- Home

- »

- Advanced Interior Materials

- »

-

Concrete Admixtures Market Size, Industry Report, 2033GVR Report cover

![Concrete Admixtures Market Size, Share & Trends Report]()

Concrete Admixtures Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Water Reducing Admixtures, Air-entraining Admixtures, Waterproofing Agents, Accelerating Agents), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-544-1

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Concrete Admixtures Market Summary

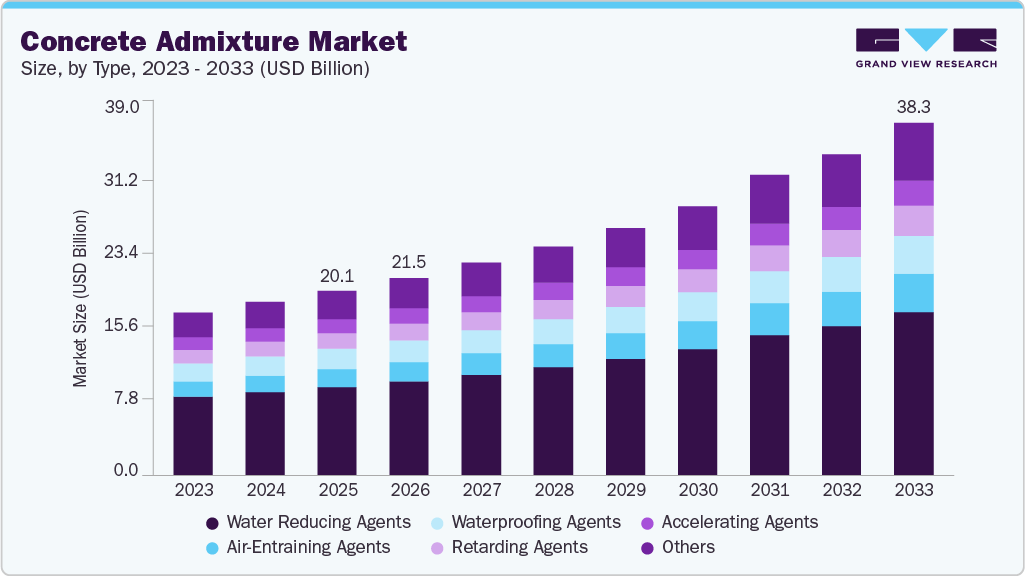

The global concrete admixtures market size was estimated at USD 20.07 billion in 2025 and is projected to reach USD 38.34 billion by 2033, growing at a CAGR of 8.6% from 2026 to 2033. The demand for concrete admixtures is increasing steadily due to rapid urbanization, large-scale infrastructure development, and rising construction activities across both emerging and developed economies.

Key Market Trends & Insights

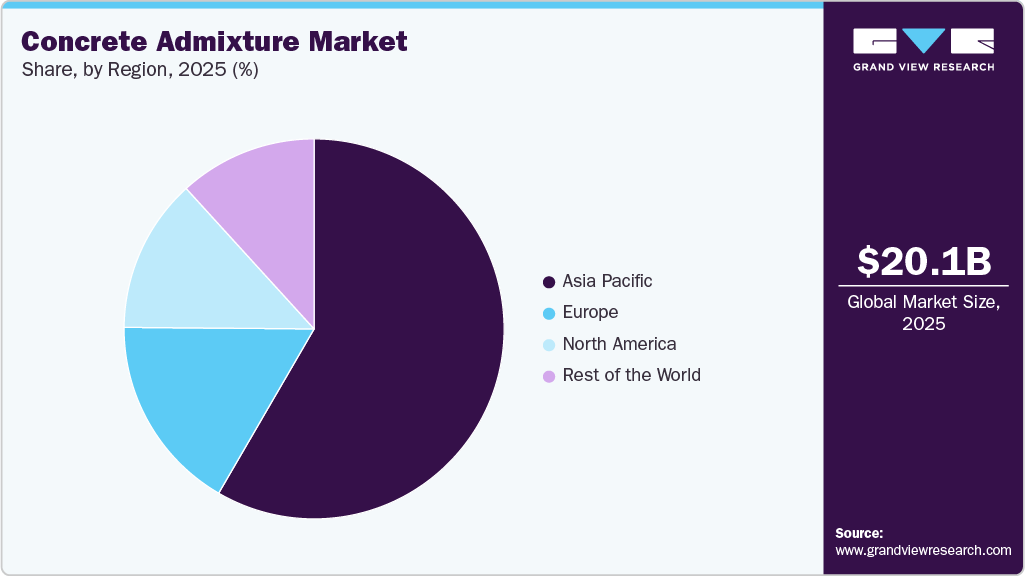

- Asia Pacific dominated the global concrete admixtures market with the largest revenue share of 56.1% in 2025.

