- Home

- »

- Animal Health

- »

-

Companion Animal Medicine Market, Industry Report, 2034GVR Report cover

![Companion Animal Medicine Market Size, Share & Trends Report]()

Companion Animal Medicine Market (2026 - 2034) Size, Share & Trends Analysis Report By Product (Biologics, Pharmaceuticals, Medicated Feed Additives), By Animal, By Indication, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-698-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2034

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Companion Animal Medicine Market Summary

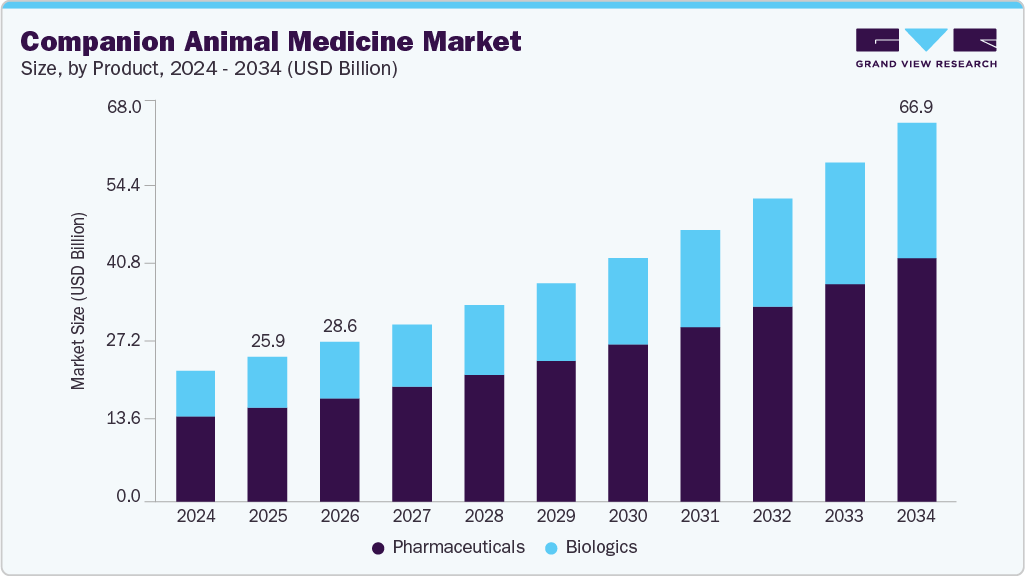

The global companion animal medicine market size was estimated at USD 25.88 billion in 2025 and is projected to reach USD 66.96 billion by 2034, growing at a CAGR of 11.22% from 2026 to 2034. The market is primarily driven by factors like rapid advancements in companion animal medicine, increasing humanization of pets & expenditure on pets, supportive initiatives, and changing pet demographics globally.

Key Market Trends & Insights

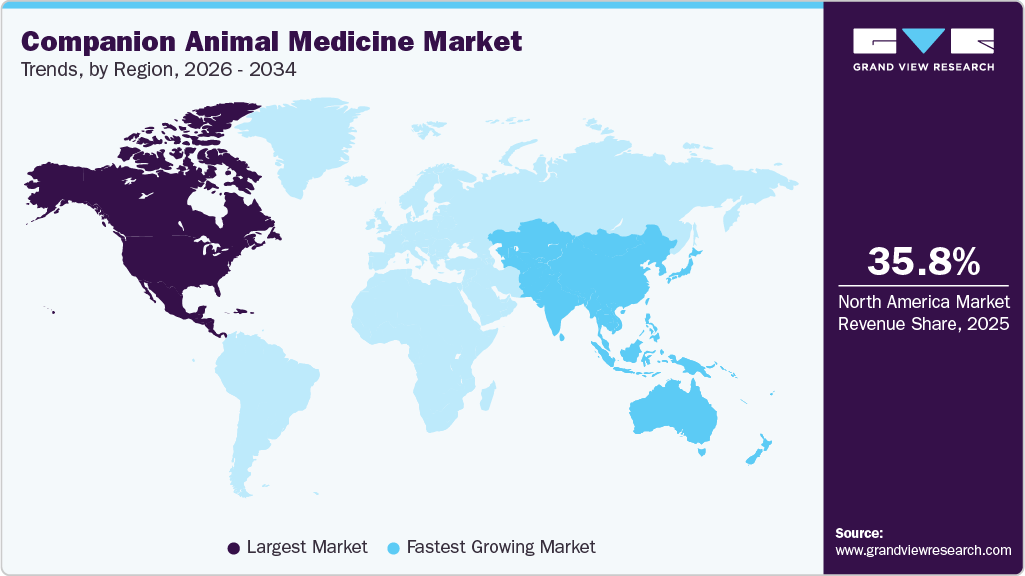

- The North American companion animal medicine market held the largest revenue share of 35.79% in 2025.

