- Home

- »

- Plastics, Polymers & Resins

- »

-

Recycled Plastics Market Size & Share, Industry Report 2033GVR Report cover

![Recycled Plastics Market Size, Share & Trends Report]()

Recycled Plastics Market (2026 - 2033) Size, Share & Trends Analysis Report by Product (Polyethylene, Polyethylene Terephthalate, Polypropylene, Polyvinyl Chloride, Polystyrene), By Source, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-043-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Recycled Plastics Market Summary

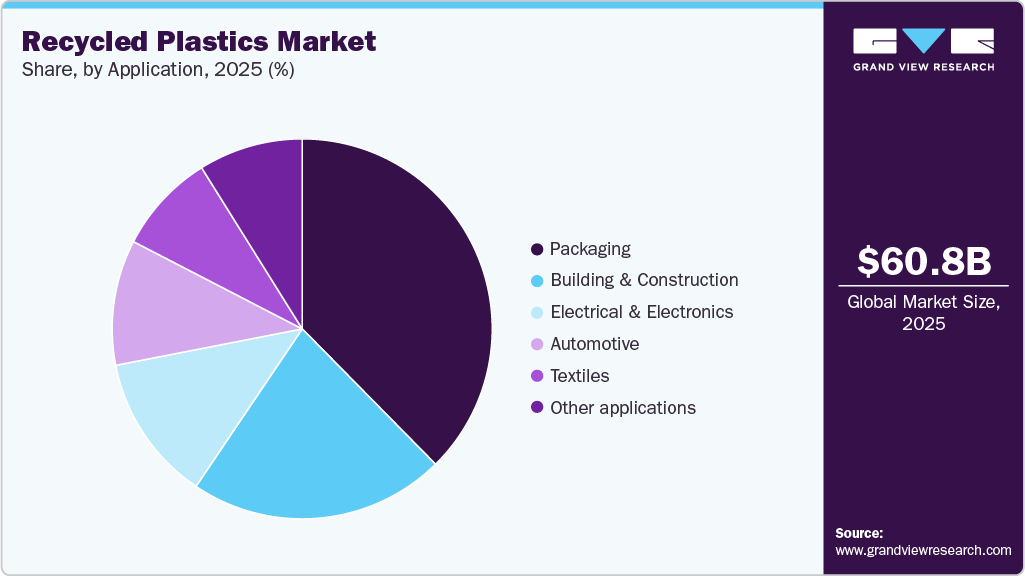

The global recycled plastics market size was estimated at USD 60.76 billion in 2025 and is projected to reach USD 132.33 billion by 2033, growing at a CAGR of 10.4% from 2026 to 2033. The increasing consumption of plastic in the production of lightweight components, which are utilized in various industries such as building & construction, automotive, electrical & electronics, and others, is expected to drive the growth of recycled plastics demand over the forecast period.

