- Home

- »

- Pharmaceuticals

- »

-

Congestive Heart Failure Drugs Market Size Report, 2030GVR Report cover

![Congestive Heart Failure Drugs Market Size, Share & Trends Report]()

Congestive Heart Failure Drugs Market Size, Share & Trends Analysis Report By Drug Class (ACE Inhibitors, Angiotensin 2 Receptor Blockers), By Distribution Channel, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-987-5

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Healthcare

Report Overview

The global congestive heart failure drugs market size was valued at USD 6.15 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 14.60% from 2022 to 2030. The market is witnessing growth due to a robust product pipeline, a rising geriatric population, and increasing R&D for drug development. Another major factor facilitating growth is the rising burden of diseases such as obesity, diabetes, hypertension, chronic pulmonary diseases, and renal disease as these are considered CHF-associated prominent co-morbidities. Over the forecast period, the high saturation of generic drugs is expected to slow down the growth. Congestive heart failure (CHF) is a global concern that remains a highly prevalent disorder with a high morbidity and mortality rate. According to the Global Health Data Exchange registry, the global prevalence of disease was around 64.34 million cases, and in the U.S., the prevalence was approximately 5.5 million in 2022.

Currently, pharmacological options for the disease are stepping towards a better treatment approach through product approvals and new product launches. For instance, in February 2022, the FDA approved Boehringer Ingelheim's Jardiance (empagliflozin) to reduce the risk of cardiovascular death and hospitalization in adults. Such new approvals and launches are propelling growth.

Furthermore, the upsurge in R&D activities and the presence of several drugs under the clinical pipeline create remunerative opportunities and fierce competition among companies. For instance, in February 2022, the FDA accepted NDA for Cytokinetics' drug Omecamtiv Mecarbil, a selective cardiac myosin activator, effective in improving contractility associated with heart failure. CHF clinical trial drugs also include Furoscix infusor, CardiAMP cell therapy, Revascor (Rexlemestrocel-L), semaglutide, tirzepatide, cimlanod, and others. Approval and subsequent launch of such drugs over the coming years are expected to boost the growth.

Moreover, the increasing burden of diseases such as diabetes and obesity contributes to the rising CHF prevalence over the forecast period. For instance, CDC research studies show a strong association between CHF with diabetes and the increasing hospitalization rate in the U.S. According to the NCBI article, around 35% of CHF patients have diabetes mellitus.

Amid the pandemic, the clinical trial space witnessed a setback. In addition, the market observed a disturbance in the demand and supply of drugs, and patients faced difficulty accessing healthcare. Government and regulatory authorities imposed restrictions that have delayed clinical trial procedures. However, post the first quarter of 2021, the market regained stability and continued at its regular pace.

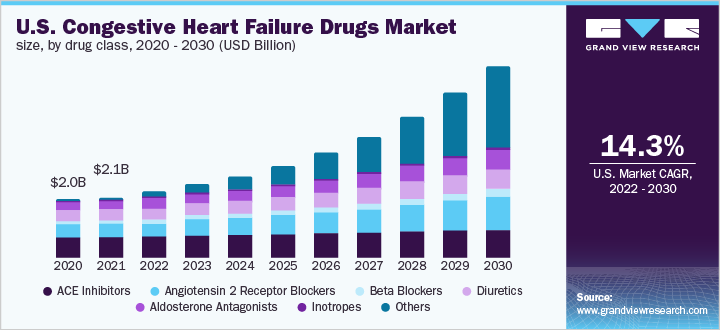

Drug Class Insights

The angiotensin-converting enzyme (ACE) inhibitors segment dominated the market in 2021 with a revenue share of over 30.0%. This can be due to its effectiveness as an individual treatment or approved combination therapeutic options in the market. Moreover, it is the first choice of treatment for CHF patients. It includes drugs such as Vasotec, Epaned (enalapril), Zestril, Qbrelis, Prinivil (lisinopril), and captopril. Inhibitors block the production of Angiotensin-2, and release arterial pressure, resulting in increased cardiac output without affecting heart rate. This is the most targeted mechanism of action to control heart failure.

