- Home

- »

- Medical Imaging

- »

-

Cone Beam Computed Tomography Market Size Report 2030GVR Report cover

![Cone Beam Computed Tomography Market Size, Share & Trends Report]()

Cone Beam Computed Tomography Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Dental Implantology, Orthodontics), By Patient Position (Seated, Standing Position), By End-use, And Segment Forecasts

- Report ID: GVR-4-68039-624-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cone Beam Computed Tomography Market Summary

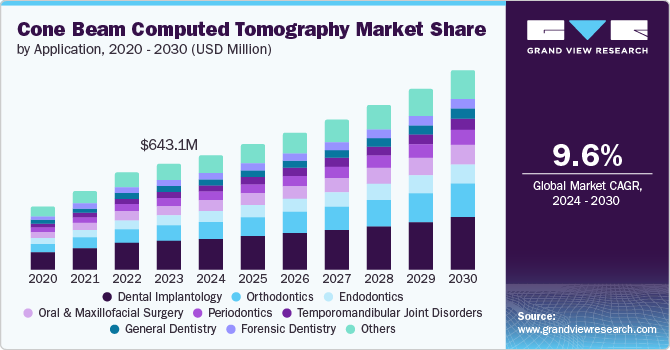

The global cone beam computed tomography market size was estimated at USD 643.1 million in 2023 and is projected to reach USD 1,217.1 million by 2030, growing at a CAGR of 9.6% from 2024 to 2030. Factors contributing to the projected growth include technological advancements to reduce radiation exposure, enhanced image quality, compact equipment size, and low costs associated with it compared to computed tomography (CT) scans.

Key Market Trends & Insights

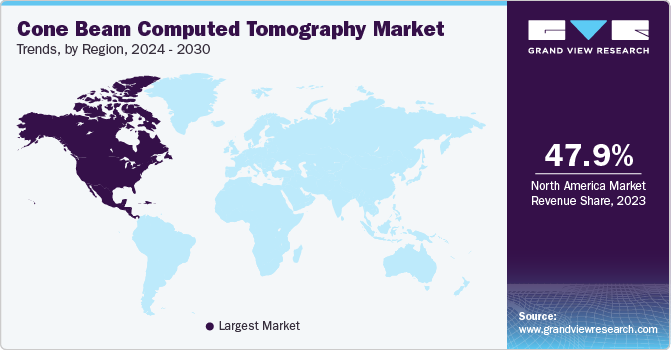

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, China is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, dental implantology accounted for a revenue of USD 172.5 million in 2023.

- Orthodontics is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 643.1 Million

- 2030 Projected Market Size: USD 1,217.1 Million

- CAGR (2024-2030): 9.6%

- North America: Largest market in 2023

COVID-19 had a noteworthy impact on the digital imaging market. Though the availability of multiple healthcare domains, including dental care, was limited to emergency cases, a sudden rise in the use of digital imaging for cardiac health developed significant demand for the industry during a pandemic. For instance, Chest CT was one of the essential parts of diagnosing COVID-19 infections. CBCT is extensively used in orthodontics, implantology, endodontics, oral medicine, oral surgeries, and more. Professionals prefer this technology due to its benefits that two-dimensional (2D) imaging methods cannot offer.

The increasing inclusion of cone beam computed tomography (CBCT) in application areas, such as forensic dentistry, endodontics, oral & maxillofacial surgery, and orthodontics, has fueled the market growth for CBCT technology. CBCT is commonly adopted in orthodontic treatment planning, morphometric analysis, palatal bone examinations, assessment of upper airway, implant site assessments, assistance in root canal system demonstration, surgical planning, and other important functions in the delivery of dental care.

Application Insights

The dental implantology segment dominated the market and accounted for a share of 26.8% in 2023. In dentistry, CBCT has been established as the preferred method for cross-sectional imaging, with definite results for implant therapy. Implant-supported dental restorations offer functional and natural-looking tooth replacement options to patients. CBCT is utilized to assess the implant site, avoid injuries & complications, understand the bone density, gather alveolus profile, and perform post-surgical assessment of the receiver site. These factors are projected to increase market demand during the forecast period.

