanced diagnostic technologies, particularly PCR-based techniques, which enable early and accurate detection of diseases in companion animals such as dogs, cats, and other pets. This technological advancement allows veterinarians to diagnose and treat illnesses more effectively, improving overall animal health outcomes. Additionally, there is a growing emphasis on animal healthcare across the country, with more pet owners becoming aware of the importance of preventive care and regular health monitoring for their animals. This rising awareness is fueling demand for sophisticated diagnostic services.

Latin America Companion Animal Diagnostics Market Trends

Latin America drives the growth of the companion animal diagnostic products market through several dynamic factors, including rising pet ownership, increasing awareness about animal health, and expanding veterinary infrastructure. In countries like Brazil and Mexico, a growing middle class with higher disposable incomes is investing more in the health and wellness of their companion animals, resulting in increased demand for advanced diagnostic services. For example, Brazil’s large population of pet owners has contributed to a surge in the use of diagnostic tools such as blood chemistry analyzers and rapid test kits for common diseases like canine ehrlichiosis and feline leukemia.

Brazil companion animal diagnostics market is witnessing significant growth increasing pet ownership and rising awareness of animal health. Brazil, which boasts the largest pet population in Latin America, offers a vibrant and rapidly expanding market for veterinary diagnostics. The market's growth is primarily driven by the rising humanization of pets, increasing expectations for high-quality veterinary care, and escalating spending on pet health. These factors have heightened the demand for precise and timely diagnostic solutions that facilitate early disease detection and preventive healthcare. Additionally, the growing number of veterinary clinics throughout the country has led to increased utilization of diagnostic technologies such as blood analyzers, rapid testing kits, and advanced imaging tools, all of which are contributing significantly to the market’s expansion.

Middle East & Africa Companion Animal Diagnostics Market Trends

The Middle East & Africa companion animal diagnostics market is experiencing notable growth, fueled by increased investments in veterinary healthcare infrastructure and the rising adoption of advanced diagnostic technologies. Countries such as South Africa and the UAE are at the forefront of this trend, with growing expenditures on veterinary services and diagnostic equipment. This surge in investment and modernization highlights the region’s evolving approach to animal healthcare and is expected to further accelerate market expansion in the coming years.

Saudi Arabia companion animal diagnostics market is poised for growth, driven by increasing pet ownership, rising awareness of preventive veterinary care, and government investments in advanced veterinary infrastructure. Demand is growing for molecular diagnostics, point-of-care testing, and disease-specific assays that enable early detection and targeted treatment for companion animals. For example, in July 2024, Saudi Arabia announced a $46.6 million investment to build a state-of-the-art veterinary laboratory in Riyadh focused on DNA-based disease diagnostics and local vaccine development, which will enhance diagnostic capabilities and support advanced testing for pets and livestock alike. Additionally, the adoption of international laboratory standards and modern diagnostic technologies is expected to strengthen veterinary service quality and expand market opportunities across the Kingdom.

South Africa companion animal diagnostics market is experiencing robust growth, largely fueled by a surge in product launches from local companies. These domestic players are developing innovative diagnostic solutions tailored to the specific needs of South African pet owners. For instance, companies such as EasyDNA South Africa and International Biosciences South Africa have introduced breed identification and health screening tests, offering affordable access to genetic diagnostics. These tools enable pet owners to determine breed composition and assess potential genetic health risks, supporting more informed decisions about their pets' care.

Key Companion Animal Diagnostics Company Insights

The companion animal diagnostics market is highly competitive, with key players such as IDEXX Laboratories, Zoetis Inc., and Thermo Fisher Scientific holding significant market shares. These companies are actively engaging in strategic moves such as mergers, acquisitions, partnerships, and geographic expansions to reinforce their competitive positions. The presence of emerging regional players and increased investments in R&D are intensifying market competition and shaping the market dynamics.

Key Companion Animal Diagnostics Companies:

The following are the leading companies in the companion animal diagnostics market. These companies collectively hold the largest Market share and dictate industry trends.

- IDEXX Laboratories, Inc.

- Zoetis

- Antech Diagnostics, Inc. (Mars Inc.)

- Agrolabo S.p.A.

- Embark Veterinary, Inc.