- The concrete admixtures market in China accounted for the largest market revenue share in the Asia Pacific in 2025.

- By type, the water-reducing segment led the market with the largest share of 47.8% in 2025.

- By type, the air-entraining agent segment is expected to grow at the fastest CAGR of 10.1% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 20.07 Billion

- 2033 Projected Market Size: USD 38.34 Billion

- CAGR (2026-2033): 8.6%

- Asia Pacific: Largest market in 2025

The growing need for high-performance and durable concrete in residential, commercial, and industrial projects has significantly boosted admixture consumption. Increasing investments in transportation infrastructure, such as roads, bridges, metros, and airports, further support market growth. Admixtures help improve workability, strength, setting time, and durability, making them essential for modern construction. The rise of high-rise buildings and complex architectural structures is also driving demand. In addition, the adoption of ready-mix concrete is expanding admixture usage. Climate variability and challenging construction conditions are pushing contractors to rely more on specialized admixtures.

Key drivers of the concrete admixtures industry include the need for enhanced construction efficiency, reduced project timelines, and improved concrete performance. Water-reducing and superplasticizer admixtures are widely used to achieve high strength with lower cement content. Rising awareness of lifecycle cost reduction and structural longevity is encouraging the adoption of chemical admixtures. Sustainability goals are driving builders toward admixtures that reduce carbon emissions by lowering cement usage. Growth in mega infrastructure projects and smart city developments is another major driver. Labor shortages in the construction industry are also accelerating the use of admixtures to enhance workability and improve placement. Technological advancements in admixture formulations continue to support demand.

Government initiatives focused on infrastructure modernization and urban development are strongly supporting the concrete admixtures industry. Large public investments in transportation, housing, water management, and energy projects are increasing concrete consumption. Green building codes and sustainability regulations are encouraging the use of admixtures that enhance durability and reduce environmental impact. Many governments are promoting affordable housing schemes, which rely heavily on cost-effective and high-performance concrete solutions. Infrastructure stimulus packages in emerging economies are accelerating project execution timelines, boosting admixture usage. Regulations on construction quality and safety standards further encourage the use of performance-enhancing admixtures. Public-private partnerships in infrastructure projects are also contributing to market expansion.

Innovation in the concrete admixtures industry is centered around high-performance, sustainable, and customized solutions. Manufacturers are developing advanced superplasticizers, shrinkage-reducing admixtures, and corrosion inhibitors. Bio-based and low-VOC admixtures are gaining traction due to environmental concerns. The integration of digital construction technologies is enabling precise admixture dosing and performance optimization. Admixtures designed for extreme weather conditions, such as hot and cold climates, are becoming increasingly important. The trend toward self-compacting and ultra-high-performance concrete is driving innovation. In addition, admixtures compatible with recycled aggregates are emerging as a key trend.