The orthodontics segment is expected to register the fastest CAGR during the forecast period. CBCT offers images in multiple dimensions that are accurate for diagnosing and planning treatment. This technology has proved itself extremely helpful for orthodontic procedures. Rapid commercialization and advancements in CBCT technology have driven accessibility and affordability while raising awareness of its various clinical benefits. It is expected to propel the segment growth in the coming years.

Patient Position Insights

The seated position segment accounted for the largest revenue share in 2023. A CBCT scan offers more thorough imaging of teeth and other parts than a 2D dental X-ray image. The 3D pictures capture images of soft tissue and bone structures with exceptional detail, enabling accurate treatment planning for necessary procedures. The seated position CBCT scan procedure has been extensively used as it delivers greater accuracy.

The supine position segment is expected to experience a significant CAGR during the forecast period. It is commonly used as a preferred position while generating images related to the maxillofacial region. Accessories, such as head clamps, straps, or foam pads, assist in supine patient positions. Professionals increasingly recommend this patient position while performing procedures, such as implant planning and orthodontic surgeries.

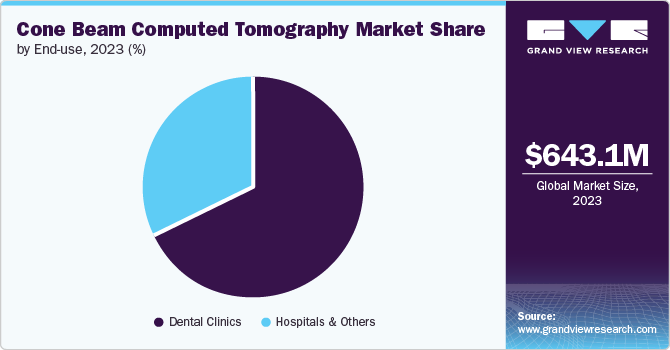

End-use Insights

The dental clinics segment dominated the market in 2023. Due to the easy accessibility and availability of dental care in private practices, many patients prefer dental clinics. The increasing availability of advanced equipment, cost-effectiveness, unceasing patient flow, and provision of personalized treatment experiences are some factors expected to drive segment growth during the forecast period.

The hospital & others segment is expected to register a noteworthy CAGR from 2024 to 2030. Many facilities have been enlisting dental care as one of their departments to deliver multiple solutions under one roof. Enhanced infrastructural support provided by such facilities, positive reimbursement scenarios, and easier access are projected to generate growing demand for this segment in the coming years.

Regional Insights

The North America cone beam computed tomography market accounted for a revenue share of 47.9% in 2023. Factors, such as increasing awareness regarding the significance of oral health & dental care, growing availability of independent clinics, and R&D activities in digital imaging, are fueling the regional market's growth.

U.S. Cone Beam Computed Tomography Market Trends

The cone beam computed tomography market in the U.S. is expected to experience a significant CAGR during the forecast period. This market is primarily driven by the extensive utilization of CBCT technology in dental care and other applications, increasing inclusion of a dental care department in larger healthcare establishments, and advancements in technology & innovation. According to the American Dental Association, dental care expenditures in the U.S. amounted to USD 165 billion in 2022.

Europe Cone Beam Computed Tomography Market Trends

The Europe cone beam computed tomography market is identified as one of the key regions in the industry. This is mainly due to the region's growing number of dental care treatments. According to The Platform for Better Oral Health in Europe, a joint initiative by multiple organizations working in the European dental health domain, over 50% of Europe's population is projected to experience periodontitis. Approximately 10% is expected to encounter severe disease, as the prevalence is increasing to 70 to 85% of the population over 60- 65.

The cone beam computed tomography market in the UK is projected to experience lucrative growth from 2024 to 2030. Dental care professionals in the country have been adopting CBCT technology to evaluate risks in lower third molar surgery and outcomes in maxillofacial trauma.