Key Market Trends & Insights

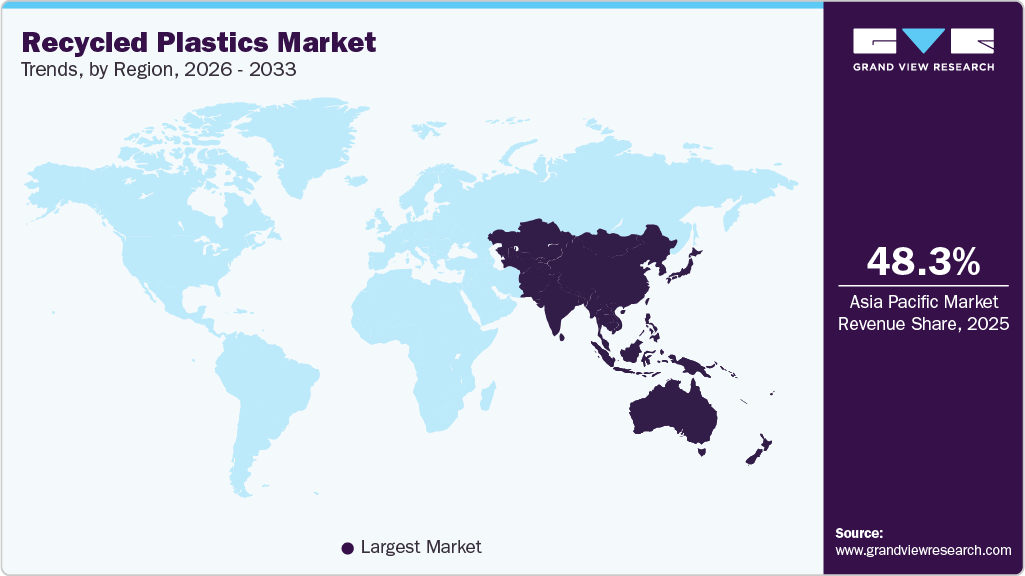

- Asia Pacific dominated the global recycled plastics market with the largest revenue share of 48.27% in 2025.

- The recycled plastics industry in China is expected to grow at a substantial CAGR of 11.3% from 2026 to 2033.

- By product, the polypropylene segment is expected to grow the fastest CAGR of 11.2% from 2026 to 2033.

- By application, the packaging segment led the market with the largest revenue share of 37.6% in 2025.

- By source, the plastic bottles segment led the market with the largest revenue share of 74.34% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 60.76 Billion

- 2033 Projected Market Size: USD 132.33 Billion

- CAGR (2026-2033): 10.4%

- Asia Pacific: Largest market in 2025

The growth of the construction industry in emerging economies, such as Brazil, China, India, and Mexico, is expected to drive demand for recycled plastics in the manufacturing of components like insulation, fixtures, structural lumber, windows, fences, and other materials over the forecast period.

The growth of recycled plastic in the building & construction market can be attributed to increased foreign investment in these countries' construction industry, owing to the easing of FDI norms and requirements for the redevelopment of public and industrial infrastructure.

Drivers, Opportunities & Restraints

The factors driving the recycled plastics industry are rooted in increasing regulatory demands for circular economies, heightened commitments to sustainability from brand owners, and the improving cost-effectiveness of recycled resins compared to virgin materials. Manufacturers in sectors such as packaging, automotive, construction, and consumer goods are progressively incorporating recycled materials to satisfy compliance requirements and achieve corporate ESG goals, which, in turn, is boosting the demand for high-quality post-consumer and post-industrial recyclate.

Opportunities in the recycled plastics industry are increasing due to rapid progress in mechanical and chemical recycling technologies, growing policy incentives for circular materials, and a rising demand for high-quality recycled grades designed for food-contact, automotive, and electrical applications. Collaborations among resin manufacturers, recyclers, and brand owners are creating new growth pathways as businesses invest in closed-loop systems and high-purity recycling platforms.

However, the challenges in the recycled plastics industry arise from inconsistent availability of feedstock, fluctuations in material quality, and ongoing deficiencies in collection and sorting systems. The restricted capacity for advanced recycling, problems with contamination, and differences in regional waste-management practices continue to limit the reliability of supply and impede widespread use in applications where performance is crucial.

