- Home

- »

- Animal Health

- »

-

Companion Animal Rehabilitation Services Market Report 2030GVR Report cover

![Companion Animal Rehabilitation Services Market Size, Share & Trends Report]()

Companion Animal Rehabilitation Services Market Size, Share & Trends Analysis Report By Animal Type (Dogs, Cats, Others), By Therapy Type, By Indication, By End-use (Veterinary Rehab Centers & Hospitals) By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-044-1

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global companion animal rehabilitation services market size was valued at USD 499.7 million in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) 11.42% from 2023 to 2030. The growing awareness among veterinarians & pet parents regarding physical rehab therapies as a drug-free & non-invasive treatment for companion animals, improving trends of pet humanization, and increasing incidence of orthopedic & musculoskeletal problems coupled with respective surgery rates, are some of the key factors driving the market. In addition, the increasing number of organizations recruiting volunteer animal rehabilitators is further boosting the market growth. For instance, ‘our companion-animal rescue & sanctuary organization’ in the U.S. offers two different ways for the general public to volunteer in rehabilitating stray companion animals.

The COVID-19 pandemic has negatively impacted the market, majorly in the year 2020. This impact was brought on by the announcement of nationwide & statewide lockdown, which led to movement restrictions and the closure of vet rehabilitation centers. It created hurdles among veterinarians, rehabilitators, and pet parents in accessing physical therapies for their beloved animals owing to the forced cancellation of rehab programs. Moreover, the pandemic also created a looming recession and increased price rates for rehabilitation services, which affected the decisions of pet parents in choosing rehabilitation therapies.

The pandemic has also had a positive impact on the market, such as an increased pet adoption rates globally. For instance, according to an article published by the National Library of Medicine in September 2021, animal rescue & shelter homes worldwide have experienced ever-increasing foster care & adoption rates during the pandemic. In addition, the U.S. CDC, in collaboration with American Veterinary Medical Association, developed guidelines for shelter homes to help continue operating and protect the health of animals during the period of the massive health crisis. Therefore, the COVID-19 pandemic has impacted the exiting and entering of animals in shelter homes and rescue centers, relevantly affecting rehabilitation services.

Furthermore, the increase in training programs for pet rehabilitation and its wide traction among veterinary practitioners and therapists are further unveiling new opportunities in the market. For instance, the American Association of Rehabilitation Veterinarians states that physical rehabilitation is a rapidly growing field in the veterinary industry with growing educational opportunities. It expands the engagement of trained, certified, & licensed professionals in rehabilitation practices. Moreover, the Academy of Animal Sport Science, California, U.S., has dedicated itself to continuing education for veterinarians in the field of animal sports medicine and rehabilitation. One of their flagship program, the “Animal (equine) Sports Therapy, and Rehabilitation (ASTR)” certification, has licensed several veterinary rehabilitators in the country.

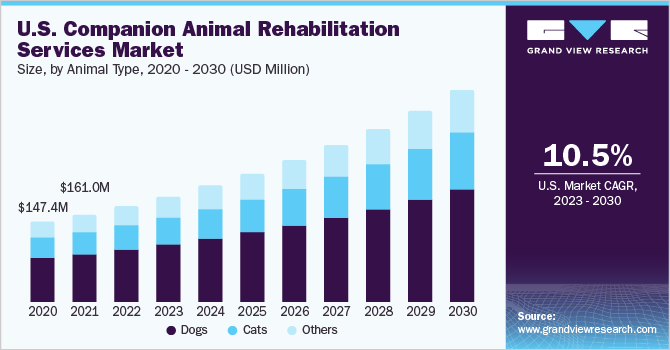

Animal Type Insights

By animal type, the dog segment accounted for the dominant revenue share of over 55% in 2022. The stable growth in dog adoption & ownership rates in developed regions, increasing incidences of chronic conditions such as arthritis and other muscular disorders among dogs, rising pet services expenditure, and growing demand, awareness, & requirements for non-invasive physical treatments, are among the factors contributing to the dominant share of the segment. In addition, the rising dog population rate in several developing economies further improves segmental growth.

For instance, according to the American Kennel Club, the number of households owning dogs in the U.S. reached 54% (69 million) during the period 2021-22, which has increased notably from 50% in 2018. On the other side, the cats’ segment is expected at the fastest CAGR of over 12% during the projected period. As cats are generally less affected by accidents or injuries comparing dogs, rehabilitation is mostly preferred for acute and chronic heritable disorders. However, rehabilitating feline patients require excellent maneuvering skills with a thorough understanding of their behavior, which could limit the rehabilitation services specific to cats. The growing adoption rates of cats in European countries are significantly increasing the growth rate over the forecast period.

