- Home

- »

- Next Generation Technologies

- »

-

Connected Enterprise Market Size & Share Report, 2030GVR Report cover

![Connected Enterprise Market Size, Share & Trends Report]()

Connected Enterprise Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services, Platform), By Application (Manufacturing, BFSI, IT & Telecom), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-430-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Connected Enterprise Market Size & Trends

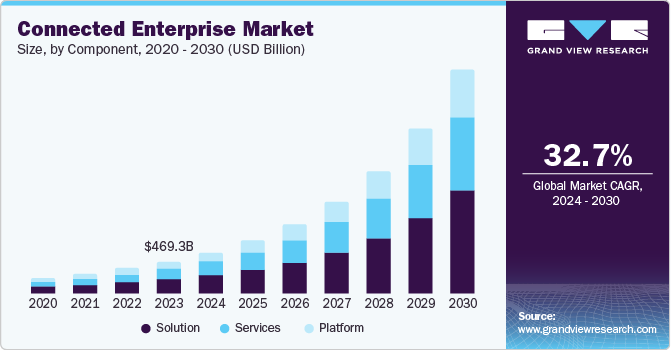

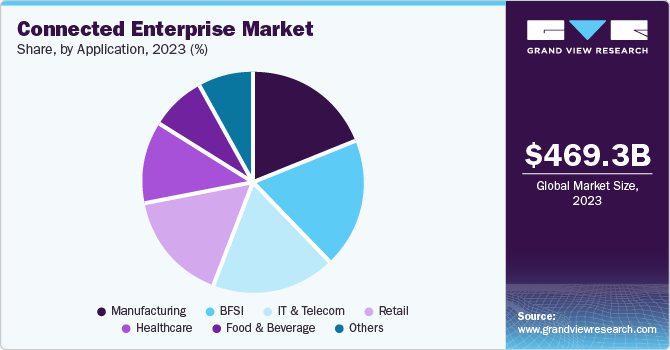

The global connected enterprise market size was valued at USD 469.32 billion in 2023 and is projected to grow at a CAGR of 32.7% from 2024 to 2030. The major factors driving the market growth are the increasing adoption of automation solutions to streamline operations, rising regulatory and compliance security, and growing cloud-computing services. The significant growth in the Internet of Things (IoT) technology and advancements in innovation backed by artificial intelligence (AI) have enabled businesses to connect and optimize various operations.

Furthermore, the need for enhanced customer experiences is another factor driving the adoption of connected enterprise solutions. Increasingly globalized operations and supply chain management further lead to demand for effective connected enterprise solutions, enhancing communication and improving collaboration across borders.

The connected enterprise market has been experiencing continuous growth primarily driven by the increasing application of advanced technology integration, such as the Internet of Things (IoT) and Artificial Intelligence (AI). These technologies are revolutionizing how businesses operate by enabling the seamless connection of various systems, devices, and processes. Furthermore, the widespread adoption of cloud computing has provided the necessary infrastructure to support connected enterprises' data analytics and connectivity needs. Cloud computing allows businesses to deploy and scale connected solutions quickly and cost-effectively, allowing enterprises to expand their connected systems and handle increasing volumes of data.

The rise in digital transformation initiatives worldwide is another factor driving the expansion of the connected enterprise market. Companies are implementing technology to improve flexibility and creativity, utilizing data for decision-making and operational enhancement. Analyzing data from connected devices offers valuable insights for process optimization, decision-making, and predictive maintenance. Moreover, the growing demand for IoT, cloud computing, and analytics across the manufacturing, healthcare, and finance industries drives growth. Furthermore, government initiatives like the Industrial Internet of Things (IIoT) and smart city projects, as well as funding for digital transformation, are boosting the market growth.

Component Insights

Based on components, the solutions segment dominated the global industry and accounted for a revenue share of 44.2% in 2023. The increasing demand for comprehensive and integrated solutions that seamlessly connect and manage various aspects of organizational operations drives segment growth. Advancements in technology such as IoT, cloud computing, and mobile device solutions enable businesses to collect and analyze huge amounts of data, providing a unified platform to manage their operations and workforce. In addition, connected solutions offer operational benefits tailored to meet the specific needs of various industries, making them more attractive to organizations seeking to address their unique challenges and requirements.