- The U.S. holds the largest share of the North America companion animal medicine market in 2025.

- By product, the pharmaceuticals segment held the largest market share of 59.55% in 2025.

- By animal, the dog segment within the companion animal medicine market is experiencing robust growth.

- By indication, the infectious diseases segment dominated the global companion animal medicine in 2025.

Market Size & Forecast

- 2025 Market Size: USD 25.88 Billion

- 2034 Projected Market Size: USD 66.96 Billion

- CAGR (2026-2034): 11.22%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Advancements in veterinary medicines have led to the development of more effective and targeted treatments for various animal diseases and health conditions. New drugs and therapies offer improved efficacy, reduced adverse effects, and better animal outcomes, driving demand for innovative veterinary medications.Increasing product approvals, rising focus on precision medicine, increasing uptake of pet insurance, growing animal health expenditure, the emergence of regenerative medicine techniques, and increasing demand for advanced animal care are expected to drive advancements in veterinary medicine in the near future. For instance, according to a dvm360 article from February 25, 2025, the FDA might provide conditional approval by March 2025 for a targeted drug known as rapamycin, which is currently under clinical trials for testing its efficacy in reversing hypertrophic cardiomyopathy (HCM) in felines.

Similarly, in March and April 2025, the US FDA approved two new veterinary drugs for cats and ornamental pet fish. In March 2025, the U.S. (FDA) granted conditional approval for Felycin-CA1 (sirolimus delayed-release tablets), the first approved treatment for cats suffering from subclinical hypertrophic cardiomyopathy (HCM). The product, manufactured by TriviumVet, an Ireland-based company, aims to manage cat ventricular hypertrophy without suppressing the immune system.

Such advancements highlight a shift toward more precise, effective, and safer pet treatment options. As veterinary science evolves, developing targeted therapies and novel drug delivery systems will enhance disease management and overall animal well-being. This growing focus on innovation, supported by increasing pet health awareness, rising veterinary care expenditures, and broader adoption of pet insurance, is driving demand for advanced veterinary solutions. These factors are expected to accelerate the sector's growth and reshape the future of companion animal medicine.

Ongoing key clinical trials in the veterinary field:

Trial Name

Location

Application

Sponsor Name

Animal Type

Status

Novel Monoclonal Antibody for Feline Atopic Skin Syndrome (FASS)

Yonkers, New York, United States

Feline Atopic Skin Syndrome (FASS)

NA

Cats

Ongoing

Bedinvetmab (Librela/Beransa) client survey study

Elemental Pet Vets, Freeville, New York

Pain management

Elemental Pet Vets

Dogs

Ongoing

Evaluation of the effect of Spascupreel on chronic enteropathies in dogs

University of Georgia

Gastrointestinal disorders

University of Georgia

Dogs

Ongoing

Treatment of pulmonary fibrosis with hymecromone (4MU)

Tufts University

Pulmonary fibrosis treatment

Tufts University

Dogs

Ongoing

Please note that these are just a few examples of our report's detailed clinical trial analyses

The market continuously evolves due to research into novel product development, business expansion efforts, and strategic alliances to introduce innovative technologies. These activities drive changes in market demands and practices. For example, in February 2025, Felix Pharmaceuticals announced plans to raise $200-250 million by selling a controlling stake in its pet drug subsidiary, Felix Generics. This move aims to tap into the rapidly growing companion animal health sector, with the funds being used to expand Felix Generics' product portfolio and explore new areas in animal health. The company intends to sell over 51% of its stake to a private equity firm.

These initiatives demonstrate how strategic collaborations, technological advancements, and innovative research drive the demand for veterinary drugs. Expanding product offerings, improved treatment options, and breakthroughs in animal health research address emerging needs and foster growth in the pet health market. As companies continue to invest in innovation and expand their portfolios, the demand for effective and diverse veterinary drugs will likely rise, shaping the future of the animal health industry.