Therapy Type Insights

Based on the therapy type, the therapeutic exercises segment held the largest revenue share of over 22% in the global companion animal rehabilitation services market in 2022. Guided or directed exercises are the most frequently used physical non-invasive therapy for pet animals. It comprises weight shifting, weight loss therapies, balance therapies, and several other exercises using cavalletti rails, water or grounded treadmills, peanut balls, and balance discs, among others. These guided exercises enhance the core & muscle strength of animals and improve flexibility. It is widely recommended for senior pets with musculoskeletal and neurological problems; however, is also preferred for geriatric, deconditioned patients, and injured sports animals.

On the other side, the hydrotherapy segment is anticipated at the fastest CAGR of over 12% during the projected period. The rising awareness about the potential benefits of aquatic therapy for companion animals with painful medical conditions is boosting the market growth. The two most common pet hydrotherapy forms are swimming and underwater treadmill exercises. It utilizes water viscosity, buoyancy, hydrostatic pressure, and resistance to help animals move their limbs and joints with relatively less pain. Increasing admission rates for hydro therapies, especially with warm water, in pet rehab centers, are fueling the opportunities for market growth.

Indication Insights

On the basis of the indication, the post-surgery segment registered the largest revenue share of more than 30% in the global market. The increasing rate of orthopedic or musculoskeletal surgeries performed on pets, with veterinarians referring those patients to rehab for rapid healing & recovery, are greatly contributing to this substantial share. Post-operative veterinary patients are more likely to consider physical therapies to reduce pain & inflammation and to fasten the healing rate. Rehab after surgical procedures has become more common in the veterinary industry with cutting-edge techniques, which further improves segmental growth.

The acute & chronic disease segment is anticipated to grow faster during the projected period, owing to its large prevalence & incidence rates in companion animals. Degenerative joint disorders/arthritis, obesity, neurological disorders, intervertebral disc disease, and others are some of the commonly diagnosed conditions among pet species. For instance, in an article published by Parnell Living Science, around 80% of the world’s dog population shows signs or symptoms of arthritis, regardless of age. American Kennel Club, Inc. reported that in America, one out of every five dogs suffers from orthopedic conditions such as arthritis, which mostly affects the back, legs, hips, and other body parts. NC State University published an article stating that 90% of feline species aged over 10 years old show symptoms/signs of arthritis. Therefore, the rise in risk factors and incidence of such chronic disorders have significantly increased the adoption of veterinary rehabilitation services, which supports market growth.

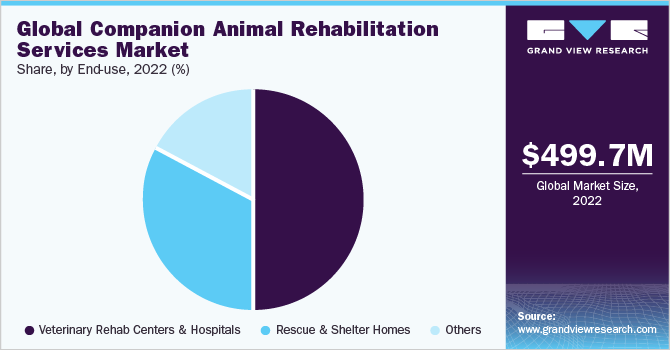

End-use Insights

Based on the end-use, the veterinary rehab centers & hospitals segment is estimated to have the largest revenue share of more than 45% in 2022. This is due to a growing number of veterinary rehab centers and hospitals worldwide with advanced cutting-edge infrastructures. These centers are the major spot for veterinary physical therapies due to the availability of licensed rehabilitators. The rising number of veterinary rehab practitioners is another factor propelling the segment’s growth. According to the American Animal Hospital Association (AAHA), several veterinarians and veterinary technicians are trained & certified to rehabilitate companion animals, in veterinary hospitals. These affirmative factors are boosting the growth of the segment.

The rescue & shelter homes segment is anticipated at the fastest CAGR of over 12% over the projected period. In February 2021, the National Library of Medicine published an article stating that around 6 to 8 million cats and dogs enter U.S. animal rescue shelters each year. Animal welfare foundations in several countries are collaborating with rescue or shelter homes to provide better care for old, orphaned, paralyzed, injured, blind, and sick companion animals, nursed and rehabilitated by professionals. These factors support the substantial growth rate of the segment over the forecast period.

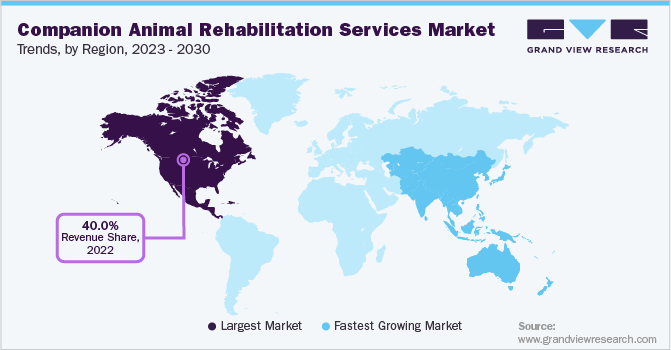

Regional Insights

North America dominated the market with the largest revenue share of over 40% in 2022. The high share of the region is owing to the large presence of pet rehabilitation centers, increasing pet ownership & pet service expenditure, growing awareness among veterinarians & pet owners regarding physical rehab therapies, and improving veterinary rehab infrastructure with advanced equipment. The growing number of veterinary hospitals with licensed & certified veterinarians who also offer rehabilitation therapies is another factor propelling the market growth. In 2020, American Veterinary Medical Association estimated that over 110,000 registered veterinarians were residing in the U.S., majorly offering services to small pets. According to the American Pet Products Association, a sizable portion of these licensed veterinarians are currently trained & certified to provide rehabilitation.