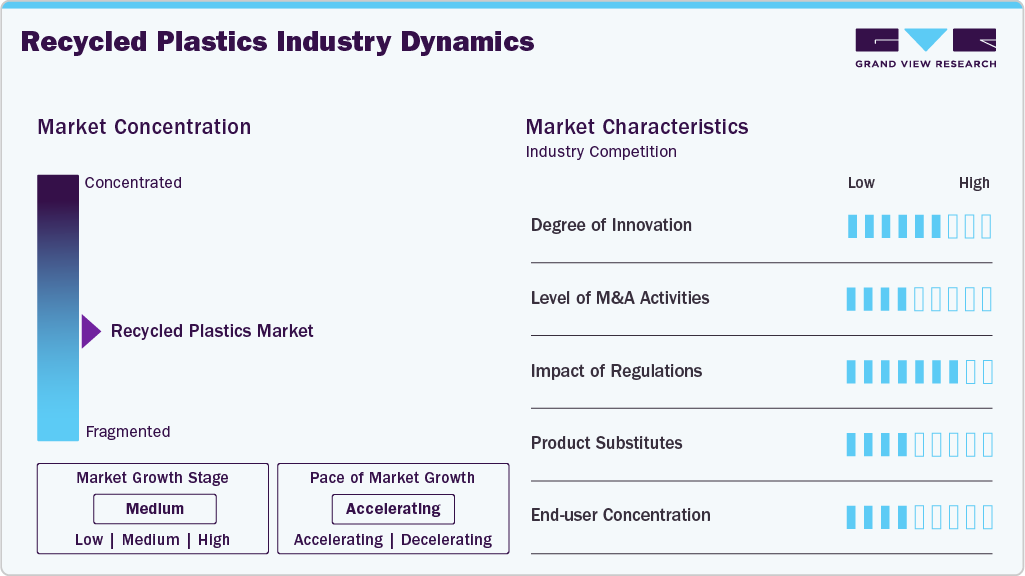

Market Concentration & Characteristics

The growth of the construction industry in emerging economies, such as Brazil, China, India, and Mexico, is expected to drive demand for recycled plastics in the manufacturing of components like insulation, fixtures, structural lumber, windows, fences, and other materials over the forecast period. The growth of recycled plastic in the building & construction market can be attributed to increased foreign investment in these countries' construction industry, as a result of easing FDI norms and requirements for redevelopment of public and industrial infrastructure.

Regulatory measures and policies aimed at reducing plastic pollution and promoting a circular economy help boost the recycling of plastics. Governments and environmental agencies worldwide are implementing measures to limit the use of single-use plastics, encourage recycling, and incentivize the use of alternative materials, including recycled plastics.

Growing demand for sustainable materials, such as recycled and bio-based plastics, is driving the market growth. These materials offer the potential for reduced environmental impact and are often marketed as eco-friendly alternatives. This can lead to potential growth in the market.

Companies are pursuing global expansion strategies through market entry into new geographic areas, forming partnerships with local distributors, and customizing products to align with rising needs for recycled plastics materials in several industries, including packaging, construction, and automotive.

Product Insights

The polyethylene segment led the market with the largest revenue share of 23.8% in 2025. This high share is attributable to the rising demand for packaging material in consumer goods, food & beverage, industrial, and various other industries. In addition, it is commonly used in laundry detergent packaging, milk cartons, cutting boards, and garbage bins, among various other sources. Polypropylene is extensively used in the manufacturing of automotive components, packaging & labelling, medical devices, and various laboratory equipment, among other applications, owing to its excellent chemical and mechanical properties. It is resistant to several chemical solvents, acids, and bases and has excellent mechanically strength. It is also among the most highly formulated plastics worldwide.

Moreover, components produced using polypropylene are fatigue-resistant, which is beneficial in the building & construction industry for producing plastic hinges, piping systems, consumer-grade daily-use products, manufacturing mats, and carpets & rugs, among various other applications. The growth of the automotive, packaging, building & construction industries is expected to drive demand for recycled polypropylene over the forecast period.

Source Insights

The plastic bottles segment led the market with the largest revenue share of 74.34% in 2025. Plastic bottles are the major source of recycled products. Plastic bottles are used in various applications across multiple industries for packaging water, oils, pharmaceuticals, and carbonated drinks. SKS Bottle & Packaging, Inc., CABKA Group, Maynard & Harris Plastics, and Placon are among the key manufacturers of recycled plastic bottles.

Polymer foam source includes packaging foam & sheets, which are widely used in impact-resistant packaging. Expanded polystyrene is the most common type of polymer foam in the packaging industry. Automobile and electrical & electronics manufacturers, such as Panasonic Corporation, SONY Electronics Inc., Ltd., Hitachi, Ltd., and Honda Motor Company Ltd., are moving toward the adoption of recycled plastic foam over virgin polymer foam.

Application Insights

The packaging segment led the market with the largest revenue share of 37.6% in 2025. The growth of the packaging industry in the region is driven by the high demand for building & construction products, consumer goods, and electrical & electronics, especially from China, India, and Southeast Asia. In addition, a flexible regulatory environment is expected to offset constraints that are usually evident in the Western markets.

Moreover, recycled plastic products, such as composite lumber, roofing tiles, insulation, rocks, and fences, among others, are widely used in the building & construction industry owing to rising environmental concerns. Furthermore, the properties of recycled plastics, including a lower carbon footprint and lower cost compared to virgin plastics, are driving demand for these materials. The building and construction application is anticipated to be one of the significant contributors to the market's growth.