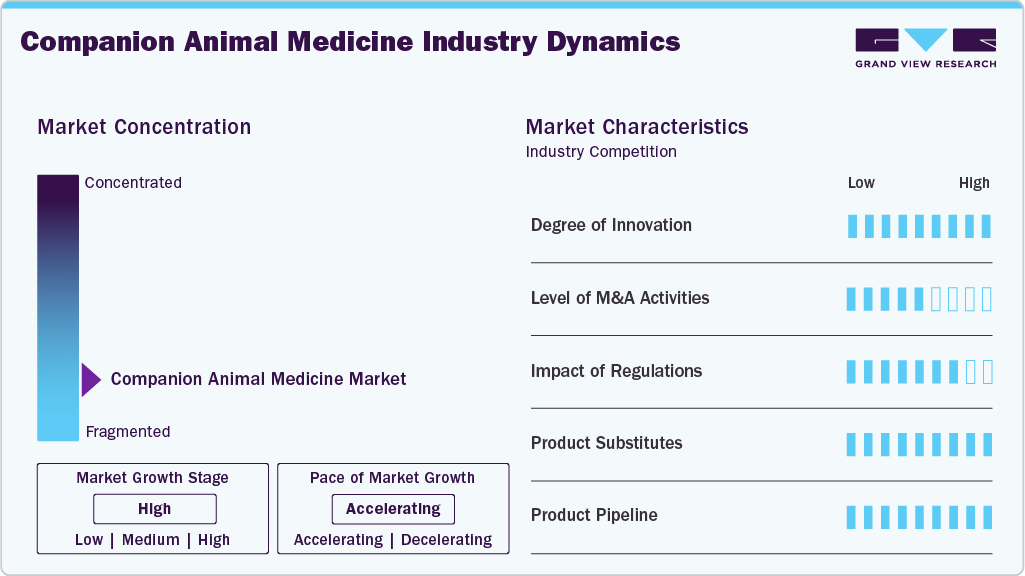

Market Characteristics & Concentration

The market exhibits a moderate to high level of innovation. Advancements in AI and machine learning are revolutionizing veterinary drug discovery by accelerating the development of targeted treatments. These technologies enhance efficiency and enable innovative delivery methods like transdermal patches and oral vaccines. Such innovations improve ease of use and boost compliance among pets. Additionally, telemedicine expands access to veterinary care, increasing demand for digitally prescribed medications.

The market reflects a moderate to high level of mergers and acquisitions conducted by market participants from various spectrums, such as investment firms, leaders, emerging players, etc. For example, in February 2025, Custom Veterinary Services (CVS) acquired Green Mountain Animal LLC (GMA) to expand into the manufacturing and distribution of veterinary soft chew and powder-format supplements.

Regulations significantly shape the industry, with agencies like the FDA and EMA enforcing strict standards on drug approval, manufacturing, and labeling. These rules ensure product safety and efficacy, while political stability and animal welfare policies influence market dynamics. Legal concerns, such as the use of gene therapies, can trigger regulatory shifts or disputes. Additionally, changes in healthcare policies, like pricing regulations, impact product availability and cost structures.

The industry faces intense competition from major players like Zoetis, Elanco, Boehringer, and Merck, driving innovation and aggressive pricing strategies. Frequent price wars in generics and preventive care reflect efforts to capture cost-sensitive consumers. Firms pursue mergers and acquisitions to expand market reach and consolidate resources to enhance competitiveness. Simultaneously, the rising popularity of herbal remedies, alternative medicines, and over-the-counter products poses a growing threat of substitution. Preventive care measures like vaccinations and wellness plans further reduce dependency on traditional veterinary drugs, increasing the pressure on established pharmaceutical offerings.

The industry features a robust and expanding product pipeline, driven by numerous ongoing clinical trials targeting various conditions in dogs, cats, and horses. These trials focus on innovative therapies, including monoclonal antibodies, gene therapies like CAR T cells, cancer treatments, and novel drug formulations for chronic diseases. Institutions like Colorado State University and primary veterinary schools are leading efforts in advanced research areas like brain cancer, aging, and immunotherapy. Successful outcomes from these trials are expected to drive regulatory approvals and fuel market growth. This intense R&D activity underscores the industry's commitment to innovation and improved animal health outcomes.