The service segment is expected to experience a significant CAGR over the forecast period. The segment is gaining considerable traction across the connected enterprise market owing to the increasing need for expertise and support in managing connected enterprise solutions. The increasing adoption of connected technologies in various sectors, such as IoT and cloud platforms, has increased demand for connected enterprise services, including maintenance and managed service. Furthermore, the complexity of connected enterprise solutions and ongoing optimization and innovation fuel the demand for service providers offering specialized expertise and flexible support models. These aspects are expected to generate greater growth for this segment in the approaching years.

Application Insights

The manufacturing segment dominated the connected enterprise market in 2023. Manufacturing units worldwide have adopted Industry 4.0 practices, where manufacturers leverage IoT, automation, and data analytics to improve functional efficiency, lower downtime, and enhance product quality. Moreover, connected solutions enable real-time monitoring & control of various manufacturing processes, ensuring uninterrupted production and facilitating estimated maintenance by reducing time. At present, manufacturers increasingly prefer digitization and connectivity, and hence, connected enterprise solutions within the manufacturing sector are highly implemented. In addition, the requirement of real-time production monitoring, execution, and control for optimizing production procedures, tracking inventory, and ensuring quality control further boosts the use of connected enterprises in this segment.

The IT & telecom segment is projected to grow at the fastest CAGR during the forecast period. The key market driving factors are enterprises towards next-generation communication technologies and increasing investments in 5G infrastructure-the upsurge in demand for high-speed data connectivity. The growing adoption of cloud-based telecom services enhances communication and collaboration capabilities. Telecom and IT service providers offer custom-designed routers to businesses that enhance operational efficiency and improve customer experiences, optimizing supply chains, improving asset management, and streamlining processes.

Regional Insights

North America connected enterprise market dominated the global industry and accounted for the largest revenue share of 34.3% in 2023. Growth of this market is mainly driven by the presence of a large number of technology companies operating in area, a strong focus on innovation, and a high early adoption rate of digital technologies. Economies such as the U.S. and Canada possess a hub for major technological advancements, with leading companies investing heavily in connected enterprise solutions. Furthermore, the region's well-developed infrastructure, skilled workforce, and favorable business environment are also driving the adoption of connected enterprise solutions.

U.S. Connected Enterprise Market Trends

The connected enterprise market in the U.S. dominated the global industry in 2023. The growth of this market is driven by various factors such as technological advancements and highly developed infrastructure. The presence of tech giants including, Google, Microsoft, and Amazon, as well as a thriving startup ecosystem, fosters innovation and investment in connected enterprise solutions. Furthermore, the presence of highly skilled employees and a favorable business environment fuels the innovation and growth of this market. For instance, the “Smart City” project in New York aims to leverage connected technologies to improve public safety, transportation, and energy management.

Europe Connected Enterprise Market Trends

Europe connected enterprise market was identified as a lucrative region for this industry in 2023. The strong focus of multiple businesses on digital transformation, advanced manufacturing, and stringent regulations are the primary factors driving growth for this market. The implementation of cutting-edge technologies like IoT, AI, and cloud computing is strengthening the expansion of the connected enterprise market in the region. The rising 4.0 industry in the region has been a significant factor, encouraging manufacturers to adopt advanced technologies including IoT, AI, and cloud computing to enhance production efficiency, transform manufacturing, and supply chain operations. In addition, Europe’s commitment to upscale digital technology and sustainability such as the European Urban Initiative and Europe’s Internet of Things policy encourages businesses to adopt smart technologies to improve quality of life and assist the regional growth.

The connected enterprise market in UK is expected to grow rapidly in the next few years. This growth is attributed to aspects such as growing adoption of IoT based solution, increasing number of organizations embracing the digital transformation initiatives, enhancements in availability and accessibility of the cutting-edge technology and more. The UK government has also been encouraging diverse businesses to invest in connected technologies.

Asia Pacific Connected Enterprise Market Trends

Asia Pacific connected enterprise market is anticipated to witness the fastest CAGR during the forecast period. This growth is attributed to increasing industrialization in the region, urbanization, entry of multiple global enterprises, and a growing inclination towards adopting digital innovation. In addition, the rapid growth of smart cities across numerous countries demonstrates how connected technologies are embraced to enhance urban infrastructure, including various public infrastructural projects, from intelligent transport systems to remote management solutions. In addition, governments and competitors are collaborating with several companies to drive connected enterprise solutions. For instance, in September 2023, Huawei unveiled three product portfolios designed for multiple industry scenarios. The three product portfolios include high-quality smart wards, high-quality SME offices, and high quality simplified data centers.