Regional Insights

The recycled plastics market in North America is expected to grow at a significant CAGR over the forecast period. The market is driven by the growth of major end-use industries, including electrical & electronics, construction, and packaging. The rising demand for packaged and processed food, as well as the growing construction industry in the U.S., Mexico, and Canada, is anticipated to drive the market growth over the forecast period.

U.S. Recycled Plastics Market Trends

The recycled plastics market in the U.S. held the significant share in North America in 2025. Polyethylene terephthalate, low-density polyethylene, high-density polyethylene, polypropylene, polyvinyl chloride, and polystyrene are the most common types of plastic waste in the country. These plastics are used to produce food & beverage bottles, films & wraps, bottle caps, containers, and blister packs, among other products.

Asia Pacific Recycled Plastics Market Trends

Asia Pacific dominated the global recycled plastics market with the largest revenue share of 48.27% in 2025. The region is characterized by a growing packaging industry and technological advancements within it. Moreover, the Asia Pacific is expected to witness significant market growth due to the increasing electronics expenditure in countries such as China, India, and Japan. In addition, the presence of various electronic product manufacturers, which are involved in research & development activities in the region, including ASE Electronics Malaysia, Foxconn Technology Group, Honeywell International Inc., SAMSUNG, Lenovo, Bajaj Electronics, Huawei Technologies Co., Ltd., Havells Group, Haier Inc., and various others, will propel industry expansion over the forecast period.

The recycled plastics industry in China is expected to grow at a substantial CAGR of 11.3% from 2026 to 2033. China's market is a well-established one. However, the ban on importing 24 types of plastic waste is expected to hinder the market growth in the country.

The Indian recycled plastics market is expected to grow at the fastest CAGR during the forecast period. Rising environmental concerns among consumers, coupled with government policies such as the “Swachh Bharat Mission,” are expected to drive demand for recycled plastics in the country. Growing packaging, automotive, and construction industries in the country are further propelling the demand for recycled plastics.

The recycled plastics market in Southeast Asia is expected to grow at a CAGR of 8.9% during the forecast period. The market is characterized by the growth in recycling activities across the region. The Association of Southeast Asian Nations (ASEAN) member countries have decided to tackle the plastic waste ending up in oceans by 2025.

Europe Recycled Plastics Market Trends

The recycled plastics market in Europe accounted for the second-largest market revenue share in 2025. The market is driven by the adoption of the circular economy, which aims to reduce the carbon footprint associated with conventional plastic production methods by increasing plastic recycling in the region.

The Germany recycled plastics market held a significant share in Europe in 2024. The advanced recycling technologies of Germany significantly influence the demand for recycled plastics in the country. According to the report of the Federal Ministry for Environment, Nature Conservation, Nuclear Safety, and Consumer Protection, in 2023, Germany generated approximately 340 million tons of plastic waste per year, with a recycling rate of around 50 million tons.

The recycled plastics market in Italy is expected to grow at a substantial CAGR during the forecast period. The plastic recycling market in Italy is quite active and involves more than 350 companies. These companies include waste collectors, sorters, and handlers of industrial waste. The cultural emphasis in Italy on sustainable products is expected to boost demand for recycled plastics in several industries, including automotive and textiles.

Central & South America Recycled Plastics Market Trends

The Central & South America Recycled Plastics Market is expected to witness a growth over the forecast period. The rise of e-commerce and changing consumer preferences towards sustainability, including plastic recycling in Central & South America, are contributing to the demand for recycled plastics in packaging.

The Brazil recycled plastics market held a significant share in Central & South America and is anticipated to register a CAGR of 9.0% over the forecast period. The country has huge potential for recycled plastics, as these can help solve both the plastic waste problem and the flooding caused by plastic waste in water bodies.

Middle East & Africa Recycled Plastics Market Trends

The recycled plastics market in the Middle East & Africa is expected to witness a substantial CAGR over the forecast period. The region was previously dependent on exporting its plastic waste to other countries for recycling. Still, as countries in the Asia Pacific and Southeast Asia ban plastic waste imports, the region is developing its own recycling facilities.