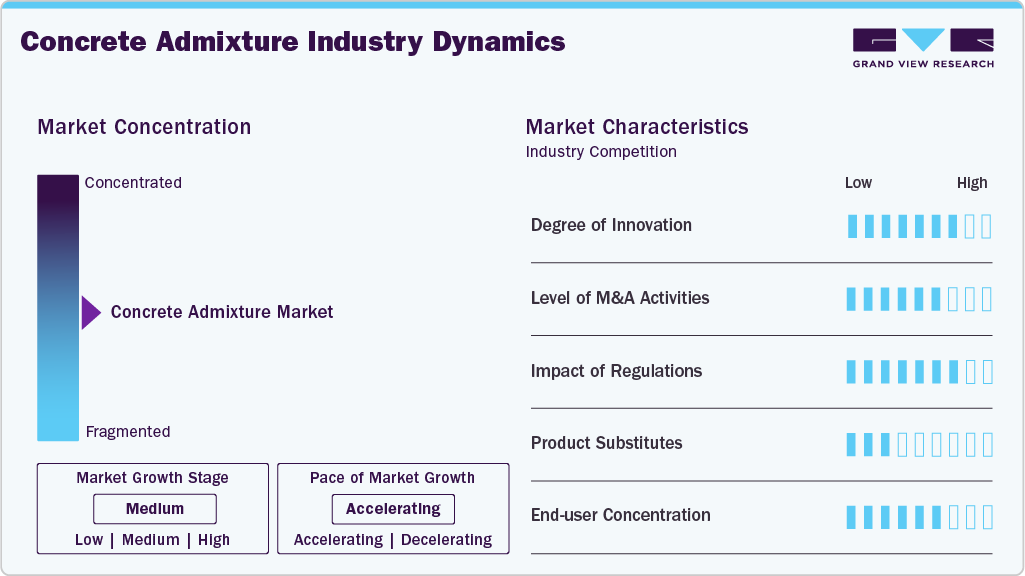

Market Concentration & Characteristics

The concrete admixtures industry is moderately consolidated, with several multinational players holding significant market share alongside strong regional manufacturers. Large companies benefit from extensive product portfolios, global distribution networks, and strong R&D capabilities. Strategic partnerships with construction companies and ready-mix concrete producers enhance market positioning. However, regional players remain competitive due to localized expertise and cost advantages. The presence of both global and local suppliers creates a balanced competitive landscape. Continuous innovation and branding play a critical role in market differentiation.

The threat of substitutes in the concrete admixtures industry is relatively low, as admixtures provide performance benefits that cannot be easily replicated by traditional construction methods. Alternatives such as higher cement usage increase costs and environmental impact, making them less attractive. Mechanical methods to improve concrete performance are limited and often inefficient. While alternative binders and construction techniques exist, they do not fully replace the functional advantages of chemical admixtures. The growing complexity of construction projects further limits the risk of substitution. Sustainability regulations also favor admixture usage over substitutes.

Type Insights

The water-reducing agents segment led the market with the largest revenue share of 47.8% in 2025. This growth is attributed to their ability to decrease water content in concrete mixes without compromising workability or strength. This enhances durability and performance, making them essential for sustainable construction practices. In addition, the increasing demand for eco-friendly building materials and rising construction activities in emerging markets further fuel their adoption. Furthermore, technological advancements also contribute to developing more effective water-reducing agents, solidifying their position in the market.

The air-entraining agents segment is expected to grow at the fastest CAGR of 10.1% over the forecast period, primarily driven by their role in improving concrete's workability and resistance to freeze-thaw cycles. By introducing tiny air bubbles into the mix, these agents enhance the durability and longevity of concrete structures. In addition, the growing focus on infrastructure development and the need for high-performance concrete solutions are key factors driving their demand. Furthermore, as environmental concerns rise, the use of air-entraining agents aligns with sustainable construction practices by reducing the overall carbon footprint of concrete production.

Regional Insights

The concrete admixtures market in North America is expected to grow at a significant CAGR of 8.0% over the forecast period, owing to a robust housing sector and increased construction activities. Rising household formations and a strong demand for residential properties are key factors contributing to this growth. Furthermore, government initiatives aimed at supporting infrastructure improvement projects are enhancing the need for advanced concrete solutions. The trend toward sustainable construction practices also drives the adoption of innovative concrete admixtures that enhance performance while reducing their environmental footprint.

U.S. Concrete Admixtures Market Trends

The concrete admixtures market in the U.S. held a significant share in North America in 2025, driven by rising construction costs and an emphasis on high-quality building materials. The demand for durable and efficient concrete solutions is growing as infrastructure projects expand nationwide. Furthermore, consumer preferences for larger homes and sustainable building practices are prompting builders to utilize advanced concrete admixtures, which improve strength and longevity while minimizing environmental impacts.

Asia Pacific Concrete Admixtures Market Trends

Asia Pacific dominated the global concrete admixtures market with the largest revenue share of 56.1% in 2025, driven by massive infrastructure development and rapid urban growth. Countries such as China, India, and Southeast Asian nations are witnessing strong demand from residential and public infrastructure projects. Increasing investments in transportation networks and smart cities support market expansion. The region benefits from large-scale concrete consumption and cost-sensitive construction practices. The rising adoption of ready-mix concrete further drives demand for admixtures. A local manufacturing presence reduces costs and improves supply chain efficiency. Favorable government policies continue to strengthen regional dominance.

The concrete admixtures market in China accounted for the largest market revenue share in Asia Pacific in 2025, primarily driven by extensive infrastructure development initiatives and urbanization. In addition, the government’s focus on sustainable construction practices and green building technologies is driving the demand for high-performance concrete solutions. Furthermore, significant investments in housing projects and public infrastructure are boosting the consumption of concrete admixtures, as they improve workability and reduce environmental impact, aligning with national goals for eco-friendly construction.