Product Insights

The pharmaceuticals segment held the largest market share of 59.55% in 2025. The pharmaceuticals segment for companion animals includes various products to treat multiple health conditions. These categories encompass parasiticides, anti-infective medicines, anti-inflammatory drugs, analgesics, and other therapeutic options designed to improve pets' well-being. Anti-inflammatory drugs and analgesics play a vital role in managing chronic pain, especially in aging animals suffering from arthritis or other long-term conditions. As awareness of pet health grows, the demand for effective and safe pain management solutions is on the rise, propelling growth in this segment.

The biologics segment is expected to grow at the fastest CAGR of 11.64% during the forecast period. This growth can be attributed to the rising need for targeted treatment options in companion animals, especially for chronic conditions such as allergies, arthritis, and immune-related diseases. Biologics such as vaccines, monoclonal antibodies, and immune modulators are gaining popularity due to their ability to provide effective and safe treatment with fewer side effects. In addition, growing awareness among pet owners and veterinarians about newer therapies is helping expand the use of biologics in animal healthcare. The market is also supported by faster approval processes and shorter development timelines for veterinary biologics, which allow new products to reach the market quickly. Improvements in biotechnology and production capabilities are making biologics more accessible and affordable.

Animal Insights

The dog segment within the companion animal medicine market is experiencing robust growth, driven by widespread pet ownership, increasing veterinary healthcare spending, and the growing availability of internal and external medicines designed for canine conditions. According to The American Pet Products Association (APPA) 2025 State of the Industry Report, 94 million U.S. households own at least one pet, with 51% of U.S. households (68 million) owning a dog. This highlights the significant cultural and economic importance of dogs as companions. Dogs are often regarded as family members, which fosters a strong demand for preventive care and therapeutic products in developed markets. Additionally, the high penetration of diagnostics, vaccines, and pharmaceuticals for dogs and rising awareness about pet hygiene and chronic disease management fuel the segment's expansion.

The cat segment is expected to grow fastest, supported by rising pet adoption and increased demand for feline-specific medical products. Cats are becoming increasingly popular, especially in countries like Canada, where they are now often preferred over dogs. Pet ownership is regaining momentum, and according to the American Pet Products Association's 2025 report, 49 million U.S. households-about 37%-own a cat. The growing incidence of infectious diseases in cats is expanding the need for targeted pharmaceuticals and vaccines. In addition, chronic conditions such as kidney disease, endocrine disorders, hyperthyroidism, and diabetes are elevating the demand for long-term treatment options, which is supporting expansion across the.

Indication Insights

The infectious diseases segment dominated the global companion animal medicine in 2025, driven by the growing burden of transmissible diseases and heightened focus on preventive care. A significant development contributing to this trend was reclassifying the leptospirosis vaccine as a core dog vaccine. In March 2024, the American Veterinary Medical Association (AVMA) recommended an annual vaccination against leptospirosis for all dogs, regardless of geography or lifestyle. This decision was supported by key veterinary bodies such as the American Animal Hospital Association (AAHA), the World Small Animal Veterinary Association (WSAVA), and the American College of Veterinary Internal Medicine (ACVIM), underscoring the growing emphasis on disease prevention.

The other indications segment addresses conditions in companion animals, such as injuries, accidents, genetic disorders, dental complications, and cardiovascular diseases. These issues often require immediate or long-term pharmaceutical care, particularly in aging pets or those with breed-specific predispositions. Dental diseases are especially common in dogs and cats, usually leading to secondary complications if left untreated. Similarly, genetic and congenital disorders such as hip dysplasia or heart defects necessitate sustained medication and care, driving demand in this segment. Key veterinary pharmaceutical companies are developing and distributing medications targeting these indications. For instance, Elanco and Boehringer Ingelheim offer cardiac drugs like Vetmedin (pimobendan) to manage congestive heart failure in dogs.