Furthermore, approval of an extended label for sodium-glucose co-transporter 2 (SGLT2) inhibitors for CHF is anticipated to propel the segment growth. For instance, in May 2020, Farxiga (dapagliflozin) and in February 2022, Jardiance (empagliflozin) received label expansion for the treatment of CHF. These SGLT2 inhibitor drugs clinically demonstrated significant cardioprotective benefits and a 35% reduction in hospitalization. The drug class has also demonstrated clinical significance in controlling CHF in patients without diabetes.

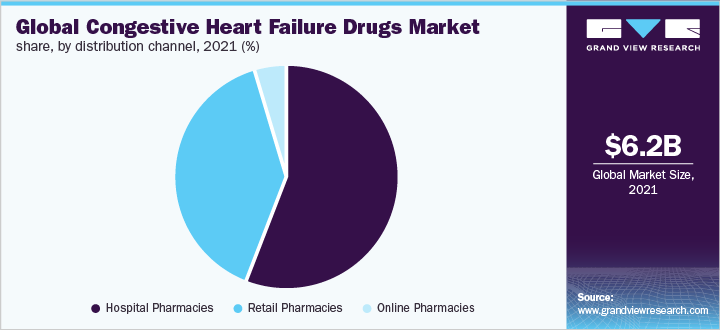

Distribution Channel Insights

The hospital pharmacies held the largest share of over 55.0% in 2021. The retail pharmacies segment is anticipated to witness the highest growth over the forecast period. Retail pharmacies are at ease with most medications, especially in the homecare setting as CHF disease management takes long support of medications. Additionally, CHF drugs are prescription medicines. All these factors favor the growth of the segment.

The online pharmacies segment is expected to expand at a CAGR of 13.6% during the forecast period. Online pharmacy platform encourages the comfort of buying. In addition, in developing countries such as India, companies such as Netmeds Marketplace Ltd. and Tata 1mg promote online medicines buying. However, online buying of prescription drugs is unfavorable to many individuals, which is expected to slow down online pharmacy growth.

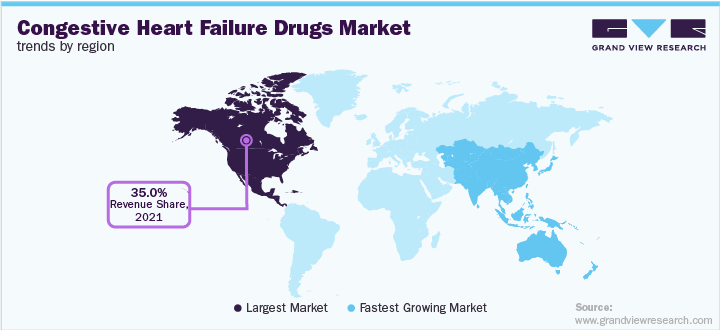

Regional Insights

North America held the largest share of over 35.0% in 2021. This can be attributed to the high disease burden, rise in patient awareness, increased healthcare expenditure, and presence of major players in the region. Furthermore, rising approval of new products is expected to fuel the industry growth over the forecast period.

In the European region, Italy was the least affected, and Germany had the highest CHF prevalence in 2021. The Asia Pacific region is expected to register the highest CAGR of 15.7% over the forecast period. This growth is due to the substantial presence of global companies in this region and the high CHF prevalence in countries such as China, Japan, and Australia. For instance, in 2020, in Australia, the estimated prevalence rate of CHF ranged between 1.2% and 5.3%, majorly due to the rising incidences of diabetes and obesity in the country.

Key Companies & Market Share Insights

The industry will witness intense competition in the forecast period owing to the presence of companies such as AstraZeneca and Boehringer Ingelheim International GmbH. Key players are trying to acquire a greater share through collaborations, partnerships, regional expansions, and other strategic initiatives. For instance, after successful regulatory approval of Forxiga (dapagliflozin) in the U.S., Europe, and Japan, in February 2021, AstraZeneca announced the approval of Forxiga in China, indicated for heart failure with or without type-2 diabetes in adults. Some prominent players in the global congestive heart failure drugs market include:

-

Bayer AG

-

Novartis AG

-

Merck & Co., Inc.

-

AstraZeneca

-

Bristol-Myers Squibb Company

-

Amgen Inc.

-

Boehringer Ingelheim International GmbH

-

Pfizer, Inc.

-

Johnson & Johnson Services, Inc.

