- Home

- »

- Homecare & Decor

- »

-

Construction Toys Market Size, Share & Growth Report, 2030GVR Report cover

![Construction Toys Market Size, Share & Trends Report]()

Construction Toys Market Size, Share & Trends Analysis Report By Product (Bricks & Blocks, Tinker Toy), By Material (Wood, Polymer, Metal), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-356-0

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Construction Toys Market Size & Trends

The global construction toys market size was estimated at USD 14.74 billion in 2023 and is expected to grow at a CAGR of 11.9% from the forecast period of 2024 to 2030. This is attributed to an increase in disposable income among families enabling increased expenditure on non-essential items, the educational value of construction toys, the popularity of licensed products, and the growing availability of construction toys on e-commerce platforms.

Construction toys play a significant role in a child's overall development, including critical thinking, problem-solving skills, motor skills, creativity, and imagination. Construction toys such as building blocks present kids with numerous possibilities and challenges, encouraging them to analyze, strategize, and figure out creative solutions to problems. Moreover, construction toys help build language and social skills in children. According to a report published by The LEGO Group, a holistic approach to learning focused on cognitive, emotional, creative, physical, and social skills better supports and prepares kids to adapt to the constantly evolving world. Construction toys provide kids with an opportunity to engage in cooperative play.

Raw material suppliers in the market are focusing on decreasing the use of bisphenol A, phthalate, cadmium, and lead owing to growing awareness of the harmful effects of these chemicals and the stringent regulations governing the market. The raw materials used need to undergo various quality and health safety tests in accordance with government regulations. Plastic resins are popular raw materials for manufacturing construction toys owing to their easy-to-mold property. Companies such as LEGO use Acrylonitrile Butadiene Styrene (ABS) to manufacture bricks as the material is thermal and chemically stable, tough, and highly durable.

With the advancement of technology, many modern construction toys incorporate interactive and electronic features to enhance the play experience. These toys often include elements such as robotics, sensors, and programming capabilities, providing children with opportunities to engage in hands-on building activities while also exploring concepts related to technology and engineering.

The integration of interactive and electronic features represents a fusion of traditional play with digital innovation, catering to the evolving preferences of tech-savvy children and parents. For instance, Lego offers a construction toy set called LEGO Powered Up. LEGO Powered Up is a system of electronic components that allows LEGO builders to add motion and sound functions to their creations. It uses Bluetooth technology to connect a variety of sensors, motors, and controllers to a central hub, which can then be programmed to perform specific actions.

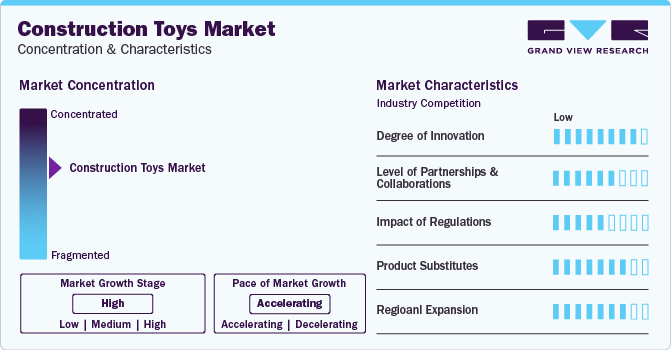

Market Concentration & Characteristics

The market growth stage is high, and the pace of the growth is accelerating. The construction toys market shows a high degree of innovation driven by a growing emphasis on STEM (Science, Technology, Engineering, and Mathematics) education and child development. STEM toys, such as building blocks and puzzles, have become increasingly popular among parents globally due to their ability to promote problem-solving skills, critical thinking, and creativity in children. These toys provide hands-on experiences that encourage experimentation and exploration, effectively engaging young minds.

Moreover, they serve as an introduction to key STEM concepts, including basic engineering principles, physics fundamentals like stability and balance, and mathematical reasoning.

The level of collaborations and partnerships in the market is moderately high. In January 2024, Spin Master, a global children's entertainment enterprise, finalized its acquisition of Melissa & Doug, a renowned U.S.-based brand celebrated for its early childhood play products. The acquisition, valued at USD 950 million, strengthens Spin Master's position in the market. Melissa & Doug, known for its commitment to igniting imagination and fostering a sense of wonder in children, holds a cherished reputation among parents and children alike. The brand is synonymous with high-quality, sustainable wooden toys and promotes screen-free play, aligning perfectly with the evolving preferences of modern families.

Product Insights

Bricks & blocks sales accounted for a share of 57.2% in 2023. The steady growth is attributed to the rising consumer preference for toys that keep children engaged for a long duration. Moreover, manufacturers have been innovating various toy sets to include new designs that replicate real-life scenarios and create awareness among kids.

A number of companies present in the market are offering bricks and blocks made from sustainable and eco-friendly materials like recycled plastic or bamboo husk. The LEGO Group offers a range of plant-shaped bricks made from sustainably sourced sugarcane. The botanical elements-including leaves, trees, and bushes-are part of the company’s efforts to refurbish its manufacturing processes to prioritize plant-based materials and recycled sources by 2030.