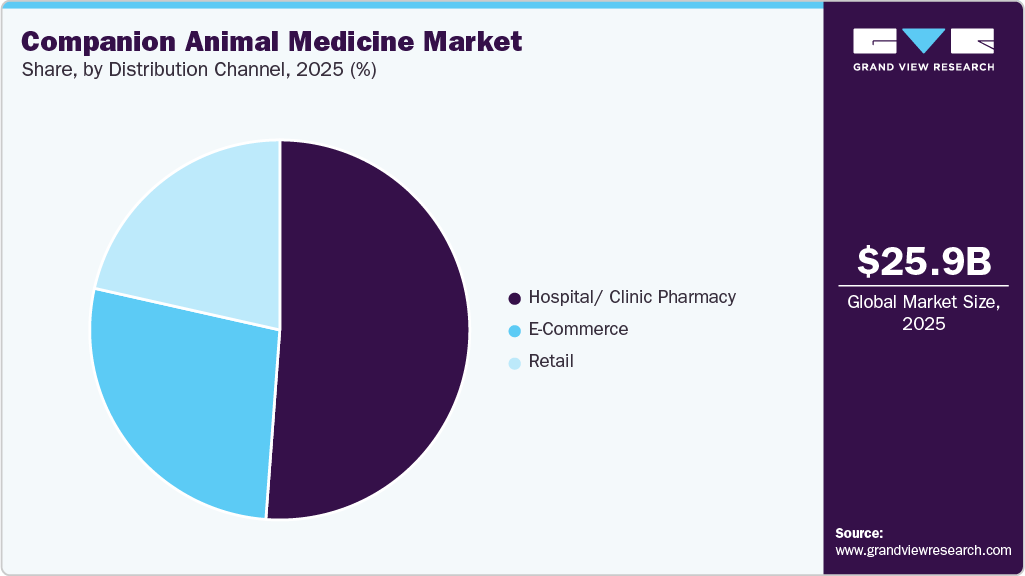

Distribution Channel Insights

Hospital/Clinic Pharmacy held the largest share in the distribution channel segment in 2025. This is mainly due to its accessibility and affordability, with hospitals playing a central role in providing advanced treatment products for companion animals. As more pets are adopted worldwide, the demand for veterinary care continues to rise, leading to more frequent visits and readmissions for treatments. This has resulted in a higher need for veterinary pharmaceuticals, further driving the adoption of animal health products in Hospital/Clinic Pharmacies. Additionally, initiatives to improve safety and reduce adverse effects are important factors contributing to the growth of this segment.

E-commerce is expected to grow at the fastest CAGR of 14.42% during the forecast period. The shift towards online shopping for pet healthcare products has been fueled by increased convenience, wider availability, and the growing reliance on digital platforms. Pet owners now enjoy easy access to medications, supplements, and other pet health essentials, with the added benefit of features like auto-ship, digital prescriptions, and competitive pricing. A prime example of this trend is Walmart's partnership with Pawp, launched in October 2024. This initiative provides Walmart+ members with free, 24/7 access to Pawp's online veterinary team for unlimited virtual visits, enhancing accessibility to veterinary care.

Regional Insights

The North American companion animal medicine market held the largest revenue share of 35.79% in 2025, driven by increasing pet ownership and the deepening human-animal bond. According to the 2024 AVMA Pet Ownership and Demographic Sourcebook, dog-owning households in the U.S. have surged from 31.3 million in 1996 to 59.8 million in 2024, while cat-owning households increased from 27 million to 42.1 million in the same period. Nearly 89% of dog owners and 85% of cat owners now consider pets family members, fueling demand for preventive healthcare, vaccinations, and routine checkups. This emotional connection is reflected in spending, with average total pet-related expenditures per household reaching $1,516 in 2024.

Additionally, growing innovations in companion animal medicines and developing advanced, safer, and more effective medications drive market growth. For instance, in June 2024, Merck Animal Health launched NOBIVAC NXT Rabies, the first RNA-particle-based rabies vaccine for cats and dogs, now available in countries like Canada. The vaccines are adjuvant- and preservative-free, offering advanced, safe protection against rabies. This move enhances Canada's pet vaccine landscape and supports global efforts to eliminate rabies, aligning with Merck's long-standing commitment to animal health and disease prevention.

U.S. Companion Animal Medicine Market Trends

The U.S. holds the largest share of the North America companion animal medicine market in 2025, owing primarily to rising pet ownership and increasing awareness about pet health and wellness. Pet ownership in the U.S. has risen significantly, with 94 million households owning at least one pet, up from 92 million in 2023, according to the American Pet Products Association (APPA). The pet industry reached $152 billion in expenditures in 2024, with projections to hit $157 billion in 2025. Notably, 51% of households own dogs and 37% own cats. This pet ownership and spending surge drives growth in the U.S. Companion Animal Medicine Market. Furthermore, the demand for veterinary services and pet products, including calming aids and preventive care, is growing as pets are treated as family members.