- Esaote SPA

- Thermo Fisher Scientific, Inc.

- Innovative Diagnostics SAS

- Virbac

- FUJIFILM Corporation

Recent Developments

-

In September 2025, Zomedica strengthened its intellectual property portfolio with four newly issued U.S. patents covering its TRUVIEW digital cytology and TRUFORMA diagnostic platforms, enhancing protected innovations in automated slide processing and advanced sensor technology. The company now holds over 228 global patents and trademarks, reinforcing its competitive position in the rapidly expanding multi-billion-dollar veterinary diagnostics market.

-

In May 2025, Hill’s Pet Nutrition partnered with MiDOG Animal Diagnostics to integrate advanced microbiome sequencing into nutrition research and veterinary care. By combining MiDOG’s rapid, high-precision microbial diagnostics with Hill’s science-based nutrition, the collaboration aims to enhance infection detection, guide targeted treatments, and develop more effective, personalized dietary solutions for pets.

-

In January 2025, IDEXX launched IDEXX Cancer Dx, a new low-cost blood test for early detection of canine lymphoma that can be added to routine wellness screenings and delivers results in 2-3 days.

-

In September 2024, Zoetis Inc. introduced Vetscan OptiCell, a new cartridge-based hematology analyzer that employs AI-powered technology to deliver precise Complete Blood Count (CBC) analysis at the point of care, offering lab-quality results with time, cost, and space efficiencies for veterinary clinics.

-

In July 2024, EKF Diagnostics launched the Biosen C-Line, an advanced glucose and lactate analyzer designed for enhanced usability. This benchtop analyzer provides highly precise glucose and lactate measurements, used in clinical settings for diabetes management and by elite sports teams for tracking lactate production in training.

-

In June 2024, Oxford BioDynamics developed EpiSwitch SCB, a non-invasive blood test that can accurately detect and distinguish six common canine cancers, including multiple lymphomas, sarcomas, and malignant melanoma, with over 89% accuracy.

-

In February 2024, MiDOG Animal Diagnostics introduced an advanced All-in-One Diagnostic Test capable of rapidly detecting bacterial and fungal infections, including antibiotic resistance, across various animal species.

Companion Animal Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 7.75 billion

Revenue forecast in 2033

USD 14.41 billion

Growth Rate

CAGR of 9.27% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal, testing category, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

IDEXX Laboratories, Inc.; Zoetis; Antech Diagnostics, Inc. (Mars Inc.); Agrolabo S.p.A.; Embark Veterinary, Inc.; Esaote SPA; Thermo Fisher Scientific, Inc.; Innovative Diagnostics SAS; Virbac; FUJIFILM Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Companion Animal Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the companion animal diagnostics market report based on product, animal, testing category, end use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumables, Reagents & Kits

-

Equipment & Instruments

-

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Dogs

-

Cats

-

Horses

-

Other Companion Animals

-

-

Testing Category Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinical Chemistry

-

Microbiology

-

Parasitology

-

Histopathology

-

Cytopathology

-

Hematology

-

Immunology & Serology

-

Imaging

-

Molecular Diagnostics

-

Other Categories

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Reference Laboratories

-

Veterinary Hospitals and Clinics

-

Home care settings

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global companion animal diagnostics market size was estimated at USD 7.06 billion in 2025 and is expected to reach USD 7.75 billion in 2026.

b. The global companion animal diagnostics market is expected to grow at a compound annual growth rate of 9.27% from 2026 to 2030 to reach USD 14.41 billion by 2033.

b. North America dominated the companion animal diagnostics market with a share of 37.91% in 2025. This is attributable to favorable healthcare structure and rising government initiatives.

b. Some key players operating in the companion animal diagnostics market include IDEXX Laboratories, Inc.; Zoetis; Antech Diagnostics, Inc. (Mars Inc.); Agrolabo S.p.A.; Embark Veterinary, Inc.; Esaote SPA; Thermo Fisher Scientific, Inc.; Innovative Diagnostics SAS; Virbac; FUJIFILM Corporation

b. Key factors that are driving the companion animal diagnostics market growth include prevalence of chronic diseases demanding effective diagnostics in pet animals and rising number of pet owners indicating increased adoption of companion animals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.