The Europe region held the second-largest revenue share of the market in 2022, owing to the growing pet adoption rates, and improving veterinary care services in the region. On the other hand, the Asia Pacific market is anticipated to grow faster in the next few years, with a CAGR of over 13%. This is attributable to the rising disposable income of households & relatively increasing veterinary services expenditure in developing countries. The growing awareness and demand for timely rehabilitation to relieve companion animals from painful conditions, and emerging trends of pet humanization in developing economies like Australia and India are further boosting the growth of the market.

Key Companies & Market Share Insights

Companion animal rehabilitation service providers are significantly involved in implementing strategic initiatives such as collaborating with referral hospitals, enhancing their infrastructure with advanced rehab therapeutic equipment, and launching new ranges of programs & therapies. In addition, key pet medicine manufacturers are entering the companion animal rehabilitation services market with new strategies. For example, in July 2022, one of the major pet medicine manufacturers, Vetoquinol, launched their new animal rehabilitation program called Vetoquinol Rehabilitation Business Solution (VeRBS), which offers basic rehab equipment along with training programs to veterinary clinics & hospitals. Such initiatives by veterinary organizations and companies are unveiling newer opportunities for market growth.Some of the prominent players in the global companion animal rehabilitation services market include:

-

Back on Track Veterinary Rehabilitation Center, LLC

-

Animal Acupuncture and Rehabilitation Center

-

BARC

-

Treasure Coast Animal Rehab & Fitness

-

Animal Rehab Center of Michigan

-

Blue Springs Animal Rehabilitation Center

-

Essex Animal Hospital

-

Triangle Veterinary Referral Hospital

-

Butterwick animal rehab clinic Ltd

-

Animal Rehab and Conditioning Center

Companion Animal Rehabilitation Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 0.56 billion

Revenue forecast in 2030

USD 1.18 billion

Growth rate

CAGR of 11.42% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Animal type, therapy type, indication, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Germany; U.K.; France; Spain; Italy; Japan; China; India; Australia; Brazil; Mexico; South Africa.

Key companies profiled

Back on Track Veterinary Rehabilitation Center LLC; Animal Acupuncture and Rehabilitation Center; BARC; Treasure Coast Animal Rehab & Fitness; Animal Rehab Center of Michigan; Blue Springs Animal Rehabilitation Center; Essex Animal Hospital; Triangle Veterinary Referral Hospital; Butterwick animal rehab clinic Ltd; Animal Rehab and Conditioning Center

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Companion Animal Rehabilitation Services Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global companion animal rehabilitation services Market on the basis of animal type, therapy type, indication, end-use, and region:

-

Animal TypeOutlook (Revenue, USD Million; 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Therapy Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Therapeutic Exercises

-

Manual Therapy

-

Hydrotherapy

-

Hot & Cold Therapies

-

Electro Therapies

-

Acupuncture

-

Shockwave Therapy

-

Other Therapies

-

-

Indication Outlook (Revenue, USD Million; 2018 - 2030)

-

Post-surgery

-

Traumatic Injuries

-

Acute & Chronic Diseases

-

Developmental Abnormality

-

Other Indications

-

-

End-use Outlook (Revenue, USD Million; 2018 - 2030)

-

Veterinary Rehab Centers & Hospitals

-

Rescue & Shelter Homes

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of LATAM

-

-

Middle East & Africa

-

South Africa

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global companion animal rehabilitation services market size was estimated at USD 499.7 million in 2022 and is expected to reach USD 0.56 billion in 2023.

b. The global companion animal rehabilitation services market is expected to grow at a compound annual growth rate (CAGR) of 11.42% from 2023 to 2030 to reach USD 1.18 billion by 2030.

b. North American region registered the highest market revenue share of about 40% in 2022 owing to the large presence of pet rehab centers and increasing awareness among pet parents regarding non-invasive physical therapies.

b. Some key players operating in the global companion animal rehabilitation services market include Animal Acupuncture and Rehabilitation Center, Back on Track Veterinary Rehabilitation Center, LLC, BARC, Animal Rehab Center Of Michigan, and Treasure Coast Animal Rehab & Fitness, among others.

b. The key factors driving the market growth include the increasing number of veterinary rehabilitators, the growing prevalence of orthopedic and musculoskeletal problems in pet animals, significant pet ownership rates, rising pet humanization trends, and huge animal healthcare spending, among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."