Europe Companion Animal Medicine Market Trends

Europe's companion animal medicine market is expected to experience consistent growth over the forecast period due to increased pet ownership and pet care expenditure. For instance, according to the FEDIAF report 2024, the number of pet owners is growing, with 166 million out of Europe's 352 million pets owned by 50% of European households. However, steady growth in the dog population is expected to propel the demand for related products and services, driving the market. In addition, the approval of veterinary drugs by the European Medicines Agency (EMA) plays a crucial role in driving the companion animal medicine market in the European region.

For instance, according to an article published by the European Medicines Agency, in January 2025, EMA approved 25 veterinary medications for marketing authorization in 2024, the most recommendations ever made in a single year. Two of these had a novel active ingredient that had never been approved in an EU veterinary medication. There were fourteen vaccines, seven of which were developed using biotechnology. Eleven medications were suggested for marketing authorization in 2024 for companion animals like dogs and cats.

The UK companion animal medicine market is projected to grow significantly over the forecast period, owing primarily to the large pet population, increasing pet ownership, and rising incidence of chronic diseases in pets. According to the PDSA PAW Report 2024, 51% of UK adults own a pet, of which 28% of UK adults have a dog (estimated population of 10.6 million pet dogs), 24% have a cat (estimated population of 10.8 million pet cats), and 2% have a rabbit (estimated population of 800,000 pet rabbits). Rising product launches & collaborations by major players in the country are estimated to boost market growth. For instance, in July 2024, Dechra Pharmaceuticals acquired US-based Invetx for up to $520 million, gaining access to its innovative monoclonal antibody (mAb) platform for chronic companion animal conditions.

The Germany companion animal medicine market can be attributed to increasing pet ownership, availability of pet insurance, and product innovation. For instance, according to a Swedish Board of Agriculture study, around 60% of households in Sweden own at least one pet, with cats and dogs being the most popular. The study also stated that pet ownership has increased by around 25% over the last decade, indicating a significant rise in the demand for the companion animal medicine market. Additionally, Sweden's emphasis on research and development, particularly through acquisitions, is expected to drive market growth. For instance, in March 2025, Swedencare acquired UK-based Summit Veterinary Pharmaceutical for £30 (USD 40.20) million, expanding into the specialty veterinary pharmaceuticals segment. Summit serves over 5,500 clinics and adds a strong portfolio focused on small animals and equines, with potential for future EU market expansion.

Asia Pacific Companion Animal Medicine Market Trends

The Asia Pacific market has been growing rapidly and is projected to grow significantly over the forecast period. Primary reasons anticipated to propel the regional market are the rise in middle-class families, the growing adoption of companion animals, increasing pet expenditure, humanization of pets, the strong presence of market players, and favorable government initiatives. Besides, countries such as China & India are anticipated to have strong growth potential as the number of regional facilities increases. In addition, rising consumer awareness of pet surgeries & treatment and pet insurance is expected to boost the market in the coming years. The region has many market players involved in strategic partnerships, expansions, product launches, and other initiatives to cater to the growing market demand. For instance, in July 2024, Protect Animal Health (PAH) and DotBio formed a strategic partnership to develop advanced antibody-based therapies for dogs and cats, leveraging DotBio's DOTBODY technology to address chronic diseases like cancer and autoimmune disorders.

The market for companion animal medicine in India is expected to grow rapidly over the forecast period, attributed primarily to an increase in pet ownership, pet insurance, growing expansion of hospitals, and numerous funding schemes by state & national agencies. In India, pet ownership is likely to continue to rise. These factors, combined with people changing their attitudes about pets and welcoming them as family members, have led to India's fast-growing pet industry. Over the past decade, the demand for quality pet care has been increasing in terms of treatment and surgeries. For instance, in February 2024, Tata Trusts launched India's first small animal hospital in Mumbai. It is the first of its kind, spans over 98,000 sq ft across five floors, and has a capacity of 200+ beds. The facility would provide services with a mission to save lives. The small animal hospital was anticipated to be launched in March 2024. Such factors are expected to drive the market over the forecast period.

Latin America Companion Animal Medicine Market Trends

The Latin American companion animal medicine market is witnessing steady growth, driven by multiple socio-economic and healthcare-related factors. One of the most prominent drivers is increasing pet ownership, especially in urban centers across Brazil and Argentina. According to the Brazilian Institute of Geography and Statistics (IBGE), Brazil alone has over 149 million pets, including dogs, cats, birds, and other animals. This rise is mainly due to urbanization, lifestyle changes, and the growing emotional bond between people and their pets, often called the "humanization of pets." As more households treat pets as family members, demand for veterinary care, including preventive and treatment, has grown significantly.