The Saudi Arabia recycled plastics market is expanding and is witnessing steady adoption across key industries. This growth is supported by rising sustainability initiatives, increased recycling capacities, and strong government focus on circular economy goals. The flourishing building & construction industry in the country is expected to drive demand for recycled plastics. The flourishing building & construction industry in the country is expected to drive demand for recycled plastics.

Key Recycled Plastics Market Company Insights

The recycled plastics industry is moderately competitive, with several key global players dominating the landscape. Major companies include REMONDIS SE & Co. KG, Biffa, Stericycle, Republic Services, Inc., WM Intellectual Property Holdings, L.L.C., Veolia, Shell International B.V., Waste Connections, Inc., Clean Harbors, Covestro AG, among others. Key companies are adopting various organic and inorganic growth strategies, including new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

Key Recycled Plastics Companies:

The following are the leading companies in the recycled plastics market. These companies collectively hold the largest market share and dictate industry trends.

- REMONDIS SE & Co. KG

- Biffa

- Stericycle

- Republic Services, Inc.

- WM Intellectual Property Holdings, L.L.C.

- Veolia

- Shell International B.V.

- Waste Connections

- CLEAN HARBORS, INC.

- Covestro AG

Recent Developments

-

In March 2025, Versalis, the chemical subsidiary of Eni, announced the inauguration of a new facility in Porto Marghera aimed at producing plastics that are entirely or partially derived from mechanically recycled materials. This initiative represents another significant milestone in the company's commitment to promoting a more circular and eco-friendly economy through technological advancements and the recycling of post-consumer plastics.

-

In June 2024, Dow Chemical Co. launched two new variants of its REVOLOOP recycled plastic resins intended for non-food contact packaging uses. One variant is made entirely from 100% post-consumer recycled (PCR) material, while the other is a formulated grade composed of up to 85% PCR sourced from household waste. These resins are appropriate for uses such as shrink films, protective packaging, heavy-duty shipping bags, stretch films, and liners.

Recycled Plastics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 66.11 billion

Revenue forecast in 2033

USD 132.33 billion

Growth rate

CAGR of 10.4% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue & volume forecast, competitive landscape, growth factors, and trends

Segment covered

Product, source, application, region

Regional scope

North America; Europe; Asia Pacific; Southeast Asia; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; Malaysia; Indonesia; Thailand; Brazil; Saudi Arabia

Key companies profiled

REMONDIS SE & Co. KG; Biffa; Stericycle; Republic Services, Inc.; WM Intellectual Property Holdings, L.L.C.; Veolia; Shell International B.V.; Waste Connections; CLEAN HARBORS, INC.; Covestro AG

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recycled Plastics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global recycled plastics market report based on the product, source, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Polyethylene

-

Polyethylene Terephthalate

-

Polypropylene

-

Polyvinyl Chloride

-

Polystyrene

-

Other Products

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Plastic Bottles

-

Plastic Films

-

Polymer Foam

-

Other Sources

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Building & Construction

-

Packaging

-

Electrical & Electronics

-

Textiles

-

Automotive

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Southeast Asia

-

Malaysia

-

Indonesia

-

Thailand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global recycled plastics market size was estimated at USD 60.76 billion in 2025 and is expected to reach USD 66.11 billion in 2026.

b. The global recycled plastics market is projected to grow at a compound annual growth rate (CAGR) of 10.4% from 2026 to 2033, reaching USD 132.33 billion by 2033.

b. Polyethylene dominated the recycled plastics market with a share of over 26% in 2025. This is attributable to the rising demand for sustainable packing and components used in various end-use industries to reduce the carbon footprint.

b. Some of the key players operating in the recycled plastics market include REMONDIS SE & Co. KG, Biffa, Stericycle, Republic Services, Inc., WM Intellectual Property Holdings, L.L.C., Veolia, Shell International B.V., Waste Connections, CLEAN HARBORS, INC., and Covetsro AG.

b. Key factors driving the recycled plastics market growth include laws & regulations enforced by governments, increasing awareness regarding sustainable plastic waste management, and reduction in environmental impact from plastic production.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.