The connected enterprise market in China is expected to grow rapidly in the approaching years. The growth of this market is primarily influenced by numerous aspects, such as the rising automation in industrial processes, the implementation of Industrial Internet of Things (IoT) solutions, and the merging of IT and operational technology (OT) in businesses. The rapid growth of smart cities in the region and supportive government initiatives accelerate region growth. For instance, the “Made in China 2025” initiative encourages manufacturers to adopt smart technologies, leading to the rise of smart factories to enhance production and reduce costs.

Key Connected Enterprise Company Insights

Some of the key companies in the connected enterprise market include Accelerite, Robert Bosch GmbH, Cisco Systems, Inc, Rockwell Automation, and UiPath, among others. Companies are expanding their business to achieve a competitive edge in the marketplace. To achieve this goal, major companies are implementing strategies such as mergers and acquisitions and establishing alliances with other leading companies. By making these efforts, they can solidify their market position and offer improved service to their clients.

-

IBM Corporation, a U.S.-based multinational company operating in IT consultancy, cloud computing, computer hardware, software, robotics, quantum computing, and artificial intelligence, offers connected enterprise solutions under IBM App Connect Enterprise, IBM Maximo, and IBM TRIRIGA, among other enterprise software solutions that aim to help organizations improve operational efficiency and optimize supply chain operations.

-

Robert Bosch GmbH, a global company from the engineering and technology industry, operates in various sectors such as technology, energy, and consumer goods. The company offers a wide range of products and services, including power tools, electronics, home appliances, cloud computing, automotive, IoT, and many more.

Key Connected Enterprise Companies:

The following are the leading companies in the connected enterprise market. These companies collectively hold the largest market share and dictate industry trends.

- Accelerite

- Robert Bosch GmbH

- Cisco Systems, Inc.

- GE Digital (GE Vernova)

- Honeywell International

- IBM

- LTIMindtree Limited

- PTC

- Rockwell Automation

- UiPath

Recent Developments

-

In July 2024, IBM and Telefónica Tech announced a new collaborative agreement to advance AI, analytics, and data management solutions for enterprises. The collaboration aims to help enterprises accelerate their digital transformation journeys, focusing on AI, Analytics, and Data management. The agreement includes the deployment of SHARK.X, a hybrid and multi-cloud software and hardware platform, and a joint office to develop customer pilots, among other major announcements.

-

In April 2024, LTIMindtree announced a collaboration with Vodafone to deliver connected smart IoT solutions. This partnership is expected to enable industry X.0 and digital transformation across multiple vertical sectors, offering connected and smart IoT solutions. The collaboration aims to solve complex business challenges and empowers clients to maximize their efforts in sustainability, revenue acceleration, and cost efficiency.

Connected Enterprise Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 602.44 billion

Revenue forecast in 2030

USD 3,282.65 billion

Growth rate

CAGR of 32.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, Application, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, and UAE

Key companies profiled

Accelerite; Robert Bosch GmbH; Cisco Systems, Inc.; GE Digital (GE Vernova); Honeywell International; IBM; LTIMindtree Limited; PTC; Rockwell Automation; UiPath

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

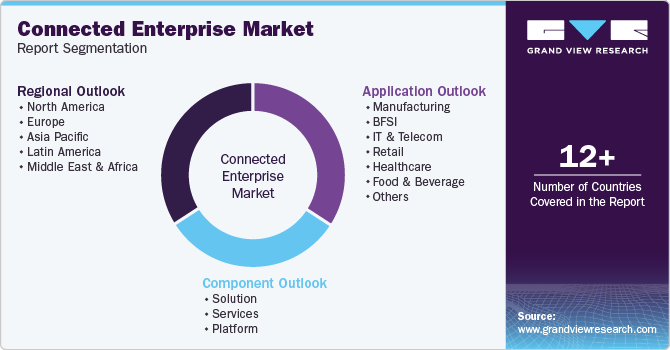

Global Connected Enterprise Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global connected enterprise market report based on component, application and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Device Management

-

Connectivity Management

-

Application Enablement

-

-

Services

-

Real-Time Collaboration

-

Enterprise Infrastructure Management

-

Streaming Analytics

-

Security Solution

-

Data Management

-

Remote Monitoring System

-

Network Management

-

Mobile Workforce Management

-

Customer Experience Management

-

Asset Performance Management

-

-

Platform

-

Professional Services

-

Consulting Services

-

Integration and Deployment Services

-

Support and Maintenance

-

Managed Services

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Manufacturing

-

BFSI

-

IT & Telecom

-

Retail

-

Healthcare

-

Food & Beverage

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.