Another major factor is the expansion of veterinary infrastructure and services. Across the region, there has been a notable increase in veterinary clinics, pet hospitals, and specialized pet pharmacies. As per the Federal Council of Veterinary Medicine, Brazil leads the region, with over 50,000 registered veterinary professionals. This expansion is complemented by rising pet health and wellness awareness, supported by governmental and private health campaigns encouraging routine vaccinations, deworming, and disease screenings.

The Argentina companion animal medicine market is experiencing steady growth, primarily driven by the rising pet ownership rates. According to the Argentina Pet Food Manufacturers Association, approximately 78% of households own at least one pet, with dogs being the most popular (63%), followed by cats (26%). This high ownership rate creates substantial demand for veterinary pharmaceuticals and preventive care products. Higher disposable incomes among Argentine consumers have increased pet healthcare spending. This economic trend enables pet owners to invest in advanced veterinary services and premium pet care products, further fueling the growth of the companion animal medicine market. Urbanization and changing social structures have contributed significantly to the market's expansion. As more Argentinians live in urban settings and family sizes decrease, pets increasingly fulfill emotional companionship roles. This "humanization" trend has led pet owners to spend more on premium healthcare solutions, with average annual veterinary expenditure reaching approximately 15,000-20,000 Argentine pesos per pet in urban centers like Buenos Aires, Córdoba, and Rosario.

MEA Companion Animal Medicine Market Trends

South Africa, Saudi Arabia, the UAE, and Kuwait are the key countries in the MEA market. The Middle East and Africa (MEA) companion animal medicine market is experiencing significant growth due to several driving factors, including the rising pet ownership trend, increasing disposable incomes, and enhanced awareness of animal health. Pet ownership in the region, particularly in countries like the UAE, Saudi Arabia, and South Africa, is growing rapidly, with more households adopting pets due to changing social dynamics and increasing urbanization. This shift has increased the demand for veterinary care, pharmaceuticals, and specialized pet treatments. In countries like the UAE, the pet population is expected to grow by 9.5% annually, fueling the need for advanced veterinary services and animal health products.

The South Africa companion animal medicine market is driven by the rising animal health concerns, developed infrastructure, and growing requirements for veterinary care drive animal medicine in South Africa. The market is expected to witness growth due to a diverse population, the presence of well-established infrastructure, and the availability of veterinarians. Pet ownership is on the rise, with 59% of South African households having pets, and dogs being the most popular, owned by 78% of pet owners. This trend has led to increased demand for veterinary services and products. Pet owners in South Africa spend between USD 1,800 and USD 4,000 annually on their pets, reflecting a growing investment in pet health and wellness. Rising disposable income among South Africa's middle class has significantly impacted spending patterns on pet healthcare, with annual expenditure on veterinary services increasing by 12% between 2019 and 2023.

Key Companion Animal Medicine Company Insights

The market is highly competitive, with increasing consolidation driven by strategic initiatives from companies of all sizes. Businesses focus on mergers and acquisitions, partnerships, R&D, and product launches to enhance market share. Barriers to entry in the industry are moderate, primarily due to high R&D costs and stringent regulatory requirements. Dominance by established players like Zoetis and Merck creates strong brand loyalty and limits opportunities for new entrants. New companies face challenges in gaining market share but may succeed through innovation or targeting unmet needs. Overall, a significant investment is essential for market entry and competitiveness. For example, in April 2025, Virbac partnered with MabGenesis to license novel therapeutic monoclonal antibodies, aiming to develop and commercialize innovative treatments for canine diseases using MabGenesis' advanced antibody technology.

Key Companion Animal Medicine Companies:

The following are the leading companies in the companion animal medicine market. These companies collectively hold the largest market share and dictate industry trends.

- Merck & Co., Inc.

- Ceva

- Vetoquinol

- Zoetis

- Boehringer Ingelheim International GmbH

- Elanco Animal Health Incorporated

- Ourofino Animal Health

- Virbac

- Phibro Animal Health Corporation

- Dechra Pharmaceuticals Plc

- Bimeda Inc.