Tinker toy sales are projected to grow at a CAGR of 12.8% from 2024 to 2030. Tinker Toys caters to developmental milestones and safety considerations, focusing on children aged 3 and above. Tinker toys have been a popular educational toy for children for many years. They encourage creativity, problem-solving skills, and fine motor development as children experiment with different combinations and designs. Tinker toys are often used in educational settings to teach principles of engineering, architecture, and spatial reasoning. Moreover, they facilitate collaborative play, enhancing social, communication, and teamwork skills.

Material Insights

Polymer-based construction toys accounted for a revenue share of 36.5% in 2023. The lightweight nature of plastic construction toys enhances safety during group activities, as children can handle and manipulate the pieces without risk of injury from heavy or rigid materials. In addition, the flexibility of polymers ensures that the toys are resilient to bending and twisting, reducing the likelihood of breakage and extending their lifespan. This durability is particularly advantageous in environments where children may be prone to rough handling or accidents during play.

Wooden construction toys are projected to grow at a CAGR of 11.1% from 2024 to 2030. As wood complies with most of the safety guidelines for toys in different countries and is a safe material, wood is expected to emerge as one of the leading raw materials for manufacturing over the forecast period.

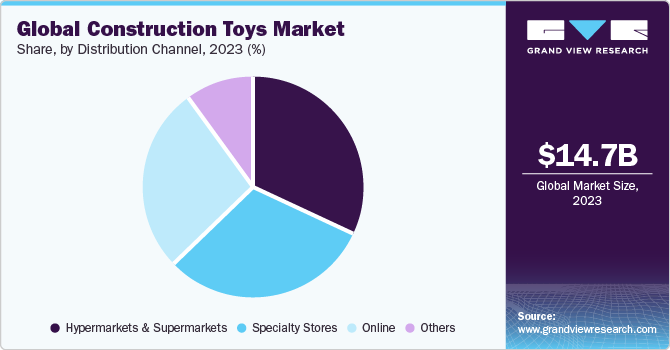

Distribution Channel Insights

Construction toy sales through hypermarkets & supermarkets held a revenue share of 32.1% in 2023. Hypermarkets and supermarkets often have large, well-organized toy sections that attract shoppers' attention. The easy accessibility of construction toys in these stores increases the likelihood of impulse purchases.Regular promotions, discounts, and sales events in hypermarkets and supermarkets drive higher sales of construction toys. Special offers, such as buy-one-get-one-free deals or seasonal discounts, attract customers and encourage purchases.

Construction toy sales through online channels are projected to grow at a CAGR of 12.6% from 2024 to 2030. The convenience of online shopping allows customers to browse a vast array of construction toys from the comfort of their homes, eliminating the need to visit physical stores. This convenience appeals to busy parents and gift shoppers seeking a hassle-free shopping experience.

According to the YouGov survey conducted in 2022, nearly two in five parents from the Asia-Pacific (APAC) region, comprising 45%, indicate that they are more likely to purchase toys and games online. This finding suggests a strong preference for online shopping among parents in the APAC region when it comes to buying toys and games for their children.

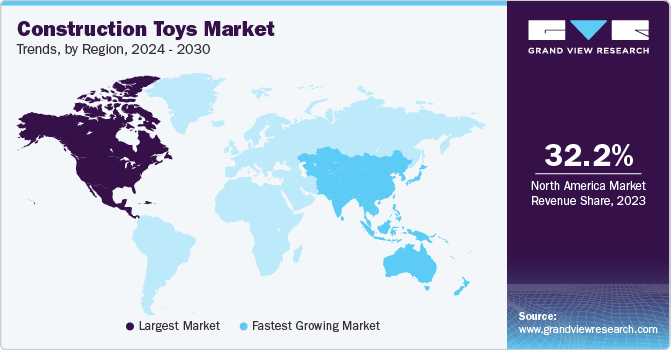

Regional Insights

The market in North America held 32.2% of the global revenue share in 2023. The market is driven by strategic product launches and a rise in the sale of licensed products. In Canada, Daron Worldwide Trading's introduction of a 66-piece Air Canada construction set specifically targets the Canadian population, showcasing the industry's responsiveness to regional preferences. Meanwhile, Mexico's robust market is driven by seasonal spikes in sales during Christmas, January, and Children's Day in April. With approximately 80 toy companies in Mexico, dominated by well-known brands like Mattel, Hasbro, LEGO, Mega Bloks, and Spin Master, the market demonstrates strong demand for construction toys.