Europe Concrete Admixtures Market Trends

The concrete admixtures market in Europeis expected to witness a significant growth over the forecast period, owing to stringent construction quality and sustainability regulations. Countries within Europe are increasingly focusing on eco-friendly building practices, which promote the use of high-performance concrete with reduced carbon footprints. In addition, the presence of established manufacturers and a strong emphasis on infrastructure development further support market expansion. Furthermore, rising urbanization rates necessitate innovative solutions to meet construction demands efficiently.

The Germany concrete admixtures market is expected to be driven by a strong construction sector characterized by high standards for quality and sustainability. The country's commitment to green building practices encourages the use of advanced concrete admixtures that enhance durability and reduce environmental impact. Moreover, ongoing investments in infrastructure projects, including transportation and residential developments, create a favorable environment for adopting innovative concrete solutions that meet evolving engineering specifications.

Key Concrete Admixtures Company Insights

Key companies in the global concrete admixtures industry include GCP Applied Technologies, Inc., RPM International, Inc., Fosroc, Inc., and others. These companies adopt various strategies to enhance their competitive edge. These include investing in research and development to innovate and improve product offerings, expanding their geographic presence through strategic partnerships and acquisitions, and focusing on sustainable practices to meet environmental regulations.

Furthermore, companies emphasize customer engagement and tailored solutions to address specific market needs, while also enhancing their distribution networks to ensure efficient product availability and support for construction projects worldwide.

-

RPM International, Inc. manufactures concrete admixtures that enhance concrete mixes' durability, workability, and strength. The company's product portfolio includes various construction materials such as grouts, mortars, and protective coatings, catering to industrial and commercial applications.

-

Fosroc, Inc. specializes in manufacturing concrete admixtures designed to improve the performance and durability of concrete in various applications. The company’s product offerings include water-reducing agents, superplasticizers, and air-entraining agents. Operating primarily in the construction segment, Fosroc serves diverse markets including infrastructure, commercial, and residential projects to meet evolving industry demands.

Key Concrete Admixtures Companies:

The following are the leading companies in the concrete admixtures market. These companies collectively hold the largest market share and dictate industry trends.

- Sika AG

- BASF SE

- GCP Applied Technologies, Inc.

- RPM International, Inc.

- Fosroc, Inc.

- Mapei SpA

- CHYRSO SAS

- Rhein-Chemotechnik GmbH

Recent Developments

-

In May 2024, Fosroc India inaugurated a state-of-the-art construction chemicals plant in Hyderabad, enhancing its capacity to produce concrete admixtures and other products. This facility, covering over 260,000 square feet, aims to improve service levels and expand geographical reach across South and Central India. The inauguration featured notable dignitaries and reflects Fosroc's commitment to sustainability and innovation in the construction sector.

-

In November 2023, Sika expanded its production capacity for concrete admixtures at its Sealy, Texas facility. This investment, the second in five years, aimed to meet the growing demand for Sika ViscoCrete, a high-performance concrete admixture. The expansion is driven by U.S. government initiatives that promote infrastructure development and sustainability.

Concrete Admixtures Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 21.47 billion

Revenue forecast in 2033

USD 38.34 billion

Growth rate

CAGR of 8.6% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2023

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Asia Pacific; Europe; Rest of the World

Country scope

U.S.; Canada; Mexico; China; India; Japan; Germany; UK; France; Brazil

Key companies profiled

Sika AG; BASF SE; GCP Applied Technologies, Inc.; RPM International, Inc.; Fosroc, Inc.; Mapei SpA; CHYRSO SAS; Rhein-Chemotechnik GmbH.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Concrete Admixtures Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global concrete admixtures market report based on type, and region.

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Water reducing agents

-

Waterproofing Agents

-

Accelerating Agents

-

Air-Entraining Agents

-

Retarding Agents

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Rest of the World

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the concrete admixtures market include Sika AG, BASF SE, GCP Applied Technologies Inc., RPM International, Inc., Fosroc Inc., Mapei SpA, CHYRSO SAS, and Rhein-Chemotechnik GmbH.

b. The concrete admixtures market is expected to grow at a significant rate over the estimated time frame owing to their properties such as high strength, water reduction, retardation, durability, and others to concrete, thereby making it ideal for use in infrastructure components.

b. The global concrete admixtures market size was estimated at USD 20.07 billion in 2025 and is expected to reach USD 21.47 billion in 2026.

b. The global concrete admixtures market is projected to grow at a compound annual growth rate (CAGR) of 8.6% from 2026 to 2033, reaching a value of USD 38.34 billion by 2033.

b. Water-reducing agents dominated the market and accounted for the largest revenue share of 47.8% in 2025. This growth is attributed to their ability to decrease water content in concrete mixes without compromising workability or strength.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.