Asia Pacific Cone Beam Computed Tomography Market Trends

The Asia Pacific cone beam tomography market is expected to grow significantly in the coming years. The increasing number of clinics, enhanced R&D in healthcare technology, and increasing awareness about the significance of dental care are driving market growth. Technological advancements are leading to the development of healthcare infrastructure in the region. In addition, growing medical tourism is expected to positively impact the market growth.

The cone beam computed tomography market in China held a substantial revenue share in 2023. A rise in awareness regarding dental care, technology-based treatment delivery, and the increasing volume of dental care procedures in the country drive market growth.

Key Cone Beam Computed Tomography Company Insights

Some key companies in the cone beam computed tomography market are CurveBeam AI Ltd.; Dentsply Sirona; J. MORITA MFG. CORP.; Carestream Health (ONEX Corporation); and VATECH. Owing to growing competition, key companies enhance their R&D activities to deliver novel products and services. Adopting tools such as AI, strategic collaborations, and technological advancements helps companies develop a competitive advantage over others.

-

Carestream Health Inc., owned by ONEX Corp. in 2007, specializes in healthcare IT solutions, such as X-ray film and digital X-ray systems for non-invasive procedures. It also provides modified materials for electronics and precision film markets

-

J. Morita Mfg. Corp. is a specialized manufacturer of medical technology products globally, including endodontics, X-ray diagnostics, and the entire range of dental products. The company focuses on product quality, precision, and maintaining customer relationships through innovations

Key Cone Beam Computed Tomography Companies:

The following are the leading companies in the cone beam computed tomography market. These companies collectively hold the largest market share and dictate industry trends.

- Dentsply Sirona.

- J. MORITA MFG. CORP.

- VATECH

- CurveBeam AI, Ltd.

- Carestream Health Inc. (ONEX Corporation)

- Danaher Corporation

Recent Developments

-

In February 2024, Carestream Dental, a digital dental care technology company, launched an advanced 4-in-1 CBCT system. The newly delivered system is enabled with CS 8200 3D Access, which provides enhanced quality images and full-arch scanning for professionals

Cone Beam Computed Tomography Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 700.5 million

Revenue forecast in 2030

USD 1,217.1 million

Growth rate

CAGR of 9.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, patient position, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Arabia; Kuwait; UAE; South Africa

Key companies profiled

Dentsply Sirona.; J. MORITA MFG. CORP.; VATECH; CurveBeam AI, Ltd.; Carestream Health Inc. (ONEX Corp.); Danaher Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cone Beam Computed Tomography Market Report Segmentation

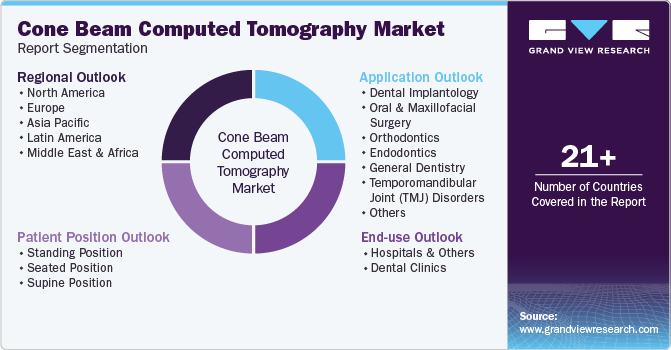

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2028. For this study, Grand View Research has segmented the global cone beam computed tomography market report based on application, patient position, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Implantology

-

Oral and Maxillofacial Surgery

-

Orthodontics

-

Endodontics

-

General Dentistry

-

Temporomandibular Joint (TMJ) Disorders

-

Periodontics

-

Forensic Dentistry

-

Others

-

-

Patient Position Outlook (Revenue, USD Million, 2018 - 2030)

-

Standing Position

-

Seated Position

-

Supine Position

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Others

-

Dental Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.