-

Otsuka Pharmaceutical Co., Ltd.

-

Eli Lilly and Company

-

Novo Nordisk A/S

Recent Developments

-

In February 2023, AstraZeneca acquired CinCor Pharma, Inc., a US-based clinical-stage biopharmaceutical company. The acquisition bolsters AstraZeneca’s cardiorenal pipeline by adding baxdrostat (CIN-107)for blood pressure lowering in treatment-resistant hypertension to its cardiorenal portfolio.

-

In November 2022, Johnson & Johnson signed an agreement to acquire Abiomed. The agreement improved Johnson & Johnson MedTech's (JJMT) position as a growing innovator in cardiovascular innovation, increasing the standard of care for one of healthcare's most pressing unmet disease states: heart failure and recovery.

-

In September 2022, Bayer launched vericiguat, a soluble guanylate cyclase (sGC) stimulator in India. Adults dealing with symptomatic chronic heart failure and decreased ejection fraction (less than 45%) are eligible for Vericiguat in addition to guideline-based medical treatment.

-

In March 2022, Pfizer Inc. acquired Arena Pharmaceuticals, a company that deals in the treatment of several immuno-inflammatory diseases. Arena Pharmaceuticals offers Pfizer a variety of exciting, development-stage pharmaceutical candidates in the fields of cardiology, dermatology, and gastrointestinal.

-

In February 2021, Novartis announced that the US Food and Drug Administration (FDA) has approved the expanded use of Entresto to lower the risk of cardiovascular death and heart failure hospitalization in adult patients with chronic heart failure.

Congestive Heart Failure Drugs Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 6.80 billion

Revenue forecast in 2030

USD 20.23 billion

Growth rate

CAGR of 14.60% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Bayer AG; Novartis AG; Merck & Co., Inc.; AstraZeneca; Bristol-Myers Squibb Company; Amgen Inc.; Boehringer Ingelheim International GmbH; Pfizer, Inc.; Johnson & Johnson Services, Inc.; Otsuka Pharmaceutical Co., Ltd.; Eli Lilly and Company; Novo Nordisk A/S

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Congestive Heart Failure Drugs Market Segmentation

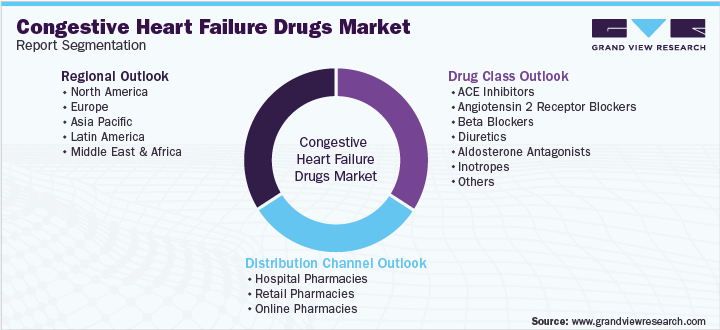

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global congestive heart failure drugs market report on the basis of drug class, distribution channel, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

ACE Inhibitors

-

Angiotensin 2 Receptor Blockers

-

Beta Blockers

-

Diuretics

-

Aldosterone Antagonists

-

Inotropes

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global congestive heart failure drugs market size was estimated at USD 6.15 billion in 2021 and is expected to reach USD 6.80 billion in 2022.

b. The global congestive heart failure drugs market is expected to witness a compound annual growth rate of 14.6% from 2022 to 2030 to reach USD 20.23 billion in 2030.

b. Based on drug class, the angiotensin-converting enzyme (ACE) inhibitor segment dominated the market with a share of 32.88% due to its high prescription rate as it is the first line of treatment.

b. Some key players operating in the congestive heart failure drugs market include Bayer AG, Novartis AG, Merck & Co., Inc., AstraZeneca, Bristol-Myers Squibb Company, Amgen Inc., Boehringer Ingelheim International GmbH, Pfizer, Inc., Johnson & Johnson Services, Inc., Otsuka Pharmaceutical Co., Ltd., Eli Lilly and Company, and Novo Nordisk A/S.

b. Key factors driving the congestive heart failure drugs market growth include increasing investment in R&D, approval of new drugs such as Jardiance, and rising geriatric population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."