Recent Developments

-

In November 2025, Akston Biosciences launched a clinical trial at Cornell University College of Veterinary Medicine testing a once-weekly GLP‑1 protein therapy for overweight cats to help regulate appetite and manage weight. The therapy showed no adverse effects in early studies and could offer a new way to address widespread feline obesity when paired with diet and vet care.

-

In September 2025, Virbac launched Vikaly, the first ever medicated feed for cats, which blends prescription-medication with renal kibble to treat chronic kidney disease. This feed aims to simplify treatment by delivering this external medicine through daily meals, thus improving compliance and reducing stress for cats and their owners.

-

In April 2025, MSD Animal Health launched Bravecto TriUNO, a first all-in-one monthly chew for dogs combining flea, tick, and worm protection. This tablet uses three active ingredients, fluralaner, moxidectin, and pyrantel, for treatment of fleas, ticks, roundworms and hookworms, and prevent heartworm and lungworm

-

In February 2025, Vetanco added access to its Colombia website to its global corporate website, aiming to integrate its various regional websites from countries like Argentina, Brazil, Mexico, and Colombia.

-

In February 2025, the investment firm BC Partners acquired a majority stake in PetLab Co. Ltd, a pet supplement brand.

-

In February 2025, Loyal, a clinical-stage animal health company focused on developing longevity drugs for dogs, announced that the FDA's Center for Veterinary Medicine had accepted the Reasonable Expectation of Effectiveness (RXE) section of its conditional approval application for LOY-002.

-

In January 2025, Ceva Sante Animale partnered with Touchlight to utilize its proprietary dBDNA technology to initiate the manufacturing of DNA-based animal vaccines.

-

In October 2024, Panav Biotech launched Maropitine injection, a drug designed to treat vomiting and nausea in dogs.

Companion Animal Medicine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.59 billion

Revenue forecast in 2034

USD 66.96 billion

Growth Rate

CAGR of 11.22% from 2026 to 2034

Actual data

2021 - 2025

Forecast period

2026 - 2034

Quantitative units

Revenue in USD million and CAGR from 2026 to 2034

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, clinical trials outlook, and volume analysis

Segments covered

Product, animal, indication, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; Kuwait; UAE

Key companies profiled

Merck & Co., Inc.; Ceva; Vetoquinol; Zoetis; Boehringer Ingelheim International GmbH; Elanco Animal Health Incorporated; Ourofino Animal Health; Virbac; Phibro Animal Health Corporation; Dechra Pharmaceuticals Plc; Bimeda Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Companion Animal Medicine Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2034. For the purpose of this report, Grand View Research has segmented the global companion animal medicine market report on the basis of product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2034)

-

Biologics

-

Vaccines

-

Modified/ Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines

-

-

Other Biologics

-

Monoclonal Antibody (mAb)

-

Dogs

-

Cats

-

-

Other Biologics (excluding mAb)

-

-

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Other Pharmaceuticals

-

-

Medicated Feed Additives

-

-

Animal Outlook (Revenue, USD Million, 2021 - 2034)

-

Dogs

-

Cats

-

Horses

-

Other Animals

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2034)

-

Infectious Diseases

-

Dermatologic Diseases

-

Pain

-

Orthopedic Diseases

-

Behavioral Diseases

-

Other Indications

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2034)

-

Retail

-

E-commerce

-

Hospitals/Clinics

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2034)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global companion animal medicine market was valued at USD 25.88 billion in 2025 and is expected to reach USD 28.59 billion in 2026.

b. The global companion animal medicine market is expected to grow at a compound annual growth rate of 11.22% from 2026 to 2034 to reach USD 66.96 billion by 2034.

b. The North America companion animal medicine market is driven by increasing pet ownership and the deepening human-animal bond. Additionally, growing innovations in companion animal medicines and the development of advanced, safer, and more effective medications drive market growth. For instance, in June 2024, Merck Animal Health launched NOBIVAC NXT Rabies, the first RNA-particle-based rabies vaccine for cats and dogs.

b. Some key players operating in the companion animal medicine market include Merck & Co., Inc., Ceva, Vetoquinol, Zoetis, Boehringer Ingelheim International GmbH, Elanco Animal Health Incorporated, Ourofino Animal Health, Virbac, Phibro Animal Health Corporation, Dechra Pharmaceuticals Plc, and Bimeda Inc.

b. Key factors that are driving the companion animal medicine market growth include rapid advancements in companion animal medicine, increasing humanization of pets & expenditure on pets, supportive initiatives, and changing pet demographics globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.