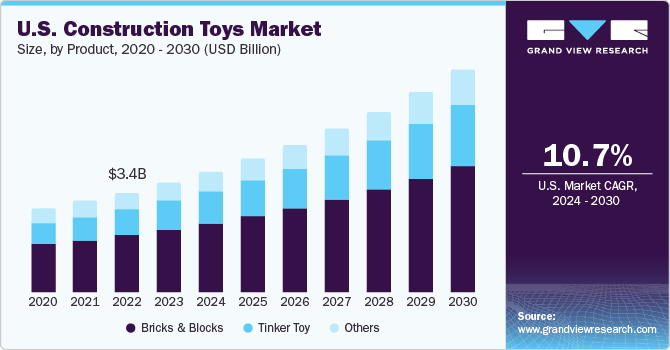

U.S. Construction Toys Market Trends

The construction toys market in the U.S. is expected to grow at a CAGR of 10.7% from 2024 to 2030. The U.S. market’s growth is expected to be driven by their increasing demand from schools, education centers, daycares, and classrooms. For example, in 2022, Manor Independent School District in Texas introduced a robotics program that utilizes LEGO Education products, aiming to incorporate interactive and enjoyable learning experiences for elementary school students.

Asia Pacific Construction Toys Market Trends

Asia Pacific construction toys market held a share of 26.0% of the global revenue share in 2023 and is projected to grow at a CAGR of 13.0% during the forecast period. This is mainly attributed to the increasing internet penetration in developing countries like India, China, Indonesia, and Vietnam. The expansion of the online market for construction toys is further driven by aggressive promotions and substantial discounts offered by e-commerce giants such as Flipkart, Amazon, and Alibaba, attracting new parents towards online shopping. Major players like Tegu, Mattel, Spin Master Ltd., and The LEGO Group capitalize on this trend with strong online and offline presence, catering to regional demands. The presence of nearly 200 LEGO stores in Asia Pacific as of February 2024 highlights the region's significance in the global construction toys market.

Key Construction Toys Company Insights

The global market is consolidated. The product offerings of the companies in the market span from fundamental building blocks to intricate sets, catering to a broad range of consumer preferences and needs. Companies in the market are focused on continuous product innovation. The global presence of some of the key players such as The LEGO Group, Mattel, Spin Master, Hasbro, and Bandai Namco Holdings Inc.enables them to understand and cater to local preferences and educational requirements, ensuring their products resonate with consumers worldwide.

Key Construction Toys Companies:

The following are the leading companies in the construction toys market. These companies collectively hold the largest market share and dictate industry trends.

- Basic Fun! Inc.

- The LEGO Group

- Mattel

- Spin Master

- TEGU

- PlayMonster Group LLC

- Magformers

- Schylling

- Polydron (UK) Ltd

- Ravensburger

- Bandai Namco Holdings Inc.

- Hasbro

Recent Developments

-

In October 2023, The LEGO Group launched its inaugural build experience inspired by the Dune universe in collaboration with Legendary Entertainment and based on Denis Villeneuve's film adaptation of Frank Herbert's renowned masterpiece. Introducing the LEGO Icons Dune Atreides Royal Ornithopter, this set brings to life one of the most iconic aircraft from the sci-fi epic in intricate LEGO brick form.

-

In March 2023, PlayMonster Group LLC., a prominent international toy and game company, and Hasbro Inc., a global leader in branded entertainment, jointly declared that PlayMonster would be integrating the entire Playskool brand into its diverse portfolio in 2024. This strategic move was a pivotal aspect of PlayMonster's comprehensive global growth strategy, aimed at delivering innovative and reimagined classic play experiences to preschoolers and their families worldwide.

-

In July 2022, Mattel partnered with SpaceX to develop a line of toys and collectibles aimed at sparking children's interest in space exploration. The product line featured figures, plush toys, and building sets. This collaboration is built on Mattel's past work with Elon Musk on remote-controlled cars.

Construction Toys Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.4 billion

Revenue forecast in 2030

USD 32.17 billion

Growth rate

CAGR of 11.9% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia; Indonesia; Brazil; South Africa

Key companies profiled

Basic Fun! Inc.; The LEGO Group; Mattel; Spin Master; TEGU; PlayMonster Group LLC; Magformers; Schylling; Polydron (UK) Ltd.; Ravensburger; Bandai Namco Holdings Inc.; Hasbro

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Construction Toys Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global construction toys market report based on product, material, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bricks & Blocks

-

Tinker Toy

-

Others

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wood

-

Polymer

-

Metal

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. In 2023, the North America construction toys market accounted for 32.2% of global revenue, driven by strategic product launches and licensed items. Daron Worldwide Trading's Air Canada set in Canada and seasonal sales peaks in Mexico drive regional market growth.

b. Some of the key market players include Basic Fun! Inc., The LEGO Group, Mattel, Spin Master, TEGU, PlayMonster Group LLC, Magformers, Schylling, Polydron (UK) Ltd, Ravensburger, Bandai Namco Holdings Inc., and Hasbro.

b. Key factors that are driving the construction toys market growth include an increase in disposable income driving increased expenditure on non-essential items, the educational value of construction toys, and the growing availability of construction toys on e-commerce platforms.

b. The global construction toys market size was estimated at USD 14.74 billion in 2023 and is expected to reach USD 16.4 billion in 2024.

b. The global construction toys market is expected to grow at a compound annual growth rate of 11.9% from 2024 to 2030 to reach USD 32.17 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."